Stock Photography Market Report Scope & Overview:

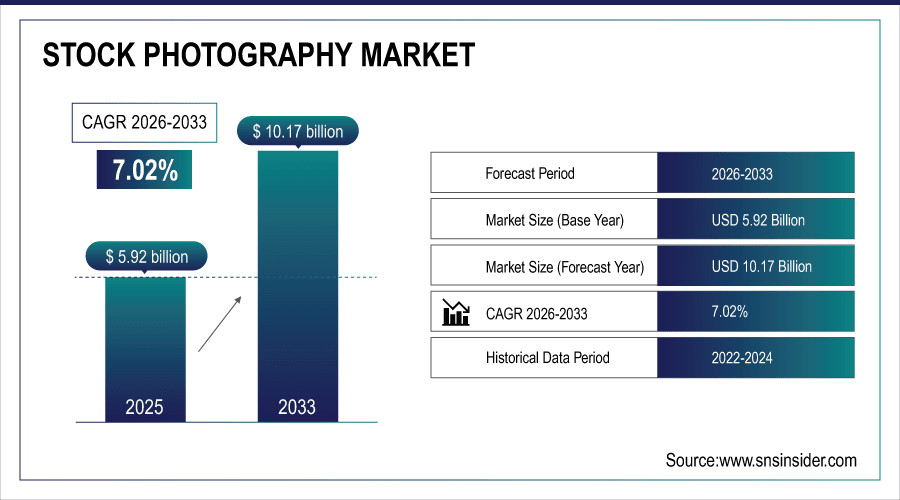

The Stock Photography Market Size was valued at USD 5.92 Billion in 2025E and is expected to reach USD 10.17 Billion by 2033 and grow at a CAGR of 7.02% over the forecast period 2026-2033.

The Stock Photography Market growth is fueled by the increasing demand for high-quality visual content across digital platforms. Images, videos, and illustrations are being used by businesses, marketers, and media companies all over the world to increase the level of engagement and to tell their brand story in advertisements, social media, and website content. E-commerce & Online Marketing continues to grow and that only increases the demand for affordable, diverse, and readily available stock aesthetics. In addition, subscription-based licensing models and intuitive stock platforms have lowered the barrier of entry, placing all technologies a few clicks away from small and medium enterprises and widening the market. According to study, The e-commerce sector accounts for nearly 30% of demand for stock visuals due to rising online marketing.

To Get More Information On Stock Photography Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 5.92 Billion

-

Market Size by 2033: USD 10.17 Billion

-

CAGR: 7.02% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Stock Photography Market Trends

-

Increasing reliance on affordable stock visuals for digital-first marketing strategies.

-

Rapid adoption of subscription-based licensing models boosts SME content accessibility.

-

Growing demand for video-based stock content in e-commerce and social campaigns.

-

AI-powered auto-tagging improves discoverability and relevance of stock image libraries.

-

Personalization through AI enhances customer experience with tailored visual recommendations.

-

Expansion of AI-generated stock content offers innovative opportunities beyond photography.

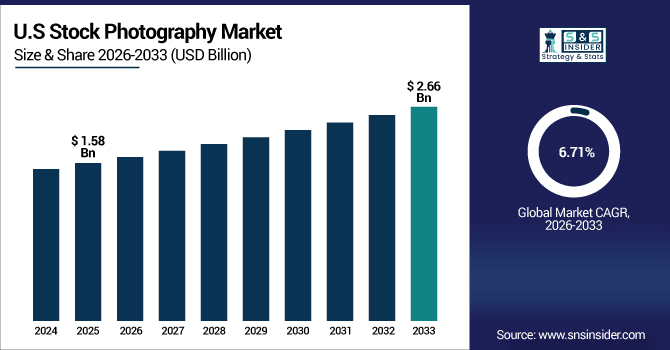

The U.S. Stock Photography Market size was USD 1.58 Billion in 2025E and is expected to reach USD 2.66 Billion by 2033, growing at a CAGR of 6.71% over the forecast period of 2026-2033, driven by high digital marketing adoption, social media engagement, and e-commerce growth. Advanced AI tools, subscription-based platforms, and demand for diverse, high-quality visuals further strengthen market dominance and innovation.

