BOTOX Market Report Scope and Overview:

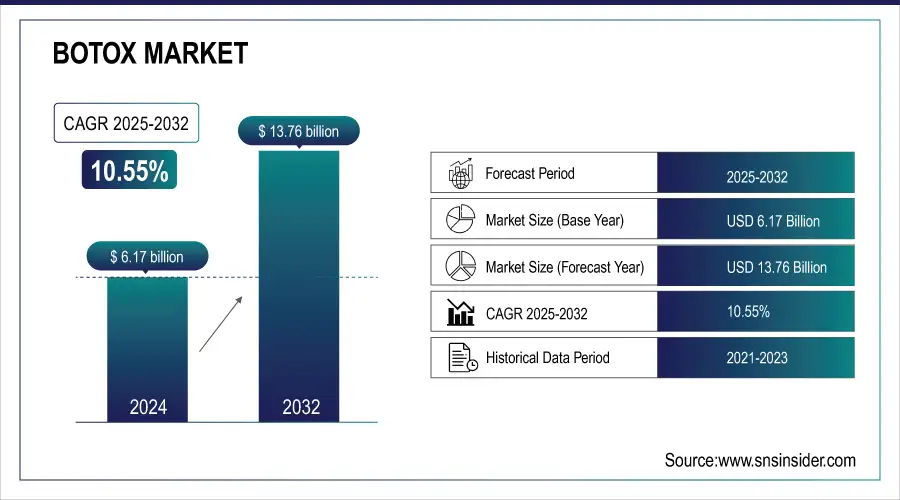

The BOTOX Market size was valued at USD 6.17 billion in 2025E and is projected to reach USD 13.76 billion by 2033, growing at a CAGR of 10.55% from 2026-2033.

This report examines the prevalence and incidence of conditions treated using BOTOX, including cosmetic treatments and medical procedures for migraines and muscle diseases. It analyzes prescription and procedure trends in various regions. The study also investigates pricing trends and cost analysis, evaluating drivers of affordability and market accessibility. Regulatory and approval trends significantly influence the industry, affecting product availability and innovation. The study also explores consumer and patient demographics, discussing how age ranges, income brackets, and lifestyle choices influence demand. In addition, it examines healthcare expenditure on BOTOX in government, commercial, private, and out-of-pocket categories, identifying geographic differences and opportunities for market growth.

BOTOX Market Size and Forecast:

- Market Size in 2025E: USD 6.17 billion

- Market Size by 2033: USD 13.76 billion

- CAGR: 10.55% from 2026 to 2033

- Base Year: 2025

- Forecast Period: 2026–2033

- Historical Data: 2022–2024

Get more information on BOTOX Market - Request Sample Report

BOTOX Market Highlights:

-

Growing demand for non-invasive aesthetic procedures and increasing consumer awareness are driving the BOTOX market.

-

Expanding medical applications, including FDA-approved uses for chronic migraines, muscle spasticity, and overactive bladder, fuel market growth.

-

Aging population and advancements in long-acting formulations, such as Daxxify, enhance patient satisfaction and market penetration.

-

Safety concerns, side effects, high treatment costs, and strict regulatory requirements limit market adoption.

-

Emerging opportunities include preventive “Baby Botox,” expansion into emerging markets, medical tourism, and new therapeutic applications (e.g., neurological disorders, obesity, depression).

-

Technological innovations, biosimilars, telemedicine, and e-commerce platforms improve accessibility, affordability, and adoption of BOTOX treatments.

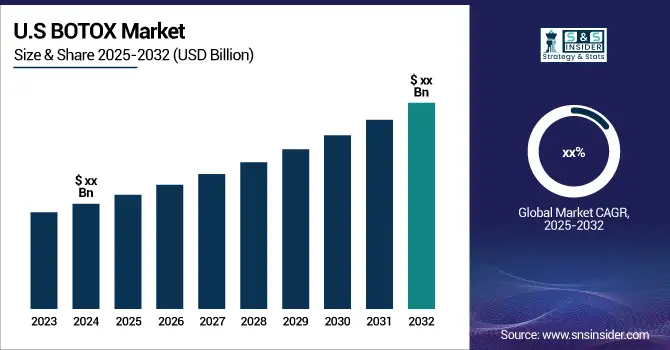

The U.S. BOTOX market size was valued at an estimated USD 3.05 billion in 2025 and is projected to reach USD 6.85 billion by 2033, growing at a CAGR of 10.4% over the forecast period 2026–2033. Market growth is driven by the strong demand for minimally invasive aesthetic procedures, increasing awareness of cosmetic enhancements, and the growing adoption of botulinum toxin treatments for therapeutic applications such as chronic migraine, muscle spasticity, and hyperhidrosis. Rising disposable income, expanding medical aesthetics clinics, and continuous product innovations by key manufacturers further support market expansion. Additionally, favorable regulatory approvals and the presence of a well-established cosmetic healthcare ecosystem continue to reinforce the U.S. BOTOX market’s growth trajectory during the forecast period.

