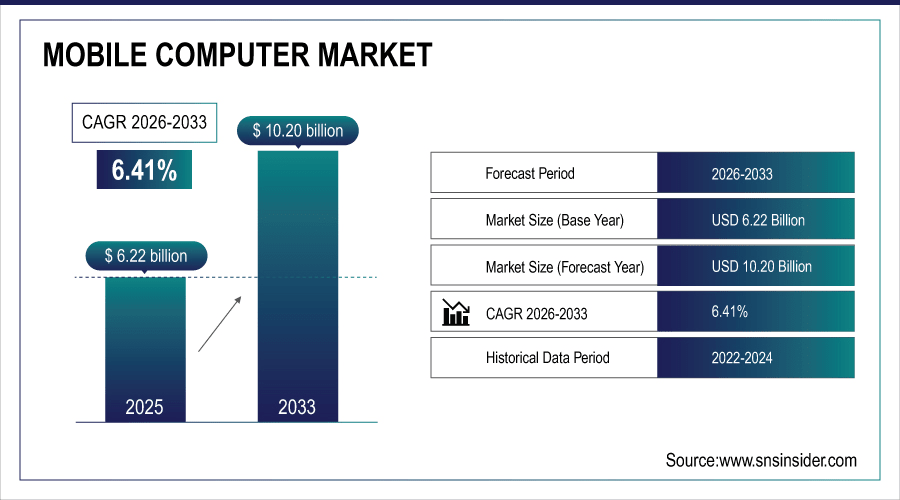

Mobile Computer Market Size & Growth:

The Mobile Computer Market size was valued at USD 6.22 Billion in 2025E and is projected to reach USD 10.20 Billion by 2033, growing at a CAGR of 6.41% during 2026-2033.

The Mobile Computer Market is expanding due to the increasing adoption of mobile computing devices across enterprises and industries. Growing demand for rugged handheld devices, tablets, and laptops in logistics, healthcare, and retail is driving market growth. Technological advancements such as integrated barcode scanners, NFC, GPS, and IoT compatibility are enhancing device functionality and efficiency. Rising digitization and the need for real-time data access are encouraging organizations to deploy mobile computing solutions.

Over 85% of Tier-1 logistics firms globally deployed rugged mobile computers with integrated barcode/RFID in 2024, reducing scan errors by 45% and improving parcel sorting speed by 30%.

To Get More Information On Mobile Computer Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 6.22 Billion

-

Market Size by 2033: USD 10.20 Billion

-

CAGR: 6.41% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Mobile Computer Market Trends

-

Growing demand for durable, rugged mobile computers in logistics, healthcare, and manufacturing ensures reliable performance in harsh environments.

-

Mobile computers with IoT, GPS, and NFC enable real-time data collection, tracking, and seamless enterprise connectivity.

-

Increasing online retail and warehouse automation drives adoption of handheld scanners, tablets, and mobile computing devices for inventory management.

-

Organizations are deploying mobile computers to enhance workforce productivity, field service efficiency, and remote operations management across industries.

-

Rising focus on secure mobile computing with encryption, biometric authentication, and device management to protect sensitive enterprise data.

The U.S. Mobile Computer Market size was valued at USD 1.77 Billion in 2025E and is projected to reach USD 2.84 Billion by 2033, growing at a CAGR of 6.14% during 2026-2033. Mobile Computer Market growth is driven by increasing adoption of mobile devices across industries such as logistics, healthcare, and retail. Rising demand for rugged and versatile handheld computers, tablets, and laptops supports operational efficiency and real-time data access. Technological advancements, including IoT integration, GPS tracking, and wireless connectivity, enhance productivity and enterprise mobility. Expansion of e-commerce, warehouse automation, and field services fuels the deployment of mobile computing solutions.

Mobile Computer Market Growth Drivers:

-

Rising Adoption of Rugged and IoT-Enabled Mobile Computers Across Industries.

