Micro Injection Molded Plastic Market Analysis & Overview:

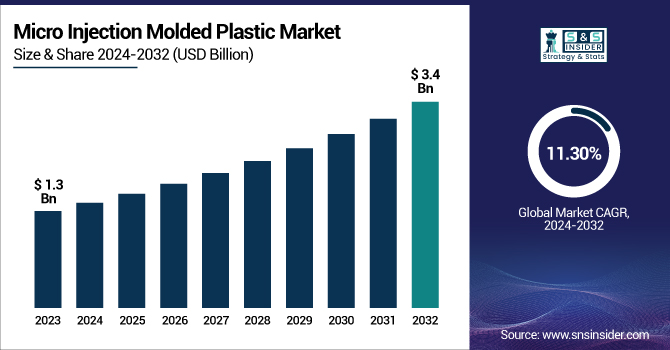

The Micro Injection Molded Plastic Market size was valued at USD 1.3 billion in 2023 and is expected to reach USD 3.4 billion by 2032, growing at a CAGR of 11.30% over the forecast period of 2024-2032.

Get more information on Micro Injection Molded Plastic Market - Request Sample Report

The report provides in-depth insights into key trends shaping the industry, including the rising demand for miniaturized components across healthcare, electronics, and automotive sectors. The report highlights technological advancements in micro molding processes, such as precision tooling and automation, which enhance production efficiency and product quality. Additionally, it explores the increasing adoption of bio-based and high-performance polymers, driven by sustainability concerns and regulatory compliance. It also provides supply chain challenges, competitive landscape, and regional growth patterns, are also analyzed. Furthermore, the report examines emerging applications in medical implants, microfluidics, and consumer electronics, providing strategic insights for industry stakeholders to capitalize on future opportunities.

Micro Injection Molded Plastic Market Dynamics:

Drivers

-

Rising demand for automotive industry in micro molding market drives the market growth.

The Automotive industry is another major factor contributing to driving the growth of the micro injection molded plastic market. Micro injection molding refers to the process of manufacturing very small and precise plastic components and is becoming increasingly popular in automotive applications where strong, lightweight, and complex parts need to be produced. Micro injection molding is being increasingly used in the automotive industry for high-performance component manufacturing, including those for sensors, connectors, switches, and other miniaturized components utilized in a vehicle's interior, electronics, and engine system. All of these provide increasing vehicle efficiency, safety and functions which are held at strict industry standards. Also, many of these components are relatively light, which helps to save weight in the vehicles, resulting in improved fuel economy and reduced emissions, consistent with the increasing trend for sustainable and environment-friendly solutions among automotive industry players. Additionally, factors such as the push for electric vehicles (EVs) in the automotive segment have increased the demand through micro-molded components. EVs need high level electronic systems, battery management systems and the highly sophisticated components, which can be manufactured efficiently using micro-injection molding.

Restraint

-

High investment and ongoing maintenance costs may hamper the market growth.

The high investment requirement and the continuous upkeep and maintenance costs limit the micro injection molded plastic market. Micro injection molding has the burden of large, upfront capital investments in specialized, high-quality machinery and molds, as well as skilled and experienced artisans for high quality production. This initial investment can deter small manufacturers or recently established business from scaling their operations. Moreover, the complexity of micro molding requires maintaining equipment and molds over alternative, constant qualities and various components leading to generation period tremors. The rationale behind this is that high costs of maintenance, such as parts replacement, recalibration, and sometimes specialized technicians, add to the overall operational expenses.

Opportunities

-

Growing demand of electric vehicle in automotive and molding industry create an opportunity for the market.

