Medical Device Engineering Market Report Scope & Overview:

Get More Information on Medical Device Engineering Market - Request Sample Report

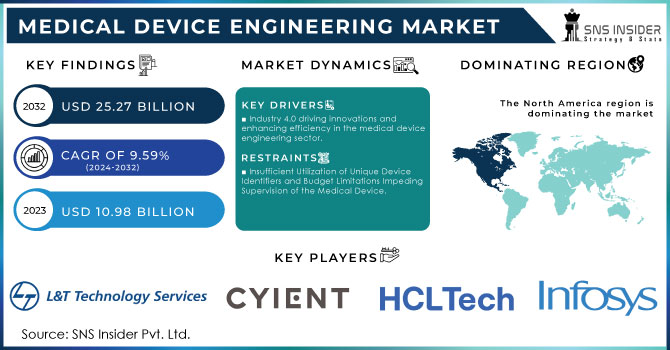

The Medical Device Engineering Market size is expected to be valued at USD 10.98 Billion in 2023. It is estimated to reach USD 25.27 Billion by 2032, with a growing CAGR of 9.59% over the forecast period 2024-2032.

The medical device engineering market is experiencing rapid expansion due to technological advancements and regulatory changes such as the FDA's Total Product Life Cycle (TPLC) Advisory Program (TAP) Pilot. By August 12, 2024, 50 devices have been registered by the TAP Pilot and it is scheduled to extend its coverage in October 2024 and January 2025 to involve more regulatory offices, showing the FDA's dedication to speeding up device development and patient availability. Technological advancements, such as wearable devices, smart implants, and telemedicine solutions, are a major factor in this growth, along with the rising number of chronic diseases and an aging population. The TAP Pilot is essential for advancing devices by engaging early with the FDA, communicating frequently and strategically, involving key stakeholders, and offering customized solutions to expedite progress. The FDA's proactive strategy boosts the development of medical devices and is in line with the overall industry shift towards quicker, more effective market entry for innovative products. The addition of the Office of Radiological Health and the Division of Ophthalmic Devices, followed by the inclusion of the Office of Orthopedic Devices, demonstrates the FDA's dedication to aiding various therapeutic fields. The combination of regulatory assistance and a strong emphasis on innovation is projected to fuel additional expansion in the medical device engineering sector. the alignment of regulatory efforts such as the TAP Pilot program with technological progress sets the stage for substantial expansion in the medical device engineering industry, indicating a general move towards improved device safety, effectiveness, and faster market entry. The combining of regulatory efficiency and technological innovation highlights the ever-changing nature of the medical device industry.

The medical device engineering industry is expanding quickly thanks to technological developments, regulatory backing, and increasing healthcare needs. This expansion is in line with the wider framework of the European Union's regulations on medicines and medical devices. The EU's rules for medical devices, based on Articles 168 and 114 of the Treaty, ensure strong standards for their safety and effectiveness. The implementation of Regulation (EU) 2017/745 and Regulation (EU) 2017/746 established strict criteria for medical devices and in vitro diagnostic devices, improving post-market monitoring and clinical safety data demands. The regulations, which will be enforced in May of 2021 and May of 2022, demonstrate a dedication to enhancing the quality of devices and ensuring patient safety. The expansion of the medical device engineering market is further boosted by the EU's emphasis on groundbreaking and sophisticated treatments, as demonstrated in Regulation (EC) No 1394/2007 and Directive 2009/120/EC, which pertain to advanced therapy medicinal products (ATMPs). This encompasses gene and cell therapies, which are increasing the need for advanced engineering solutions. The EU's commitment to adjusting regulations for device availability and safety amid technological advancements is reinforced by the recent endorsement of Regulation (EU) 2023/607.Moreover, the EU's strategic programs like Horizon Europe and the EU4Health scheme support advancements in medical research and development. These programs support the growth of the medical device engineering market through promoting innovation and tackling healthcare issues such as affordable medication access and combating antimicrobial resistance. The strong regulatory system and strategic efforts in the EU support the expanding medical device engineering market, showing a commitment to improving healthcare results and advancing technology in the industry.

Market Dynamics

Drivers

-

Industry 4.0 driving innovations and enhancing efficiency in the medical device engineering sector.

