Robot Operating System Market Key Insights:

Get PDF Sample Report on Robot Operating System Market - Request Sample Report

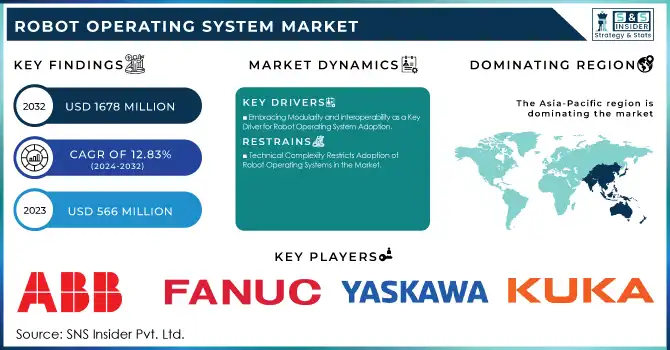

The Robot Operating System Market Size was valued at USD 566 million in 2023 and is expected to grow to USD 1678 million by 2032 and grow at a CAGR of 12.83% over the forecast period of 2024-2032.

The growing demand for automation across industries like manufacturing, logistics, healthcare, and service sectors is a major driver for the adoption of Robot Operating Systems (ROS). Businesses face increasing pressure to improve productivity, precision, and efficiency while addressing challenges like labour shortages, rising operational costs, and complex workflows. Automation has become indispensable, enabling the execution of repetitive and intricate tasks with consistency and scalability. In the United States, labour shortages are a key factor driving automation, with 45% of restaurant operators seeking more staff to meet demand while 98% higher labour costs as their primary challenge. In logistics, automation is poised to represent over 30% of capital spending for fulfilment players in the next five years, with retail and consumer goods sectors leading investments—23% planning to spend over USD 500 million on automation compared to 15% in food and beverage and 8% in automotive. ROS plays a pivotal role in these advancements, enabling cost-effective deployment through its open-source framework and modular architecture, which accelerates development timelines and ensures adaptability. Mobile robot adoption is growing, with 59% of facilities already using automated solutions like AMRs, forklifts, and conveyors. These systems deliver measurable outcomes—321% ROI in less than 12 months, 75% cost savings, and 75% productivity improvements. For instance, fleets achieved 23% greater productivity and a 20% higher ranking for cleanliness and appearance compared to traditional standards. By combining robotics with advanced process management, ROS enhances service-level agreements, integrates AI, and delivers transformative improvements in operational efficiency, making it integral to meeting the evolving demands of automation across industries.

Robot Operating System Market Dynamics

Drivers

-

Embracing Modularity and Interoperability as a Key Driver for Robot Operating System Adoption

The rising emphasis on modularity and interoperability in robotics is a major factor driving the adoption of Robot Operating Systems. Industries increasingly demand flexible, customizable solutions, and ROS offers an ideal framework by enabling developers to create modular systems that reuse and adapt components for diverse applications. This capability reduces development time and costs, accelerating innovation across sectors such as manufacturing, healthcare, and autonomous systems. ROS’s modular architecture allows developers to integrate existing libraries and algorithms, promoting rapid prototyping and scalability. Its ability to decouple software components is critical for developing interoperable systems essential for applications like autonomous navigation, multi-robot collaboration, and sensor integration.

According to research, ROS has been shown to reduce redundancy, improve functionality, and accelerate deployment timelines in robotics solutions. NASA’s initiatives in autonomous systems and robotics, for example, leverage ROS for its open-source advantages, modularity, and adaptability, highlighting its reliability in high-stakes applications. The shift in robotics paradigms toward hardware-agnostic and reusable frameworks further underscores the importance of ROS. As noted in IEEE research, modular approaches in robotics reduce costs by up to 30% and improve deployment efficiency by 40%. Furthermore, in industries like logistics, modular ROS-based systems enable rapid integration of robotic arms, sensors, and actuators, leading to significant cost savings. For instance, logistics automation with ROS can enhance supply chain efficiency by up to 25%.

In healthcare sector, ROS supports critical advancements in surgical robots and patient care automation. Its scalability and compatibility with cutting-edge technologies ensure its relevance in addressing evolving industrial demands. As robotics continues to grow, ROS remains a vital enabler of flexible, cost-effective, and innovative solutions, ensuring its central role in the global robotics ecosystem.