The automotive industry is increasingly moving towards electric mobility and hence, is experiencing an increase in the demand for lightweight, sturdy and high-performance components that help enhance the efficiencies, safety and features of vehicles (EVs). Micro injection molding can help to address these challenges, producing small, complex parts with high precision. Micro injection molding is ideal for manufacturing components used in EVs, including battery housings, connectors, sensors, and electronic enclosures. In addition, with the push towards EVs, there is a requirement for more sustainable manufacturing processes, and with micro injection molding, there is less material waste, as well as low wastage and energy-efficient solution. The rising demand for electric vehicles drives the micro-molded components market and further challenges the developers in innovating molding technologies to cater the changing automotive requirements, thus providing good growth opportunity for market players.

Challenges

-

High competition from alternative technologies in micro injection molded plastic market.

A technology of rapid and high-precision localizing micro-fabrication and reconstruction, offer precision and cost-effective solution but 3D printing, compression molding, and traditional injection molding are also alternative technologies that are being increasingly adopted. For larger volumes or simpler parts, these alternative methods can often be more economical. Additionally, 3D printing supports rapid prototyping and the assembly of complex designs without costly mold, so it is a great choice for enterprises that want to minimize initial investment. On the other hand, compression molding is typically used for larger, more durable parts and can be more appropriate for certain materials that may not be suitable for micro injection molding.

Micro Injection Molded Plastic Market Segments:

By Material Type

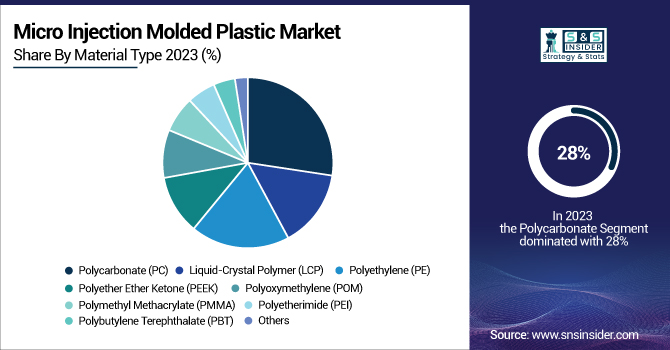

Polycarbonate held the largest market share around 28%in 2023. Polycarbonate is a durable thermoplastic known for its impact resistance, optical clarity, and dimensional stability, which makes PC ideal for precision components requiring both durability and transparency. Such attributes are especially critical in automotive, electronics, and medical industries, where components must bear the mechanical stress that retains performance and aesthetics. A common example is the political correctness of the automotive sector, in which PC is used for interior components, lighting systems, and also exterior parts, as it absorbs impact without cracking or shattering.

By Application

Medical segment held the largest market share around 24% in 2023. The growing need for high precision components used in medical devices and equipment. Micro injection moulding is most useful when a part to be made is small and complex, for example in the case of a syringe, connector, drug delivery system, diagnostic component, and an implant requiring the utmost precision and repeatability. Micro injection molding helps manufacturers produce tiny components and keep them cost-effective while, at the same time, making large volumes of components that can meet the strict rules of the medical industry, which are claiming for high-quality, durable and sterile components.

Micro Injection Molded Plastic Market Regional Analysis:

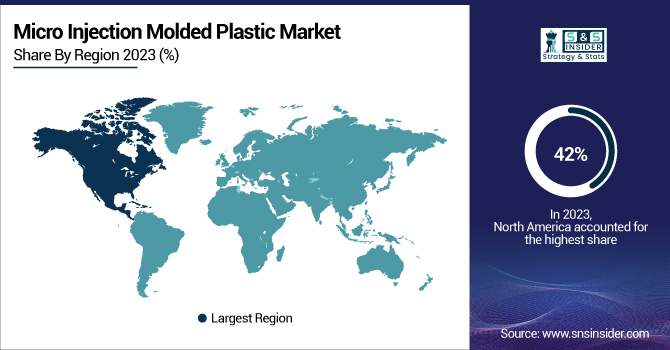

North America held the largest market share around 42% in 2023. It is due to factors such as better technological infrastructure, strong manufacturing base and high automotive, medical and electronic demand. Micro injection molding has several applications in industries such as automotive, which is one of the largest adopters of micro injection molding, owing to the presence of large number of companies in the region. Meanwhile, America comprises of a network of efficient R&D environment which then catalyzes innovations on micro molding technologies prompting versatile application across distinct industries. High-performance small components demand in automotive industry's transition towards electric vehicles (EVs) and compact diagnostic tools and devices in the medical sector are some opportunities witnessed in these automotive components and medical device companies based in US and Canada.

