Mold Inhibitors Market Report Scope & Overview:

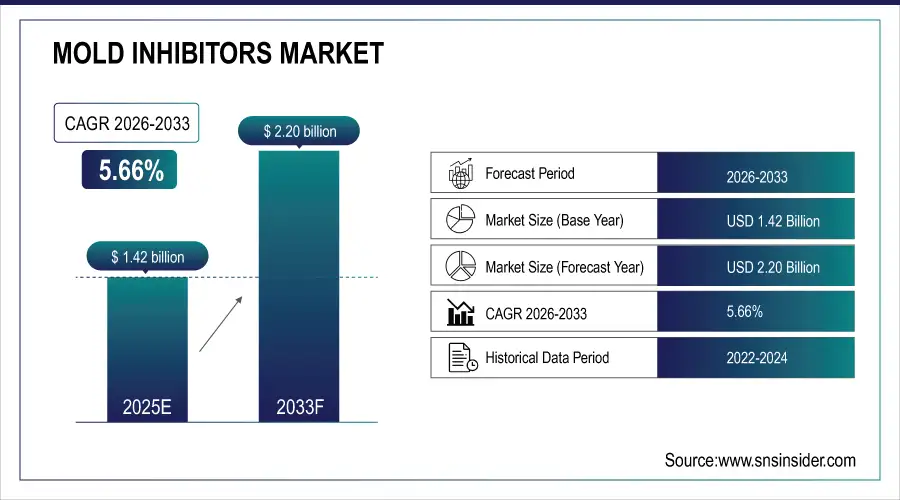

The Mold Inhibitors Market size is valued at USD 1.42 Billion in 2025E and is projected to reach USD 2.20 Billion by 2033, growing at a CAGR of 5.66% during 2026-2033.

The Mold Inhibitors Market analysis highlights the increasing demand for natural and clean-label preservatives among food, feed, and industrial applications. Increasing concern of food security and longer shelf life is fueling the market.

Over 1.3 billion tons of food are wasted annually, with spoilage due to mold accounting for 25%—driving demand for effective, clean-label mold inhibitors

Market Size and Forecast:

-

Market Size in 2025E: USD 1.42 Billion

-

Market Size by 2033: USD 2.20 Billion

-

CAGR: 5.66% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Mold Inhibitors Market - Request Free Sample Report

Mold Inhibitors Market Trends

-

Growing consumption of natural & bio-based mold inhibitors on the back consumer preference for clean label and chemical free food preservatives solutions.

-

Rise in the utilization of mold inhibitors for animal feed to extend shelf life, protect nutritional content and minimize spoilage-related losses.

-

Increasing development of multi-functional preservatives that provides both antibacterial and antioxidant properties to ensure an improved food safety and shelf life.

-

Increased use of mold inhibitors in packaging materials and coatings for the prevention of contamination, enhancing product longevity.

-

Technology development: Inexpensive natural preservative could be developed by fermentation and plant extract formulation.

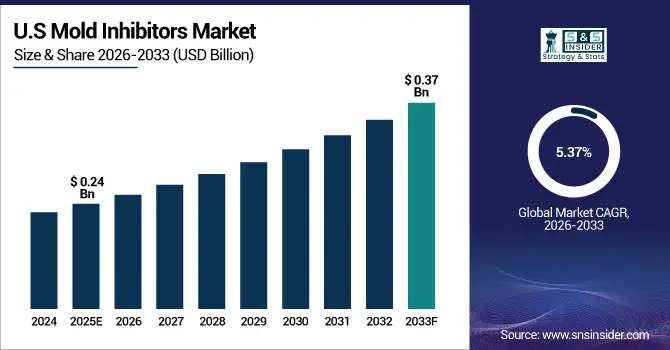

The U.S. Mold Inhibitors Market size is valued at USD 0.24 Billion in 2025E and is projected to reach USD 0.37 Billion by 2033, growing at a CAGR of 5.37% during 2026-2033. Mold Inhibitors Market growth is driven by increasing consumer awareness and demand for natural and clean label preservatives. Rising use in the food, beverage and animal feed industry will pave the way for market growth.

