Micro-Electro-Mechanical System Market Report Scope & Overview:

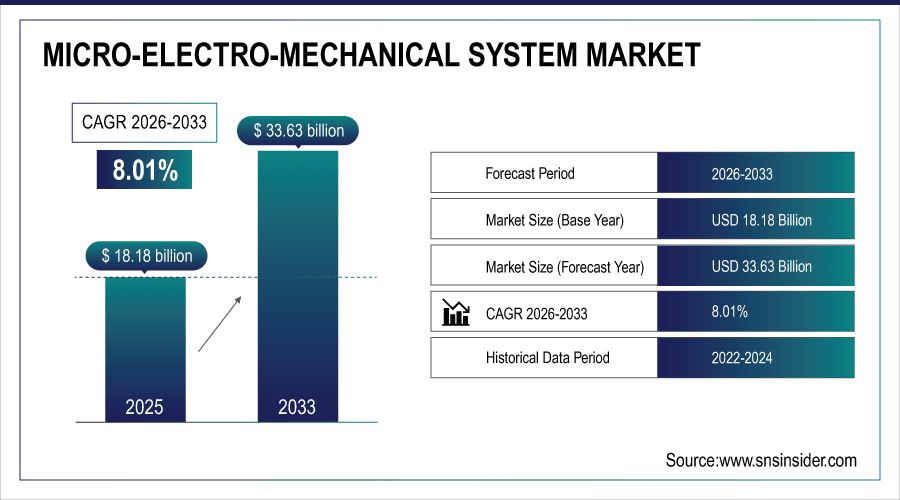

The Micro-Electro-Mechanical System Market size was valued at USD 18.18 Billion in 2025E and is projected to reach USD 33.63 Billion by 2033, growing at a CAGR of 8.01% during 2026-2033.

The Micro-Electro-Mechanical System Market analysis highlights the increasing demand from automotive, consumer electronics and healthcare applications. Rising penetration of IoT equipment and smart sensors are largely fostering expansion. Trends toward miniaturization and the precision of sensors have both helped to drive growth. The growing production and adoption in smart phones, wearables, and vehicles is bolstering the market growth. In general, MEMS are becoming essential enablers for next generation connected and smart devices.

More than 90% of smartphones shipped in 2025 will include 7+ MEMS sensors (accelerometer, gyro, mic, etc.) for enhanced user experience.

To Get More Information On Micro-Electro-Mechanical System Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 18.18 Billion

-

Market Size by 2033: USD 33.63 Billion

-

CAGR: 8.01% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Micro-Electro-Mechanical System Market Trends

-

MEMS sensors are integrated into an expanding range of devices such as smart phone, wearable and AR/VR devices, increasing the need for small-size, low power- consuming and multiple functioned sensor products to enrich user experiences and smart functions.

-

Automotive applications including ADAS, airbags, tire pressure monitoring and in-vehicle infotainment systems are driving MEMS adoption to the next level, enabling advanced safety, automation and connected car ecosystem evolution.

-

Increasing MEMS usage in medical devices, diagnostic gadgets, drug delivery technology and patient-monitoring devices is driving precision healthcare growth and fuelling adoption of telemedicine and wearables.

-

The boom in IoT is also accelerating proliferation of MEMS that integrates smart devices in industrial automation, smart home and city, which optimizes the real-time data monitoring, energy efficiency and predictive maintenance for connected infrastructure solutions.

-

Wafer-level packaging, 3D stacking and cost-effective manufacturing approaches are enhancing MEMS performance, reducing cost of MEMS devices and driving their mass adoption in a range of industries worldwide.

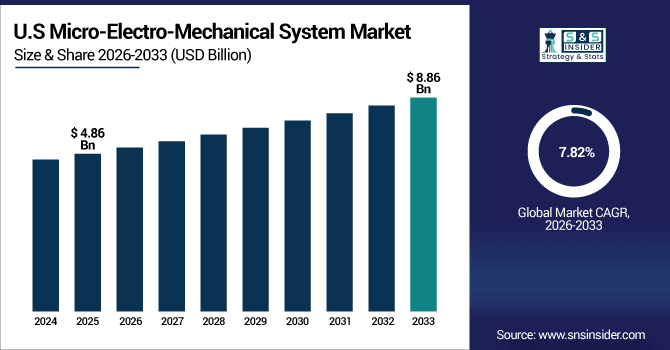

The U.S. Micro-Electro-Mechanical System Market size was valued at USD 4.86 Billion in 2025E and is projected to reach USD 8.86 Billion by 2033, growing at a CAGR of 7.82% during 2026-2033.