Asia Pacific held the significant market share in the forecast period. The region has become a global manufacturing hub, driven by cost-effective production, advanced technological adoption, and a growing middle-class population that fuels demand for consumer electronics and medical devices. Countries like China, Japan, and South Korea have emerged as leaders in the automotive and electronics sectors, which are key drivers for micro injection molded plastic applications, such as precision components for sensors, connectors, and small mechanical parts. The shift toward electric vehicles (EVs) and advanced healthcare devices further amplifies the demand for small, lightweight, and durable parts, positioning micro injection molding as an ideal technology.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players:

-

Paragon Medical (Medical Device Components, Drug Delivery Devices)

-

Spectrum Plastics Group, Inc. (Medical Injection Molding, Custom Molded Parts)

-

Makuta Micro Molding (Precision Molding, Complex Micro Components)

-

Precikam Inc. (Micro Molding Services, Medical Micro Components)

-

MTD Micro Molding (Micro Precision Parts, Medical Injection Molding)

-

3M (Electronic Components, Medical Devices)

-

Accumold LLC (Micro Injection Molding, Precision Molds)

-

SMC Ltd. (Micro Injection Molding, Medical Components)

-

Isometric Micro Molding, Inc. (Precision Micro Molding, Micro Medical Components)

-

BMP Medical (Medical Molding, Custom Molding Solutions)

-

Starkey Hearing Technologies (Hearing Aid Components, Micro Molding)

-

GPI Prototype & Manufacturing Services (Custom Injection Molding, Micro Components)

-

Protolabs (Custom Injection Molding, Rapid Prototyping)

-

North American Tool & Die (Molding Solutions, Micro Injection Molds)

-

BASF (Polymer Materials, Precision Molded Components)

-

Arburg GmbH (Injection Molding Machines, Precision Molding Solutions)

-

Kistler Instrumente (Molding Solutions, Micro Molding Technology)

-

Milacron (Injection Molding Equipment, Precision Molding)

-

Fischer Group (Micro Molding, Precision Medical Parts)

-

Accurate Molding, Inc. (Custom Molding, Medical Components)

Recent Development:

In 2024, Paragon Medical expanded its capabilities in precision molding by acquiring a new state-of-the-art facility dedicated to the production of medical device components. This move aims to enhance their ability to meet the growing demand for complex, small-scale parts in the medical industry.

In 2023, Spectrum Plastics Group announced the launch of a new injection molding technology that reduces production costs while improving the precision and durability of micro-molded medical components. The technology aims to meet the increasing demand for high-performance medical devices and drug delivery systems.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 1.3 Billion |

|

Market Size by 2032 |

USD 3.4 Billion |

|

CAGR |

CAGR of 11.30% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Material type (Liquid-Crystal Polymer (LCP), Polyether Ether Ketone (PEEK), Polycarbonate (PC), Polyethylene (PE), Polyoxymethylene (POM), Polymethyl Methacryate (PMMA), Polyetherimide (PEI), Polybutylene Terephthalate (PBT), Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Paragon Medical, Spectrum Plastics Group, Inc., Makuta Micro Molding, Precikam Inc., MTD Micro Molding, 3M, Accumold LLC, SMC Ltd., Isometric Micro Molding, Inc., BMP Medical, Starkey Hearing Technologies, GPI Prototype & Manufacturing Services, Protolabs, North American Tool & Die, BASF, Arburg GmbH, Kistler Instrumente, Milacron, Fischer Group, Accurate Molding, Inc. |