Modular Construction Market Report Scope & Overview:

Get More Information on Modular Construction Market - Request Sample Report

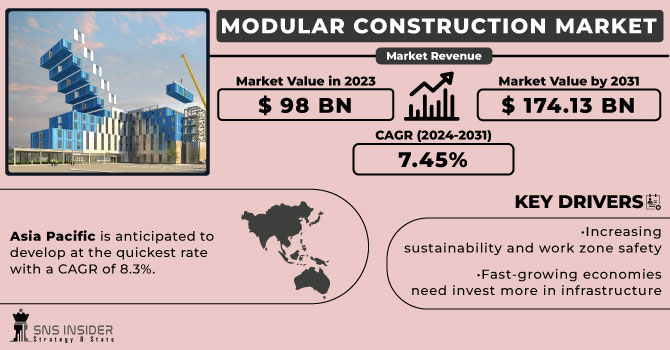

The Modular Construction Market size was valued at USD 91.14 billion in 2023 and is expected to grow to USD 160.52 billion by 2032 and grow at a CAGR of 6.49% over the forecast period of 2024-2032.

The modular construction market is witnessing rapid expansion as industries worldwide shift toward cost-effective, time-efficient, and sustainable building solutions. This method involves assembling building components known as modules offsite in a controlled factory environment before transporting and installing them at the final location. By streamlining the construction process, modular construction significantly reduces project timelines, minimizes material waste, and enhances quality control compared to traditional on-site construction. The market is being driven by increasing demand for affordable housing, rapid urbanization, and government initiatives promoting eco-friendly building practices. The ability to complete projects in a shorter timeframe makes modular construction highly attractive for residential, commercial, and healthcare infrastructure developments. Additionally, the ongoing labor shortages in the construction industry are encouraging developers to adopt prefabricated solutions that require fewer on-site workers. A key trend fueling market growth is the integration of advanced materials and technologies such as Building Information Modeling (BIM), automation, and robotics, which are improving efficiency and precision. The adoption of 3D printing and digital twin technology is further transforming the industry by enabling mass customization and reducing costs. Sustainability is another major factor, with many modular construction projects utilizing recyclable materials and energy-efficient designs to meet green building certifications.

According to research modular construction can reduce project timelines by 30% to 50%, making it an ideal choice for urgent infrastructure needs. It also minimizes material waste by up to 90%, contributing to sustainability efforts. Around 50% of modular projects are dedicated to residential buildings, while commercial and healthcare sectors are rapidly increasing their adoption. Additionally, modular construction leads to up to 80% fewer site disruptions, improving safety and reducing environmental impact. As demand for fast, cost-efficient, and sustainable buildings continues to rise, modular construction is set to play a vital role in the future of the global construction industry.

MARKET DYNAMICS

DRIVERS

-

Modular construction is growing rapidly due to its cost efficiency, faster timelines, sustainability benefits, and advancements in automation and 3D printing.

Modular construction is gaining traction due to its cost efficiency and reduced construction time, making it a preferred choice in residential, commercial, and infrastructure projects. By manufacturing building modules off-site in a controlled environment, modular construction minimizes delays caused by weather conditions, labor shortages, and site constraints. This streamlined process reduces overall project timelines by up to 50% and labor costs by nearly 20%, significantly improving profitability. The market is experiencing strong growth, driven by rising urbanization, housing shortages, and increasing demand for sustainable building solutions. Key trends include the adoption of 3D printing, automation, and advanced materials to enhance precision and durability. Additionally, governments worldwide are promoting prefabrication to address housing crises and sustainability goals, further fueling market expansion.

RESTRAINT

-

High initial investment in factory setup, specialized machinery, and transportation logistics creates a financial barrier for small and mid-sized firms, limiting the adoption of modular construction.

High initial investment and capital costs present a significant barrier to the widespread adoption of modular construction, particularly for small and mid-sized firms. Unlike traditional construction, which relies on incremental site-based expenditures, modular construction requires substantial upfront investment in factory setups, specialized machinery, and workforce training. Additionally, transportation logistics for prefabricated modules can be costly, as oversized loads require careful planning, specialized vehicles, and adherence to regulatory constraints. The need for advanced technology, automation, and quality control measures further adds to the financial burden. For many firms, securing funding for such large-scale capital investments can be challenging, limiting their ability to enter or expand in the modular construction market. Despite long-term cost savings, the high entry barrier often deters smaller players and slows industry growth. To overcome this challenge, government incentives, financial assistance, and collaborations with larger industry players could help facilitate broader adoption.

MARKET SEGMENTATION

By Type

Permanent segment dominated with the market share over 62% in 2023, due to its versatility, durability, and suitability for a wide range of applications, including residential, commercial, and industrial structures. Unlike relocatable modular buildings, which are temporary, permanent modular construction provides long-term solutions that are robust and customizable. This type of construction allows for flexible design, enabling buildings to be tailored to specific needs while adhering to strict quality and safety standards. Developers and clients increasingly prefer permanent modular solutions because of their ability to deliver high-quality, durable buildings more quickly and cost-effectively compared to traditional construction methods. Its ability to meet the demands of both temporary and long-term needs solidifies its position as the dominant segment in the modular construction market.

By Material

The wood segment dominated with the market share over 42% in 2023 due to its numerous advantages in sustainability. Wood is a renewable resource, meaning it can be replenished through responsible forestry practices, making it an eco-friendly option. Additionally, wood is biodegradable, reducing its environmental impact after disposal. The availability of wood resources, particularly in regions with strong forestry industries, makes it widely accessible and cost-effective for various packaging applications, such as crates, pallets, and boxes. These attributes align well with the increasing consumer and industry demand for sustainable packaging solutions. As companies prioritize eco-friendly practices, wood continues to be a go-to material for packaging, particularly in logistics, shipping, and storage, supporting both environmental goals and operational needs.