Stock Photography Market Growth Drivers:

-

Expanding Digital Marketing Needs Propel Stock Photography Growth

The social media networks, e-commerce, and online ads have surged at lightning speed, so has the need for mesmerizing, eye-grabbing, stomach-churning, rib rattling video & photo content. Brands use stock visuals to increase engagement, strengthen their identity, and execute economical campaigns. Stock photography gives you instant access to millions of visuals at prices within the budget of SMEs and startups compared to traditional photoshoots. This increasing digital-first focus is one of the main drivers which are responsible for the growth in the market.

SMEs account for nearly 50% of subscription-based stock photo users due to affordability.

Stock Photography Market Restraints:

-

Copyright Complexities and Licensing Issues Challenge Market Adoption

Despite the benefits, the complexity of copyright and licensing rules is one of the key restraining factors. Unlicensed use of stock photos based on misunderstood licensing terms including royalty-free (RF) and rights-managed (RM) puts a variety of businesses and individuals in legal trouble. Legal disputes and financial penalties may ensue if the images are misused, redistributed without permission, or copyright laws are not understood. Such worries slow down adoption of stock photography by making some organizations reluctant to use stock photography extensively.

Stock Photography Market Opportunities:

-

AI-Powered Personalization Creates New Stock Photography Horizons

The integration of AI and machine learning presents a major growth opportunity. Using these AI tools to auto tag and classify visual content and provide recommendations, helps users discover content better. Additionally, AI-generated images and videos are opening new monetization avenues for platforms to expand beyond conventional stock photography. As businesses crave targeted, niche, and unique content, AI-fueled personalization will transform the stock photography industry while also unlocking added revenue streams for providers.

Platforms integrating AI features report a 25% higher subscription renewal rate than traditional platforms.

Stock Photography Market Segmentation Analysis:

-

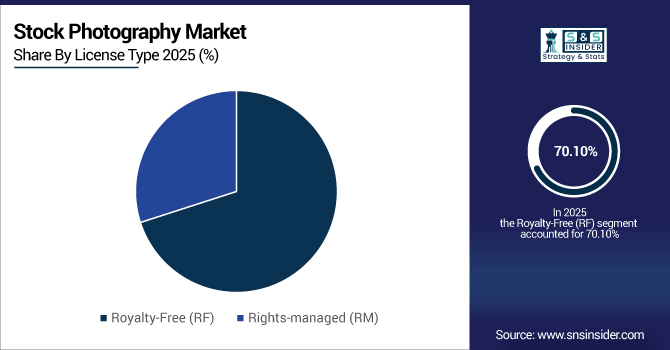

By License Type: In 2025, Royalty-Free (RF) led the market with a share of 70.10%, while Royalty-Free (RF) is also the fastest-growing segment with a CAGR of 7.90%.

-

By Product: In 2025, Images led the market with a share of 34.50%, while Videos Footage and Motion Pictures is the fastest-growing segment with a CAGR of 8.70%.

-

By Model: In 2025, Macrostock / Traditional Stock Photography led the market with a share of 61.34%, while Microstock Photography is the fastest-growing segment with a CAGR of 8.14%.

-

By End User: In 2025, Media and Publishing Companies led the market with a share of 31.70%, while Scientific Research is the fastest-growing segment with a CAGR of 8.20%.

By License Type, Royalty-Free (RF) Leads Market with Fastest Growth

In 2025, the Royalty-Free (RF) accounts for the major share of the license type segment in the Stock Photography Market thanks to its affordability and flexibility which means users can access images, videos, and illustrations multiple times and in different ways after paying a fee only once. This model is particularly attractive to businesses, marketers, and content producers, who need high-quality imagery and don’t want to deal with the complexities of usage rights explaining their favor of RF licenses throughout media, advertising, and digital environments. Additionally, Royalty-Free (RF) is the largest the fastest-growing segment, which is fueled by the growing need for digital contents, streaming based platforms along with the rising demand of scalable, economical and convenient visual resources which will continue to expand the overall market and its global adoption.

By Product, Images Leads Market and Videos Footage and Motion Pictures Fastest Growth

By Product, images segment of the Stock Photography Market accounts for the major share owing to mass consumption in advertising, publishing, e-commerce, and corporate communications among others. Quality images will always be one of the most usable content types, which keeps the business and marketing need almost evergreen for more efficient brand storytelling and online presence. On the other hand, the highest growth occurs in the videos, such as videos and films, due to the explosion of video-oriented platforms such as YouTube, Instagram, and TikTok, and the growing trend of industry digital marketing campaigns for active content. It was going to happen sooner or later as the market gradually moved to embracing higher media standards fitting of today’s generation of viewers.

