Energy Measurement IC Market Size & Growth:

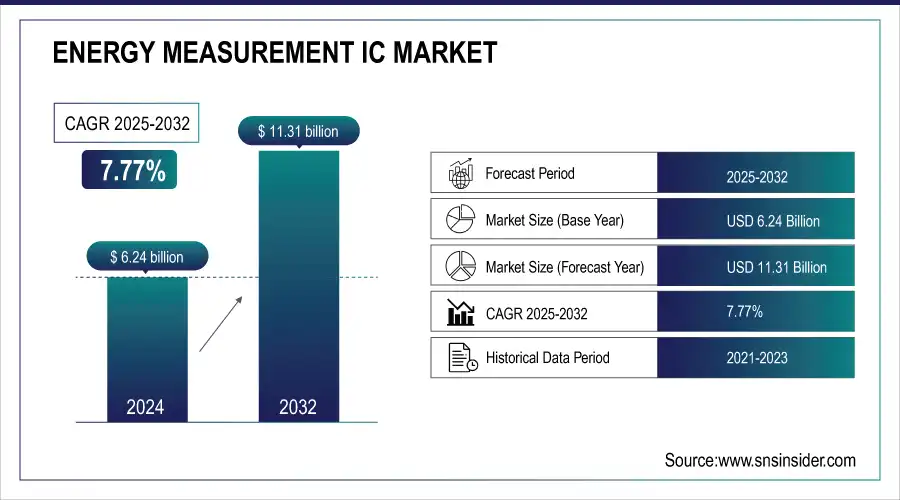

The Energy Measurement ICs Market size was valued at USD 6.24 billion in 2024 and is expected to reach USD 11.31 billion by 2032 and grow at a CAGR of 7.77% over the forecast period of 2025-2032.

The global market is seeing a healthy momentum across the globe primarily on account of increasing implementation of smart grids, investments in industrial automation, and increasing need for accurate power measurements in modern electric vehicles and renewable energy systems. In this report, detailed Energy Measurement IC market analysis pertaining to the cause factor, high potential market segments, leading market players, growth catalysts and regional performance are provided, which indicate strong growth potential across applications, geographies in the coming years.

To Get more information on Energy Measurement ICs Market - Request Free Sample Report

For instance, over 65% of utility companies globally have initiated smart grid deployments integrating energy measurement ICs.

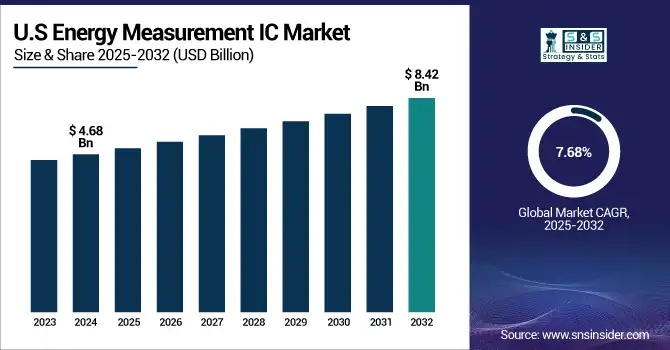

The U.S. Energy Measurement IC Market size was USD 4.68 billion in 2024 and is expected to reach USD 8.42 billion by 2032, growing at a CAGR of 7.68% over the forecast period of 2025–2032.

The U.S. market is thriving due to the unprecedented increase in smart meters deployments, robust grid modernization investments, and the rapid growth of the electric vehicle ecosystem. The forecast period is characterized by the increasing integration of renewable energy sources and the overall digitization of industrial operations, and as this continues, demand for energy measurement ICs will also be driven from the opposite direction by government support for energy-efficient technologies and solutions for residential, commercial, and utility-scale applications.

For instance, U.S. electric vehicle sales surpassed 1.5 million units in 2024, with each vehicle requiring multiple energy monitoring ICs.

Energy Measurement ICs Market Dynamics:

Key Drivers:

-

Smart Grid Deployment and Government Initiatives Accelerate the Demand for Precision Power Monitoring and Energy Management Solutions Globally

The smart grid expansion in developed and emerging economies is a major driver of energy measurement IC adoption for precise energy tracking and billing. It allows real-time consumption analytics, minimizes losses, and enhances grid fidelity. Government stimuli to upgrade utility infrastructure and encourage the adoption of smart meters play an outsized role. Furthermore, incentives and regulations in favor of energy efficiency are boosting utility providers’ adoption of metering ICs in both urban and rural environments, encouraging Energy Measurement IC market growth over the forecast period.

For instance, approximately 75% of utility companies globally have adopted some form of digital metering and energy data acquisition by 2024.

Restraints:

-

High Initial Design Complexity and Integration Challenges in Smart Grid Systems Hinder Broad Deployment Across All Regions

Designing and integrating energy measurement ICs in complex smart grids can be particularly challenging. As engineers must meet extreme accuracy, temperature stability, and power frequency noise immunity requirements, the deployment cycle often takes longer. Several utility companies, especially in the developing world, are not technologically advanced enough, nor do they have the budget to implement such advanced variations. Furthermore, as device providers must also consider incumbent infrastructure interconnectivity, the development and deployment cycle may be slower, and uptake across regions may be limited despite long-term attractiveness.