BOTOX Market Drivers:

-

The growing demand for non-invasive aesthetic procedures, increasing medical applications, and rising consumer awareness are key factors driving the BOTOX market.

The worldwide growth in aesthetic procedures is driven by social media trends, evolving beauty ideals, and a desire for younger looks. Botulinum toxin injections were the most common cosmetic procedure in 2023, with more than 7.4 million treatments in the United States alone, as reported by the American Society of Plastic Surgeons. Also, growing therapeutic applications of botulinum toxin, such as FDA-approved indications for chronic migraines, muscle spasticity, and overactive bladder, are stimulating market growth. The aging demographic also contributes heavily, as seniors pursue both medical and aesthetic applications of botulinum toxin. Also, advancements in formulation, such as long-acting botulinum toxin products like Daxxify, are leading to greater patient satisfaction and growing market penetration. The ease of access to and affordability of these treatments have enhanced as a result of the escalating presence of dermatology and aesthetic clinics. Moreover, greater healthcare spending and expanding insurance coverage for treatment uses are driving greater adoption rates. The availability of established market players such as AbbVie (Botox), Ipsen (Dysport), and Merz (Xeomin) also supports the competitive landscape in ways that drive future product innovation and extensive market expansion.

BOTOX Market Restraints:

-

The BOTOX market faces limitations due to safety concerns, side effects, and regulatory restrictions.

Botulinum toxin, a neurotoxin, is known to induce side effects like muscle weakness, eyelid drooping, and swallowing difficulty, which are concerns for consumers. FDA reports bring to light cases of botulinum toxin dissemination beyond the site of injection, resulting in serious complications. In addition, strict regulatory approval procedures delay the entry of new products and indications. The requirement for qualified practitioners and the danger of incorrect administration also restrict the market's availability, as amateur injections can lead to poor results or complications. The high price of branded botulinum toxin treatments is another significant restraint, as it renders affordability a problem for most consumers. Although aesthetic treatments are becoming increasingly popular, insurance coverage is mostly reserved for therapeutic applications, limiting access for cosmetic purposes. Moreover, some patients become resistant to botulinum toxin with time, necessitating increased doses or other forms of treatment, which can decrease the long-term efficacy of these products. The availability of unregulated and counterfeit botulinum toxin products in most markets also creates a challenge, impacting consumer confidence and posing safety issues. All these factors cumulatively slow down the adoption of botulinum toxin treatments on a large scale.

BOTOX Market Opportunities:

-

The growing acceptance of preventive aesthetic treatments, expansion into emerging markets, and advancements in botulinum toxin formulations present significant opportunities for market growth.

Youthful demographics are increasingly turning to "Baby Botox" (shorter doses for prevention of wrinkles), widening the patient base outside of classic anti-aging patients. Additionally, technology advancements in botulinum toxin, including room-temperature-stable products and longer duration of action, have the potential to change the market by making it more convenient and less frequent in terms of treatments. The increase in medical tourism, specifically in nations like South Korea and Thailand where botulinum toxin treatment is economical and highly sophisticated, is opening a new door for growth. Moreover, the expansion of new therapeutic applications for disorders like depression, atrial fibrillation, and obesity is developing untapped markets. Based on clinical trials, botulinum toxin is demonstrating promising effects in treating symptoms of neurological diseases like Parkinson's disease. Additionally, new entrants and biosimilar offerings are anticipated to reduce prices, making it more affordable and increasing adoption rates. Telemedicine and e-commerce platforms are also facilitating improved access to consultations and procedures, making botulinum toxin treatments more mainstream. If these opportunities are tapped, the BOTOX market is poised to witness unprecedented growth in both cosmetic and therapeutic uses.

