Clinical Trial Imaging Market Size Analysis:

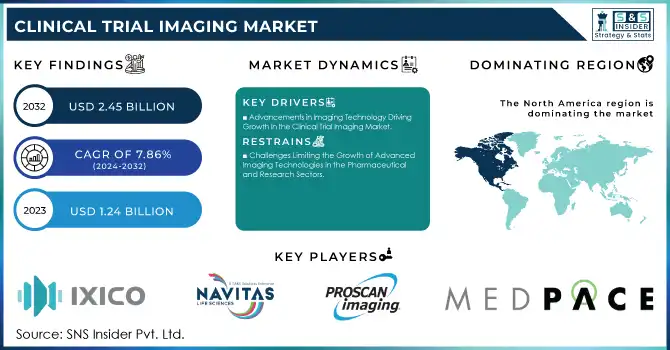

The Clinical Trial Imaging Market size was valued at USD 1.34 billion in 2024 and is expected to reach USD 2.45 billion by 2032, growing at a CAGR of 7.86% over the forecast period 2025-2032.

The Clinical Trial Imaging market plays a vital role in advancing drug development and medical research, offering critical insights into disease progression, therapeutic efficacy, and patient safety. Imaging technologies such as Magnetic Resonance Imaging (MRI), Computed Tomography (CT), Positron Emission Tomography (PET), and Ultrasound have become indispensable tools in clinical trials. These modalities provide both qualitative and quantitative data, ensuring precise monitoring of trial endpoints and enhancing regulatory compliance.

Get more information on Clinical Trial Imaging Market - Request Sample Report

Clinical Trial Imaging Market Size and Forecast:

-

Market Size in 2024: USD 1.34 Billion

-

Market Size by 2032: USD 2.45 Billion

-

CAGR: 7.86% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Clinical Trial Imaging Market Key Trends:

-

Integration of advanced imaging modalities – Adoption of MRI, CT, PET, and ultrasound in clinical trials is improving accuracy and monitoring of disease progression.

-

Regulatory compliance focus – Stringent FDA and EMA guidelines for imaging endpoints are driving the implementation of standardized imaging protocols.

-

Rise of decentralized trials – Remote imaging and tele-radiology solutions enable patient monitoring without centralized trial visits, enhancing recruitment and retention.

-

AI and machine learning adoption – AI-driven image analysis and automated quantification are accelerating data processing and reducing human error in clinical trials.

-

Personalized medicine and targeted therapies – Imaging biomarkers support precision medicine by monitoring treatment response and patient stratification in oncology and neurology studies.

-

Cloud-based imaging platforms – Cloud solutions facilitate secure storage, sharing, and analysis of imaging data across multiple trial sites worldwide.

-

Cost and efficiency optimization – Imaging outsourcing and centralized reading services reduce trial costs, accelerate timelines, and ensure data consistency.

Technological advancements, particularly artificial intelligence (AI) integration, have revolutionized clinical trial imaging by increasing accuracy and efficiency. For example, AI-powered tools like Zircaix by Telix Pharmaceuticals have shown high precision in differentiating between benign and malignant kidney tumors during trials, reducing unnecessary interventions. In phase three trials, Zircaix demonstrated exceptional diagnostic accuracy across a cohort of over 300 patients, showcasing the transformative potential of AI in clinical imaging.

Imaging biomarkers are gaining prominence as reliable indicators of therapeutic outcomes. In oncology trials, PET imaging biomarkers have improved the precision of cancer therapy response assessments, with studies indicating a 20-30% increase in accurate patient stratification. Similarly, cardiovascular trials increasingly rely on advanced imaging to evaluate plaque stability, which is crucial for predicting cardiovascular event risks.

Collaborations between pharmaceutical companies and specialized imaging vendors have streamlined clinical workflows while developing hybrid imaging systems has expanded diagnostic capabilities. For instance, the combination of PET and CT in hybrid systems enables comprehensive disease assessment, enhancing trial accuracy and efficiency.