The Mobile Computer Market is driven by increasing demand for rugged and IoT-enabled devices across industries like logistics, healthcare, retail, and manufacturing. Businesses are seeking solutions that provide real-time data access, operational efficiency, and seamless connectivity. Growing adoption of mobile computers for inventory management, field services, and enterprise mobility is accelerating market growth. Additionally, technological advancements, including barcode scanning, GPS tracking, and wireless connectivity, further enhance the market’s expansion globally.

In 2024, 78% of global manufacturers deployed rugged mobile computers on factory floors for real-time work order tracking — reducing downtime incidents by 33%. Field service teams using GPS-enabled mobile devices improved first-time fix rates by 41% and cut travel time by 27% through dynamic routing.

Mobile Computer Market Restraints:

-

High Device Costs and Complexity Limiting Widespread Enterprise Adoption

Market growth is restrained by the high cost of rugged and feature-rich mobile computers, which can be prohibitive for SMEs. Complexity in device integration with existing enterprise systems, maintenance requirements, and specialized training needs also slow adoption. Additionally, frequent technological updates and compatibility issues may result in increased operational costs. These factors collectively limit large-scale deployment, especially in price-sensitive markets, hindering the overall growth pace of the mobile computing market.

Mobile Computer Market Opportunities:

-

Expansion of E-Commerce, Field Services, and Digital Transformation Initiatives

Significant opportunities exist in expanding e-commerce, automated warehouses, and growing demand for mobile computing in field service operations. Businesses are increasingly adopting mobile computers to enhance workforce productivity, improve supply chain management, and enable real-time tracking. Integration with IoT, AI, and cloud technologies presents additional growth potential. Moreover, digital transformation initiatives across enterprises globally are creating favorable conditions for mobile computing devices, offering untapped market segments and revenue opportunities in emerging and developed regions.

In 2025, 75% of Tier-1 automated warehouses use mobile devices with real-time AI-guided task routing, reducing worker travel distance by 40%. Mobile-directed putaway and cycle counting cut labor costs by 22% YoY, with error rates falling below 0.1% in AI-assisted environments.

Mobile Computer Market Segment Analysis

-

By Product, Smartphones led the market with a 55.21% share in 2025E and also registered the fastest growth with a CAGR of 8.50%.

-

By Application, Internet access dominated the market with a 40.57% share in 2025E, while Emergency services were the fastest-growing application with a CAGR of 12.84%.

-

By Component, Hardware led the market with a 69.75% share in 2025E, and Services were the fastest-growing component with a CAGR of 12.40%.

-

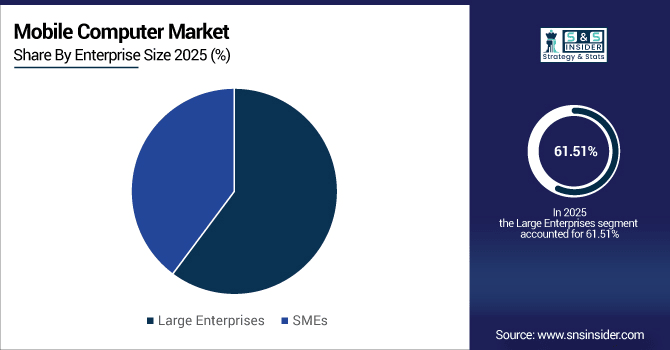

By Enterprise Size, Large Enterprises held the largest share at 61.51% in 2025E, while SMEs were the fastest-growing segment with a CAGR of 9.24%.

By Enterprise Size, Large Enterprises Lead While SMEs Grow Fastest

Large enterprises dominate the Mobile Computer Market, leveraging extensive mobile computing deployments to optimize operations, enhance workforce productivity, and integrate real-time data solutions across global operations. These organizations benefit from economies of scale, advanced IT infrastructure, and robust budgets for enterprise mobility. Small and medium-sized enterprises (SMEs), however, are the fastest-growing segment, driven by increasing digital transformation, affordable mobile solutions, and adoption of cost-effective rugged devices. SMEs are rapidly recognizing mobile computing as critical for efficiency, competitive advantage, and business scalability.

