mRNA Sequencing Market Size & Trends:

Get More Information on mRNA Sequencing Market - Request Sample Report

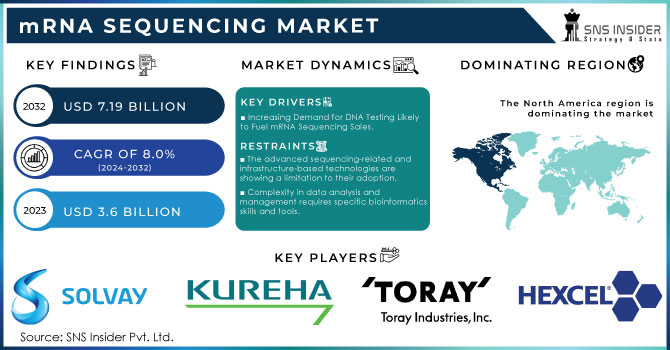

The mRNA Sequencing Market Size was valued at USD 3.6 billion in 2023 and is expected to reach USD 7.19 billion by 2032 and grow at a CAGR of 8.0% over the forecast period 2024-2032.

Advancements in genome mapping programs and technological advancement that leverage leading expertise to improve the analysis and interpretation of complex biological data enhance the growth of the mRNA sequencing market. Since these activities are so critical, they thus facilitate more detailed epidemiological and public health studies through the sequencing of bacteria and viruses and the identification of factors that may contribute to virulence. Such capabilities will come to be especially noteworthy in the context of early detection and treatment of infectious diseases and cancer, where timely intervention often makes all the difference between successful and unsuccessful outcomes.

One of the most important growth drivers for the mRNA sequencing market is the accelerated rise in cancer and other infectious diseases. With such rapid disease conditions, there is an enhanced requirement for advanced diagnostic solutions that can give early and accurate detection results. Notably, mRNA sequencing allows exhaustive information regarding genetic and molecular profiles, which in turn will be of importance for discovering diseases at their earliest instances as well as tailoring appropriate therapies.

| Drivers | Description |

|---|---|

| Increased Research Funding | Boosts investment in mRNA sequencing technologies |

| Technological Advancements | Innovations improve accuracy and reduce costs |

| Rising Incidence of Genetic Disorders | Drives demand for genetic research and diagnostics |

| Growing Personalized Medicine Market | Encourages use of mRNA sequencing for tailored treatments |

Technological advancements are crucial in the development of the market. The advancement in mRNA sequencing technology improved the accuracy and efficiency of the analysis of DNA, which answered the increasingly large call for DNA testing. Such innovations include new sequencers measuring changes in electrical conductivity as DNA strands pass through biological pores. In this regard, the technology has been able to progress in the effective sequencing of pathogens such as the Zika virus, thus making it quite representative of the potentialities that may help in handling global health challenges.

Advances in whole exome and genome sequencing technologies, combined with the rising popularity of DNA testing, are also driving the market. These technologies offer relatively inexpensive alternatives and faster results than conventional genotyping-based DNA microarrays. This, in turn, is further fueling demand for mRNA sequencing.

Examples of some notable contributions are found in the company GenapSys where they have released the GENIUS sequencer: a sequencing device that can be practically applied almost anywhere to yield more accessible and flexible sequencing technologies while catering to the different demands of research and clinical work.

In conclusion, the mRNA sequencing market is expected to increase further due to the advancements in the technological sector, increasing demand for early disease diagnosis, and improvements in DNA testing methodologies. The area is going to offer even more insights and applications regarding genomics as well as personalized medicine as it continues to advance.

| Regulation | Region | Impact on mRNA Sequencing Market | Recent Updates |

|---|---|---|---|

| FDA Guidelines | North America | Ensures safety and efficacy of mRNA products | Updated guidelines for clinical trial approvals |

| EMA Regulations | Europe | Affects approval and market entry | Recent changes in clinical trial submission processes |

| NMPA Regulations | Asia-Pacific | Influences market access and product development | New regulations on genetic testing and diagnostics |

| MHRA Standards | United Kingdom | Impacts product standards and regulatory compliance | Revised standards for genomics research |

mRNA Sequencing Market Dynamics

Drivers

• Increasing Demand for DNA Testing Likely to Fuel mRNA Sequencing Sales.