Clinical Trial Imaging Market Drivers:

-

Advancements in Imaging Technology Driving Growth in the Clinical Trial Imaging Market

The increasing complexity of clinical trials, particularly in areas such as oncology, neurology, and cardiology. These trials demand sophisticated imaging techniques, like MRI and PET, to provide non-invasive, high-resolution insights into disease progression and treatment effectiveness. Another major factor is the rising use of imaging biomarkers as surrogate endpoints. These biomarkers are critical in early-phase trials, enabling the evaluation of therapeutic responses, reducing dependence on invasive procedures, and accelerating the drug development process. For instance, imaging biomarkers have been particularly impactful in Alzheimer’s research, where detecting subtle changes in brain structure and volume is essential.

Technological advancements, including developing portable imaging devices, are also contributing to market expansion. These innovations support decentralized clinical trials, enhancing accessibility and encouraging greater patient participation, aligning with the trend toward patient-centered trial designs. Regulatory bodies are playing an influential role by promoting the standardization of imaging protocols and ensuring uniformity and reliability in data collection across global studies. Additionally, adopting cloud-based platforms for imaging data management has streamlined collaboration and enabled faster decision-making among researchers. Finally, strategic partnerships between pharmaceutical companies and imaging solution providers drive innovation, resulting in advanced and tailored imaging technologies designed to meet the unique demands of clinical trials. These combined factors are propelling the Clinical Trial Imaging market forward.

Clinical Trial Imaging Market Restraints:

-

Challenges Limiting the Growth of Advanced Imaging Technologies in the Pharmaceutical and Research Sectors

High costs associated with advanced imaging technologies, specialized equipment, and skilled personnel pose a major barrier, particularly for smaller pharmaceutical companies and research institutions. Regulatory compliance is another challenge, as imaging protocols must meet varying standards across regions, which can cause delays and increase costs, especially in multi-country studies. Additionally, managing and integrating the large volumes of data generated by imaging modalities requires sophisticated and costly data management systems. Finally, patient variability, such as differences in anatomy, age, and disease stage, can affect the consistency and accuracy of imaging results, complicating data interpretation and limiting the generalizability of findings. These factors continue to restrict the market’s full potential.

Clinical Trial Imaging Market Segmentation Analysis

By Modality, MRI Dominates Clinical Trial Imaging Market in 2024, OCT Shows Fastest Growth

In 2024, Magnetic Resonance Imaging (MRI) was the dominant modality due to its broad application across multiple therapeutic areas. MRI is highly valued for its ability to produce high-resolution images of soft tissues without the need for ionizing radiation, making it indispensable in the diagnosis of conditions related to neurovascular diseases, cardiovascular diseases, and oncology. MRI held a significant share of the market, representing approximately 40% of the overall imaging modalities segment.

The fastest-growing modality was Optical Coherence Tomography (OCT), largely driven by its increasing use in ophthalmology, particularly in retinal imaging. OCT’s high-resolution cross-sectional imaging capabilities make it a critical tool in diagnosing eye diseases such as diabetic retinopathy, macular degeneration, and glaucoma. Technological advancements and the rising prevalence of ophthalmic conditions have contributed to the rapid growth of OCT. It has gained popularity for its non-invasive nature and precision in monitoring retinal health.

By Therapeutic Area, Oncology Leads Market Share in 2024, Ophthalmology Registers Fastest Growth

In 2024, oncology emerged as the dominant therapeutic area, driven by the increasing global burden of cancer. Imaging technologies like CT scans and MRI play a crucial role in diagnosing and staging cancers, as well as monitoring treatment responses. The oncology segment represented the largest portion of the market, accounting for 45% of the market share, as imaging is integral in managing a wide range of cancers, from early detection to post-treatment evaluations.

The ophthalmology segment was the fastest-growing area, largely due to the aging population and the rising incidence of eye disorders such as macular degeneration, glaucoma, and diabetic retinopathy. Advances in imaging technologies, particularly OCT, have driven significant growth in this segment. The increasing demand for precise and non-invasive diagnostic tools in eye care has contributed to the rapid expansion of the ophthalmology market, making it a key focus area for technological development and investment.

