Enterprise Mobility Management Market Report Scope & Overview:

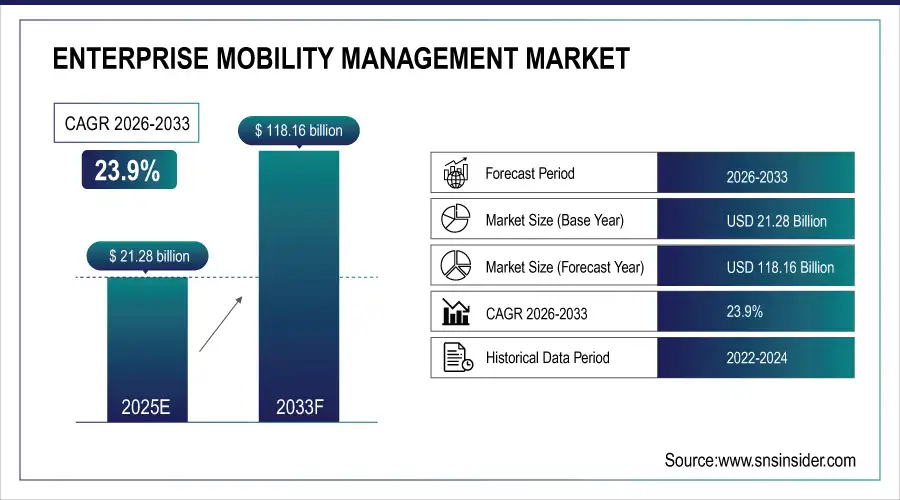

Enterprise Mobility Management Market was valued at USD 21.28 billion in 2025E and is expected to reach USD 118.16 billion by 2033, growing at a CAGR of 23.9% from 2026-2033.

The Enterprise Mobility Management (EMM) market is growing due to increasing adoption of mobile devices, cloud-based solutions, and digital workplace initiatives. Rising demand for secure device management, application control, and data protection, especially for remote work and BYOD environments, drives market expansion. Integration with enterprise IT systems, regulatory compliance needs, and advancements in AI, analytics, and cloud technologies further enhance operational efficiency, productivity, and scalability, fueling EMM market growth globally.

Enterprise Mobility Management Market Size and Forecast

-

Market Size in 2025E: USD 21.28 Billion

-

Market Size by 2033: USD 118.16 Billion

-

CAGR: 23.9% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get more information on Enterprise Mobility Management Market - Request Sample Report

Enterprise Mobility Management Market Trends

-

Rising adoption of mobile devices and remote work is driving the enterprise mobility management (EMM) market.

-

Growing need to secure corporate data and ensure compliance across BYOD and mobile endpoints is boosting demand.

-

Expansion of cloud-based EMM solutions is enhancing scalability, device management, and real-time monitoring.

-

Integration with AI, analytics, and unified endpoint management (UEM) platforms is improving operational efficiency.

-

Increasing focus on workforce productivity, secure app deployment, and mobile device lifecycle management is shaping market trends.

-

Advancements in mobile security, containerization, and identity management are strengthening enterprise adoption.

-

Collaborations between EMM providers, IT service companies, and enterprises are accelerating innovation and global deployment.

Enterprise Mobility Management Market Growth Drivers:

-

Growing Adoption of Cloud-Based Solutions and Mobile Devices is Driving Enterprise Mobility Management Market Growth Globally

The increasing adoption of cloud-based platforms and mobile devices across enterprises is significantly enhancing the demand for Enterprise Mobility Management (EMM) solutions. Organizations are integrating EMM to ensure secure access to corporate applications, centralized device management, and real-time monitoring of mobile endpoints. Cloud adoption facilitates scalability, cost efficiency, and easy deployment, allowing businesses to support remote work and digital transformation initiatives. Furthermore, enterprises are investing in comprehensive mobility solutions to enhance productivity, streamline IT operations, and maintain compliance, making cloud and mobile device adoption a key factor driving EMM market expansion.