Demand for DNA testing due to the rapidly increasing rates of adoption is majorly driving the mRNA sequencing market. Improved whole-genome and exome sequencing techniques give higher accuracy compared to traditional genotyping-based DNA microarrays, which are cheap and fast in results that make them a more preferred choice for further application of DNA testing. The upward trend in DNA testing for research, clinical diagnostics, and personalized medicine applications tends to fuel the adoption of mRNA sequencing technologies. In this regard, as DNA sequencing becomes increasingly integrated into the clinical workflow, there is a growing need for complete RNA sequencing solutions that can introduce insight into the expression of genes, transcription profiles, and molecular pathways. Of particular relevance, mRNA sequencing provides an important route for the identification of genetic mutations and variations and understanding the mechanisms of disease in enabling earlier diagnosis of cancer and infectious diseases. With the advance of personal medicine, and tailored treatment according to individual genetic information, there is rising demand for advanced sequencing technologies; among them, mRNA sequencing is one. Additionally, mRNA sequencing has unique capabilities for the identification and analysis of the transcriptome, which is critical to understanding gene function, expression patterns, and mechanisms of regulation. Further expansion in the adoption of DNA testing within research institutes, pharmaceutical companies, and healthcare settings further accelerates the demand for mRNA sequencing as a supplementary tool that drives market sales and increases its applications in genomics and molecular biology.

Restraints

-

The advanced sequencing-related and infrastructure-based technologies are showing a limitation to their adoption.

-

Complexity in data analysis and management requires specific bioinformatics skills and tools.

mRNA Sequencing Market Segmentation Analysis

By Product & Service:

Platforms and consumables were the market's leading segment of sequencing platforms in 2023 as they are highly integral to the whole sequencing process. High demand for advanced platforms and consumables with assured accuracy and efficiency for sequencing makes this segment dominate the market. The evolution of sequencing technology is continuously going on and currently involves high-end capabilities in platforms as well as specialty consumables, which is fueling the leading position of this segment.

RNA sequencing services have been rapidly growing due to the need for outsourcing sequencing activities among researchers and clinicians. Today, it is mainly driven by the need for high-quality, cost-effective sequencing solutions that do not require too much up-front capital investment in in-house sequencing platforms. Contributions to rapid expansion are also coming from service providers, based on the accessibility and convenience offered and full support analysis.

By Technology:

The SBS technology leads the mRNA sequencing market in terms of share with 34.3% in the year 2023, primarily because of its well-established reliability, accuracy, and high throughput base. SBS platforms are highly adopted across research and clinical settings for comprehensive sequencing capabilities catering to diverse needs in genomics and transcriptomics.

Nanopore sequencing is the fastest-growing technology in the mRNA sequencing market based on the absolute advantages of real-time sequencing, long read lengths, and portability. Once detailed genetic information is available with minimal sample preparation, it has captured significant interest and investment, thereby accelerating the growth of nanopore sequencing compared to other technologies.

By Application

Expression profiling analysis was the led application segment with a 30.1% share in 2023, as it fundamentally allows understanding and knowledge of gene expression patterns and their role in various biological processes. It forms an indispensable basis for both basic research and clinical diagnostics, a factor that maintains its leading stance within the market.

Small RNA sequencing is experiencing tremendous growth due to its pivotal role in the study of small noncoding RNAs and their roles in gene regulation, disease, and therapeutic development. With the efforts to understand small RNAs and how they interact and influence cellular functions and disease mechanisms contributing to the accelerated growth of this segment, the future of the small RNA sequencing market looks very promising.

By End-User

The segment of the end-user comprises 52.1% of the market share through immense deployments of mRNA sequencing by pharmaceutical and biotechnology companies, which account for the bulk of company sales and revenue. Such companies aim to achieve better information about genetic targets and biomarkers by using the most advanced sequencing technologies, thus supporting their leading position in the market.

The fastest-growing end-user segment is hospitals and clinics, mainly because of the increasing integration of mRNA sequencing into clinical diagnostics and patient care. Increasing focus on the whole approach of precision medicine in healthcare settings is fueling the rapid adoption of sequencing technologies in those settings.