By End-Use

The residential segment dominated with the market share over 34% in 2023, primarily due to factors like the increasing global population, rapid urbanization, and the rising demand for affordable housing. With traditional construction methods struggling to meet these needs efficiently, modular construction offers compelling benefits. It significantly reduces construction timelines, with buildings completed in a fraction of the time compared to conventional methods. Additionally, the cost-effectiveness of modular homes, along with better quality control due to factory-based construction, makes it an appealing choice. These advantages are fueling the growth of the residential segment, as governments, developers, and individuals seek quicker, affordable, and sustainable housing solutions to address the growing housing crisis worldwide.

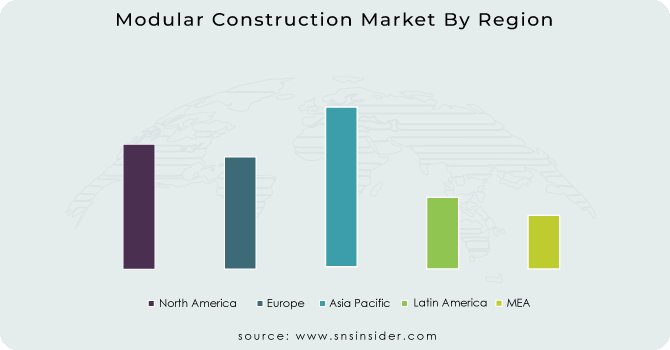

KEY REGIONAL ANALYSIS

Europe region dominated with the market share over 38% in 2023, with a focus on addressing housing shortages and promoting sustainability. In the UK, there is a strong push to meet ambitious housing targets, aiming to build thousands of homes annually through modular methods. This approach reduces construction time and costs, making it an efficient solution for affordable housing. In Germany, modular construction is gaining traction for projects like student housing and hotels, where fast, cost-effective construction is crucial. The growing demand for sustainable building methods, coupled with the increasing need for affordable and scalable housing options, has made the residential sector the dominant driver of the modular construction market in Europe.

Asia-Pacific region is rapidly gaining popularity due to its efficiency and benefits in fast-developing urban areas. This method involves prefabricating modules in controlled off-site environments and then assembling them at the construction site. PMC significantly reduces construction time, as much of the work is completed before delivery, allowing for quicker project completion. It also ensures better quality control, as components are made in factories where conditions can be regulated. Additionally, PMC minimizes construction waste by using precise materials and techniques. These advantages make it an attractive option for housing and infrastructure projects, particularly in areas with increasing demand for affordable, high-quality, and sustainable construction solutions.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Some of the major key players of the Modular Construction Market

-

Guerdon Modular Buildings (U.S.)

-

Laing O'Rourke (U.K.)

-

ATCO (Canada)

-

Red Sea International Company (Saudi Arabia)

-

Bouygues Construction (France)

-

VINCI Construction Grands Projets (U.K.)

-

Skanska AB (Sweden)

-

Algeco (U.K.)

-

KLEUSBERG GmbH & Co. KG (Germany)

-

Katerra (U.S.)

-

Lendlease Corporation (Australia)

-

Modspace (U.S.)

-

Horizon North Logistics (Canada)

-

Fleetwood Australia (Australia)

-

Marriott Modular (U.S.)

-

Turner Construction Company (U.S.)

-

Wernick Group (U.K.)

-

Balfour Beatty (U.K.)

-

Bouygues Construction (France)

-

Laing O'Rourke (U.K.)

Suppliers for (Advanced technology and automation in off-site construction, focusing on speed and efficiency) on Modular Construction Market

-

Katerra

-

Laing O'Rourke

-

Red Sea Housing Services

-

Skanska

-

Lendlease

-

Z Modular

-

Honomobo

-

Factory_OS

-

Modular Management Group (MMG)

-

Premier Modular

RECENT DEVELOPMENT

In September 2024: Atco Structures revealed that it has acquired NRB Limited, a prominent Canadian manufacturer specializing in modular educational, industrial, and residential buildings.

In April 2023: Modular home construction is permitted in select areas of Los Angeles thanks to a new zoning regulation that was adopted by the city areas.

In May 2023: Skanska, a business that specializes in modular construction, stated that it will establish a new production site in the United States.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 91.14 billion |

| Market Size by 2032 | USD 160.52 billion |

| CAGR | CAGR of 6.49% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Permanent, Relocatable) • By Material (Steel, Wood, Concrete) • By Module (Four-sided, Open-sided, Partially open-sided, Mixed modules & floor cassettes, Modules supported by a primary structure, Others) •By End-Use (Residential, Office, Education, Retail & Commercial, Hospitality, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Guerdon Modular Buildings (U.S.), Laing O'Rourke (U.K.), ATCO (Canada), Red Sea International Company (Saudi Arabia), Bouygues Construction (France), VINCI Construction Grands Projets (U.K.), Skanska AB (Sweden), Algeco (U.K.), KLEUSBERG GmbH & Co. KG (Germany), Katerra (U.S.), Lendlease Corporation (Australia), Modspace (U.S.), Horizon North Logistics (Canada), Fleetwood Australia (Australia), Marriott Modular (U.S.), Turner Construction Company (U.S.), Wernick Group (U.K.), Balfour Beatty (U.K.), Bouygues Construction (France), Laing O'Rourke (U.K.) |

| Key Drivers | • Modular construction is growing rapidly due to its cost efficiency, faster timelines, sustainability benefits, and advancements in automation and 3D printing. |

| Restraints | • High initial investment in factory setup, specialized machinery, and transportation logistics creates a financial barrier for small and mid-sized firms, limiting the adoption of modular construction. |