Clinical Trial Imaging Market Regional Analysis:

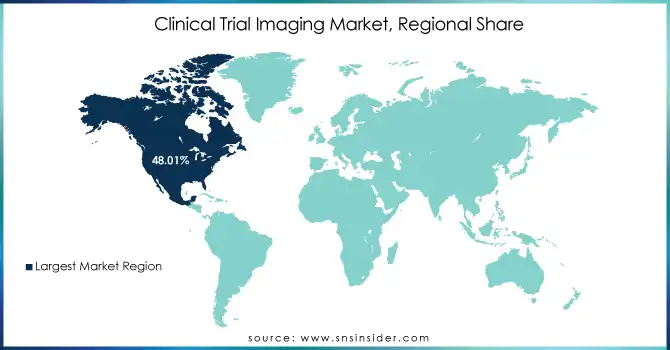

North America dominates the Clinical Trial Imaging market in 2024

In 2024, North America holds an estimated 42% share of the Clinical Trial Imaging market, driven by high adoption of advanced imaging technologies, extensive clinical trial networks, and strong R&D investments. The region benefits from collaborations between hospitals, pharmaceutical companies, and contract research organizations (CROs). Regulatory support from the FDA ensures standardized imaging protocols, while widespread use of MRI, CT, PET, and OCT systems enhances trial efficiency. Increasing prevalence of chronic and oncological diseases, combined with technological innovation, reinforces North America’s leadership position and supports continued market growth.

-

United States leads North America’s Clinical Trial Imaging market

The U.S. dominates due to its mature healthcare infrastructure, availability of skilled radiologists, and strong government and private sector investment in clinical research. Advanced imaging modalities and AI-powered analysis tools are widely adopted across hospitals and research centers. Collaborative efforts between pharmaceutical companies, CROs, and academic institutions enable large-scale, high-quality trials. Increasing chronic disease incidence, precision medicine initiatives, and rapid adoption of innovative imaging techniques strengthen the U.S.’s contribution to North America’s clinical trial imaging market.

Asia-Pacific is the fastest-growing region in the Clinical Trial Imaging market in 2024

The Asia-Pacific market is projected to expand at an estimated CAGR of 10.5% from 2025 to 2032, driven by rising healthcare expenditure, growing clinical trial activities, and adoption of advanced imaging technologies. The region benefits from government incentives, partnerships with global pharmaceutical firms, and expanding hospital infrastructure. Increasing patient pools, favorable regulatory reforms, and rising demand for precision medicine accelerate imaging adoption. Strong investment in oncology and ophthalmology trials further positions Asia-Pacific as the fastest-growing region in the forecast period.

-

China leads Asia-Pacific’s Clinical Trial Imaging market

China dominates due to its growing healthcare infrastructure, government support for clinical research, and increasing prevalence of chronic and oncological diseases. Hospitals and CROs are investing in advanced imaging modalities such as MRI, PET, and OCT to enhance trial efficiency. Partnerships with multinational pharmaceutical companies facilitate large-scale clinical trials, while regulatory reforms allow faster approvals. The country’s skilled medical workforce, large patient population, and adoption of precision medicine initiatives reinforce China’s leading role in Asia-Pacific’s clinical trial imaging market.

Europe Clinical Trial Imaging market insights, 2024

Europe shows steady growth in 2024, supported by strong clinical research activities, adoption of advanced imaging modalities, and collaboration between hospitals and pharmaceutical companies. The region benefits from regulatory frameworks ensuring high-quality imaging standards. Increasing oncology and ophthalmology trials drive demand for precise, non-invasive imaging solutions, while investments in AI-assisted imaging enhance trial outcomes.

-

Germany drives Europe’s Clinical Trial Imaging market

Germany dominates due to its advanced healthcare system, extensive clinical trial networks, and early adoption of AI-powered imaging technologies. Strong R&D investment and partnerships with global pharmaceutical firms accelerate trial implementation. Regulatory support and skilled medical professionals further bolster Germany’s leadership in Europe.

Middle East & Africa and Latin America Clinical Trial Imaging market insights, 2024

The Middle East & Africa and Latin America regions show moderate growth in 2024. In the Middle East, countries such as the UAE and Saudi Arabia invest in imaging infrastructure and clinical trial capabilities. Latin America, led by Brazil and Mexico, benefits from growing pharmaceutical trials, expanding hospitals, and increasing demand for advanced imaging solutions. Collaborations with global CROs, rising healthcare spending, and emerging skilled workforce support steady market expansion across both regions.

