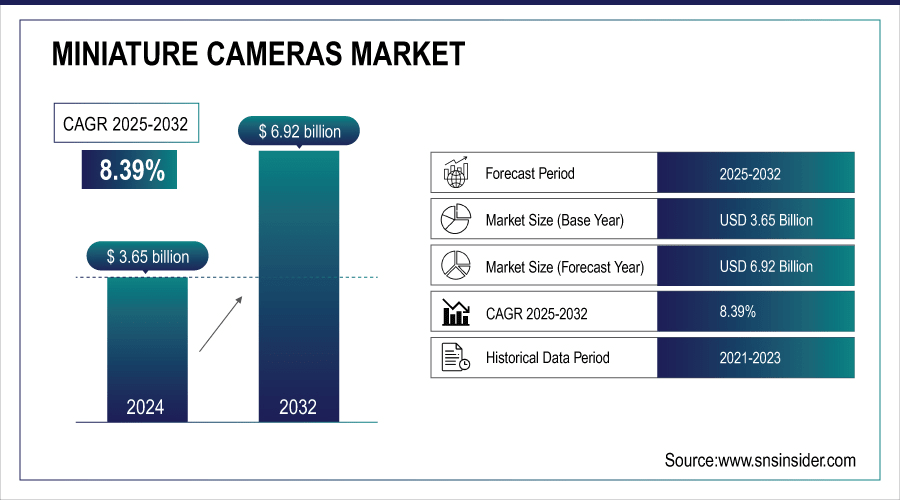

Miniature Camera Market Size Analysis:

The Miniature Camera Market size was valued at USD 3.65 billion in 2024 and is expected to reach USD 6.92 billion by 2032, growing at a CAGR of 8.39% over the forecast period of 2025-2032.

Miniature Camera Market trends are advancing toward ultra-HD resolution, medical endoscopy growth, wearable adoption, automotive integration, and AI-enabled imaging.

Miniature Camera Market are witnessing fast-paced growth owing to increasing requirements for compact and high-resolution imaging solutions across a number of industries. This has resulted in rapid adoption in healthcare due to endoscopic and diagnostic applications, automotive manufacturers are adopting miniature cameras for ADAS and too for most autonomous driving. Smartphones, wearables, and even lifestyle consumer electronics, further spur growth. Furthermore, these cameras are also used for surveillance and monitoring in the defense security and industrial sectors, where miniaturization and technology evolution act as the key growth enablers.

To Get More Information On Miniature Camera Market - Request Free Sample Report

Approximately 33% of new vehicles sold in the U.S., Europe, Japan, and China were equipped with ADAS features with expectations that 50% of all vehicles on the road will be ADAS-enabled by 2030

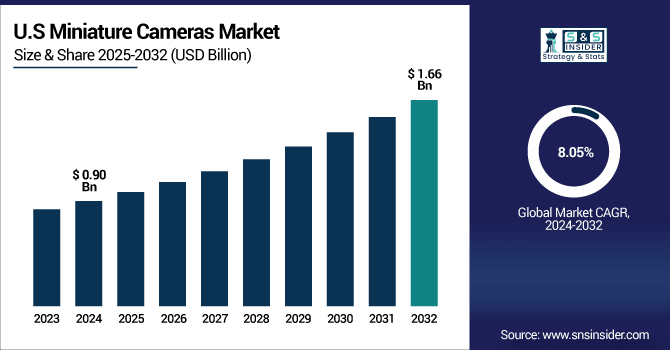

The U.S. Miniature Camera Market size was valued at USD 0.90 billion in 2024 and is expected to reach USD 1.66 billion by 2032, growing at a CAGR of 8.05% over the forecast period of 2025-2032. U.S. miniature camera market is growing due to rising demand in healthcare imaging, ADAS-equipped vehicles, advanced surveillance systems, and consumer electronics like smartphones and wearables, supported by continuous innovation in high-resolution compact sensors.

Miniature Camera Market Dynamics:

Drivers:

-

Rising Demand for Compact High Resolution Miniature Cameras Driving Healthcare Automotive Consumer Electronics Security Growth

The global Miniature Camera Market is primarily driven by the rising demand for compact, high-resolution imaging across healthcare, automotive, consumer electronics, and security industries. In healthcare, increasing adoption of endoscopic and minimally invasive surgical procedures boosts camera integration. Automotive manufacturers are rapidly embedding miniature cameras in ADAS and autonomous driving systems, enhancing safety and driver assistance. Additionally, the proliferation of smartphones, wearables, and lifestyle consumer gadgets with multiple camera modules further fuels growth, alongside growing defense and industrial surveillance applications.

Sony Semiconductor has shipped a staggering 20 billion image sensors since inception doubling from 10 billion in just five years, driven by multi-camera smartphone adoption

Restraints:

-

Challenges and Restraints Limiting Growth of Miniature Cameras Technological Privacy Reliability Integration Regulatory Issues

The Miniature Camera Market faces restraints such as technological limitations in further miniaturization while maintaining image quality, heat dissipation issues, and challenges in ensuring reliability in harsh environments like automotive and defense. Privacy and data security concerns, especially with widespread adoption in surveillance, also restrict broader acceptance. Moreover, integration complexities in medical devices and regulatory approval hurdles can slow down adoption in healthcare applications.