By Model, Macrostock / Traditional Stock Photography Leads Market and Microstock Photography Fastest Growth

In the Stock Photography Market, macrostock or traditional stock photography accounts for the highest share as it comprises exclusive and high-quality visuals which are generally licensed at high rates – thus preferred by established media houses, advertising agencies and publishers looking for distinct content. That leadership is further enhanced by robust demand for rights-managed imagery, which guarantees exclusivity for brands and a legal defense against unwanted usage. But the fastest growing area of photography is in microstock, due to low prices, ease of access, and shifting subscribers toward subscription-based models. Microstock is booming largely due to millions of SMEs, startups and digital marketers opting for low budget imagery, as the overall market is moving towards low budget and high variant content solutions.

By End User, Media and Publishing Companies Leads Market and Scientific Research Fastest Growth

By end user, Media and publishing companies dominate segment in the Stock Photography Market in terms of end-use as they need high-quality, new and creative images on an ongoing basis for newspapers, magazines, online publications, and digital content-based outlets. Stock images and videos are critical to enhancing storytelling and engaging audiences while meeting tight content production deadlines, driving the persistent need of these organizations. Meanwhile, scientific research is the fastest growing end-user segment, which is driven by the rise in use of visual aids in academic publications, research reports and educational platforms. Scientists are using stock imagery, illustrations and videos to display data, beef up reports, and aid understanding, consistent with the trend of gaining knowledge visually, as researchers and journals adopt visually targeted means of communication.

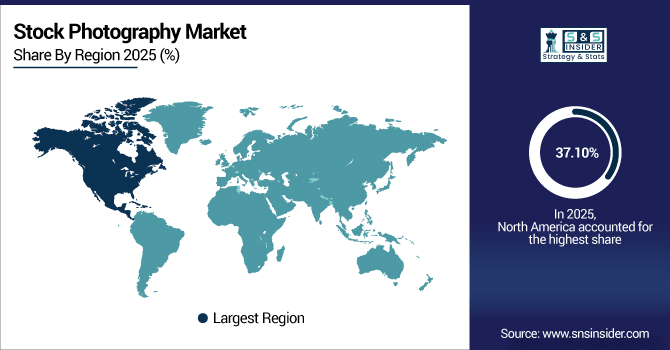

Stock Photography Market Regional Analysis:

North America Stock Photography Market Insights:

The Stock Photography Market in North America held the largest share 37.10% in 2025, due the highest adoption of Digital Marketing, e-commerce, and Social Media platforms. Hundreds of stock images, videos and illustrations have been sold to businesses, media companies, and colleges – proliferating engagement and brand awareness. Shutterstock, Getty Images, and Adobe Stock are big players in the region, providing with huge collections and subscription-based models. Moreover, the incorporation and introduction of technological innovations such as AI-based search, automatic tagging, and AI-generated content are also fuelling the market growth. The high demand for different on-demand visual content solutions continues to drive the market while North America accounts for the largest share as well as highest growth and innovation potential in the region.'

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Dominates Stock Photography Market with Advanced Technological Adoption

The U.S. dominates the Stock Photography Market, driven by advanced technological adoption, including AI-powered search, auto-tagging, and AI-generated content, alongside high digital marketing and e-commerce demand.

Asia-Pacific Stock Photography Market Insights

In 2025, Asia-Pacific is the fastest-growing region in the Stock Photography Market with a CAGR 8.61%, due to rapid digitalization, growing e-commerce, and the increasing adoption of social media which are spurring the growth of the Stock Photography market in the region and is the fastest-growing region worldwide. The increasing availability of the internet and the rise of smartphones have led to the demand for cheap and high-quality stock images, videos and illustrations from companies, SMEs and individual content creators. Subscription-based and microstock platforms are opening up commercial imagery to new audiences and technologies like AI-driven search, auto-tagging, and AI-generated content are all spurring the proliferation of imagery into the market. The growing demand of companies to tell their stories visually while also engaging with customers through pleasing graphics is creating huge stock photography market growth opportunities in the Asia-Pacific (APAC) region.

China and India Propel Rapid Growth in Stock Photography Market

China and India drive rapid Stock Photography Market growth, fueled by rising digital content consumption, increasing social media engagement, adoption of subscription-based platforms, and strong demand for affordable, high-quality images, videos, and illustrations across businesses and marketing sectors.

