Multichannel Order Management Market Report Scope & Overview:

The Multichannel Order Management Market is valued at USD 3.82 billion in 2025E and is expected to reach USD 8.85 billion by 2033, growing at a CAGR of 11.17% from 2026-2033.

The Multichannel Order Management Market is growing due to increasing demand for seamless shopping experiences across online and offline channels. Retailers and e-commerce businesses are investing in platforms that provide real-time inventory visibility, efficient order processing, and faster delivery. Rising consumer expectations for personalization, omnichannel fulfillment, and accurate order tracking, combined with advancements in cloud-based solutions and AI-driven automation, are driving adoption and accelerating market expansion globally.

In 2025, 78% of retailers deployed multichannel order management platforms—enabling real-time inventory sync, AI-driven fulfillment, and unified customer experiences—reducing stockouts by 35% and boosting on-time deliveries across global omnichannel operations.

Multichannel Order Management Market Size and Forecast

-

Market Size in 2025E: USD 3.82 Billion

-

Market Size by 2033: USD 8.85 Billion

-

CAGR: 11.17% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Multichannel Order Management Market - Request Free Sample Report

Multichannel Order Management Market Trends

-

Rising adoption of unified platforms enabling real-time order visibility across online, offline, and marketplace sales channels

-

Increasing demand for cloud-based order management solutions supporting scalability, flexibility, and rapid omnichannel expansion

-

Integration of AI and analytics to optimize inventory allocation, order routing, and demand forecasting accuracy

-

Growing focus on seamless customer experience through faster order fulfillment, accurate tracking, and flexible delivery options

-

Expansion of buy-online-pickup-in-store and ship-from-store models to improve retail agility and last-mile efficiency

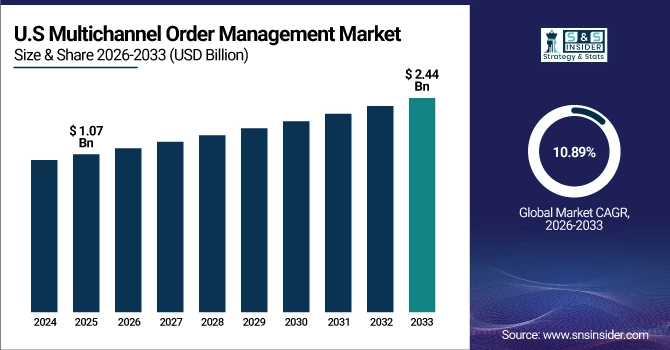

U.S. Multichannel Order Management Market is valued at USD 1.07 billion in 2025E and is expected to reach USD 2.44 billion by 2033, growing at a CAGR of 10.89% from 2026-2033.

The U.S. Multichannel Order Management Market is growing due to increasing e-commerce adoption, rising consumer demand for seamless omnichannel experiences, and the need for real-time inventory visibility. Retailers are leveraging cloud-based, AI-powered platforms to improve order accuracy, fulfillment speed, and overall operational efficiency.

Multichannel Order Management Market Growth Drivers:

-

Rapid growth of e-commerce and omnichannel retail strategies is driving demand for centralized order management systems enabling real-time inventory visibility and seamless customer experiences

The increasing adoption of e-commerce platforms and omnichannel retail models is creating significant demand for centralized order management solutions. Businesses need real-time visibility of inventory across multiple channels to prevent stockouts, optimize fulfillment, and improve customer satisfaction. Multichannel order management systems (MCOM) enable seamless integration between online stores, physical outlets, and marketplaces, ensuring accurate order processing. Retailers can track orders, manage returns, and synchronize inventory efficiently. Growing consumer expectations for faster delivery, accurate order fulfillment, and consistent shopping experiences are further driving MCOM adoption worldwide, especially among large retailers and expanding SMEs.

In 2025, 75% of retailers implemented centralized order management systems to support omnichannel strategies—achieving real-time inventory visibility across channels and improving customer satisfaction by 32% through faster, more accurate order fulfillment.