The advancement of Industry 4.0 is greatly influencing the medical device engineering sector, promoting creativity and productivity through cutting-edge technologies such as IoT, AI, robotics, and big data analytics. These advancements allow for the development of intelligent medical devices that are more interconnected, offering real-time predictive maintenance, improved engineering, and precise diagnostics and treatment. The implementation of Industry 4.0 enables the use of cutting-edge manufacturing methods like 3D printing, enabling fast creation of protoService Type s and customized products, ultimately decreasing time-to-market and improving operational productivity. Furthermore, data analytics and machine learning play a role in ongoing enhancements in device effectiveness and patient results while also maintaining adherence and standards. In November 2022, L&T Technology Services Limited opened two new design and prototyping facilities in Peoria, Illinois - the Electrification & Prototyping Center and 1DigitalPlace. These centers aim to enhance digital manufacturing and electrification solutions in sectors like medical devices. Likewise, the HCL Innovation Center in Edmonton, Alberta, established in January 2022, provides a cutting-edge venue for customers to advance product prototyping, research, and collaborative innovation. These advancements highlight how Industry 4.0 is driving significant changes in the medical device engineering market by improving functionality, innovation, and process efficiency.

-

Improvements in regulations are boosting innovation in the medical device engineering industry.

The regulatory guidelines in Europe and the United States are essential for promoting innovation in the medical device engineering sector, specifically concerning Advanced Therapy Medicinal Products (ATMPs). Each region categorizes ATMPs as biological products, but their sub-classifications vary. Within the EU, ATMPs are classified into four separate categories: gene therapy, somatic cell therapy, tissue-engineered products, and combined ATMPs. On the other hand, the US system breaks this down into just two primary classifications: gene therapy and cellular therapy. In spite of these variances, both regulatory frameworks highlight the importance of stringent handling of biological substances to comply with advanced therapy standards. An example is the EU's Regulation 1394/2007/EC and Directive 2009/120/EC, which set out specific criteria for ATMPs, such as assessment by the Committee for Advanced Therapies (CAT) and the Committee for Medicinal Products for Human Use (CHMP). This centralized process guarantees a consistent and efficient approach to marketing approval throughout EU Member States. In the US, the 21st Century Cures Act also implemented the RMAT designation to speed up the progress and authorization of advanced therapies for unmet medical needs. OTAT of the FDA regulates these products to meet FDCA and PHSA standards. These regulatory improvements not only make the approval process more efficient but also promote a more innovative and adaptable medical device engineering industry. Through establishing precise standards and expediting groundbreaking treatments, these structures empower businesses to efficiently create and sell state-of-the-art medical equipment, ultimately boosting the growth and advancement of the medical device engineering industry.

Restraints

-

Insufficient Utilization of Unique Device Identifiers and Budget Limitations Impeding Supervision of the Medical Device.

The GAO report points out important limitations impacting the FDA's postmarket surveillance program for medical devices, with wider implications for the medical engineering device market. Some of the main obstacles identified are the underutilization of Unique Device Identifiers (UDIs) in electronic health records and inadequate funding for surveillance projects. The report shows that the FDA's program is hindered by these limitations, despite Congress's mandate in 2012 to create a strong post market surveillance system. Active surveillance depends greatly on real-world data from electronic health records, insurance claims, and medical device registries to identify safety concerns. Nevertheless, the limited incorporation of UDIs into these files greatly hinders the capacity to thoroughly monitor and track device performance. Additionally, lack of funding limits the FDA's ability to effectively carry out and sustain a proactive monitoring system, hindering its capacity to promptly deal with safety issues. The constraints on surveillance lead to a delay in finding and fixing safety issues, as seen in recent cases like the court ruling for Philips and its Respironics division to stop making sleep apnea machines because of unresolved manufacturing issues. These challenges have an impact on not just regulatory oversight, but also on market confidence and the rate of innovation in the medical engineering device industry. Failing to efficiently monitor and resolve device-related problems can result in higher market risks, impede regulatory adherence, and delay the implementation of new technologies. It is essential to focus on these limitations in order to improve the supervision of medical equipment and promote a safer and more effective medical technology industry.

Segment Analysis

By Service Type

Based on Service Type, Software Development & Testing Services is capturing the largest share in medical device engineering market with 28% of share in 2023. The rise can be credited to the growing popularity of outsourcing in medical device firms, aiming to cut development expenses, speed up time-to-market, and acquire specialized knowledge. By contracting out software development and testing tasks to expert service providers, businesses can concentrate on their key strengths like innovation and product design, while utilizing the specialized skills and abilities of outside collaborators. This method improves operational efficiency and also guarantees adherence to strict regulatory and assurance standards, which are crucial in the medical device sector. TietoEVRY and Tata Consultancy Services (TCS) are key players in the outsourcing industry, offering customized software development and testing services for the medical device sector. For instance,TietoEVRY provides comprehensive solutions that cover every step from software design to validation, guaranteeing that medical devices comply with regulations and function dependably in healthcare environments. In the same way, TCS offers a variety of engineering services, such as software development and testing, to assist medical device companies in launching their products quicker and at a lower cost. The increasing complexity of medical devices, which frequently come with embedded software, connectivity functions, and data analytics capabilities, is a major factor in driving the outsourcing trend. As the FDA and other regulatory agencies increase their standards for software validation and cybersecurity, the need for top-tier, compliant software is at an all-time high. Medical device companies can ensure regulatory compliance and meet expectations by collaborating with specialized service providers to deliver reliable and high-performance products for healthcare providers and patients.