Opportunities:

-

Emerging Opportunities in Ultra HD AI Enabled Miniature Cameras Driving Healthcare Automotive Smart Device Growth

Significant opportunities lie in advancing ultra-HD and AI-enabled miniature cameras, enhancing image processing and diagnostics in healthcare and precision monitoring in automotive. Emerging economies present untapped demand in medical devices, smart devices, and surveillance systems.

Innovations like MiniTac, an ultra-compact (8 mm) vision-based tactile sensor with an embedded miniature camera, are being integrated into robot-assisted minimally invasive surgery, enabling tissue palpation and enhancing surgical precision beyond visual capture.

Challenges:

-

Overcoming Technological Obsolescence Supply Chain Durability and Regulatory Challenges in AI Driven Miniature Camera Solutions

Key challenges include rapid technological obsolescence, requiring continuous innovation and R&D investment, and supply chain disruptions affecting critical semiconductor components. Ensuring durability and long operational life in compact formats remains a technical barrier. Additionally, aligning AI-driven imaging solutions with strict industry standards in healthcare and automotive sectors creates regulatory and interoperability challenges.

Miniature Camera Market Segmentation Analysis:

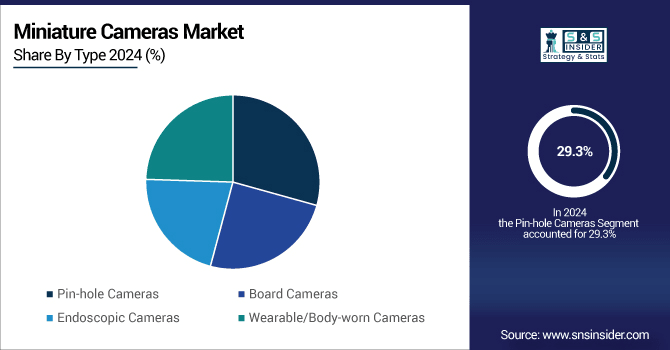

By Type

Pin-hole cameras dominated the global Miniature Camera Market in 2024, accounting for approximately 29.3% of total demand. Their widespread adoption is driven by applications in surveillance, security, and defense, where discreet, compact imaging solutions are essential. These cameras are favored for law enforcement, industrial monitoring, and smart infrastructure projects due to their ability to capture high-quality images while being unobtrusive.

Endoscopic cameras are expected to grow at the fastest CAGR from 2025 to 2032, fueled by rising demand in healthcare for minimally invasive surgeries and diagnostics. Advances in ultra-high-definition imaging, AI-assisted diagnostics, and robotic-assisted procedures are enhancing their utility. Increasing investments in healthcare infrastructure and the adoption of advanced medical imaging technologies further drive growth in this segment globally.

By Application

The medical and healthcare segment dominated the global Miniature Camera Market in 2024, holding approximately 29.4% of the market. This strong position is driven by increasing adoption of endoscopic procedures, minimally invasive surgeries, and advanced diagnostic imaging that rely on compact, high-resolution cameras. The segment is also expected to grow at the fastest CAGR from 2025 to 2032, supported by innovations in ultra-HD imaging, AI-assisted diagnostics, and robotic-assisted surgical systems, alongside expanding healthcare infrastructure and rising demand for precision medical technologies worldwide.

By Resolution

The High Definition (HD) segment dominated the global Miniature Camera Market in 2024, accounting for approximately 31.8% of total demand. HD cameras are widely used across consumer electronics, healthcare, automotive, and surveillance applications due to their ability to provide clear and detailed imaging while maintaining a compact form factor. The strong adoption of HD cameras in smartphones, wearable devices, and ADAS-equipped vehicles has contributed significantly to their market dominance.

Ultra HD (4K and above) cameras are expected to grow at the fastest CAGR from 2025 to 2032, driven by the increasing demand for ultra-clear imaging in medical diagnostics, autonomous vehicles, and professional surveillance. Advancements in AI-enabled image processing, miniaturization, and high-resolution optics further enhance the utility of Ultra HD cameras, creating significant growth opportunities across healthcare, automotive, and high-end consumer electronics sectors globally.

By End User

The healthcare institutions segment dominated the global Miniature Camera Market in 2024, accounting for approximately 27.3% of the market. This dominance is driven by the increasing use of miniature cameras in endoscopic procedures, minimally invasive surgeries, and advanced diagnostic imaging across hospitals and clinics. The segment is also expected to grow at the fastest CAGR from 2025 to 2032, supported by innovations in AI-assisted imaging, ultra-HD cameras, and robotic-assisted surgical systems. Expanding healthcare infrastructure and rising demand for precision medical technologies further fuel growth in this segment globally.

