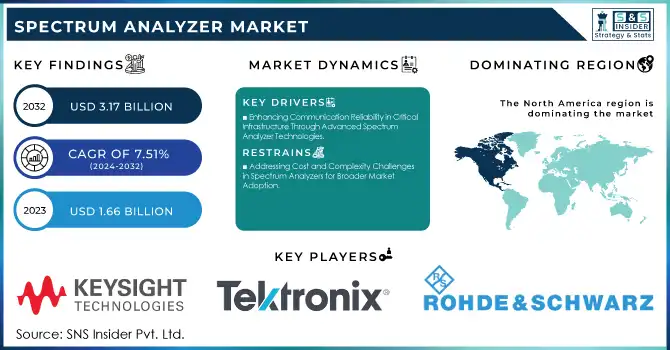

Spectrum Analyzer Market Size & Trends:

The Spectrum Analyzer Market was valued at USD 1.78 billion in 2025E and is expected to reach USD 3.19 billion by 2033, growing at a CAGR of 7.51% from 2026-2033.

The spectrum analyzer market analysis highlights its growth due to the advanced communication technologies, such as 5G and IoT, increasing the demand for precise frequency analysis and integrity testing of signals. spectrum analyzers are used in research and development regarding various industries, from telecommunications to aerospace and defense, further driving the adoption. Electronic devices are becoming increasingly complex, and, consequently, the testing equipment needs to be quite advanced, strictly regulated, and even standardized. Spectrum analyzers incorporate the notion of software-defined radio technology. This technology makes the analyzers more functional for advanced analysis and measurement capabilities by injecting flexibility into the analyzers themselves.

Spectrum Analyzer Market Size and Forecast

-

Spectrum Analyzer Market Size in 2025E: USD 1.78 Billion

-

Spectrum Analyzer Market Size by 2033: USD 3.19 Billion

-

CAGR: 7.51% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To get more information on Spectrum Analyzer Market - Request Free Sample Report

The U.S. Spectrum Analyzer market size was valued at an estimated USD 0.76 billion in 2025 and is projected to reach USD 1.35 billion by 2033, growing at a CAGR of 7.11% over the forecast period 2026–2033. Market growth is driven by increasing demand for spectrum analyzers across telecommunications, aerospace & defense, electronics manufacturing, and research institutions. Rising deployment of 5G networks, expanding use of wireless communication technologies, and growing complexity of RF environments are accelerating market expansion. Additionally, advancements in signal analysis capabilities, portable and real-time spectrum analyzers, and increasing investments in testing and measurement infrastructure further strengthen the growth outlook of the U.S. spectrum analyzer market during the forecast period.

For instance, sales in 2023 in the U.S. for the spectrum analyzer market reached nearly 47,000 units. Mostly this growth is connected with development in the area of telecommunication and its processes of rollout of 5G technology. Demand in such sectors as IT, telecommunications, aerospace, and defense has been high for these types of key devices. In the defense sector, the spending stood at an astonishing USD 916 billion. In this case, spectrum analyzers are of paramount importance in designing military communications systems and their maintenance.

Spectrum Analyzer Market Trends

-

Rising demand for advanced signal testing and wireless communication analysis is driving the spectrum analyzer market.

-

Increasing adoption across telecommunications, aerospace, defense, and electronics manufacturing is boosting growth.

-

Integration with 5G, IoT, and radar technologies is enhancing measurement accuracy and capabilities.

-

Growing need for real-time monitoring, spectrum management, and interference detection is shaping market trends.

-

Advancements in portable, benchtop, and handheld analyzers are improving flexibility and usability.

-

Expansion of R&D and testing labs is increasing demand for high-performance instruments.

-

Collaborations between equipment manufacturers, telecom providers, and research institutions are accelerating innovation and product development.

Spectrum Analyzer Market Growth Drivers:

-

Enhancing Communication Reliability in Critical Infrastructure Through Advanced Spectrum Analyzer Technologies

One of the big drivers for the spectrum analyzer market growth is the increased demand in critical infrastructure industries, such as power grids, transportation, and public safety. These industries rely on wireless communications to ensure smooth functioning and continuous spectrum analysis to prevent interference in signals or communication breakdown. For instance, in smart grids, spectrum analyzers allow undisturbed sensor control communication that can diagnose any glitch that might lead to power diversion.

-

Revolutionizing Automotive Safety with Spectrum Analyzers for Advanced Driver Assistance and Radar Systems

An important growth factor is the adoption of spectrum analyzers in the automobile field for advanced driver assistance systems and automotive radar systems. In the case of automobile manufacturers, spectrum analyzers are utilized to detect and check the frequency of the radars that are used in their automobiles' collision avoidance systems with the required safety and accuracy. For instance, when developing self-driving cars, spectrum analyzers play a critical role in the fine-tuning of the radar sensors, obstacle detection capabilities, and vehicle-to-vehicle communication which are critical for ensuring that the actual automobile is safe and successful.