Mold Inhibitors Market Growth Drivers:

-

Rising Demand for Natural and Clean-Label Preservation Solutions Across Food and Feed Industries

Factor driving the Mold Inhibitors Market is growing consumer inclination towards natural and chemical free food preservative. There is a growing preference for bio-based mold preservatives among food and beverage manufacturers as they seek to adhere to the regulations and clean-label demands. Increasing demand to enhance the shelf life and inhibit rancidity in bakery, dairy, and livestock products further encourages sustainable adoption across worldwide industries.

In 2025, 72% of global consumers said they avoid foods with artificial preservatives, accelerating adoption of bio-based mold inhibitors like cultured wheat, vinegar, and rosemary extract

Mold Inhibitors Market Restraints:

-

Regulatory Challenges and Rising Costs of Natural Ingredient Sourcing Limiting Market Expansion

Tough laws covering food stuffs added and preservatives in several regions hamper the manufacturers. GRAS/EFSA grade is more costly to produce and requires more testing. Furthermore, the cost of natural raw materials such as plant-based acids and essential oils is expensive, which increases total production costs, therefore profitability becomes limited and scale of operation for the small and medium businesses in mold inhibitor industry becomes compromised due to overall higher prices.

Mold Inhibitors Market Opportunities:

-

Expansion of Bio-Based and Eco-Friendly Mold Inhibitors in Emerging Economies

The transition away from non-sustainable food preservation drives growth for bio-based and naturally derived Mold inhibitors. Industrializing food & feed sectors in APAC and Latin America will propel the industrial enzymes market. This makes it possible for manufacturers to bring new mold inhibition solutions to market that are effective, competitively-priced and environmentally-friendly as part of the global clean-label trend.

The global natural mold inhibitors grew by 13.2% in 2024, driven by clean-label demand, with bio-based solutions like cultured wheat and vinegar dominating new product launches

Mold Inhibitors Market Segment Analysis

-

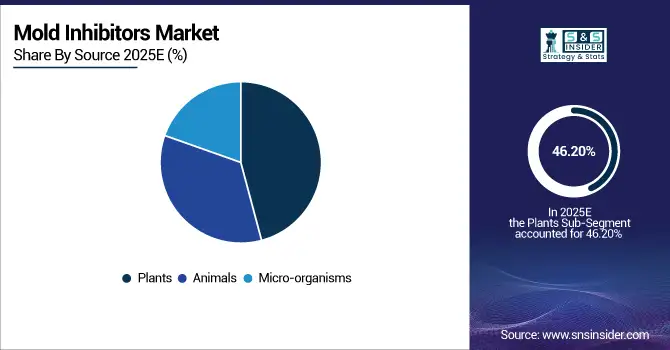

By Source, plants led the Mold Inhibitors Market with a 46.20% share in 2025, while micro-organisms emerged as the fastest-growing segment, registering a CAGR of 8.90%.

-

By Application, the food & beverage segment dominated the market with a 41.50% share in 2025, whereas the pharmaceuticals segment is projected to grow the fastest, recording a CAGR of 9.30%.

-

By Type, propionates accounted for the largest market share of 37.80% in 2025, while natamycin is expected to witness the highest growth rate, with a CAGR of 9.80%.

-

By Nature, synthetic mold inhibitors held a major share of 58.40% in 2025, while natural mold inhibitors are forecasted to expand at the fastest rate, growing at a CAGR of 10.10%.

By Source, Plants Leads Market While Micro-organisms Registers Fastest Growth

Plant-based sources dominate Mold Inhibitors Market in 2025 on account of their high popularity across food & feed applications. Natural, effective and safe preservatives such as essential oils, phenolics and organic acids of plant origin are preferred. The increasing knowledge about such chemical-free ingredients and about sustainability, is also contributing further towards market growth. While, micro-organism-based inhibitors are increasingly popular for their ‘bio-efficacy’ and greater environmental acceptability, now the fastest-growing segment as biotechnological advances improve still further their commercial attractiveness.

