Next Generation Non-Volatile Memory Market Size Analysis:

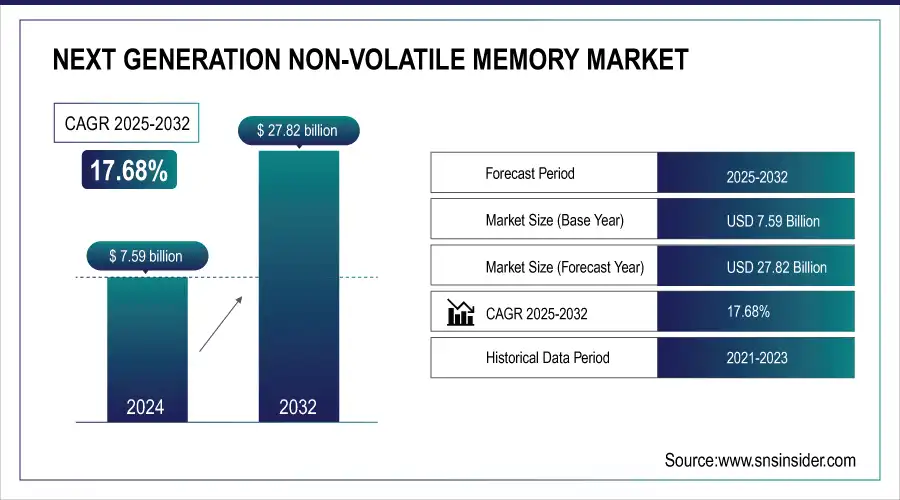

The Next Generation Non-Volatile Memory Market Size was valued at USD 7.59 Billion in 2024 and is expected to reach USD 27.82 Billion by 2032 and grow at a CAGR of 17.68% over the forecast period 2025-2032. The Next Generation Non-Volatile Memory market helps significantly upscale concerning growth due to advancements in memory technology that shape the digital landscape. Memory technology remains the primary influencer in shaping the digital landscape with continued and rapid development, thus the Next Generation Non-Volatile Memory market is bound to boom further. Innovative memory solutions that make data retention possible even in the absence of a power supply are better alternatives than other traditional non-volatile memories like Flash. One of the largest Samsung rivals, SK Hynix, said the company had taken all of its ordered stacked high-bandwidth memory DRAM for 2024 production. The company produces the components used in AI processors deployed at the data center. Samsung Electronics has acquired parts of building and equipment in the Samsung Display (Samsung Display) Cheonan plant for HBM production as preparation for increasing the production capacity. The new line of packaging to be constructed at Cheonan will prepare large-scale HBM, worth an estimated 700 billion to 1 trillion won.

Get More Information on Next Generation Non-Volatile Memory Market - Request Sample Report

Among the newer memory technologies, some of which are being developed by key industry players include Phase Change Memory, Spin-Transfer Torque Magnetic RAM, and ReRAM among others. Their improvements are seen to start appearing in terms of speeds, endurance, and energy efficiency compared to their traditional counterparts. The upsurge is seen to meet the growing demands for high-performance memory in varying applications. One of the drivers of adoption for Phase Change Memory (PCM) will be through enterprise storage solutions applications.

Key Next Generation Non-Volatile Memory Market Highlights:

-

Rising demand for high speed and high capacity memory driven by big data, cloud storage, and the need for faster, energy efficient memory solutions

-

Emergence of advanced NVM technologies such as Phase Change Memory PCM, ReRAM, and MRAM offering higher speed, larger capacity, and better reliability than traditional Flash memory

-

Critical role in autonomous and connected vehicles where NVM enables real time data processing from sensors, cameras, radar, and LiDAR supporting safe navigation and ADAS functionalities

-

Integration with AI and modern applications with increasing adoption in AI, autonomous systems, and enterprise storage solutions to enhance performance and reliability

-

High production costs due to complex manufacturing processes and expensive materials limiting widespread adoption

-

Scalability and longevity challenges as some NVM types face limitations in storage capacity and endurance under continuous data write operations restricting their use in certain applications

Next Generation Non-Volatile Memory Market Drivers:

-

Emerging Non-Volatile Memory Technologies Driving the Future of Data Storage and Performance Enhancement

The main drivers for this market are increasing demand for data storage, recent semiconductor technologies, and the rising adoption of emerging products such as autonomous vehicles and AI. This market involves various modern memory technologies like phase-change memory, resistive random-access memory, and magnetic random-access memory. All these options have a significant advantage over non-volatile memory, such as Flash, in terms of higher access speed, larger capacities, and better reliability.