Spectrum Analyzer Market Restraints:

-

Addressing Cost and Complexity Challenges in Spectrum Analyzers for Broader Market Adoption.

The present spectrum analyzers also raise serious concerns about high costs and complexity. High prices prevent the wider availability of advanced spectrum analyzers along with extra features in smaller businesses and organizations. Furthermore, increased complexity in the modern form of communications, namely 5G and IoT, demands highly skilled persons to deal with results obtained from the analyzers and a talent gap is emerging. Another challenge is the rapid technological advancements, which call for frequent updates and recalibration of devices. This increases cost maintenance and reduces the lifespan of earlier equipment, adding to the complexities of market adoption among industries.

Spectrum Analyzer Market Segment Analysis

By Offering, Hardware dominates the spectrum analyzer market, while software-based solutions are growing faster.

Hardware dominated the spectrum analyzer market with a market share of 58% in 2025, because of the intrinsic need to have reliable, accurate physical devices that help measure and analyze the frequency of the signal in the market. Hardware spectrum analyzers are, therefore, used in application areas such as telecommunications, aerospace, defense, and automotive sectors where real-time accurate measurement of signals is required; hence their robustness and holding capacity for high-frequency signals make them inevitable in such industries requiring accurate testing and monitoring.

The software-based segment is growing faster at a CAGR of 8% during the forecast period 2026-2033, due to the massive adoption of software-defined technologies. Software-based spectrum analyzers feature higher ease and flexibility along with great adaptability and cost-effectiveness, as they make use of existing hardware and include newer features through upgrades. These solutions help in real-time analysis, remote monitoring, and integration with other systems with greater ease, making them suitable for industries focusing on digital transformation. Advancements in the importance of cloud computing, IoT, and 5G accelerate the drive for software-driven spectrum analysis that can operate more dynamically and seamlessly on a much larger scale. Software-based solutions are usually allowed to have enhanced data processing and more sophisticated analysis resulting in faster adoption in R&D and testing environments.

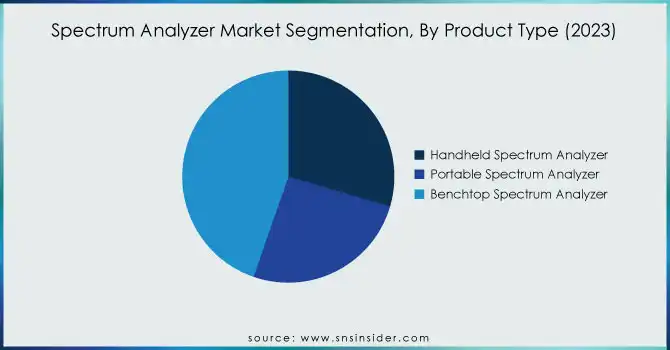

By Product Type, Benchtop spectrum analyzers hold the largest share, and handheld analyzers are the fastest-growing segment.

The Benchtop Spectrum Analyzer held a market share of 44% in 2025 since it is very advanced, accurate, and highly valued for use in laboratory or industrial applications. The advanced functionalities, such as higher frequency ranges and more advanced signal processing are some of the most significant requirements of sectors including telecommunications, aerospace, and defense. Accuracy in signal testing, monitoring, and validation of these segments fuels the demand for benchtop models.

The Handheld Spectrum Analyzer happens to be the fastest growing segment, as it accounted CAGR of 8.38% from the development perspective, largely because of its portability, ease of use, and increasingly high applications in fieldwork. They are gaining popularity more and more as industries are turning towards on-site testing and remote monitoring. Their compact size and relatively lower price make them all the more attractive for sectors including maintenance, telecommunications, and broadcasting, which require mobility as well as real-time analysis in diverse environments. Advancement in handheld technology is also improving their performance, further speeding up their adoption.

By Network Technology, Wireless network technology leads the market, with rapid growth driven by 5G, IoT, and Wi-Fi 6 adoption.

In 2025, the spectrum analyzer market is dominated by wireless network technology, accounting for a 54% share. This can be attributed to the rapid adoption of wireless communication technologies such as 5G, IoT, and Wi-Fi 6. These technologies require accurate frequency analysis and monitoring to ensure signal integrity without interference. Spectrum analyzers play a very important role in wireless network deployment and maintenance, making this device indispensable in fields, such as telecommunications, aerospace, defense, and consumer electronics.

The wireless application is expected to grow by 7.63% CAGR during the forecast period 2026-2033 due to the rapid expansion of 5G networks, proliferation of IoT devices, and growing need for real-time spectrum monitoring. Spectrum analyzers would be needed for compliance with regulatory standards and optimization of network performance as industries make a move towards more advanced wireless technologies. The growth process in the market is further being driven by the applications of wireless in smart cities, autonomous vehicles, and connected devices.