By Application, Food & Beverage Dominate While Pharmaceuticals Shows Rapid Growth

Food & beverage is the largest application of the Mold Inhibitors Market in 2025 owing to high demand for increased shelf life and microbial safety in bakery items, dairy products, and packaged foods. Natural and artificial inhibitors are increasingly favored by manufacturers to sustain the freshness of their products and to prevent spoilage. Meanwhile, the pharmaceutical industry is expanding at a fast pace due to rise in use of mold inhibitors in drugs formulations and packaging these days for better stability and longer shelf life as per safety norms. Segmental growth is further attributed to growing application.

By Type, Propionates Lead While Natamycin Registers Fastest Growth

Propionates segment account for the lead market share in 2025, with their well-documented mold ad bacterial stopping power in bakery, dairy and feed industries providing a strong growth platform. They are both an economical and safe method to inhibit spoilage and prolong shelf life. However, the Natamycin segment is projected to be the fastest-growing owing to the natural origin of natamycin, and better antifungal activity as well as its recognition as a GRAS certified bio-preservative. Growing Regulatory Push for Natural Additives and Consumer Attraction towards Chemical-Free Products Sets Pace for Natamycin Adoption in Food and Pharmaceutical Manufacturing Units Worldwide

By Nature, Synthetic Lead While Natural Grow Fastest

Synthetic mold inhibitors having a leading position in the market of 2025, it’s effective, stable and low cost they are being widely accepted and used across various industries among all other industries, food processing and feed manufacturing sector dominates the global synthetic mold inhibitors market. Natural mold inhibitors are quickly growing and being adopted as a more natural solution to mold and, quite frankly, driven by the very same interest in clean label and environmental factors. Natural ingredients like plant extracts and organic acids are preferred by consumers as they are safe and sustainable. Stringent regulations pertaining to synthetic preservatives, and increased R&D investment for bio-based alternatives are driving the growth of the natural segment.

Mold Inhibitors Market Regional Analysis:

Asia-pacific Mold Inhibitors Market Insights

In 2025 Asia-Pacific dominated the Mold Inhibitors Market and accounted for 45.72% of revenue share and growing fastest with 5.99% CAGR, this leadership is due to the surge in food processing, animal feed, and pharma industry. Population growth, evolving eating habits and the greater consumption of packaged foods also raise demand for preservatives. Synthetic and natural mold inhibitor is being used in several countries including China, India, Japan and South Korea. It is also the market is being driven by government support towards food safety regulations and increasing trend for clean-label ingredients.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Mold Inhibitors Market Insights

China also plays a critical role in the Asia-Pacific Mold Inhibitors Market as a result of its enormous food production and industrial base. The nation’s fast-urbanizing economy, as well as its robust feed milling industry, encourage the consumption of mold inhibitors. Growing government concern towards food safety standards and eco-friendly chemical usage will drive demand.

North America Mold Inhibitors Market Insights

North America is mature and the regulatory standards are also high, that helps the Mold Inhibitors Market to have a decent market share in 2025. Synthetic and natural inhibitors for prolonged product shelf life are used to the greatest extent in the U.S. and Canada. A growing requirement for free from and natural food products provides new opportunities in bio-based nutrition.

U.S. Mold Inhibitors Market Insights

The U.S. is the largest market for food processing aids in North America, which is further driven by technological advancements in food processing and owing to regulatory focus on product safety. Heavy intake of bakery and processed food items ensures continuous demand for mold inhibitors.

Europe Mold Inhibitors Market Insights

In 2025, Europe emerged as a promising region in the Mold Inhibitors Market, due to high demand in food preservation, feed additives as well as pharmaceutical applications. EFSA, along with regulatory bodies, encourage the safe and sustainable use of preservatives that help lead to a cleaner environment. Nations like Germany, France, Italy and Spain are at the forefront of clean-label implementation, as manufacturers pour funds into R&D of bio-based preservatives.

Germany Mold Inhibitors Market Insights

Germany is a key market of Europe due to its powerful chemical and food sectors. And the country possesses leading-edge research capabilities for synthetic and natural mold inhibitors. Growing export of various bakery & dairy products augments the importance of efficient preservatives.