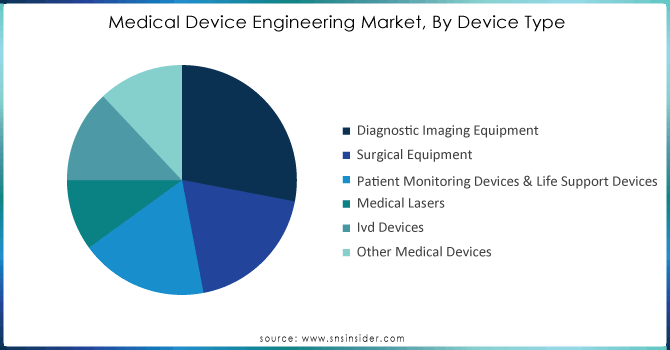

By Device Type

Based on Device Type, Diagnostic Imaging Equipment capturing the largest share in Medical Device Engineering Market with 28% of share. The growing focus on early disease detection plays a key role in elevating treatment success and managing the advancement of chronic illnesses, leading to this substantial portion. The increasing need for advanced imaging technologies, which allow for accurate and early detection, has resulted in their widespread use in healthcare environments. The use of high-quality imaging and advanced 3D imaging techniques, along with incorporating artificial intelligence (AI) and machine learning, are transforming the possibilities for diagnosis. These advancements enable quick and precise detection of issues in hospitalized patients, helping healthcare providers to promptly make well-informed choices, which is essential in both acute and chronic care environments. Siemens Healthineers and GE Healthcare are leading the way in this technological revolution. Siemens Healthineers created the Somatom Force CT scanner, providing fast, detailed imaging while using less radiation, enhancing patient safety and accuracy of diagnosis. Likewise, the Revolution Apex CT scanner from GE Healthcare uses AI algorithms to improve image quality and speed up scans, leading to better patient flow and confidence in diagnoses. Furthermore, Philips Healthcare has launched its cutting-edge spectral CT imaging technology, providing unparalleled image precision and tissue analysis for improved and earlier detection of conditions like cancer and cardiovascular diseases. The incorporation of AI and machine learning in these imaging systems improves their diagnostic abilities through predictive analytics, automation of tasks, and aiding radiologists in detecting anomalies that may go unnoticed by humans. The technological progress is enhancing patient results and cutting healthcare expenses by allowing early intervention and decreasing the need for costly procedures.

Need any customization research on Medical Device Engineering Market - Enquiry Now

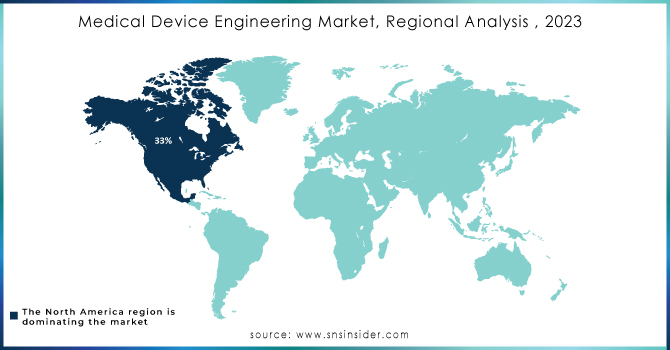

Regional Analysis

North America is capturing the largest share in Medical Device Engineering Market with 33% of share in 2023. The area's strong healthcare system, substantial funding for research and development, and top medical device companies contribute to its dominance. Organizations like Medtronic, Boston Scientific, and Johnson & Johnson have played a key role in advancing innovation in this industry. Medtronic, based in Minnesota, has been leading the way in creating innovative medical equipment, such as minimally invasive surgery tools and implantable heart devices. Their cutting-edge technology in the form of the Micra AV, the smallest pacemaker with AV synchrony in the world, showcases the innovation coming from the area. This device demonstrates the area's ability to create life-saving technologies that meet crucial healthcare requirements. The favorable regulatory environment in the region is supported by the U.S. Food and Drug Administration (FDA), which plays a key part in guaranteeing the safety and effectiveness of new medical devices. The strict approval process of the FDA motivates companies to strive for innovation while upholding strong quality standards. Moreover, the emphasis on digital health and telemedicine in North America has led to the creation of wearable gadgets and remote monitoring options.