Restraints

-

Technical Complexity Restricts Adoption of Robot Operating Systems in the Market

The technical complexity associated with implementing Robot Operating Systems (ROS) is a significant restraint in the market, particularly for small- and medium-sized enterprises. Deploying ROS requires expertise in robotics, programming, and system integration, making it challenging for businesses with limited technical resources. The steep learning curve for ROS, especially for large-scale deployments and customizations, discourages companies without dedicated engineering teams or robotics professionals. Hardware and software requirements demand precise configuration and extensive testing to ensure compatibility and functionality, adding to the adoption barriers.

Additionally, transitioning to ROS2, the latest version of the platform, requires substantial effort to migrate codebases and update tools, which further increases complexity. Companies often face difficulties aligning system requirements with operational goals due to the intricacies of open-source ecosystems, including dependency management and software maintenance. The lack of standardization across different ROS frameworks exacerbates interoperability challenges, resulting in longer development cycles and higher costs. These issues are particularly pronounced in industries like manufacturing and healthcare, where real-time performance, reliability, and safety are critical, often necessitating advanced customizations. For businesses in emerging markets, limited access to skilled engineers and training resources further hinders the adoption of ROS-based solutions. Addressing these barriers is crucial for accelerating the integration of robotics and automation systems across various sectors. Simplifying ROS implementations, improving training programs, and providing strong support ecosystems can significantly reduce the challenges associated with adopting ROS. This will not only foster innovation but also enhance the adoption of robotics technologies globally, enabling industries to fully leverage the benefits of automation and modular systems.

Robot Operating System Market Segment Outlook

By Type

The articulated robots segment is a dominant force in the Robot Operating System market, accounting for approximately 40% of the market share in 2023. These robots, characterized by their multiple rotary joints, are widely favoured for their versatility, precision, and adaptability across various industries. In manufacturing, articulated robots are extensively used for tasks such as welding, assembly, and material handling, where high degrees of freedom are essential. Their ability to mimic human arm movements makes them particularly suitable for intricate operations requiring dexterity. The integration of ROS enhances their capabilities by enabling seamless programming, real-time control, and modular customization. Furthermore, advancements in sensors and AI integration have bolstered their efficiency, allowing industries like automotive, electronics, and healthcare to optimize productivity, reduce costs, and meet complex operational demands.

By End use

The automotive segment dominates the Robot Operating System market, holding approximately 30% of the market share in 2023. Automotive manufacturers are leveraging ROS-driven robots to enhance precision, efficiency, and scalability in production processes. From welding and painting to assembly and quality inspection, ROS-powered robots streamline complex operations, ensuring consistent output and reducing production errors. The industry's shift toward electric vehicles and autonomous driving technologies has further amplified the demand for robotics, as manufacturers rely on ROS for advanced automation and testing capabilities. Additionally, ROS enables the integration of collaborative robots on production lines, allowing humans and machines to work safely in tandem, increasing flexibility. This adoption helps automotive companies meet rising demands for innovation, while addressing labour shortages and maintaining cost efficiency in highly competitive markets.

Robot Operating System Market Regional Analysis

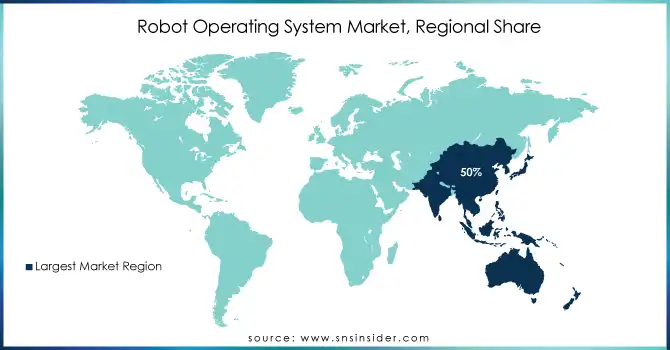

Asia-Pacific dominates the Robot Operating System market, holding approximately 50% of the market share in 2023, driven by rapid industrialization, technological advancements, and strong government support for automation. Key countries like China, Japan, and South Korea are at the forefront of robotics innovation. China, the world’s largest industrial robotics market, continues to expand its manufacturing automation to maintain its global competitiveness. The country’s "Made in China 2025" initiative emphasizes the integration of robotics across industries, boosting ROS adoption. Japan, a global leader in robotics, utilizes ROS in sectors ranging from automotive manufacturing to healthcare robotics. Meanwhile, South Korea, known for its high-tech advancements, supports robotics research and development through substantial funding and policies. Emerging economies like India and Southeast Asian countries are also rapidly adopting ROS, particularly in manufacturing and logistics, driving the region's dominance.