The need for large-capacity high-speed memory technologies arises from the increasing demand for big data and dependency on cloud storage. The larger the demand for performance enhancement is, the greater the need for memory devices with high speed and low power consumption. Emerging non-volatile memory technologies try to fill out market requirements and provide a competitive advantage over existing alternatives.

SAN JOSE, Calif.--BUSINESS WIRE--NetApp® (NASDAQ: NTAP), the intelligent data infrastructure company, today announced the new line of all-flash NetApp ASA A-Series storage systems, particularly designed for block storage, aimed to promote the modernization of storage in every organization. By offering customers these new systems and further development in NetApp's intelligent data infrastructure, customers no longer have to choose between ease of operation, high-end features, and value for their storage.

-

Critical Role of NVM in Powering Connected and Autonomous Vehicles for Real-Time Data Processing

Connected cars with their integration with technologies like infotainment systems, telematics, navigation systems, and advanced driver assistance systems (ADAS) tend to demand the robust memory solutions required for data storage and processing effectively. NVM is therefore a critical element in the preservation of data types that include maps, multimedia content, software updates, and sensor data for these applications. Hence, NVM would be highly critical in the storage and processing of data from a multitude of complex sensor arrays, cameras, radar, LiDAR, and other devices; its integration will facilitate autonomous vehicles to make rational choices by processing real-time data for safe navigation across different driving conditions.

Next Generation Non-Volatile Memory Market Restraints:

-

Navigating the High Cost of High-Tech Office Peripherals.

The largest barrier is that it is much more expensive to produce than traditional memory technologies such as Flash and DRAM. Novel NVM alternatives like phase-change memory (PCM), resistive random-access memory (ReRAM), and magnetic random-access memory (MRAM) often have complex manufacturing processes and expensive materials, costing much more than other memory technologies. Moreover, the scalability of some of the varieties of next-gen NVMs is also limited and might further limit their use in applications that demand a higher storage capacity. Besides, faster and more reliable as compared to conventional DRAMs, endurance and longevity issues, in particular when exposed to a continuous data write operation, could restrain lifetime in such specific use cases.

Next Generation Non-Volatile Memory Market Segment Analysis:

By Type

In 2024, high-bandwidth memory (HBM) share dominated with 58.85% revenue because of the surge in the demand for high bandwidth and low power consumption and emerging technologies such as AI and big data analytics. The increased trend of consumers towards various electronic devices and automotive developments also increases the count of HBM, which provides more performance and faster transfer rates.

The hybrid memory cube market is expected to grow at a CAGR of 18.9% from 2025 to 2032, driven by its unique design, advanced technologies, and superior performance as compared to traditional memory. Its compact structure and other advanced features allow HMC to penetrate the adoption in various industries and applications that demand energy efficiency, such as AI, IoT, machine learning, and data centers.

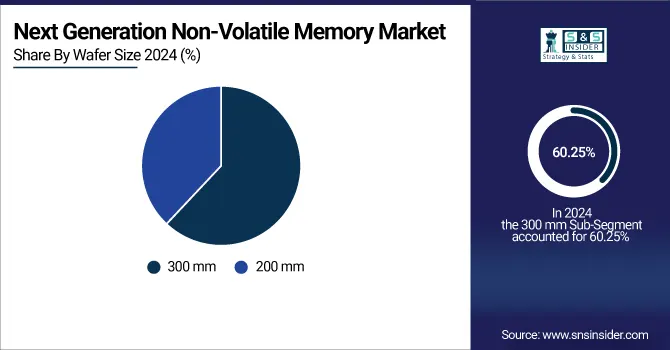

By Wafer Size

The 300mm wafer segment led the market in 2024, with a market share of 60.25%. The 300mm wafers have more than two-fold surface area compared to that of 200mm wafers, meaning this offers more production and saves cost. Therefore, growth in AI, 5G, and high-performance computing will fuel 300mm wafer growth in the future.

