mHealth Market Report Scope & Overview:

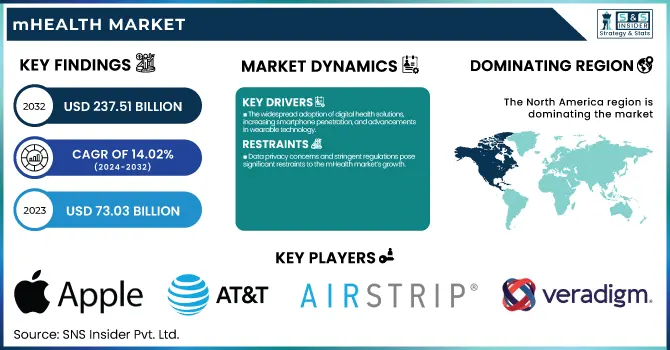

The mHealth Market was valued at USD 73.03 billion in 2023 and is expected to reach USD 237.51 billion by 2032, growing at a CAGR of 14.02% over the forecast period of 2024-2032. This report showcases user adoption and engagement patterns by region driven by rising smartphone penetration, digital health literacy, and regulatory facilitation of telemedicine. Prescription and usage patterns of mHealth solutions are studied where healthcare practitioners incorporated mobile apps in managing chronic diseases and remote monitoring of patients. Furthermore, it delves into wearable devices and mobile health application adoption, with AI analytics advances and real-time health monitoring driving market growth. mHealth expenditure in healthcare is examined by region, with private, commercial, and government investments influencing affordability and accessibility.

Get More Information on mHealth Market - Request Sample Report

The U.S. mHealth Market was valued at USD 21.52 billion in 2023 and is expected to reach USD 63.28 billion by 2032, growing at a CAGR of 12.75% over the forecast period of 2024-2032. The U.S. is experiencing a high-growth mHealth market on the back of enhanced telehealth usage, heightened digital health services' reimbursement policies, and aggressive investment in AI-backed remote monitoring offerings to boost the quality of care and contain medical expenses.

Market Dynamics

Drivers

-

The widespread adoption of digital health solutions, increasing smartphone penetration, and advancements in wearable technology.

With more than 6.8 billion smartphone users worldwide, mobile health apps have emerged as an important self-health management tool, remote consultation tool, and chronic disease monitoring tool. The increasing popularity of AI-based diagnostic tools and telemedicine platforms is also accelerating market growth. For instance, AI-based health chatbots and virtual assistants such as Babylon Health and Ada Health are facilitating patient engagement and diagnosis. The growing incidence of chronic diseases like diabetes and cardiovascular diseases has become a driving factor for remote patient monitoring solutions. In 2023, over 537 million adults worldwide lived with diabetes, further emphasizing the need for digital health management solutions. The interoperability of mHealth platforms with EHRs has also facilitated access to patient data and instant healthcare decision-making. Government efforts to encourage digital health, including the FDA's Digital Health Innovation Action Plan, also contribute to market expansion. The rollout of 5G networks is also a major impetus, optimizing the efficiency of telehealth services through low-latency, high-speed connectivity for smooth video consultations and remote diagnosis, increasing mHealth accessibility and efficacy.

Restraints

-

Data privacy concerns and stringent regulations pose significant restraints to the mHealth market’s growth.

The growing dependency on electronic health solutions creates fears about breaches in data and illegal entry into confidential patient data. A total of more than 133 million health records were leaked in cyberattacks in 2023, projecting the vulnerability of electronic health platforms. Most users are reluctant to embrace mHealth apps owing to threats of data leakage and noncompliance with international data protection legislation, including HIPAA (United States), GDPR (Europe), and PDPA (Asia). Regulatory issues further hinder mHealth solution adoption because digital health apps must comply with complicated and changing healthcare regulations. For example, the FDA's clearance of mobile medical applications is slow and costly, and it can inhibit the speedy roll-out of novel solutions. Secondly, most developing nations do not have uniform mHealth regulatory mechanisms, resulting in variations in the compliance process. The interoperability of mHealth solutions with installed healthcare IT systems is also an issue, given that hospitals and clinics use varying electronic health record (EHR) systems, causing integration challenges. These factors all impede market growth and retard the mass adoption of mobile health technologies.

Opportunities

-

The growing integration of AI, big data, and remote patient monitoring (RPM) technologies in mHealth presents vast opportunities for market expansion.

AI-based diagnostics and customized health guidance are revolutionizing healthcare delivery through the improvement of early disease diagnosis and preventive treatments. For instance, AI-based applications such as SkinVision support the early detection of skin cancer, which has drastically improved patient outcomes. The expansion of RPM technology, particularly in chronic condition management such as hypertension and diabetes, is another substantial opportunity. Remote patient monitoring has been effective in preventing hospital readmissions and long-term patient improvements. Research by the American Heart Association discovered that RPM lowered hospitalization rates among heart failure patients by 38%. Furthermore, collaborations between health providers and technology giants are pushing innovation. Tech companies such as Apple, Google, and Amazon are heavily investing in digital health, with examples like Apple's HealthKit and Google's integration with Fitbit making mHealth solutions more readily available. The increasing emphasis on patient-centric healthcare models and personalized medicine is also driving the demand for telehealth services and AI-led insights. Increased healthcare applications through 5G also augment the opportunities by supporting real-time remote monitoring and effective virtual consultations with minimal latency.

Challenges

-

The lack of digital literacy and inadequate healthcare infrastructure, particularly in low- and middle-income countries.