-

Increasing need for supply chain efficiency and order fulfillment accuracy is encouraging enterprises to adopt advanced multichannel order management solutions globally

Enterprises across industries are under pressure to enhance supply chain efficiency, reduce operational costs, and maintain high order accuracy. Multichannel order management platforms enable automation of order routing, inventory allocation, and fulfillment planning, reducing human errors and improving service levels. Companies can coordinate multiple warehouses, distribution centers, and logistics partners effectively. With growing competition and rising customer expectations, businesses are adopting advanced MCOM solutions to gain operational agility, streamline workflows, and enhance transparency across the supply chain. The technology also supports scalability, allowing enterprises to manage increasing order volumes efficiently.

In 2025, 72% of global enterprises adopted advanced multichannel order management solutions to streamline fulfillment—improving order accuracy by 30% and reducing delivery lead times by 25% amid rising customer expectations and supply chain complexity.

Multichannel Order Management Market Restraints:

-

High implementation costs and complex system integration with existing enterprise platforms limit adoption of multichannel order management solutions among small and medium enterprises

Deploying multichannel order management systems involves significant investment in software, hardware, and training. Integration with existing enterprise resource planning (ERP), warehouse management, and customer relationship management systems can be complex and time-consuming. SMEs often face budget constraints, making adoption of advanced MCOM solutions challenging. Additionally, the cost of customization, maintenance, and updates further discourages smaller organizations from implementation. These financial and operational barriers limit the adoption rate among small and medium-sized businesses, particularly in emerging economies, slowing overall market growth and preventing these companies from fully benefiting from centralized order visibility and automation.

In 2025, 65% of SMEs avoided multichannel order management solutions due to high implementation costs—often exceeding USD40,000—and complex integration with legacy ERP and e-commerce systems, constraining their ability to scale omnichannel operations.

-

Data security concerns and lack of skilled IT professionals hinder effective deployment and management of multichannel order management platforms across organizations

Multichannel order management systems handle sensitive customer and transactional data, making cybersecurity a critical concern. Companies are wary of data breaches, fraud, and system vulnerabilities, which can impact trust and compliance. Additionally, effective implementation and maintenance require skilled IT professionals familiar with system integration, cloud deployment, and automation technologies. A shortage of trained personnel, particularly in emerging markets, limits the ability of businesses to fully utilize MCOM platforms. These challenges create operational risks, reduce confidence in adoption, and slow market expansion, especially for SMEs or organizations lacking advanced IT infrastructure and expertise.

In 2025, 60% of organizations delayed multichannel order management deployments due to data security risks and a shortage of skilled IT staff—leading to integration gaps, operational delays, and increased vulnerability to breaches in complex retail environments.

Multichannel Order Management Market Opportunities:

-

Advancements in cloud computing, AI, and automation create opportunities to enhance scalability, predictive analytics, and intelligent order orchestration capabilities

The integration of cloud computing, artificial intelligence, and automation in multichannel order management systems is transforming operational efficiency. Cloud-based platforms reduce infrastructure costs, provide real-time access, and support scalability for growing order volumes. AI-powered analytics enable predictive demand forecasting, inventory optimization, and intelligent order routing, reducing fulfillment errors and improving customer satisfaction. Automation streamlines repetitive tasks, such as invoicing, order tracking, and returns management, freeing up resources for strategic initiatives. These technological advancements present significant growth opportunities for vendors to offer innovative, high-value MCOM solutions that address evolving business needs globally.

In 2025, 70% of order management platforms integrated AI and cloud automation—enabling predictive inventory allocation, dynamic order routing, and 35% faster fulfillment across omnichannel retail and e-commerce operations globally.