mRNA Sequencing Market Regional Insights

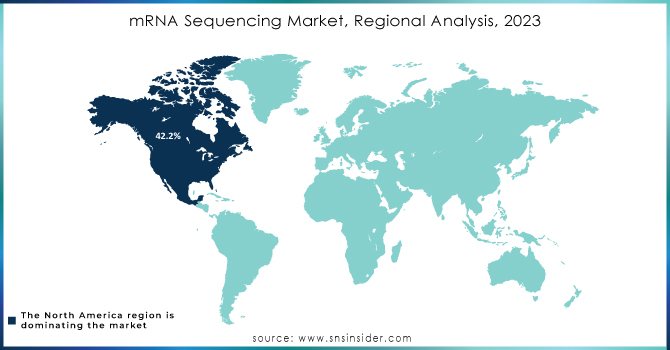

North America dominated, at 42.2% share in 2023. The primary drivers are: large funding by the government for genomics-related research in place; the prevalence of target diseases is high; and innovative activity concerning RNA sequencing products is continuous. Another driver, especially in driving the market growth, is the focus on research into inherited rare diseases and cancer. Major industry players that have bases in the USA and major presence include Thermo Fisher Scientific, Illumina, and Agilent Technologies. In that regard, there is some added value brought to the growth in the market with their latest innovation in the field.

The second most promising region is Europe. The growth in the region is driven by the increasing demand for cost-effective and rapid sequencing solutions. This is further driven by the rising prevalence of hereditary diseases, the expanding use of genomics in drug development and discovery, and a general increase in mRNA sequencing adoption. Furthermore, the increase in cancer cases worldwide fosters further growth in the market. In the European region, Germany will hold the biggest share of the market. The country's market for blood diagnostic tests also thrives on high rates of transfusion-related procedures, such as heart surgeries, chemotherapy, and organ transplants, as well as low screening costs for infectious diseases. Furthermore, active programs on blood donation, with about 2 million people donating now and then, aid the expansion of the market, in the case of Germany.

Need any customization research on mRNA Sequencing Market - Enquiry Now

Key Players in mRNA Sequencing Market

-

Kureha Corporation

-

Toray Industries, Inc.

-

Mitsubishi Chemical Holdings

-

SGL Group

-

Royal DSM

-

Hexcel Corporation

-

Teijin Limited

-

SABIC

-

Illumina, Inc.

-

QIAGEN

-

F. Hoffmann-La Roche Ltd

-

Quantabio

-

Zymo Research Corporation

-

base click GmbH

-

Paragon Genomics, Inc.

-

Yeasen Biotechnology (Shanghai) Co., Ltd.

-

Novogene Co, Ltd

-

Norgen Biotek Corp and other players

Recent Developments

-

May 2023: Twist Bioscience introduced a new suite of RNA sequencing tools, including the Twist RNA Exome, RNA Library Prep Kit, and Ribosomal RNA and Hemoglobin Depletion Kit. These products provide end-to-end workflows compatible with a wide range of sample types, including difficult or low-quality samples.

-

September 2023: Foundation Medicine, Inc. launched "FoundationOne RNA," a research and investigational RNA test. It expands its capabilities to analyze 318 genes for fusion detection and offers gene expression reporting for over 1,500 genes to support biomarker discovery.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.6 Billion |

| Market Size by 2032 | US$ 7.19 billion |

| CAGR | CAGR of 8.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product & Service (Sample Preparation, Application, Method, Sequencing Platforms & Consumables for RNA Sequencing, RNA Sequencing Services, Data Analysis, Storage, and Management) • By Technology (Sequencing by Synthesis (SBS), Ion Semiconductor Sequencing, Single-molecule Real-time (SMRT) Sequencing, Nanopore Sequencing) • By Application (De Novo Transcriptome Assembly, Expression Profiling Analysis, Variant Calling & Transcriptome Epigenetics, Small RNA Sequencing) • By End User (Research Centers and Academic & Government Institutes, Hospitals & Clinics, Pharmaceutical & Biotechnology Companies, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Iveric Bio, Alkeus Pharmaceuticals, Inc., Apellis Pharmaceuticals, Inc., Hemera Biosciences LLC, Genentech, Inc., F. Hoffmann-La Roche AG, Stealth BioTherapeutics, Allegro Ophthalmics, LLC, Gensight Biologics SA, Gyroscope Therapeutics Limited, Regenerative Patch Technologies, LLC, NGM Biopharmaceuticals Inc., Novartis, Perceive Biotherapeutics, Inc., Annexon, Inc., Aviceda Therapeutics, Astellas Pharma Inc and others. |

| Key Drivers | • Increasing Demand for DNA Testing Likely to Fuel mRNA Sequencing Sales. |

| Restraints | • The advanced sequencing-related and infrastructure-based technologies are showing a limitation to their adoption. • Complexity in data analysis and management requires specific bioinformatics skills and tools. |