Micro-Electro-Mechanical System Market growth is driven by demand for advanced sensors in automotive, consumer electronics and healthcare sectors will support the U.S. MEMS market outlook. Wide adoption of autonomous vehicles and safety systems provide additional stimulus for MEMs integration. The growth of the IoT and wearables continues to drive demand for smaller, more efficient MEMS solutions. Significant investments in R&D for semiconductors and innovation in manufacturing insure domestic production capacity.

Micro-Electro-Mechanical System Market Growth Drivers:

-

Rising Integration of MEMS in Consumer Electronics, Automotive, and Healthcare Devices Fuels Rapid Market Expansion.

The Micro-Electro-Mechanical System Market growth is expanding due to they are the heart of every smart phone, wearable device, vehicle and medical equipment. Miniaturization, low power consumption and precision sensing makes MEMS desirable for developing advanced technologies such as autonomous cars, IoT devices and portable health-care monitoring systems.” Furthermore, robust investment in semiconductor advancements and sensor-equipped application integration is hastening integration into various end-use applications, thereby expedite market growth at a global level.

Over 60% of new remote patient monitoring systems launched in 2024–25 rely on MEMS pressure, flow, or acoustic sensors for real-time diagnostics.

Micro-Electro-Mechanical System Market Restraints:

-

High Manufacturing Costs and Technical Complexities Limit Large-Scale MEMS Market Penetration Across Industries

The Micro-Electro-Mechanical System Market faces several restraints that may hinder its growth potential. Heavy start-up investments and complex design procedures as well as expensive manufacturing equipment. Guaranteeing reliability, precision and robustness of MEMS in harsh industrial or automotive conditions cause additional costs. Furthermore, there is still the problem of standardization and inability to achieve economies of scale for large volumes. Such limitations have hindered small and mid-size companies from implementing MEMS-based solutions. Expansion of the market is thus slowed down relative to its full potential.

Micro-Electro-Mechanical System Market Opportunities:

-

High Manufacturing Costs and Technical Complexities Limit Large-Scale MEMS Market Penetration Across Industries

Introduction of IoT, 5G-connected devices and AI-based systems will create huge growth opportunities for MEMS technology. Their ability to deliver small footprint, accuracy and energy efficiency means they are well suited for wearables, smart home, connected vehicle and digital health applications. Rise in need for miniaturized diagnostic devices, and implantable products, and remote monitoring are projected to augment the demand of MEMS in the healthcare sector. Growing industrial automation levels and consumer appetite for smart, connected gadgets will also support the development of MEMS technologies globally.

By 2025, over 60% of newly deployed 5G-connected IoT edge devices will integrate at least 2 MEMS sensors for environmental or motion intelligence. AI-enabled MEMS sensor fusion (combining accelerometer, gyro, magnetometer data) is used in 75% of smart edge devices for real-time context awareness.

Micro-Electro-Mechanical System Market Segment Analysis

-

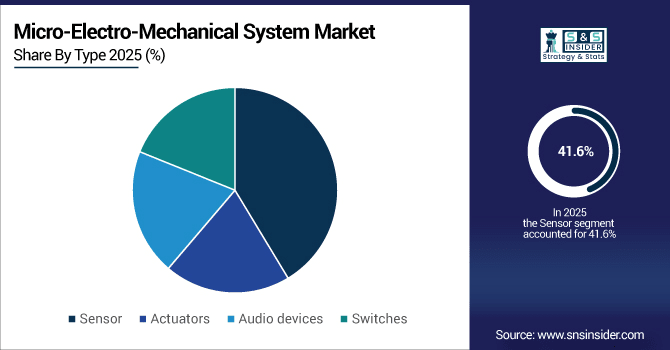

By Type, Sensors accounted for the largest share at 41.60% in 2025E, while Audio Devices are set to grow at the fastest pace with a CAGR of 11.40%.

-

By Sensor, Pressure Sensors led the market with a 28.50% share in 2025E, while Environmental Sensors are projected to be the fastest growing with a CAGR of 10.80%.

-

By Actuator, Inkjet Print Heads dominated with 30.20% share in 2025E, whereas RF MEMS are expected to record the fastest growth at a CAGR of 12.10%.

-

By Vertical, Consumer Electronics held the leading position with 37.90% market share in 2025E, while Healthcare is anticipated to register the fastest CAGR of 12.70%.

By Type, Sensor Lead While Audio Devices Registers Fastest Growth

The sensors based on MEMS are the largest market type segment in all applications such as automotive safety system, consumer products, industrial application, and health care industry. The high adoption rate of load cells is mainly due to their capacity to give accurate data and enhance the system performance. Audio is the fastest growing, though, driven largely by increasing demand for MEMS microphones and microspeakers in smartphones, wearables, smart assistants and AR/VR products. Superior audio quality, small form factor, and integration with AI-based sound capabilities have been key in driving demand for these devices in new consumer applications.