Enterprise Mobility Management Market Restraints:

-

High Implementation Costs and Complexity May Restrain Growth of Enterprise Mobility Management Market

The high implementation and operational costs of Enterprise Mobility Management solutions are limiting market growth for many organizations. Deploying comprehensive EMM platforms requires substantial investment in software, hardware, and IT infrastructure. Additionally, integration with existing enterprise systems and multiple device types adds complexity, requiring skilled IT resources for management and maintenance. Small and medium enterprises, in particular, may find the cost and complexity barriers prohibitive, leading to slower adoption. Consequently, these financial and operational challenges act as restraints, slowing the overall growth of the EMM market despite rising demand for mobility management solutions globally.

Enterprise Mobility Management Market Opportunities:

-

Integration of AI and Advanced Analytics Offers New Growth Opportunities in Enterprise Mobility Management Market

Integrating artificial intelligence (AI) and advanced analytics into Enterprise Mobility Management platforms provides a strong growth opportunity. AI-driven insights help organizations optimize device usage, monitor threats, predict anomalies, and automate routine IT tasks. Analytics enable real-time decision-making, enhance operational efficiency, and improve security policy enforcement. Enterprises adopting AI-enabled EMM solutions can reduce costs, improve compliance, and enhance user productivity. This technological evolution allows market players to differentiate solutions, offering intelligent and proactive mobility management, which opens new avenues for revenue growth and expanded market penetration globally.

Enterprise Mobility Management Market Segment Analysis

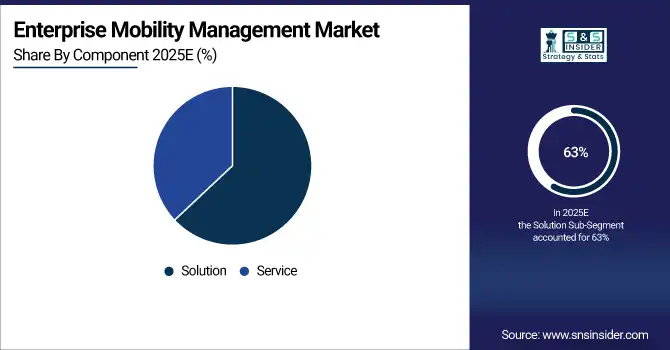

By Component, Solution segment dominates the Enterprise Mobility Management (EMM) Market

The Solution segment holds 63% of the EMM market, dominating due to its comprehensive capabilities in mobile device, application, and security management. Enterprises prefer solutions over standalone services for centralized control, real-time monitoring, and automation. Solutions enhance operational efficiency, simplify IT administration, and ensure compliance, making them ideal for organizations seeking scalable, secure, and efficient mobility management across diverse devices and business environments.

By Deployment Model, Cloud deployment leads the Enterprise Mobility Management (EMM) Market

Cloud deployment accounts for approximately 59% of the EMM market, leading due to its scalability, flexibility, and lower infrastructure costs. Enterprises adopt cloud-based EMM to enable remote work, centralized device management, and real-time updates. Subscription-based models reduce upfront costs, while enhanced security and simplified maintenance drive adoption. Cloud solutions are favored for supporting dynamic business environments and providing efficient, accessible mobility management.

By Enterprise Size, Large enterprises lead the Enterprise Mobility Management (EMM) Market

Large enterprises dominate with a 69% share of the EMM market, driven by their extensive mobile workforce and complex IT needs. They require robust solutions for secure access, compliance, and productivity across multiple devices and locations. EMM platforms reduce operational risks, streamline workflows, and ensure data protection. High budgets and the need for integrated, scalable management further reinforce adoption by large organizations.

By Device Type, Laptops dominate the Enterprise Mobility Management (EMM) Market

Laptops hold 46% of the EMM market, dominating as primary enterprise devices for work productivity and mobile operations. Organizations prioritize managing laptops for secure access, application deployment, and data protection. EMM platforms enable centralized control, compliance enforcement, and efficient IT administration, ensuring seamless workflow and collaboration. Laptops remain critical in enterprise mobility strategies, supporting both remote and on-site operations effectively.