Latin America (LATAM) and Middle East & Africa (MEA) Mold Inhibitors Market Insights

The Mold Inhibitors Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to growing food, feed, and agriculture industries are fueling the growth of mold inhibitors in the markets. Brazil, Mexico and South Africa are frontrunners in market uptake due to increased processed food consumption and exportation. Fueled by increased levels of food safety awareness and shelf-life consideration; the demand for propionates as well as natural substitutes is also raised.

Mold Inhibitors Market Competitive Landscape:

DuPont is one of the leading innovators in the Mold Inhibitors Marke it offers advanced preservation solutions for food, feed, and industrial applications. The company concentrates on sustainable, bio-based technologies that improve product life and safeguard consumers. DuPont’s extensive research and development infrastructure and worldwide presence drive Natural preservation and antimicrobial ingredients innovation.

-

In June 2024, DuPont signed an agreement to acquire Donatelle Plastics Incorporated, a medical-device components manufacturer, strengthening its healthcare and advanced materials capabilities.

BASF SE largely dominates the Mold Inhibitors Market with synthetic and natural products across diverse industries. The corporation emphasizes formulation to consumer expectations for eco-friendly solutions that assure food safety and shelf stability. BASF’s vast global network of operations and expertise in flue gas desulfurization guarantees the best product consistency, efficiency, and regulatory compliance.

-

In October 2025, BASF SE announced a strategic collaboration with International Flavors & Fragrances Inc. (IFF) to co-develop advanced enzyme and polymer technologies for home care and industrial cleaning applications, aiming to strengthen its sustainable chemical solutions portfolio globally.

ADM is among the most important contributors to the Mold Inhibitors Market, providing naturally sourced preservatives and feed inhibitors. The firm relies on its processing of agricultural commodities to come up with bio-based solutions that are safe for people and animals. The new trend toward bio-based methods and general disinfection goods offered to cater to expanding demand in the newly Industrialized Countries drives ADM’s development.

-

In March 2024, ADM entered into a US $1 billion accelerated share-repurchase agreement to reinforce shareholder value, enhance capital efficiency, and support its strategic growth across the nutrition and ingredient businesses through disciplined financial management.

Associated British Foods plc, performs a major role in the Mold Inhibitors Market. The company’s food preservation and anti-fungal alternatives for bakery, dairy, and beverage industries are highly successful. ABF’s built-in development ability and concentrate on colorful and consumer-friendly supplies have bolstered its capabilities.

-

In August 2025, Associated British Foods plc announced the acquisition of Hovis Group Limited, integrating it into its Allied Bakeries division to achieve operational synergies, expand market share, and strengthen its leadership in the UK bakery segment.

Mold Inhibitors Market Key Players:

Some of the Mold Inhibitors Market Companies are:

-

DuPont

-

BASF SE

-

ADM

-

Associated British Foods plc

-

HANDARY S.A.

-

Hawkins Watts Limited

-

Kemin Industries, Inc.

-

Niacet

-

Pacific Coast Chemical Co.

-

ANGUS Chemical Company

-

Eastman Chemical Company

-

DSM

-

Watson Inc.

-

Bentoli

-

Corbion

-

Ravago Chemicals

-

Cargill Inc.

-

Kerry Group

-

Tate & Lyle PLC

-

Archer Daniels Midland Company

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 1.42 Billion |

| Market Size by 2033 | USD 2.20 Billion |

| CAGR | CAGR of 5.66% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Source (Animals, Plants, and Micro-organisms) • By Application (Pharmaceuticals, Food & Beverage, Animal Feed, Cosmetics & Personal Care, Paints, and Others) • By Type (Benzoates, Propionates, Sorbates, Parabens, Natamycin, and Others) • By Nature (Natural and Synthetic) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | DuPont, BASF SE, ADM, Associated British Foods plc, HANDARY S.A., Hawkins Watts Limited, Kemin Industries Inc., Niacet, Pacific Coast Chemical Co., ANGUS Chemical Company, Eastman Chemical Company, DSM, Watson Inc., Bentoli, Corbion, Ravago Chemicals, Cargill Inc., Kerry Group, Tate & Lyle PLC, Archer Daniels Midland Company |