By Sensor, Pressure Sensor Leads Market While Maskless Lithography Registers Fastest Growth

Pressure sensors are leading the MEMS market as a result of their usage in automotive, consumer electronics, and industrial applications among others where there is accurate measurement and safety systems. It is driven by the increasing penetration of smart automobiles and wearable devices, which need accurate pressure readings. The maskless lithography segment is trending with the fastest growth rate and offers excellent precision, flexibility, and cost effectiveness in MEMS fabrication for the production of sophisticated sensors to realize future IoT and healthcare applications.

By Actuator, Inkjet Print Heads Dominate While RF MEMS Shows Rapid Growth

Inkjet print heads are the largest actuator application as this is critical in printing, 3D manufacturing and bio-technology. They offer high precision and cost effectiveness, and are increasingly prevalent in the consumer and industrial market ranges. On the flip side, RF MEMS actuator is experiencing robust demand as telecom, smartphone and 5G backdrop surge. They are key to modern wireless communication due to their low power consumption and high operating frequencies, which offer vast market opportunities.

By Vertical, Consumer Electronics Lead While Healthcare Grow Fastest

Consumer electronics is the major contributor to MEMS regardless of top used in smartphones, wearables, tablets and laptops. Motion sensors, audio microphones and gyroscopes often use MEMS technology on the demand side. But medical is the fastest-growing segment, observing high adoption of MEMS in diagnosis tools, implantable products, remote monitoring, and lab-on-chip applications. The rise in digital healthcare system, tele-medicine facilities and custom made medical device is creating the strong growth of MEMS in healthcare.

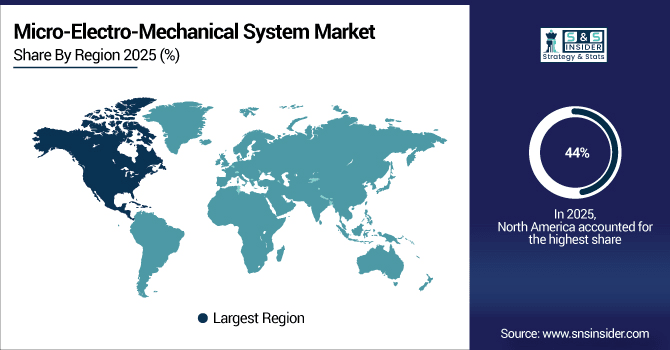

Micro-Electro-Mechanical System Market Regional Analysis:

North America Micro-Electro-Mechanical System Market Insights

In 2025E North America dominated the Micro-Electro-Mechanical System Market and accounted for 44% of revenue share, this leadership is due to the mature R&D infrastructure and the leadership in MEMS application in both its aerospace/defense program’s. Growth is further propelled by the emergence of IoT, smart homes, and autonomous vehicles. Market adoption is spurring through cooperation between MEMS manufacturers and tech firms.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Micro-Electro-Mechanical System Market Insights

The U.S. MEMS market is growing via high integration in medical devices, defense systems and consumer goods of the future. Miniaturized sensors in wearable fitness monitors and sophisticated automotive uses power demand. Investments and co-operation with overseas manufacturers in semiconductor development encourage innovation.

Asia-pacific Micro-Electro-Mechanical System Market Insights

Asia-pacific is expected to witness the fastest growth in the Micro-Electro-Mechanical System Market over 2026-2033, with a projected CAGR of 10.38 due to high adoption of smartphones, IoT device, automotive sensors. Growing investments in semiconductor manufacturing and government background for digital infrastructure are the factors encouraging market growth. The existence of such world class MEMS companies/foundries guarantees fast developments. Increasing usage of smart wearables and health applications also propels the regional market.

China Micro-Electro-Mechanical System Market Insights

China is the leading consumer of MEMS in the Asia-Pacific on account of huge electronics market and automotive industry. The nation’s status as a world manufacturing center speeds up the manufacture and integration of MEMS into smartphones, wearables, and vehicles.

Europe Micro-Electro-Mechanical System Market Insights

Europe holds a dominant share in the MEMS market owing to its well-established automotive and industrial automation industries. Germany, France and the UK are leading the way in adoption, specifically around connected cars and Industry 4.0 programmes. The area also attaches great importance to energy conservation and environmental monitoring, so the demand for MEMS sensors is increasing.

Germany Micro-Electro-Mechanical System Market Insights

Germany is a key country in Europe’s MEMS market being so strong in automotive and industrial. MEMS sensors are incorporated into the cars of leading auto manufacturers for safety, navigation and efficiency. The nation’s Industry 4.0 activities propel the uptake of MEMS technology in smart factories and robotics.