Asia Pacific is the fastest growing region in Medical Device Engineering Market with 29% of share in 2023. Regulatory advancements and a flourishing innovation environment in key nations such as China and India are primarily responsible for this growth. These countries have made significant progress in improving their regulatory systems, resulting in a significant reduction in obstacles to the advancement and marketing of new medical equipment. For example, the National Medical Products Administration (NMPA) of China has introduced changes that speed up the process of approving medical devices, enabling new products to be available on the market faster. This flexibility in regulations has led to an increase in interest from both local and global businesses, causing a rise in the need for advanced engineering services to guarantee that products adhere to strict quality and compliance criteria. In India, the Central Drugs Standard Control Organization (CDSCO) has also implemented measures to simplify the process of product approvals, helping companies to better understand regulatory requirements.For instance, Mindray has achieved significant progress in developing diagnostic imaging and patient monitoring systems by taking advantage of the supportive regulatory landscape, introducing creative solutions to the market. At the same time, Wipro GE Healthcare continues to lead in the advancement of imaging technologies and life-saving devices, with the backing of India's forward-thinking regulatory changes. The growing emphasis on innovation and adherence to regulations is leading to a heightened need for specialized engineering services in the area, as businesses aim to guarantee their products meet worldwide standards while also keeping up with quick development schedules.

Key Players

The Major Players L&T Technology Services Limited, Infosys Limited (India), HCL Technologies Limited (India), Cyient (India), Wipro (India), Tech Mahindra Limited (India), TATA Consultancy Services Limited (India), FLEX LTD (US), Capgemini (France), Embien Technologies India Pvt Ltd. (India), Alten Group (France), Accenture (Ireland), Consonance (Poland), Althea Group (US), MED INSTITUTE (US), Saraca Solutions Private Limited (India), Nemedio Inc. (US), Sternum (Israel), Medcrypt (US), MCRA, LLC (US), North American Science Associates, LLC (US), MedQtech (Sweden), Veranex (US), Ontogen Medtech LLC (US), Seisa Media (US), and Simplexity Product Development (US), Tietoevry and Others

Recent Development

-

In May 2024, Infosys Limited from India completed the acquisition of InSemi Technology Services Pvt Ltd. (India) - The nation of India. The commitment to the semiconductor ecosystem is highlighted by Infosys' strategic investment in InSemi, which also strengthens its Engineering R&D services expertise. The goal of this acquisition is to provide full product development services for clients around the world.

-

In November 2023, LTTS partnered with NVIDIA to create software-defined architectures for medical devices aimed at endoscopy, improving image quality and product scalability.

-

In October 2023, the Alten Group based in France purchased East Japan Institute of Technology Co., Ltd. (Japan) is the country in question. This purchase is in line with ALTEN's plan to enhance its engineering expertise in Japan and reach a significant scale, establishing itself as a top provider of engineering services in the nation.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 10.98 Billion |

| Market Size by 2032 | USD 25.27 Billion |

| CAGR | CAGR of 9.59 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type(Radiation Therapy Devices ,Ablation Devices{Microwave ablation ,Radiofrequency ablation ,Cryoablation , Others},Embolization Device {Micro catheters ,Guide wires}) • By Cancer Type(Lung Cancer ,Liver Cancer ,Kidney Cancer ,Others) • By End-User (Hospitals ,Specialty Clinics ,Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | L&T Technology Services Limited,Infosys Limited (India), HCL Technologies Limited (India), Cyient (India), Wipro (India), Tech Mahindra Limited (India), TATA Consultancy Services Limited (India), FLEX LTD (US), Capgemini (France), Embien Technologies India Pvt Ltd. (India), Alten Group (France), Accenture (Ireland), Consonance (Poland), Althea Group (US), MED INSTITUTE (US), Saraca Solutions Private Limited (India), Nemedio Inc. (US), Sternum (Israel), Medcrypt (US), MCRA, LLC (US), North American Science Associates, LLC (US), MedQtech (Sweden), Veranex (US), Ontogen Medtech LLC (US), Seisa Media (US), and Simplexity Product Development (US).and Others |

| Key Drivers | • Industry 4.0 driving innovations and enhancing efficiency in the medical device engineering sector. • Improvements in regulations are boosting innovation in the medical device engineering industry. |

| RESTRAINTS | • Insufficient Utilization of Unique Device Identifiers and Budget Limitations Impeding Supervision of the Medical Device. |