BOTOX Market Segment Analysis:

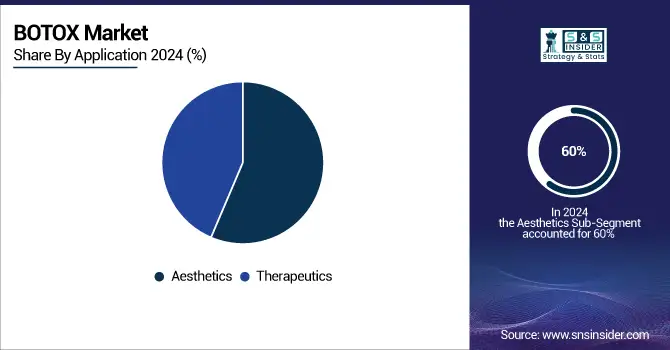

By Application

The Aesthetics segment led the BOTOX market in 2025 with a share of more than 60% of the overall market. The growing demand for non-surgical cosmetic treatments, growing social media pressure, and an expanding aging population demanding anti-aging treatments have driven the segment's growth. Furthermore, the evolution of injectable methods and the increasing popularity of botulinum toxin for facial rejuvenation have played a key role in its leadership.

The Therapeutics segment is the fastest-growing due to rising FDA approvals for novel medical indications like chronic migraines, muscle spasticity, and overactive bladder. Increased awareness of the therapeutic uses of botulinum toxin and enhanced reimbursement policies for its medical uses are driving growth in this segment.

By Type

Botulinum Toxin Type A commanded the largest market share in 2025 and generated more than 85% of the revenue. Its popularity is due to its extensive usage in both aesthetic and therapeutic applications, with superior efficacy, and the established brands of Botox (Allergan), Dysport (Ipsen), and Xeomin (Merz). Its longer duration and greater patient preference have made it the market leader.

Botulinum Toxin Type B is the most rapidly growing segment, driven mainly by its increasing role in the treatment of cervical dystonia and other neurological disorders. Although its market penetration is still lower than that of Type A, growing clinical studies and its success in patients who are resistant to Type A formulations are fueling its use.

By End-User

The Specialty & Dermatology Clinics segment led the market in 2025 with over 57.2% of the overall revenue. Expansion in the number of dermatology and aesthetic clinics, as well as the growing preference for specialized treatment facilities over hospitals for cosmetic procedures, has driven growth. These clinics are favored by patients because of their knowledge, proximity, and improved treatment options.

The segment of Hospitals & Clinics is the most rapidly expanding, driven by the growing utilization of botulinum toxin for therapeutic applications in neurological and muscular disorders. The growth in hospital-based aesthetic procedures and the expanding utilization of botulinum toxin to improve muscle recovery post-surgery are fueling the segment's high growth.

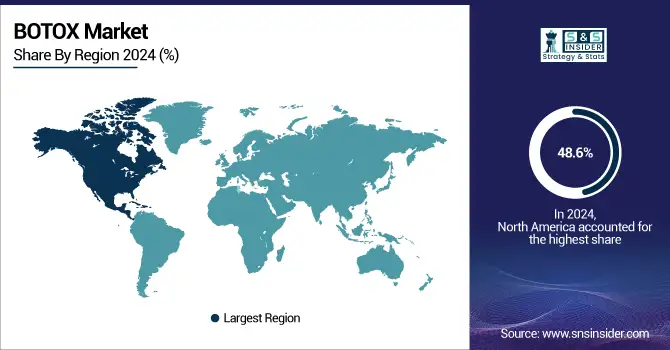

BOTOX Market Regional Analysis:

North America BOTOX Market Trends:

North America led the BOTOX market in 2025, contributing more than 48.6% of the revenue. The market is propelled by the region's high incidence of aesthetic treatments, rising medical uses, and strong consumer knowledge. The United States is still the prime contributor, with numerous FDA-approved indications for botulinum toxin and well-developed dermatology and aesthetic clinic networks. Moreover, the presence of leading players such as Allergan (AbbVie) and Ipsen has boosted market development. Positive reimbursement policies for therapeutic use and the increasing geriatric population further support North America's leadership.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia-Pacific BOTOX Market Trends:

In 2025, The Asia-Pacific region is the most rapidly growing region, which is poised to experience a substantial increase in demand for botulinum toxin treatments. The growth of the region is driven by a growing acceptance of beauty treatments, a proliferating middle class, and increased medical tourism, especially in South Korea, China, and Japan. The market is developing at a fast rate as a result of the economic costs of treatment, a growing number of qualified professionals, and an expanding number of new therapeutic uses approved. Further, the impact of social media and beauty-savvy consumers is driving the growth of non-invasive cosmetic treatments. Consequently, Asia-Pacific is expected to witness the highest market growth in the coming years.