North America emerged as the fastest-growing region in the Robot Operating System market in 2023, driven by significant technological advancements, robust industrial automation, and a thriving innovation ecosystem. The United States leads the region, propelled by its strong robotics industry and extensive investments in research and development. Federal initiatives such as the National Robotics Initiative and collaborations between government agencies and private firms are accelerating ROS adoption across various sectors, including manufacturing, logistics, and healthcare. Canada, too, is experiencing rapid growth, with its focus on smart factories and advanced robotics integration in industries such as automotive and aerospace. The region's growth is fueled by the increasing deployment of collaborative robots and autonomous systems in warehouses and production lines. North America's emphasis on digital transformation, coupled with a skilled workforce and innovation hubs, positions it as a frontrunner in ROS implementation.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Some of the major players in Robot Operating System market with product:

-

ABB Ltd. (IRB Series Industrial Robots)

-

Fanuc Corporation (R-30iB Plus Controller)

-

Yaskawa Electric Corporation (Motoman Robots)

-

KUKA AG (KR AGILUS Robots)

-

Universal Robots (UR Collaborative Robots)

-

Rethink Robotics (Intera Software for Collaborative Robots)

-

Omron Corporation (LD Series Autonomous Mobile Robots)

-

iRobot Corporation (Roomba Series with Navigation Systems)

-

Boston Dynamics (Spot Autonomous Robot)

-

Fetch Robotics (FetchCore Cloud Robotics Platform)

-

NVIDIA Corporation (Isaac Robotics Platform)

-

Clearpath Robotics (Husky Unmanned Ground Vehicle)

-

Microsoft Corporation (ROS on Azure Platform)

-

Denso Robotics (VS-Series SCARA Robots)

-

Staubli International AG (TX2 Series Robots)

-

Seiko Epson Corporation (T-Series SCARA Robots)

-

Autodesk, Inc. (Simulation Tools for ROS Integration)

-

Amazon Robotics (Kiva Autonomous Robots)

-

Honda Robotics (ASIMO Humanoid Robot)

-

Cyberdyne Inc. (HAL Robotic Assistance Devices)

List of 20 key suppliers of raw materials and components critical for the Robot Operating System (ROS) ecosystem, categorized by their offerings:

-

Intel Corporation (Processors and microcontrollers)

-

NVIDIA Corporation (Graphics Processing Units - GPUs)

-

Texas Instruments (Embedded processors and sensors)

-

Qualcomm Technologies, Inc. (Communication chipsets)

-

STMicroelectronics (Microelectronics and sensors)

-

Broadcom Inc. (Network and connectivity solutions)

-

Bosch Sensortec GmbH (IMUs and motion sensors)

-

Honeywell International Inc. (Industrial sensors and actuators)

-

TE Connectivity (Connectors and cables)

-

Renesas Electronics Corporation (MCUs and SoCs)

-

Analog Devices, Inc. (Precision measurement components)

-

Samsung Electronics Co., Ltd. (Memory and storage solutions)

-

Micron Technology, Inc. (DRAM and NAND flash memory)

-

Panasonic Corporation (Batteries and power components)

-

Laird Connectivity (Wireless communication modules)

-

Murata Manufacturing Co., Ltd. (Capacitors and wireless components)

-

Infineon Technologies AG (Power electronics and sensors)

-

Omron Electronic Components (Relays and switches)

-

Maxim Integrated (Analog and mixed-signal ICs)

-

Amphenol Corporation (Interconnect systems)

Recent Trends:

-

September 10, 2024, NVIDIA is advancing the development of robotics with its ROSCon events in Japan, Denmark, and China, focusing on the integration of AI in robotics. These events will highlight key innovations in the Robot Operating System, including AI training, simulation, and robot integration. The growing emphasis on ROS underscores its crucial role in transforming the robotics landscape and fueling market growth for robotics solutions.