By Product, Smartphones Leads Market as well as Registers Fastest Growth

Smartphones dominate the Mobile Computer Market, accounting for the largest share due to widespread adoption across both personal and enterprise applications. They offer portability, high processing power, and multiple connectivity options, making them suitable for logistics, retail, healthcare, and field services. Simultaneously, smartphones also register the fastest growth, driven by continuous technological innovation, integration with IoT and AI, and increasing demand for versatile, multi-functional mobile devices. Rising enterprise mobility initiatives and consumer reliance on smart devices further accelerate market expansion.

By Application, Internet access Dominate While Emergency Services Shows Rapid Growth

Internet access remains the primary application for mobile computers, enabling real-time data communication, cloud-based operations, and seamless connectivity across enterprises and consumer segments. It drives widespread adoption in logistics, retail, and corporate environments, ensuring productivity and operational efficiency. Emergency services, however, are emerging as the fastest-growing application, as first responders increasingly rely on mobile devices for location tracking, communication, and real-time data access, enhancing response times and operational effectiveness in critical situations.

By Component, Hardware Lead While Services Registers Fastest Growth

Hardware constitutes the largest share of the Mobile Computer Market, encompassing devices such as handheld computers, tablets, rugged laptops, and integrated sensors. Its dominance is due to the essential role of durable, high-performance components in ensuring device reliability and functionality across industries. Services, on the other hand, are the fastest-growing component segment, driven by rising demand for software solutions, device management, maintenance, cloud integration, and training programs that support enterprise mobility, optimize device performance, and reduce operational downtime.

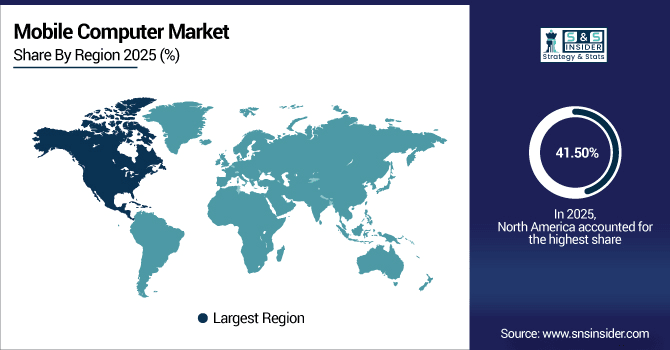

North America Mobile Computer Market Insights

In 2025E North America dominated the Mobile Computer Market and accounted for 41.50% of revenue share, this leadership is due to the increasing adoption of enterprise mobility solutions across industries. Logistics, retail, and healthcare sectors are heavily investing in rugged handheld devices, tablets, and laptops. Technological advancements, including IoT integration, cloud-based solutions, and real-time tracking, further enhance operational efficiency.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Mobile Computer Market Insights

The U.S. leads the North American Mobile Computer Market due to widespread enterprise mobility initiatives and digital transformation. Large-scale deployment of smartphones, rugged devices, and tablets in logistics, field services, and retail drives market demand.

Asia-pacific Mobile Computer Market Insights

Asia-pacific is expected to witness the fastest growth in the Mobile Computer Market over 2026-2033, with a projected CAGR of 7.10% due to rapid industrialization, digital transformation, and growing logistics and retail sectors. Rising adoption of rugged handheld devices and enterprise mobility solutions drives market growth. Countries like China, Japan, and India are leading in demand for smartphones, tablets, and rugged laptops.

China Mobile Computer Market Insights

China remains a key market for mobile computers due to its vast manufacturing and logistics ecosystem. Strong adoption of mobile computing solutions in warehouses, retail chains, and field operations fuels demand. Technological advancements, including IoT integration, GPS, and barcode scanning, are driving device deployment.

Europe Mobile Computer Market Insights

Europe’s Mobile Computer Market is witnessing steady growth due to increasing adoption of rugged devices, tablets, and laptops across logistics, healthcare, and manufacturing sectors. Enterprises are investing in mobile computing solutions to enhance operational efficiency and real-time data access. Technological advancements such as IoT integration, wireless connectivity, and barcode scanning support market expansion.

Germany Mobile Computer Market Insights

Germany, as one of Europe’s leading markets, shows significant adoption of mobile computers in manufacturing, logistics, and healthcare industries. The demand for rugged handheld devices, tablets, and enterprise mobility solutions is growing steadily.