200mm wafers, to witness an expected CAGR of 18.32%, 200mm is a well-established mature technology for microprocessors, RF, and power chips through applying power and compound semiconductors necessary to consumer, automotive, and industrial sectors.

By Application

In 2024, BFSI sector had the largest revenue share at 22.15% in the market, becoming significantly well-positioned by relying heavily on IoT and AI technologies. Big data in BFSI improves investor decision-making and ensures consistent returns. A rapid increase in the number of connected devices is generating large amounts of data, often stored on cloud servers. With growing financial data volumes, BFSI requires more security. Advanced memory technologies in the industry help enhance operational efficiency and ensure data security.

Telecommunication is a growing sector in the forecast period and is expected to grow at 19.04%. This boom has been due to emerging technologies like AI and IoT. Soon enough, growth prospects for this industry can be expected through an uptake in 5G technology, which increases bandwidth and allows for up to 10GB download speeds per second.

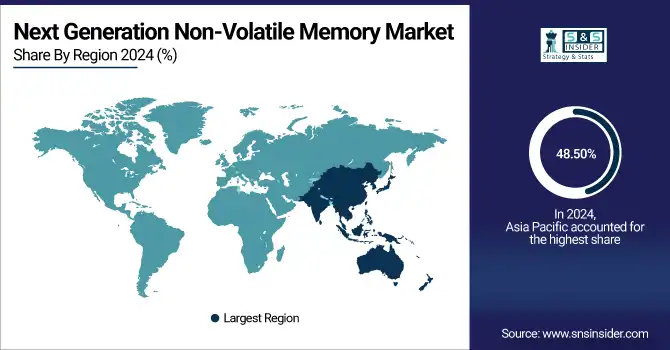

Asia-Pacific Next Generation Non-Volatile Memory Market Trends

Asia Pacific led the market in 2024 and emerged as the market leader, capturing a high revenue share of 48.50%, primarily due to factors inherent in its dynamic business environment. The need for memory solutions that support energy efficiency and data retention has been fueled by the increasing use of mobile technologies and the Internet of Things (IoT), These countries are leading the list of nations for production and innovation in semiconductors - China, Japan, and South Korea, among others.

Need Any Customization Research On Next Generation Non-Volatile Memory Market - Inquiry Now

North America Next Generation Non-Volatile Memory Market Trends

The North American next-generation non-volatile memory market will grow with a tremendous CAGR of 18.51% in the forecast period due to the construction of new infrastructures, such as data centers, and the rapid growth of the digital economy in countries like the U.S. and Canada. For instance, according to the reports in March 2024, there were 5,381 in the U.S., the highest of any country worldwide.

Europe Next Generation Non-Volatile Memory Market Trends

Europe is expected to witness steady growth in the next-generation non-volatile memory market during the forecast period. The region benefits from advanced semiconductor research facilities, strong industrial automation, and high adoption of IoT and smart devices. Countries like Germany, France, and the U.K. are leading in production and innovation, driving demand for efficient memory solutions.

Latin America Next Generation Non-Volatile Memory Market Trends

The Latin American market is projected to grow moderately, supported by increasing digital transformation initiatives and expansion of IT and telecommunications infrastructure. Brazil and Mexico are the key contributors, with rising adoption of cloud computing and smart devices creating demand for next-generation memory solutions.

Middle East & Africa Next Generation Non-Volatile Memory Market Trends

The Middle East and Africa region is gradually emerging as a market for next-generation non-volatile memory due to government-backed smart city initiatives, growth in data centers, and increased adoption of IoT solutions. The UAE, Saudi Arabia, and South Africa are leading the region in semiconductor deployment and innovation.