Europe Stock Photography Market Insights

Europe Stock Photography Market in Process of Steady Growth due to Growth of Digital Marketing, Online Publishing, and Requirement for Corporate Content The use of stock images, videos, and illustrations for brand storytelling, audience engagement, and online presence has increased and businesses, media houses, and creative agencies are using it like never before. Subscription based and microstock based platforms are finding their own ways where we can internally buy pictures which are cheaper yet diverse and to the point with quality. At the same time, AI-driven search, topic auto-tagging, and AI-generated images, among others, are enhancing content discovery and user experience in new ways. Market demand is bolstered by the increased adoption of visual content across advertising, social media, and e-commerce, making Europe an important pillar of the global stock photography market.

Germany and U.K. Lead Stock Photography Market Expansion Across Europe

Germany and the U.K. lead Stock Photography Market expansion in Europe, driven by high digital marketing adoption, extensive media content usage, and increasing demand for cost-effective, high-quality visual assets.

Latin America (LATAM) and Middle East & Africa (MEA) Stock Photography Market Insights

The Stock Photography Market in Latin America (LATAM) and Middle East & Africa (MEA) is poised for a slow yet positive growth due to extensive adoption of digital marketing, e-commerce, and social media platforms in the regions. In these parts, businesses, startups and content creators are opting for cost-effective stock images, videos and illustrations to facilitate brand engagement and online presence. Then there are the subscription-based and microstock platforms that are really taking off, making visual content accessible, affordable and varied to the masses. In addition, search, auto-tagging, and AI visuals are all examples of technology developed around AI that are expanding the reach and user-friendliness of content. LATAM and MEA markets for stock photography have great potential for growth, as consumption of digital content increases and the need for visual media rises.

Stock Photography Market Competitive Landscape

Shutterstock remains a dominant force in the stock photography market, offering millions of images, videos, and illustrations. Its investment in AI-powered search, personalized recommendations, and subscription models enhances content discoverability and accessibility, catering to businesses, media, and SMEs seeking high-quality, cost-effective visual assets for marketing and creative projects.

-

In June 2025, Shutterstock unveiled a bold new brand identity, introducing a fresh logo and a suite of innovative, AI-powered offerings to redefine its role in the business of creativity.

Alamy is a leading stock photography platform known for its diverse collection of editorials, creative, and historical images. By offering flexible licensing options and embracing trends in visual content, Alamy caters to media, marketing, and corporate users, driving growth and providing high-quality visuals for global creative needs.

-

In January 2024, Alamy released its 2024 Visual Content Trends Report, providing insights into the evolving landscape of visual communication and forecasting key trends for the upcoming year.

Unsplash+ provides a platform for high-quality, free and premium stock images and videos, offering contributors a global reach. Its focus on curated, royalty-free content, combined with the launch of premium subscriptions, enhances accessibility for businesses and creatives, positioning it as a key player in digital visual content.

-

In July 2025, Unsplash launched its premium subscription service, Unsplash+, offering ad-free access, legal protection, and unlimited royalty-free downloads. This move aims to provide enhanced benefits for users seeking high-quality, curated content.

Stock Photography Market Key Players:

Some of the Stock Photography Market Companies are:

-

Shutterstock

-

Getty Images

-

Adobe Stock

-

iStock by Getty Images

-

Alamy

-

500px

-

Dreamstime

-

Depositphotos

-

Envato Elements

-

Pexels

-

Unsplash+

-

Freepik

-

Scopio

-

Canva Pro

-

Snapped4U

-

Pond5

-

Foap

-

EyeEm

-

ZUMA Press

-

Pixta

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 5.92 Billion |

| Market Size by 2033 | USD 10.17 Billion |

| CAGR | CAGR of 7.02% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Images, Vectors and Illustrations, Videos Footage and Motion Pictures, Music and Audio, Others) • By Model (Macrostock / Traditional Stock Photography, Midstock Photography, Microstock Photography) • By License Type (Royalty-Free (RF), Rights-Managed (RM)) • By End User (Scientific Research, Media and Publishing Companies, Website Building Companies, Marketers, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Shutterstock, Getty Images, Adobe Stock, iStock by Getty Images, Alamy, 500px, Dreamstime, Depositphotos, Envato Elements, Pexels, Unsplash+, Freepik, Scopio, Canva Pro, Snapped4U, Pond5, Foap, EyeEm, ZUMA Press, Pixta, and Others. |