Latin America (LATAM) and Middle East & Africa (MEA) Mobile Computer Market Insights

The Mobile Computer Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the increasing digital transformation in enterprises. Growing logistics, retail, and healthcare sectors are adopting handheld computers, tablets, and rugged devices. Limited infrastructure challenges are gradually being addressed through technology investments. Rising awareness of operational efficiency and real-time tracking is supporting device adoption.

Mobile Computer Market Competitive Landscape:

Advantech Co., Ltd. is a leading provider of industrial and enterprise mobile computing solutions. The company offers rugged handheld devices, tablets, and IoT-enabled solutions for logistics, healthcare, and manufacturing sectors. Advantech focuses on integrating advanced technologies like GPS, barcode scanning, and cloud connectivity into its devices. Strategic partnerships and global distribution networks strengthen its market presence.

-

In September 2025, Advantech launched the UBX-010RC, a compact ARM-based edge computer with built-in Google Mobile Services, enhancing IoT and edge computing capabilities.

CASIO COMPUTER CO., LTD. specializes in rugged mobile devices, handheld computers, and tablets for enterprise and industrial applications. Its products are widely used in logistics, retail, and field operations due to durability and reliability. CASIO emphasizes technological innovation, including data capture, wireless connectivity, and ergonomic design.

-

In May 2025, Casio introduced the “Comfy JT-200T,” a new product incorporating 60 years of know-how, aiming to enhance user experience in scientific calculators.

CipherLab Co., Ltd. develops mobile computing solutions, including barcode scanners, rugged handheld computers, and enterprise tablets. Its devices are designed for logistics, healthcare, and retail sectors, providing accurate data capture and real-time connectivity. CipherLab focuses on integrating wireless communication, IoT capabilities, and long-lasting battery performance.

-

In November 2024, CipherLab's RS38 5G Touch Mobile Computer received the Taiwan Excellence Award 2025, recognizing its advanced features and design in mobile computing.

Datalogic S.p.A. is a global provider of mobile computing and data capture solutions, including scanners, handheld computers, and tablets. Its devices are widely adopted in retail, logistics, and manufacturing industries for inventory management and process automation. Datalogic emphasizes advanced technologies such as RFID, barcode scanning, and IoT integration in its products.

-

In June 2025, Datalogic expanded its mobile computing portfolio with the launch of the Memor™ K20-25, a compact, keypad-based mobile computer for various operational environments.

Mobile Computer Companies are:

-

CASIO COMPUTER CO., LTD.

-

CipherLab Co., Ltd.

-

Datalogic S.p.A.

-

Honeywell International Inc.

-

KEYENCE CORPORATION

-

Opticon

-

Panasonic Connect Co., Ltd.

-

Zebra Technologies Corp.

-

Unitech Electronics Co., Ltd.

-

Bluebird Inc.

-

Urovo Technology Co., Ltd.

-

Cognex Corporation

-

SATO Holdings Corporation

-

Getac Technology Corporation

-

TouchStar Technologies Ltd.

-

Janam Technologies LLC

-

Newland EMEA

-

Denso Wave Incorporated

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 6.22 Billion |

| Market Size by 2033 | USD 10.20 Billion |

| CAGR | CAGR of 6.41% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Smartphones, Tablets, Laptops and Notebooks) • By Application (Internet access, Global Position System, Emergency services and Entertainment services) • By Component (Hardware, Software and Services) • By Enterprise Size (Large Enterprises and SMEs) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Advantech Co., Ltd., CASIO COMPUTER CO., LTD., CipherLab Co., Ltd., Datalogic S.p.A., Handheld Group, Honeywell International Inc., KEYENCE CORPORATION, Opticon, Panasonic Connect Co., Ltd., Zebra Technologies Corp., Unitech Electronics Co., Ltd., Bluebird Inc., Urovo Technology Co., Ltd., Cognex Corporation, SATO Holdings Corporation, Getac Technology Corporation, TouchStar Technologies Ltd., Janam Technologies LLC, Newland EMEA, Denso Wave Incorporated. |