Opportunities:

-

Rising Integration of Renewable Energy Systems Creates Significant Demand for High-Precision Energy Measurement Solutions

The demand for accurate power monitoring in solar and wind installations is increasing as countries shift to cleaner, decentralized energy sources. In renewable systems, energy measurement ICs help keep track of generation, load balancing, and synchronization to the grid. Granular insights are made available to solar inverters, wind turbines, and microgrids through their integration into these systems. This opportunity is growing in the utility-scale and residential spaces, particularly where renewable energy targets are aggressive and green infrastructure funding is available.

For instance, over 70% of grid operators report that high-frequency data from energy measurement ICs is essential for balancing variable renewable inputs.

Challenges:

-

Lack of Universal Standards and Protocols for Energy Data Communication Hampers Seamless Interoperability Between Devices

The key challenge in deploying energy measurement ICs at scale is the lack of industrial standardization of communication protocols and data formats. As a result, this leads to the fragmentation; the device, the utility, and the platform cannot communicate well with each other, leading to higher integration costs and complexity. One of the main challenges faced in deploying energy monitoring systems across regions is the absence of universal standards. Along with IoT ecosystem to deploy energy measurement IC solutions, this issue especially impacts multi-vendor deployments in the smart grid, and industrial plant, and multi-tenant building application spaces which serves to slow their adoption.

Energy Measurement ICs Market Segmentation Outlook:

By Type

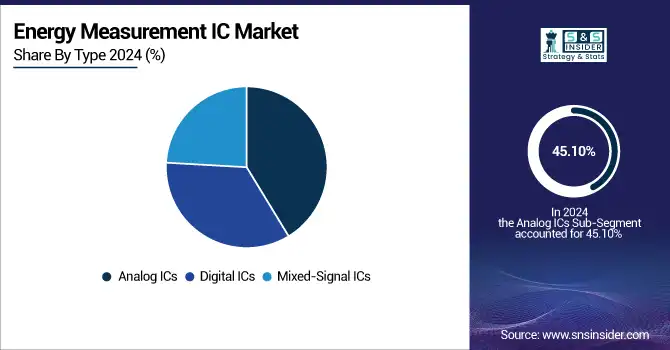

Analog ICs accounted for the largest Energy Measurement IC market share of 45.10% in 2024 and is expected to grow fastest at a blistering CAGR of 8.64% during 2024 to 2032. They are commercially adopted for precision and low-power energy metering. Companies such as Analog Devices Inc. persevered with strong analog front-end solutions, which are ubiquitous for smart grids and industrial automation. ICs are critical in areas that continue to upgrade older infrastructure to solutions that provide efficiency with digital monitoring.

By Application

Smart Meters segment accounted for the largest revenue share (35.06%) of the Energy Measurement IC Market in 2024. With ability to monitor in real time and provide accurate data, these sensors lie at the heart of grid modernization. For next-gen meters, specialized integrated ICs have been developed by various companies such as the one from Renesas Electronics. Those instruments are critically necessary for not only government-supported transmission loss reduction programs in North America, Europe and Asia but also energy efficiency programs and legislation.

Industrial Automation is expected to register the highest CAGR of 8.75% during 2024 to 2032. With the automation of factories, the need for embedded energy measurement increases. In the industrial space, Texas Instruments has ICs to bring real-time power analytics to the table to minimize energy loss and downtime. Such advances are in keeping with trends globally toward Industry 4.0 and new regulatory pressures on energy-efficient manufacturing.

By Technology

In 2024, the market share of Power Line Communication (PLC) reached 50.10%, due to its low-cost integration, with a mainly existing power infrastructure. A company to consider that is heavily involved in this space is Maxim Integrated, which makes ICs designed specifically for smart meters that utilize PLC. It is used in many developed nations, where it is impractical to replace old wiring, as it provides for uninterrupted communication of data to ensure that the billing is accurate.

The Wireless Communication market will register a 8.16% CAGR during 2024 to 2032 owing to the requirement for IoT and smart home. Silicon Labs provides industry-leading wireless energy measurement ICs for Zigbee and sub-GHz protocols. These ICs are especially popular for remote areas and those where relatively small space is available for installation, allowing real time monitoring of the diagnosis along with reduced maintenance of utilities and solar grid systems.

By End-User

In 2024, the Residential segment accounted for the highest share of 40.30%. This is bolstered by the proliferation of smart meters and the rising infusion of smart home functionality. Infineon Technologies designed a low power IC targeting small home application These devices enable the kind of load monitoring and billing transparency that will be essential for consumers and utility providers who desire an energy-efficient lifestyle.

The industrial segment is estimated to grow at a CAGR of 7.98% during 2024 to 2032. Increasing automation, sustainability demands, and hot production sites is pushing ICs into factories and at the point of energy wrong. NXP Semiconductors is providing the predictive maintenance and efficiency control high-reliability energy measurement ICs. They are crucial for lowering energy costs and the risk of operating heavy industry.