As smartphone penetration expands, few consumers, particularly elderly and rural citizens, are too technologically incompetent to leverage mHealth tools. Research by the WHO established that more than 35% of the older population fails to embrace digital health solutions as a result of issues. Other inhibiting factors against market growth are poor internet connections and inadequate availability of inexpensive smart devices in far-flung areas. In addition, most developing countries also lack adequate numbers of skilled healthcare workers properly trained to adopt and coordinate mHealth solutions efficiently. Without training, healthcare workers can resist embracing digital tools, so their full potential in enhancing patient results will not be utilized. Additionally, the urban-rural digital divide issue persists. As much as urban places enjoy fast-speed internet and modern digital health infrastructure, rural places lack basic connections, rendering telemedicine and remote patient monitoring a luxury. Redressing these deficits calls for the intervention of governments, public-private collaborations, and investments in digital health training to address the disparities and provide universal access to mHealth solutions.

Segmentation Analysis

By Component

The mHealth Apps category led the market in 2023, capturing 48.9% of the overall revenue share. The extensive use of mobile health applications is driven by rising smartphone penetration, the surge in demand for remote healthcare, and the use of AI-based health monitoring platforms. The ease of real-time monitoring, drug reminders, and virtual consultations has also boosted the growth of the segment.

The mHealth Services segment is anticipated to grow the fastest between 2024 and 2032. Growth in demand for telemedicine, remote patient monitoring, and digital health consulting services is propelling its high growth. Greater investments in digital infrastructure and government efforts in promoting virtual access to healthcare are major drivers of this growth.

By End-use

The Patient segment contributed the highest share in 2023, boosted by a very high rate of adoption of mobile health solutions by consumers. Awareness of self-health management, growth in cases of chronic diseases, and increased usage of digital healthcare solutions by patients have all propelled it to market leadership. mHealth apps and wearable devices have also been enabled to empower consumers with real-time health information and remote consultations. The patient segment is also likely to experience the fastest growth between 2024 and 2032. Growth of consumer-oriented healthcare models, combined with the growing trend towards personalized and preventive care, is driving adoption at a faster pace. Additionally, increasing smartphone penetration and improved access to mobile-based healthcare solutions are among the most influential factors driving the segment's aggressive growth.

Regional Analysis

North America led the mHealth market in 2023 due to extensive smartphone penetration, extensive use of telemedicine, and robust healthcare infrastructure. The presence of key players in digital health, such as Apple, Google, and Teladoc Health, has heavily fueled market growth. The U.S. dominates digital health investments, with more than USD 15 billion of funding for health tech startups in 2023, driving innovations in AI-powered diagnostics, remote monitoring, and digital therapeutics. Government efforts, including the FDA's Digital Health Center of Excellence, also drive market growth by facilitating regulatory pathways for mobile health solutions.

The Asia-Pacific region is the most rapidly growing market, expected to grow extensively as a result of smartphone adoption, rising digital literacy, and health digitization programs led by governments. China and India together have more than 2 billion smartphone users and are experiencing rapid growth in mHealth adoption, especially in teleconsultation services and remote patient monitoring. The Indian Ayushman Bharat Digital Mission (ABDM) and China's Healthy China 2030 initiative are fueling digital health infrastructure. Also, increasing healthcare expenses and the lack of medical personnel in rural regions are compelling governments to embrace mobile health solutions for broader healthcare access. The rapid urbanization of the region and the growing emphasis on AI-based healthcare solutions also drive market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players and Their mHealth Products

-

Apple, Inc. – Apple Health, Apple Watch, HealthKit

-

AT&T Intellectual Property – AT&T mHealth Solutions, AT&T Connected Health

-

AirStrip Technologies, Inc. – AirStrip ONE, AirStrip RPM

-

Veradigm LLC (formerly Allscripts Healthcare Solutions) – Veradigm EHR, Veradigm FollowMyHealth

-

Qualcomm Technologies, Inc. – Qualcomm 2net, Qualcomm HealthyCircles

-

Vodafone Group PLC – Vodafone Health Solutions, mHealth Connect

-

Google LLC – Google Fit, Fitbit Health Solutions, Google Health

-

Telefonica S.A. – Movistar Salud, Telefonica Telemedicine Solutions

-

SoftServe, Inc. – SoftServe Digital Health Platform, SoftServe mHealth Solutions

-

Samsung Electronics Co., Ltd. – Samsung Health, Galaxy Watch Health Features

-

Orange – Orange mHealth Solutions, Future4Care Digital Health Hub

-

SeekMed – SeekMed Telemedicine Platform, SeekMed Virtual Consultation

Recent Developments

In May 2024, the Novo Nordisk Foundation, Wellcome Trust, and Gates Foundation launched a USD 300 million global health partnership to tackle major health challenges affecting low-income communities. The three-year initiative will focus on climate-related health impacts, infectious diseases, antimicrobial resistance, and the link between nutrition, immunity, and disease outcomes.

| Report Attributes | Details |

| Market Size in 2023 | USD 73.03 billion |

| Market Size by 2032 | USD 237.51 billion |

| CAGR | CAGR of 14.02% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component [Wearables & Connected Medical Devices, mHealth Apps, Services] • By End-Use [Patients, Providers, Payers, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Apple, Inc., AT&T Intellectual Property, AirStrip Technologies, Inc., Veradigm LLC (formerly Allscripts Healthcare Solutions), Qualcomm Technologies, Inc., Vodafone Group PLC, Google, LLC, Telefonica S.A., SoftServe, Inc., Samsung Electronics Co., Ltd., Orange, SeekMed. |