-

Rising demand from emerging markets and SMEs for cost-effective, cloud-based order management solutions offers strong growth opportunities for vendors

Emerging economies are witnessing rapid growth in e-commerce and retail sectors, creating new demand for affordable multichannel order management solutions. SMEs in these regions seek cloud-based platforms that are scalable, easy to deploy, and do not require extensive IT infrastructure. Cloud adoption reduces upfront investment, maintenance costs, and allows businesses to access advanced features such as real-time inventory tracking and automated fulfillment. Vendors that offer flexible, subscription-based models and localized solutions can tap into these underserved markets. This trend presents a significant opportunity to expand global reach and increase adoption among smaller enterprises.

In 2025, 65% of SMEs in emerging markets adopted cloud-based order management solutions, driven by affordability and scalability—spurring a 40% increase in vendor deployments focused on real-time inventory, omnichannel sync, and automated fulfillment.

Multichannel Order Management Market Segment Highlights

-

By Component: Software led with 52.6% share, while Managed Services is the fastest-growing segment with CAGR of 15.8%.

-

By Deployment Mode: Cloud-Based led with 61.4% share, while Hybrid is the fastest-growing segment with CAGR of 14.6%.

-

By Order Type: B2C Orders led with 47.8% share, while Subscription-Based Orders is the fastest-growing segment with CAGR of 16.2%.

-

By End User: Retail & E-commerce led with 50.9% share, while Healthcare & Pharmaceuticals is the fastest-growing segment with CAGR of 14.1%.

Multichannel Order Management Market Segment Analysis

By Component: Software led, while Managed Services is the fastest-growing segment.

Software dominates the multichannel order management market because it serves as the core engine enabling real-time inventory visibility, order orchestration, and seamless integration across sales channels. Retailers and enterprises rely heavily on software platforms to synchronize online, mobile, and in-store operations while ensuring accurate order fulfillment. Growing omnichannel complexity, demand for AI-driven analytics, and integration with ERP and CRM systems further reinforce software adoption. Its scalability, automation capabilities, and central role in improving customer experience make it the largest revenue contributor across industries.

Managed services are witnessing the fastest growth as organizations increasingly outsource order management operations to reduce complexity, operational costs, and IT overhead. Companies prefer managed services to ensure continuous system monitoring, upgrades, cybersecurity compliance, and performance optimization. This trend is especially strong among mid-sized enterprises and fast-growing retailers lacking in-house technical expertise. The rise of cloud platforms, subscription pricing models, and demand for 24/7 support is accelerating adoption, positioning managed services as a key growth engine within the market.

By Deployment Mode: Cloud-Based led, while Hybrid is the fastest-growing segment.

Cloud-based deployment dominates due to its flexibility, scalability, and cost efficiency compared to traditional on-premises systems. Enterprises adopt cloud solutions to manage fluctuating order volumes, enable rapid feature updates, and support remote operations. Cloud platforms allow seamless integration with third-party logistics, payment gateways, and marketplace channels. Enhanced data security, disaster recovery capabilities, and subscription-based pricing further strengthen adoption. As omnichannel retail expands globally, cloud-based order management remains the preferred deployment model for enterprises seeking agility and faster time-to-market.

Hybrid deployment is the fastest-growing model as enterprises seek to balance cloud scalability with on-premises data control and regulatory compliance. Organizations with legacy systems prefer hybrid architectures to modernize operations without full infrastructure replacement. This approach enables sensitive data retention while leveraging cloud-based analytics and automation. Growth is driven by large retailers, manufacturers, and regulated industries requiring customization, data sovereignty, and high availability. Hybrid models offer a flexible transition path, making them increasingly attractive in complex enterprise environments.

By Order Type: B2C Orders led, while Subscription-Based Orders is the fastest-growing segment.

B2C orders dominate the market due to the rapid growth of e-commerce, mobile commerce, and direct-to-consumer retail models. Consumers expect fast order processing, flexible delivery options, and real-time tracking, driving enterprises to invest heavily in multichannel order management systems. High transaction volumes, frequent order cycles, and omnichannel fulfillment requirements make B2C a major revenue contributor. Integration with online marketplaces, last-mile delivery services, and digital payment platforms further strengthens the dominance of B2C order management solutions.