Latin America (LATAM) and Middle East & Africa (MEA) Micro-Electro-Mechanical System Market Insights

The Micro-Electro-Mechanical System Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the rising consumer electronics penetration and gradual adoption of industrial automation. MEA’s market is driven by increasing smart city projects, healthcare expansion, and automotive modernization. Both regions face challenges of limited semiconductor manufacturing infrastructure. However, growing imports and investments from global players are expected to expand MEMS integration across various industries in the coming years.

Micro-Electro-Mechanical System Market Competitive Landscape:

Texas Instruments is an incumbent in the MEMS industry, combining its leadership formulations in semiconductors and analog. The firm offers MEMS sensors used in the automotive, industrial, and consumer electronics sectors. Its yearlong emphasis on low-power, high-performance solutions is intended to power IoT and wearables. Significantly, companies that commit strongly toward R&D will make the most advances in pressure-and inertial-sensor technologies.

-

In September 2025, Texas Instruments unveiled the industry's most sensitive in-plane Hall-effect switch, designed to replace more expensive and complex position sensors. This innovation aims to lower design costs and enhance manufacturing efficiency in industrial and automotive applications.

TDK Corporation is known for its wide selection of MEMS sensors, which also includes motion, pressure and environmental sensors. It serves consumer electronics, automotive and healthcare markets. We rely on its InvenSense subsidiary to innovate in motion-sensing for smartphones, and gaming gear. TDK focuses on miniaturization and power-saving of MEMS for IoT.

-

In April 2025, TDK Corporation showcased its high-temperature MEMS accelerometer, the AXO314, at the Offshore Technology Conference (OTC) 2025. This sensor is tailored for directional drilling in the energy sector, offering robust performance in extreme conditions.

STMicroelectronics, a major provider of MEMS devices with sensors such as accelerometers, gyroscopes and microphones. It is a key enabling technology for smart devices, 28 automotive safety systems and industrial automation. The firm's MEMS solutions can be used in smartphones, AR/VR and autonomous vehicles. STMicroelectronics on Aug.

-

In September 2025, STMicroelectronics announced a $60 million investment in its Tours, France plant to develop a pilot line for advanced semiconductor manufacturing using Panel-Level Packaging (PLP) technology. This move is part of a broader restructuring strategy to enhance manufacturing efficiency and support long-term success.

Robert Bosch GmbH is a trailblazer in MEMS technology particularly for automotive and consumer electronics uses. Its MEMS-based sensors are used in advanced driver assistance systems, navigation and environmental monitoring. Bosch has delivered numerous MEMS sensors worldwide and enjoys a dominant position in the marketplace. The company is a little eco-conscious and aims to implement sustainable designs in the sensors.

-

In September 2025, Bosch Sensortec introduced the SMP290, a fully integrated MEMS sensor module for Tire Pressure Monitoring Systems (TPMS) featuring Bluetooth Low Energy (BLE) technology. This innovation aims to enhance safety and performance in motorcycles, cars, trucks, and buses.

Micro-Electro-Mechanical System Market Key Players:

Some of the Micro-Electro-Mechanical System Market Companies are:

-

Texas Instruments Incorporated

-

TDK Corporation

-

STMicroelectronics

-

Robert Bosch GmbH

-

Qualcomm Technologies, Inc.

-

Panasonic Corporation

-

NXP Semiconductors

-

Knowles Electronics, LLC

-

Infineon Technologies AG

-

HP Development Company, L.P.

-

Honeywell International Inc.

-

Goertek

-

DENSO CORPORATION

-

Broadcom

-

Analog Devices, Inc.

-

Murata Manufacturing Co., Ltd.

-

TE Connectivity

-

Seiko Epson Corporation

-

Sensata Technologies

-

Omron Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 18.18 Billion |

| Market Size by 2033 | USD 33.63 Billion |

| CAGR | CAGR of 8.01% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Sensor (Pressure Sensor, Optical Sensor, Microspeaker, Microphone, Inertial Sensor, Environmental Sensor and Others) • By Actuator (RF MEMS, Optical MEMS, Microfluidics, Inkjet Print Heads and Others) • By Type (Sensor, Actuators, Audio devices and Switches) • By Vertical (Telecommunication, Industrial, Healthcare, Consumer Electronics, Automotive, Aerospace and Defense and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Texas Instruments Incorporated, TDK Corporation, STMicroelectronics, Robert Bosch GmbH, Qualcomm Technologies, Inc., Panasonic Corporation, NXP Semiconductors, Knowles Electronics, LLC, Infineon Technologies AG, HP Development Company, L.P., Honeywell International Inc., Goertek, DENSO CORPORATION, Broadcom, Analog Devices, Inc., Murata Manufacturing Co., Ltd., TE Connectivity, Seiko Epson Corporation, Sensata Technologies, Omron Corporation |