Europe BOTOX Market Trends:

Europe holds a significant share of the BOTOX market, driven by high awareness of aesthetic procedures, established healthcare infrastructure, and reimbursement policies for therapeutic applications. Countries like Germany, France, and the UK are leading contributors due to a strong presence of dermatology and cosmetic clinics. Increasing adoption of botulinum toxin for both cosmetic and medical indications, along with a growing geriatric population, supports steady market growth in this region.

Latin America BOTOX Market Trends:

Latin America is witnessing moderate growth in the BOTOX market, led by Brazil, Mexico, and Argentina. The market expansion is fueled by increasing consumer awareness of cosmetic treatments, rising disposable income, and a growing number of medical aesthetic clinics. Social media influence and beauty-conscious consumers are also driving demand, while the adoption of therapeutic uses remains limited but gradually increasing.

Middle East & Africa BOTOX Market Trends:

The Middle East & Africa region is experiencing gradual growth in the BOTOX market, with countries such as the UAE, Saudi Arabia, and South Africa leading adoption. Growth is supported by rising medical tourism, increasing investment in healthcare infrastructure, and a growing interest in aesthetic procedures among the affluent population. Awareness campaigns and the availability of FDA- and local-approved products further contribute to market development, although adoption rates remain lower than in North America and Europe.

BOTOX Market Key Players:

-

AbbVie Inc. – (via its Allergan business)

-

Galderma S.A.

-

Ipsen Pharma

-

Merz Pharma GmbH & Co. KGaA

-

Medytox Inc.

-

HUGEL, Inc.

-

Evolus, Inc.

-

Revance Therapeutics, Inc.

-

Supernus Pharmaceuticals, Inc.

-

Lanzhou Institute of Biological Products Co., Ltd.

-

Daewoong Pharmaceutical Co., Ltd.

-

Eisai Co., Ltd.

-

US WorldMeds, LLC

-

Huons Co., Ltd.

-

Gufic BioSciences Ltd.

-

Protox Co., Ltd.

-

Jetema Co., Ltd.

-

Shanghai Fosun Pharmaceutical (Group) Co., Ltd.

-

Dermata Therapeutics, Inc.

-

Capsida Biotherapeutics, Inc.

BOTOX Market Competitive Landscape:

AbbVie Inc. (Allergan Aesthetics) Founded in 2013 (following the spin-off of AbbVie from Abbott Laboratories, Allergan acquired in 2020), AbbVie’s Allergan Aesthetics specializes in medical aesthetics, including BOTOX Cosmetic. The company drives innovation in aesthetic and therapeutic treatments, supporting community initiatives like its 2024 grant program empowering women entrepreneurs through crowdfunding campaigns.

-

In Sept 2024, Allergan Aesthetics, an AbbVie company, launched the next phase of its 2024 BOTOX Cosmetic grant program, empowering 20 women entrepreneurs through crowdfunding campaigns. This initiative allows the community to support and uplift these inspiring business owners in achieving their goals.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 6.17 billion |

| Market Size by 2033 | USD 13.76 billion |

| CAGR | CAGR of 10.55% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application [Therapeutics (Chronic Migraine, Spasticity, Overactive Bladder, Cervical Dystonia, Blepharospasm, Others), Aesthetics] • By Type [Botulinum Toxin Type A, Botulinum Toxin Type B] • By End-user [Specialty & Dermatology Clinics, Hospitals & Clinics, Others] |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | AbbVie Inc. – (via its Allergan business), Galderma S.A., Ipsen Pharma, Merz Pharma GmbH & Co. KGaA, Medytox Inc., HUGEL, Inc., Evolus, Inc., Revance Therapeutics, Inc., Supernus Pharmaceuticals, Inc., Lanzhou Institute of Biological Products Co., Ltd., Daewoong Pharmaceutical Co., Ltd., Eisai Co., Ltd., US WorldMeds, LLC, Huons Co., Ltd., Gufic BioSciences Ltd., Protox Co., Ltd., Jetema Co., Ltd., Shanghai Fosun Pharmaceutical (Group) Co., Ltd., Dermata Therapeutics, Inc., Capsida Biotherapeutics, Inc. |