-

September 18, 2024, Robotics is revolutionizing healthcare, particularly in surgery and rehabilitation, with the robotic-assisted surgery market projected to exceed USD 14 billion by 2026. These advancements enhance precision, reduce patient recovery time, and increase accessibility to specialized treatments, especially in remote areas. The market is benefiting from the growing integration of robotics in medical procedures, addressing unmet healthcare needs and improving patient experiences.

-

September 12, 2024 – Robotics in acute cholecystitis management is advancing, with laparoscopic cholecystectomy being the gold standard. There's a growing focus on improving treatment timing and surgical precision through robotic-assisted techniques, which are expected to enhance patient outcomes and recovery.

-

December 12, 2024, Generative AI is transforming industries by enhancing business operations and client interactions. A recent McKinsey survey shows that 65% of organizations are integrating Generative AI into their processes, nearly doubling the adoption from 2023. This trend underscores the growing importance of AI in staying competitive and fostering innovation across industries.

-

Oct. 24, 2024, Industry 5.0 focuses on a human-centered approach to manufacturing, emphasizing collaboration between workers, robots, and cobots. This shift addresses skill gaps and labor shortages while making manufacturing roles more attractive to Gen Z workers. The trend aims to enhance productivity, safety, and job satisfaction, moving away from traditional "dull, dirty, dangerous" tasks toward a more connected and fulfilling work environment.

-

December 12, 2024, Generative AI is transforming industries by improving business operations and client interactions. Approximately 65% of organizations are now integrating Generative AI into their processes, reflecting a nearly two-fold increase in adoption from 2023. This trend underscores AI's crucial role in fostering innovation and maintaining competitiveness across sectors.

Recent Development

-

September, 2024 ABB unveiled its technology demonstrator of the eMine™ Robot Automated Connection Device at MINExpo 2024, designed to enable safe, efficient high-power charging for electric mining trucks, developed in collaboration with Boliden, BHP, and Komatsu. This innovation complements the ABB eMine FastCharge solution, enhancing interoperability and performance in electric mining operations.

-

September 2024 Yaskawa launched the Motoman NEXT platform in North America, incorporating machine learning and AI for more intelligent, autonomous robotic systems, enabling robots to perform complex tasks in unstructured environments with increased adaptability and communication.

-

November 2024, KUKA Robotics highlighted an automated bottle capping solution at PACK EXPO 2024, featuring two KR 6 R500 Z200-2 SCARA robots that capped spray bottles in under 0.36 seconds, demonstrating speed, precision, and versatility in handling various cap sizes and container heights.

-

February, 2024, Omron launched the MD Series of autonomous mobile robots, designed for medium payload applications with capacities of 650kg and 900kg, offering enhanced efficiency, top speeds of 2.2 m/sec, and integrated control for up to 100 robots.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 566 Million |

| Market Size by 2032 | USD 1678 Million |

| CAGR | CAGR of 12.83% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Robot Type (Articulated Robots, Cartesian Robotics, Collaborative Robots, SCARA Robots) • By Application(Pick and Place, Plastic Injection and Blow Molding, Testing and Quality Inspection, Metal Sampling and Press Trending, End of Line Packaging, Mapping and Navigation, Inventory Management, Home Automation and Security, Personal Assistance) • By End Use (Automotive, Electrical and Electronics, Metal and Machinery, Plastics, Rubber and Chemicals, Food and Beverages, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ABB Ltd., Fanuc Corporation, Yaskawa Electric Corporation, KUKA AG, Universal Robots, Rethink Robotics, Omron Corporation, iRobot Corporation, Boston Dynamics, Fetch Robotics, NVIDIA Corporation, Clearpath Robotics, Microsoft Corporation, Denso Robotics, Staubli International AG, Seiko Epson Corporation, Autodesk, Inc., Amazon Robotics, Honda Robotics, and Cyberdyne Inc. are prominent companies in the robotics and automation sector. |

| Key Drivers | • Embracing Modularity and Interoperability as a Key Driver for Robot Operating System (ROS) Adoption. |

| Restraints | • Technical Complexity Restricts Adoption of Robot Operating Systems in the Market. |