By Industry Vertical, IT & Telecom, dominates the Enterprise Mobility Management (EMM) Market

The IT & Telecom sector dominates with 28% market share, driven by high dependence on mobile technologies and digital operations. Enterprises in this vertical require advanced EMM solutions for secure device management, operational efficiency, and compliance. EMM platforms support continuous connectivity, real-time monitoring, and application management. Rapid technological adoption and the need for robust security make IT & Telecom the largest vertical in enterprise mobility management.

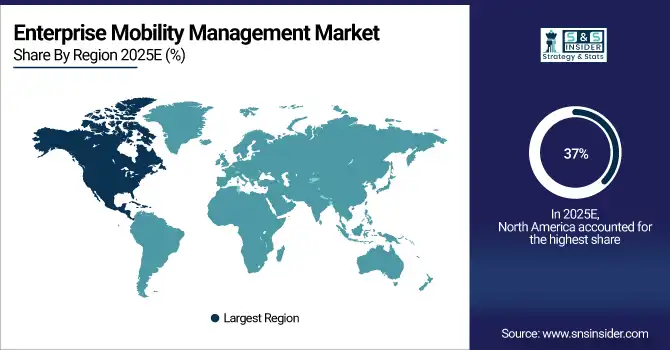

Enterprise Mobility Management Market Regional Analysis

North America Enterprise Mobility Management Market Insights

The North America Enterprise Mobility Management (EMM) market leads globally, holding approximately 37% revenue share, driven by advanced technological infrastructure and high adoption of mobile solutions across enterprises. Organizations prioritize secure device management, application deployment, and data protection to support remote work and digital operations. Strong presence of key vendors, rapid cloud adoption, and increasing demand for centralized, scalable mobility solutions contribute to the region’s dominance in the global EMM market.

Need any custom research on Enterprise Mobility Management Market - Enquiry Now

Asia Pacific Enterprise Mobility Management Market Insights

The Asia Pacific Enterprise Mobility Management (EMM) market is growing rapidly due to increasing smartphone and laptop adoption, digital transformation, and remote work trends. Enterprises across IT, BFSI, and healthcare sectors are deploying EMM solutions for secure device management, application control, and data protection. Rising awareness of mobility security, growing cloud adoption, and expanding IT infrastructure are driving regional market growth, making Asia Pacific a key emerging EMM market.

Europe Enterprise Mobility Management Market Insights

The Europe Enterprise Mobility Management (EMM) market is expanding steadily, driven by widespread adoption of mobile devices, cloud-based solutions, and digital workplace initiatives. Organizations leverage EMM to enhance data security, streamline device and application management, and ensure regulatory compliance. Growing demand for remote work solutions, integration with enterprise IT systems, and investments in advanced IT infrastructure are supporting market growth, positioning Europe as a significant EMM market globally.

Middle East & Africa and Latin America Enterprise Mobility Management Market Insights

The Middle East & Africa (MEA) and Latin America Enterprise Mobility Management (EMM) markets are witnessing steady growth due to increasing adoption of mobile devices, cloud solutions, and digital workplace initiatives. Organizations prioritize secure device management, application control, and data protection. Rising awareness of mobility security, expanding IT infrastructure, and growing demand for remote work solutions are driving market adoption, making these regions emerging hubs for EMM deployment.

Enterprise Mobility Management Market Competitive Landscape:

Jamf, LLC

Jamf, LLC is a leading enterprise software provider specializing in Apple-device management and security. Its solutions integrate device lifecycle management, endpoint security, identity management, and compliance workflows for macOS, iOS, iPadOS, and tvOS ecosystems. Jamf emphasizes seamless deployment, automation, and enterprise scalability, enabling IT teams to secure, monitor, and optimize Apple-device fleets efficiently while enhancing productivity and user experience across education, healthcare, government, and corporate sectors worldwide.