Subscription-based orders are growing rapidly as businesses adopt recurring revenue models across retail, healthcare, and consumer goods sectors. Companies rely on advanced order management to handle recurring billing, automated renewals, inventory forecasting, and customer lifecycle management. Rising adoption of subscription boxes, SaaS-enabled commerce, and replenishment services fuels growth. These models demand high system reliability and automation, driving enterprises to upgrade their multichannel platforms, making subscription-based orders the fastest-growing order type globally.

By End User: Retail & E-commerce led, while Healthcare & Pharmaceuticals is the fastest-growing segment.

Retail and e-commerce dominate the end-user segment due to their heavy reliance on seamless omnichannel experiences and high transaction volumes. These enterprises require advanced order orchestration to manage inventory across physical stores, warehouses, and online channels. Growing consumer expectations for same-day delivery, click-and-collect, and easy returns drive adoption of multichannel solutions. Continuous digital transformation, AI-based demand forecasting, and personalization further reinforce retail and e-commerce’s leading position in the market.

Healthcare and pharmaceutical companies are the fastest-growing end users as they increasingly adopt multichannel order management to handle complex distribution networks, regulatory compliance, and temperature-sensitive logistics. Rising demand for direct-to-patient delivery, online pharmacy services, and automated replenishment drives system adoption. These organizations require high accuracy, traceability, and integration with supply chain systems. Growth is further supported by digital health initiatives, e-commerce expansion in pharmaceuticals, and the need for secure, compliant order processing platforms.

Multichannel Order Management Market Regional Analysis

North America Multichannel Order Management Market Insights:

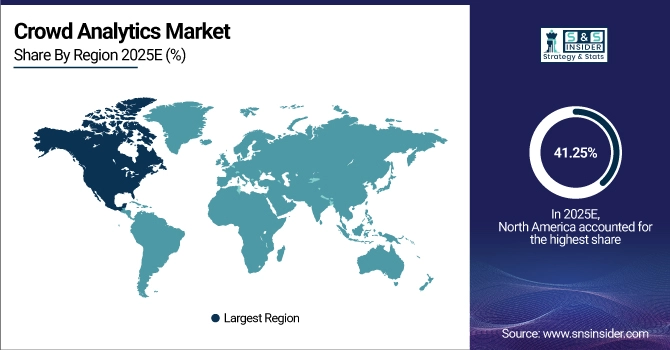

North America dominated the Multichannel Order Management Market with a 36.00% share in 2025 due to its advanced retail infrastructure, high adoption of e-commerce and omnichannel strategies, and strong presence of leading technology providers. Businesses increasingly integrated order management solutions to optimize inventory, streamline supply chains, and enhance customer experience, reinforcing regional dominance.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Multichannel Order Management Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 13.15% from 2026–2033, driven by rapid e-commerce expansion, rising smartphone and internet penetration, and growing demand for efficient order fulfillment solutions. Increasing adoption of cloud-based platforms, government initiatives supporting digital commerce, and the rise of omnichannel retailing accelerate the region’s multichannel order management market growth.

Europe Multichannel Order Management Market Insights

Europe held a significant share in the Multichannel Order Management Market in 2025, supported by well-established retail and e-commerce infrastructure, widespread adoption of omnichannel strategies, and strong presence of technology solution providers. Increasing demand for efficient inventory management, seamless customer experiences, and integration of cloud-based order management systems reinforced the region’s market position.

Middle East & Africa and Latin America Multichannel Order Management Market Insights

The Middle East & Africa and Latin America together showed steady growth in the Multichannel Order Management Market in 2025, driven by expanding e-commerce sectors, growing retail modernization, and rising adoption of cloud-based order management solutions. Improvements in digital infrastructure, increasing smartphone and internet penetration, and government initiatives supporting digital commerce contributed to the regions’ emerging market presence.