Need any customization research on Clinical Trial Imaging Market - Enquiry Now

Competitive Landscape for the Clinical Trial Imaging Market:

ICON plc

ICON plc is a global provider of outsourced development and commercialisation services to the pharmaceutical, biotechnology, and medical device industries. The company specializes in clinical trial management, imaging data acquisition, and centralized image analysis to enhance trial efficiency and accuracy. By collaborating with pharmaceutical sponsors and CRO partners, ICON accelerates clinical development timelines while ensuring regulatory compliance and high-quality imaging outputs. Its role in the Clinical Trial Imaging market is pivotal, offering end-to-end solutions that streamline imaging workflows and improve the reliability of trial endpoints.

-

In 2024, ICON plc expanded its imaging services portfolio with advanced MRI and PET analysis capabilities, supporting multi-site global trials.

Clario

Clario is a U.S.-based global contract research organization providing clinical trial services, including advanced imaging solutions for diagnostics and efficacy evaluation. The company integrates imaging data management, centralized reading, and quantitative analysis into clinical trial workflows, ensuring consistent and reproducible results. Clario partners with biopharma companies to optimize imaging-based endpoints and support regulatory submissions. Its role in the market centers on improving clinical trial accuracy, reducing variability, and accelerating decision-making through reliable imaging analytics.

-

In 2024, Clario launched enhanced cloud-based imaging platforms for multi-modality clinical trials, improving accessibility and real-time monitoring of imaging data.

Medpace

Medpace is a global full-service clinical contract research organization that offers specialized imaging solutions for oncology, cardiology, and neurology trials. The company provides end-to-end imaging services, including protocol design, image acquisition, centralized reading, and regulatory-compliant reporting. Medpace collaborates closely with clinical sites and sponsors to ensure high-quality imaging data that drives robust trial outcomes. Its role in the Clinical Trial Imaging market is significant, enhancing trial efficiency, standardization, and data integrity across global study networks.

-

In 2024, Medpace introduced new AI-assisted image analysis tools for oncology trials, enabling faster and more accurate tumor assessments.

IXICO plc

IXICO plc is a U.K.-based clinical data analytics company specializing in imaging and digital biomarker services for neurological trials. The company provides advanced MRI, PET, and digital imaging analysis to track disease progression and treatment response in neurodegenerative conditions. By partnering with pharmaceutical companies, IXICO delivers actionable insights for trial endpoints, improving study design and outcome evaluation. Its role in the Clinical Trial Imaging market is central, offering scalable, data-driven imaging solutions that enhance trial reliability and accelerate drug development.

-

In 2024, IXICO expanded its neuroimaging analytics platform to include AI-powered longitudinal assessments, supporting multi-center Alzheimer’s and Parkinson’s disease studies.

Clinical Trial Imaging Market Key Players:

-

ICON plc

-

Clario

-

Medpace

-

IXICO plc

-

Resonance Health Ltd.

-

Radiant Sage LLC

-

WCG Clinical

-

Voiant

-

Cardiovascular Imaging Technologies

-

Medical Metrics Inc.

-

Prism Clinical Imaging

-

Boston Imaging Core Lab

-

Anagram 4 Clinical Trials

-

Calyx

-

Biospective Inc.

-

Proscan Imaging

-

Micron Inc.

-

Navitas Life Sciences

-

WorldCare Clinical LLC

-

BioTelemetry, Inc.

| Report Attributes | Details |

| Market Size in 2024 | USD 1.34 billion |

| Market Size by 2032 | USD 2.45 billion |

| CAGR | CAGR of 7.86% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Modality (Computed Tomography Scan, Magnetic Resonance Imaging, X-ray, Ultrasound, Optical Coherence Tomography (OCT), and Other Modalities) • By Therapeutic Area (Neurovascular Diseases, Cardiovascular Diseases, Orthopedics & MSK Disorders, Oncology, Ophthalmology, Nephrology, and Other Therapeutic Areas) • By Services (Clinical Trial Design and Consultation Services, Reading and Analytical Services, Operational Imaging Services, System and Technology Support Services, Project and Data Management) • By End Use (Biotechnology and Pharmaceutical companies, Medical Devices Manufacturers, Academic and Government Research Institutes, Contract Research Organizations (CROs), Other End Users) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IXICO plc, Navitas Life Sciences, ProScan Imaging, Radiant Sage LLC, Medpace, Biomedical Systems Corp, Cardiovascular Imaging Technologies, Intrinsic Imaging, BioTelemetry, ICON Plc, Clario, Resonance Health Ltd. |