By Analyzer Type, Swept-tuned spectrum analyzers dominate, while vector signal analyzers show the fastest growth.

The Swept-Tuned Spectrum Analyzer accounted for a 24% share and dominated the market in 2025 on the strength of proven reliability, ease of use, and widespread application across industries. Such an analyzer is used for general-purpose signal analysis and frequency monitoring across the entire spectrum in telecommunications, aerospace, and defense. Its well-established technology offers a cost-effective solution to routine tasks and has contributed to its considerable market presence.

Vector Signal Spectrum Analyzer is fastest growing segment which will witness a CAGR of 9.46% during the forecast period. The VSA will see increased adoption due to its ability to analyze complex modulated signals on the rise in advanced wireless communication technologies such as 5G and IoT. Their ability to detail the signal analysis information on amplitude and phase makes them indispensable in the research and development of modern communication systems, which demand precision and performance in testing the integrity of signals.

By End-User, IT and Telecommunications lead in revenue, with continued growth expected due to expanding wireless networks and advanced communication technologies.

IT and Telecommunication was the leading sector in the spectrum analyzer market in 2025, holding a share of 32%, mainly due to rapid expansion in wireless networks and communication technologies. Spectrum analyzers form an integral backbone for the IT and telecommunications industry connected to every other possible activity globally, making them basically responsible for signal monitoring, interference analysis, and following regulatory standards. The ongoing rollout of 5G technologies alongside demands for fast internet and mobile connectivity made even more demanding the need for precise spectrum management and analysis in the chase for spectrum analyzer market share.

IT and Telecommunications are likely to be the leading fields in terms of growth, with an estimated CAGR of 7.94% over the forecast period. It can be attributed to further advancements in communications protocols, rapid deployment of IoT devices, and continued advancement of smart technologies. Thus, increasingly complex signals and network environments are created and there is a growing demand for sophisticated spectrum analyzers so as to ensure optimal performance and reliability in communication systems are bound to increase and grow further.

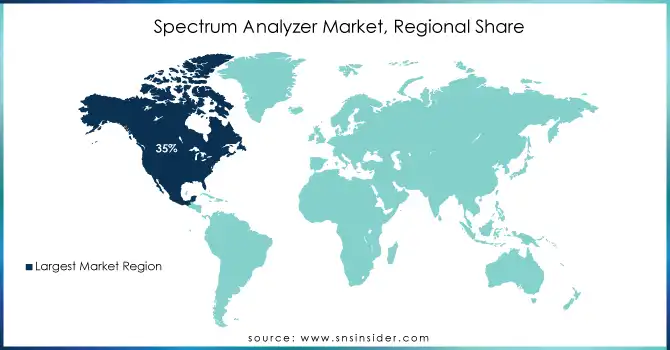

Spectrum Analyzer Market Regional Analysis

North America Spectrum Analyzer Market Insights

In 2025, North America is leading with the highest market share of 35% for the spectrum analyzer market. Such leadership can be explained by having advanced telecommunication infrastructure, adequate research and development activities, and major key players in this technology-based industry from this region. North America is an early adopter of new communication technologies, with 5G being an emerging spectrum analyzer market trend, highly demanding accurate signal analysis and monitoring. For instance, high compliance is strictly required in this region due to regulatory requirements. This, besides increasing the demand for spectrum analyzers, also expands the scope of application in different industries.

Asia Pacific Spectrum Analyzer Market Insights

Asia Pacific is the most rapidly expanding market with 8.01% CAGR during the forecast period 2026-2033. The drivers in this region include the heavy investment going into the telecommunication infrastructure, especially in the emerging economies that are also typically the countries of India and China where the demand for wireless communication continues to grow. The expansion of IoT applications and smart city initiatives in this region also underlines the increasing demand for advanced spectrum analysis tools. As the business and governmental authorities focus on technological advancements, the market in the Asia Pacific region is expected to witness tremendous growth for the adoption of spectrum analyzers.

Europe Spectrum Analyzer Market Insights

Europe holds a significant position in the Spectrum Analyzer Market, driven by increasing adoption of advanced communication systems, 5G deployment, and IoT applications. Strong presence of key manufacturers, ongoing research initiatives, and government support for wireless technology development are fueling market growth. Rising demand for high-precision measurement instruments in aerospace, defense, and telecommunications sectors further accelerates adoption, positioning Europe as a major contributor to the global spectrum analyzer market expansion.

Middle East & Africa and Latin America Spectrum Analyzer Market Insights

The Spectrum Analyzer Market in the Middle East & Africa and Latin America is expanding steadily, supported by growing investments in telecommunications, defense, and aerospace sectors. Increasing adoption of 4G/5G networks, IoT devices, and advanced communication technologies is driving demand for high-precision measurement instruments. Government initiatives, infrastructure modernization, and rising industrial automation further boost market growth, positioning these regions as emerging markets with significant opportunities in spectrum analyzer deployment.