-

2025: At JNUC 2025, Jamf introduced AI-powered AI Assistant features for search and explain skills, expanded macOS compliance and security tools, and launched a new API ecosystem to improve enterprise Apple-device fleet management.

-

2024: Jamf unveiled support for Declarative Device Management (DDM), integrated Blueprints for macOS/iOS device configuration, and refreshed its Self-Service portal, consolidating device management, endpoint security, and identity management under one platform.

Microsoft Corporation

Microsoft Corporation is a global technology leader offering cloud, productivity, and enterprise endpoint management solutions. Its Intune Suite enables organizations to secure, monitor, and manage cross-platform devices at scale, integrating device compliance, identity, and endpoint security into Microsoft 365 environments. With a focus on hybrid workplaces, automation, and AI-assisted management, Microsoft supports IT teams in improving efficiency, protecting data, and ensuring compliance across global enterprise device fleets.

-

2025: Microsoft expanded the Intune Suite with advanced endpoint-management capabilities, including remote help, firmware updates, and privilege management integrated into Microsoft 365 E3/E5, simplifying large-scale device fleet management.

-

2024: At Microsoft Ignite 2024, Intune updates enhanced endpoint management with cross-platform device inventory, remote actions, and improved app/data protection, reinforcing its role as a core EMM tool for hybrid enterprises.

VMware, Inc.

VMware, Inc. is a global leader in virtualization, cloud, and enterprise mobility solutions. Its AirWatch/Workspace ONE platform provides unified endpoint management (UEM) for mobile, desktop, and IoT devices, integrating device security, compliance, and lifecycle management. VMware focuses on scalable, cloud-based EMM solutions that enable enterprises to streamline IT operations, enhance security, and deliver flexible device experiences. Strategic partnerships and managed services expand VMware’s global footprint across multiple industries and regions.

-

2025: VMware partnered with Capgemini to offer managed enterprise mobility services, combining AirWatch EMM software with Capgemini’s managed-mobility solutions, providing hosted/cloud-based EMM services across global regions.

Key Players

Some of the Enterprise Mobility Management Market Companies

-

VMware, Inc.

-

Microsoft Corporation

-

IBM Corporation

-

SAP SE

-

Citrix Systems, Inc.

-

MobileIron, Inc. (Ivanti)

-

BlackBerry Limited

-

Sophos Ltd.

-

Cisco Systems, Inc.

-

SOTI Inc.

-

Informatica LLC

-

ManageEngine (Zoho Corporation)

-

Dell Technologies, Inc.

-

AirWatch (VMware)

-

Ivanti, Inc.

-

Matrix42 AG

-

Symantec Corporation

-

Jamf, LLC

-

42Gears Mobility Systems

-

AppTec, Inc.

| Report Attributes | Details |

| Market Size in 2025 | USD 21.28 Bn |

| Market Size by 2033 | USD 118.16 Bn |

| CAGR | CAGR of 23.9% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Component (Solution and Service) • by Deployment Model (On-Premise and Cloud) • by Enterprise Size (Large Enterprises and Small & Medium Enterprises) • by Devices Type (Laptop, Tablet, and Smartphone) • by Industry Vertical (BFSI, Healthcare, Government & Public Sector, IT & Telecom, Retail, Education, Energy & Utilities, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

VMware, Inc., Microsoft Corporation, IBM Corporation, SAP SE, Citrix Systems, Inc., MobileIron, Inc. (Ivanti), BlackBerry Limited, Sophos Ltd., Cisco Systems, Inc., SOTI Inc., Informatica LLC, ManageEngine (Zoho Corporation), Dell Technologies, Inc., AirWatch (VMware), Ivanti, Inc., Matrix42 AG, Symantec Corporation, Jamf, LLC, 42Gears Mobility Systems, AppTec, Inc. |