Next Generation Non-Volatile Memory Companies are:

-

Samsung Electronics (Z-NAND, MRAM)

-

Intel Corporation (3D XPoint, Optane)

-

Micron Technology (3D XPoint, NAND)

-

Toshiba Corporation (ReRAM, BiCS Flash)

-

SK Hynix (PCM, NAND Flash)

-

Western Digital Corporation (ReRAM, 3D NAND)

-

IBM Corporation (Racetrack Memory, PCM)

-

Cypress Semiconductor (FRAM, SONOS)

-

NXP Semiconductors (MRAM, PCM)

-

Everspin Technologies (STT-MRAM, Toggle MRAM)

-

Avalanche Technology (STT-MRAM, Spin-transfer Torque MRAM)

-

Adesto Technologies (CBRAM, ReRAM)

-

Fujitsu Limited (FeRAM, MRAM)

-

Crossbar Inc. (ReRAM, 3D RRAM)

-

Rambus Inc. (ReRAM, Resistive RAM)

-

Qualcomm Incorporated (ReRAM, MRAM)

-

HGST (a Western Digital brand) (ReRAM, 3D NAND)

-

Sony Corporation (ReRAM, MRAM)

-

Seagate Technology (Heat-Assisted Magnetic Recording, MRAM)

-

GlobalFoundries (STT-MRAM, ReRAM)

Next Generation Non-Volatile Memory Market Competitive Landscape:

Micron Technology, Inc. Established in 1978, is a leading U.S.-based semiconductor company specializing in memory and storage solutions. The company is a key player in the next-generation non-volatile memory market, developing advanced technologies such as 3D XPoint and high-performance NAND, enabling faster, energy-efficient, and reliable data storage for enterprise, cloud, and consumer applications.

-

July 30, 2024, Micron Technology, Inc. announced that it is shipping ninth-generation (G9) TLC NAND in SSDs, making it the first in the industry to achieve this milestone.

Samsung Electronics Founded in 1969, is a South Korean multinational leader in semiconductors, consumer electronics, and memory solutions. In the next-generation non-volatile memory market, the company is a major player with innovations like Z-NAND and MRAM, providing high-speed, energy-efficient, and reliable storage solutions for data centers, mobile devices, and enterprise applications.

-

In June 2024, Samsung Electronics seems almost ready with its 8nm embedded MRAM (eMRAM), which it's pushing forward on the planned process upgrades, according to the WeChat account DRAMeXchange. It's new memory technology based on magnetic principles, non-volatile and faster than traditional DRAM for access speeds and endurability, refresh-free, and with a write rate 1,000 times that of NAND.

Taiwan Semiconductor Manufacturing Company (TSMC) Established in 1987, is a leading Taiwanese semiconductor foundry, providing advanced manufacturing and fabrication services for cutting-edge memory and logic technologies. In the next-generation non-volatile memory market, TSMC enables the production of high-performance memory solutions such as 3D NAND and MRAM, supporting enterprise, mobile, and IoT applications globally.

-

In January 2024, TSMC's next-generation MRAM memory-related technology broke through, the company co-worked with the Industrial Technology Research Institute in developing a spin-orbit-torque magnetic random-access memory (SOT-MRAM) array chip.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 7.59 Billion |

| Market Size by 2032 | USD 27.92 Billion |

| CAGR | CAGR of 17.68% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Hybrid Memory Cube (HMC), High-bandwidth Memory (HBM)), • By Wafer Size (200 mm, 300 mm) • By Application (BFSI, Consumer Electronics, Government, Telecommunications, Information Technology, Others.) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Samsung Electronics, Intel Corporation, Micron Technology, Toshiba Corporation, SK Hynix, Western Digital Corporation, IBM Corporation, Cypress Semiconductor, NXP Semiconductors, Everspin Technologies, Avalanche Technology, Adesto Technologies, Fujitsu Limited, Crossbar Inc., Rambus Inc., Qualcomm Incorporated, HGST, Sony Corporation, Seagate Technology, GlobalFoundries |