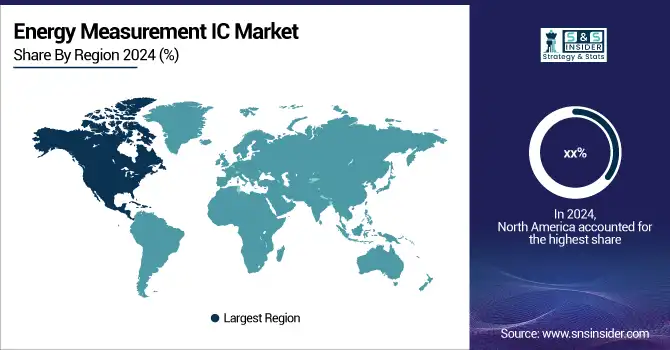

Energy Measurement ICs Market Regional Analysis:

The North America Energy Measurement IC Market is witnessing a gradual expansion owing to a gradual installation of smart meters, refurbishment of the growing older grid infrastructure, and increasing deployment of electric vehicles. Regulatory support for energy efficiency and sustainability is raising demand. The availability of advanced power monitoring solutions in the region is also being stimulated by technological upgrades and large capital investments in R&D by players, such as Texas Instruments.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

The U.S. dominates North America’s Energy Measurement IC Market due to large-scale smart grid initiatives, strong government support for energy efficiency, and high deployment of smart meters across residential and commercial sectors, led by innovation-driven companies such as Analog Devices.

Asia Pacific led the Energy Measurement IC Market with a revenue share of 38.20% in 2024 and is expected to grow at the fastest CAGR of 8.46% over the forecast period of 2024–2032, driven by wide-scale deployment of smart meters, fast-paced urbanization, and strong manufacturing & utility sectors. The Asia Pacific is the leading energy measurement IC consumer globally, as countries such as China, India, and Japan are making huge capital investments in smart grids, renewable energy, and electric vehicle infrastructure.

-

China leads Asia Pacific’s market owing to massive infrastructure development, aggressive smart city initiatives, and large-scale deployment of advanced metering infrastructure, supported by government mandates and domestic giants such as Hi-Link Electronics.

Europe’s Energy Measurement IC Market is driven by stringent energy efficiency regulations, widespread adoption of renewable energy systems, and strong focus on sustainability goals. Countries such as Germany and the U.K. are leading the transition toward smart grids and advanced metering solutions. Key players such as STMicroelectronics are contributing to regional innovation through smart energy solutions and IC development.

-

Germany dominates Europe’s Energy Measurement IC Market due to its advanced smart grid infrastructure, strong industrial sector, and aggressive renewable energy policies. Government initiatives and companies such as Infineon Technologies drive widespread adoption of energy-efficient monitoring and control systems.

The Energy Measurement ICs industry in the Middle East & Africa is led by the UAE, driven by aggressive smart grid deployments and digital energy initiatives. In Latin America, Brazil dominates due to government-backed smart meter programs, energy efficiency reforms, and widespread infrastructure upgrades enhancing market demand across utilities and industries.

Energy Measurement ICs Companies are:

Major Key Players in Energy Measurement IC companies are Analog Devices, Inc., Texas Instruments Incorporated, STMicroelectronics N.V., Infineon Technologies AG, NXP Semiconductors N.V., Microchip Technology Inc., Renesas Electronics Corporation, Maxim Integrated, ON Semiconductor Corporation, Cirrus Logic, Inc., Silicon Labs, ROHM Semiconductor, Melexis NV, Monolithic Power Systems, Inc., Dialog Semiconductor, IDT (Integrated Device Technology), Lattice Semiconductor, Vicor Corporation, Holtek Semiconductor Inc. and Semtech Corporation and others.

Recent Developments:

-

In June 2024, Analog Devices reinforced its energy measurement offerings with the ADE7758ARWZ, a high‑accuracy 3‑phase multifunction metering IC featuring integral calibration and robust performance across wide environmental conditions.

-

In December 2024, STMicroelectronics showcased the STM32WL33, a sub‑GHz wireless MCU tailored for metering and remote monitoring IoT deployments, marking strong momentum for wireless energy solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 6.24 Billion |

| Market Size by 2032 | USD 11.31 Billion |

| CAGR | CAGR of 7.77% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Analog ICs, Digital ICs and Mixed-Signal ICs) • By Application (Smart Meters, Industrial Automation, Electric Vehicles, Renewable Energy Systems and Home Automation) • By Technology (RFID, Power Line Communication and Wireless Communication) • By End-User (Residential, Commercial and Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Analog Devices, Inc., Texas Instruments Incorporated, STMicroelectronics N.V., Infineon Technologies AG, NXP Semiconductors N.V., Microchip Technology Inc., Renesas Electronics Corporation, Maxim Integrated, ON Semiconductor Corporation, Cirrus Logic, Inc., Silicon Labs, ROHM Semiconductor, Melexis NV, Monolithic Power Systems, Inc., Dialog Semiconductor, IDT (Integrated Device Technology), Lattice Semiconductor, Vicor Corporation, Holtek Semiconductor Inc. and Semtech Corporation. |