Get Customized Report as per Your Business Requirement - Enquiry Now

Spectrum Analyzer Market Competitive Landscape:

Tektronix

Tektronix, founded in 1946, is a leading global provider of test, measurement, and monitoring solutions for electronics and communications industries. The company specializes in oscilloscopes, signal analyzers, and software solutions that enable engineers to design, test, and validate complex electronic systems efficiently. With a strong focus on innovation, Tektronix continuously enhances its product portfolio to support advanced wireless communications, signal integrity, and multi-channel analysis for next-generation technologies.

-

April 2024: Tektronix launched Version 5.4 of its SignalVu Spectrum Analyzer Software, enabling multi-channel modulation analysis for up to eight signals simultaneously and supporting 26 wireless modulation schemes

Anritsu

Anritsu, established in 1895, is a global leader in test and measurement equipment, providing solutions for telecommunications, electronics, and wireless industries. The company focuses on high-precision instruments for network testing, signal analysis, and wireless communications, enabling operators and engineers to optimize system performance and reliability. By integrating innovative measurement technologies with practical usability, Anritsu supports deployment, monitoring, and maintenance of complex networks worldwide.

-

July 2024: Anritsu unveiled an integrated test instrument combining a spectrum analyzer with a cable and antenna analyzer, designed for distributed antenna systems, satellite monitoring, interference analysis, and installation/maintenance applications.

MPB Srl

MPB Srl, based in Italy and founded in 1993, develops advanced measurement and signal analysis instruments for industrial and research applications. The company specializes in portable spectrum analyzers, RF measurement solutions, and real-time monitoring devices. By focusing on compact, user-friendly, and high-performance products, MPB enables engineers and technicians to perform precise frequency analysis, signal diagnostics, and system validation across a wide range of applications, from laboratory testing to field deployments.

-

January 2024: MPB Srl introduced the Compact Spectrum Analyzer (CSA), a real-time FFT handheld spectrum analyzer featuring a 7-inch color touchscreen and frequency coverage from 10 Hz to 4 GHz.

Key Players

Spectrum Analyzer Market Companies are:

-

Keysight Technologies (E4407B, N9030A)

-

Tektronix, Inc. (RSA5000, MDO3000)

-

Rohde & Schwarz (FSV3000, FSW)

-

Anritsu Corporation (MS2830A, MT8221B)

-

Fluke Corporation (DSX-5000, 430 Series II)

-

B&K Precision (Model 855, Model 861)

-

Signal Hound (BB60C, SM200A)

-

National Instruments (PXIe-5663, PXIe-5607)

-

Agilent Technologies (N9038A, E4406A)

-

Yokogawa Electric Corporation (AQ6370D, AQ6375)

-

Bird Technologies (PMM-220, PMM-30)

-

S.A.E. Manufacturing (SMT-Spectrum Analyzer, SPM-Spectrum Analyzer)

-

Advantest Corporation (T5580, R5361)

-

Chroma ATE Inc. (Chroma 8000, Chroma 8000A)

-

Ametek Programmable Power (PXI-4000, 6200 Series)

-

Ono Sokki Co., Ltd. (CF-9200, CF-9200L)

-

GW Instek (GSP-930, GSP-830)

-

Hameg Instruments (HM7030, HM6020)

-

Tabor Electronics (WaveX, WT3)

-

Viavi Solutions (MTS-5800, T-BERD/MTS-5800)

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 1.78 Billion |

| Market Size by 2033 | USD 3.19 Billion |

| CAGR | CAGR of 7.51% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Hardware, Software) • By Product Type (Handheld Spectrum Analyzer, Portable Spectrum Analyzer, Benchtop Spectrum Analyzer) • By Network Technology (Wireless, Wired) • By Analyzer Type (Swept-Tuned Spectrum Analyzer, RF Tuning Method Analyzer, Super Heterodyne Analyzer, Vector Signal Spectrum Analyzer, Real-Time Spectrum Analyzer, Fast Fourier Transform Analyzer, Parallel Filter Analyzer, Audio Spectrum Analyzer, Others) • By End-User Industry (Automotive, IT & Telecommunication, Aerospace, Defense, Medical, Electronics, Educational, Energy, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Keysight Technologies, Tektronix, Inc., Rohde & Schwarz, Anritsu Corporation, Fluke Corporation, B&K Precision, Signal Hound, National Instruments, Agilent Technologies, Yokogawa Electric Corporation, Bird Technologies, S.A.E. Manufacturing, Advantest Corporation, Chroma ATE Inc., Ametek Programmable Power, Ono Sokki Co., Ltd., GW Instek, Hameg Instruments, Tabor Electronics, Viavi Solutions |