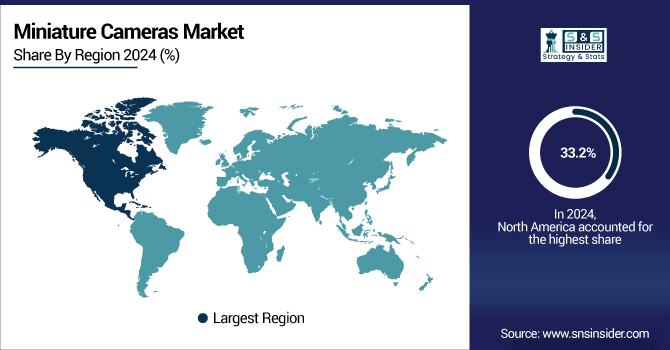

Miniature Camera Market Regional Analysis:

North America dominated the global Miniature Camera Market in 2024, accounting for approximately 33.2% of total demand. The region’s leadership is driven by advanced healthcare infrastructure, widespread adoption of endoscopic and minimally invasive procedures, and strong integration of ADAS and autonomous driving technologies in the automotive sector. High consumer electronics penetration, including smartphones, wearables, and lifestyle devices, further supports market growth. Additionally, robust investments in defense, security, and industrial surveillance systems contribute to North America’s dominant position.

Healthcare applications, particularly endoscopic and diagnostic imaging, dominate the Miniature Camera Market in North America due to advanced medical technology adoption.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific is expected to register the fastest CAGR from 2025 to 2032 in the global Miniature Camera Market. Rapid adoption of smartphones, wearable devices, and advanced medical imaging technologies, coupled with increasing integration of ADAS and automotive cameras, drives growth. Rising investments in healthcare infrastructure, smart city projects, and surveillance systems across emerging economies further accelerate demand, creating significant opportunities for miniature camera manufacturers in the region.

China dominates the Miniature Camera Market in Asia Pacific due to its strong consumer electronics manufacturing, automotive innovations, and expanding healthcare infrastructure.

Europe holds a significant position in the global Miniature Camera Market, driven by advanced healthcare systems, widespread adoption of endoscopic and diagnostic imaging, and growing use of cameras in automotive ADAS and autonomous driving. The region also benefits from strong industrial and security applications, including surveillance and smart infrastructure projects. Continuous technological innovations, coupled with supportive government initiatives for digital healthcare and smart transportation, further strengthen Europe’s market presence and contribute to steady growth in the miniature cameras sector.

Latin America and the Middle East & Africa hold emerging opportunities in the global Miniature Camera Market. Growth is driven by increasing adoption in healthcare, surveillance, and automotive applications, alongside expanding smart city and infrastructure projects. Rising investments in hospitals, clinics, and security systems, coupled with the gradual introduction of advanced imaging technologies, support market development. While adoption is slower than in developed regions, these markets present significant potential for miniature camera manufacturers seeking to capitalize on evolving healthcare, consumer electronics, and defense applications.

Miniature Camera Companies are:

The Key Players in Miniature Cameras Market are Sony Corporation, OmniVision Technologies, Samsung Electronics, Canon Inc., Nikon Corporation, Panasonic Holdings Corporation, Fujifilm Holdings Corporation, GoPro Inc., Teledyne Technologies Incorporated, FLIR Systems Inc., Polaroid Corporation, Hanwha Vision, Bosch Security Systems, Hikvision Digital Technology Co., Ltd., Axis Communications AB, Shenzhen AEE Technology Co., Ltd., Contour LLC, Garmin Ltd., Ambarella Inc., Dahua Technology Co., Ltd.

Recent Developments:

-

In July 2025, Sony revived its premium compact camera line with the RX1R III, featuring a 61MP sensor, BIONZ XR processor, and AI-assisted autofocus.

-

In June 2024, OmniVision unveiled the OCH2B30, a compact wafer-level camera module measuring just 2.6 mm x 2.6 mm. Designed for 3D intraoral dental scanners, it offers high image quality and integrates seamlessly with MIPI interfaces, enhancing dental imaging systems.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.65 Billion |

| Market Size by 2032 | USD 6.92 Billion |

| CAGR | CAGR of 8.39% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Pin-hole Cameras, Board Cameras, Endoscopic Cameras, and Wearable/Body-worn Cameras) • By Application (Medical & Healthcare, Consumer Electronics, Automotive, and Industrial & Security) • By Resolution (Standard Definition (SD), High Definition (HD), Full HD, and Ultra HD (4K and above)) • By End User (Healthcare Institutions, Defense & Security Agencies, Automotive Manufacturers, and Individual/Consumer Users) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Sony Corporation, OmniVision Technologies, Samsung Electronics, Canon Inc., Nikon Corporation, Panasonic Holdings Corporation, Fujifilm Holdings Corporation, GoPro Inc., Teledyne Technologies Incorporated, FLIR Systems Inc., Polaroid Corporation, Hanwha Vision, Bosch Security Systems, Hikvision Digital Technology Co., Ltd., Axis Communications AB, Shenzhen AEE Technology Co., Ltd., Contour LLC, Garmin Ltd., Ambarella Inc., Dahua Technology Co., Ltd. |