Multichannel Order Management Market Competitive Landscape:

SAP SE

SAP SE, a German multinational software corporation, is a global leader in enterprise application software, including multichannel order management solutions. Its SAP Commerce Cloud and SAP S/4HANA platforms enable businesses to streamline order processing, inventory management, and omnichannel fulfillment. SAP focuses on integrating AI, analytics, and cloud technologies to enhance efficiency, scalability, and customer experience. Trusted by enterprises worldwide, SAP’s solutions support seamless operations across online, offline, and hybrid sales channels, helping companies manage complex supply chains effectively.

-

March 2024, SAP enhanced SAP Commerce Cloud with a next-generation Order Management System (OMS) featuring AI-driven fulfillment optimization.

Oracle Corporation

Oracle Corporation, a US-based technology giant, offers robust multichannel order management solutions through Oracle NetSuite and Oracle Order Management Cloud. The company provides comprehensive tools for order processing, inventory optimization, and omnichannel fulfillment, catering to businesses of all sizes. Oracle emphasizes cloud-based, scalable, and integrated solutions to enhance operational efficiency, reduce errors, and improve customer satisfaction. With global deployment and advanced analytics, Oracle enables organizations to unify sales channels, improve inventory visibility, and accelerate order-to-cash cycles across multiple markets.

-

November 2023, Oracle launched a major upgrade to its Retail Order Management Cloud, introducing advanced Distributed Order Management (DOM) for global retailers.

IBM Corporation

IBM Corporation, a leading US technology and consulting company, delivers advanced multichannel order management solutions through its IBM Sterling Order Management platform. IBM focuses on seamless integration of order capture, inventory, and fulfillment across multiple channels, including e-commerce, retail, and wholesale. Leveraging AI, cloud computing, and automation, IBM helps businesses improve operational efficiency, reduce order errors, and enhance customer experiences. Its solutions are trusted globally for handling complex supply chains and enabling real-time visibility and responsive omnichannel operations.

-

January 2025, IBM released Sterling Order Management v10.0, integrating watsonx.ai to deliver predictive order intelligence and autonomous exception resolution.

Multichannel Order Management Market Key Players

Some of the Multichannel Order Management Market Companies

-

SAP SE

-

Oracle Corporation

-

IBM Corporation

-

Salesforce, Inc.

-

Microsoft Corporation

-

Manhattan Associates, Inc.

-

Blue Yonder Group, Inc.

-

Shopify Inc.

-

Adobe Inc.

-

IBM Sterling

-

VTEX, Inc.

-

NetSuite Inc. (Oracle)

-

SAP Hybris (SAP Commerce)

-

Comarch SA

-

Kibo Software, Inc.

-

Brightpearl (Sage Group)

-

OrderDynamics (Tecsys)

-

Fluent Commerce

-

HCL Technologies Ltd.

-

Zoho Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 3.82 Billion |

| Market Size by 2033 | USD 8.85 Billion |

| CAGR | CAGR of 11.17% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services, Professional Services, Managed Services) • By Deployment Mode (Cloud-Based, On-Premises, Hybrid) • By Order Type (B2C Orders, B2B Orders, Click-and-Collect Orders, Subscription-Based Orders) • By End User (Retail & E-commerce, Wholesale & Distribution, Manufacturing, Logistics & Supply Chain Providers, Healthcare & Pharmaceuticals) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | SAP SE, Oracle Corporation, IBM Corporation, Salesforce, Inc., Microsoft Corporation, Manhattan Associates, Inc., Blue Yonder Group, Inc., Shopify Inc., Adobe Inc., IBM Sterling (IBM), VTEX, Inc., NetSuite Inc. (Oracle), SAP Hybris (SAP Commerce), Comarch SA, Kibo Software, Inc., Brightpearl (Sage Group), OrderDynamics (Tecsys), Fluent Commerce, HCL Technologies Ltd., Zoho Corporation |