Network Forensics Market Size & Overview:

Network Forensics Market was valued at USD 3.06 billion in 2024 and is expected to reach USD 9.06 billion by 2032, growing at a CAGR of 14.54% from 2025-2032.

To get more information on Network Forensics Market - Request Sample Report

The network forensics market has been experiencing significant growth, mainly driven by the increasing frequency and sophistication of cyberattacks. In 2023, 93% of organizations had two or more identity-related breaches, highlighting the growing vulnerability of network infrastructures. As cyber threats continue to evolve, organizations are facing greater challenges in safeguarding their networks, creating a strong demand for advanced monitoring and analysis tools. Additionally, 61% of organizations define a privileged user as human-only, while only 38% define both human and machine identities with sensitive access as privileged users. This discrepancy further underscores the need for comprehensive solutions to detect and mitigate threats in real-time, especially as digital transformation initiatives expand and increase the complexity of network environments.

Market Size and Forecast

-

Market Size in 2024: USD 3.06 Billion

-

Market Size by 2032: USD 9.06 Billion

-

CAGR: 14.54% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Network Forensics Market Trends

-

Rising cybercrime incidents and advanced persistent threats are driving the network forensics market.

-

Growing adoption of cloud computing, IoT, and remote work setups is increasing the need for advanced forensic solutions.

-

Integration of AI, machine learning, and automation is enhancing threat detection and incident response efficiency.

-

Increasing regulatory compliance requirements for data protection and breach reporting are fueling adoption.

-

Expansion of digital banking, e-commerce, and critical infrastructure is boosting demand for network visibility and monitoring.

-

Development of scalable, real-time forensic tools with advanced analytics is shaping market trends.

-

Collaborations between cybersecurity firms, enterprises, and government agencies are accelerating innovation and deployment.

Network Forensics Market Growth Drivers:

- Growth in Digital Transformation Drives Demand for Network Forensics Solutions

The rapid adoption of digital transformation technologies such as cloud services, Internet of Things, and remote work environments is significantly expanding the attack surface for organizations. As businesses increasingly rely on interconnected networks and distributed systems, the complexity and volume of data flowing through these networks grow, making it harder to detect and prevent cyber threats. This rise in digital activities presents both opportunities and challenges, as security breaches become more difficult to identify without advanced monitoring tools. Consequently, the need for robust network forensics solutions is growing. These tools help organizations detect, analyze, and respond to network incidents, ensuring data integrity and protecting sensitive information, making them essential in securing modern digital infrastructures.

- Exponential Growth of Data Fueling Demand for Advanced Network Forensics Solutions

The rapid increase in data volume across industries is creating significant challenges for organizations in managing and securing their networks. The total amount of data created, captured, copied, and consumed globally is forecast to reach 149 zettabytes in 2024. As the amount of data generated from diverse sources continues to rise, traditional network monitoring methods struggle to keep up with the complexity and scale of network traffic. This surge in data demands more sophisticated tools to analyze, detect anomalies, and identify potential security threats in real-time. Network forensics solutions are becoming essential for organizations to efficiently monitor vast amounts of network data, allowing them to swiftly investigate and mitigate any suspicious activity.

Network Forensics Market Restraints:

- High Implementation Costs Hindering Widespread Adoption of Network Forensics Market

The significant investment required for deploying network forensics solutions poses a major barrier to adoption, particularly for small and medium-sized businesses. Implementing these tools often involves substantial costs for specialized software, hardware, and hiring skilled personnel, which can be prohibitive for organizations with limited financial resources. Additionally, ongoing maintenance, updates, and employee training further increase the overall expenditure. These high initial and operational costs may deter SMBs from adopting network forensics solutions, despite the growing need for advanced cybersecurity measures. As a result, many organizations struggle to justify the investment, limiting their access to essential tools for securing their network infrastructures and detecting potential cyber threats.

- Challenge of False Positives and Alert Overload Impacting Network Forensics Effectiveness

Network forensics systems often face challenges related to false positives, where legitimate network activities are mistakenly flagged as threats. This can overwhelm security teams with a high volume of alerts, leading to inefficiencies in threat detection and response. When security professionals are flooded with numerous non-critical alerts, they may miss genuine security incidents, increasing the risk of undetected breaches. Furthermore, the time spent investigating false positives can divert valuable resources away from addressing real threats, reducing the overall effectiveness of the system. The difficulty in distinguishing between true and false alarms can undermine confidence in network forensics solutions, making organizations hesitant to fully integrate them into their cybersecurity strategy. This challenge is a key constraint in the adoption and utilization of these tools.

Network Forensics Market Segment Analysis

By Component, Solution dominated in 2023 with 65% revenue share. Services are expected to grow fastest with 15.58% CAGR.

In 2024, the Solution segment led the network forensics market, capturing approximately 65% of the revenue share. This dominance is attributed to the increasing need for advanced tools that offer real-time monitoring, threat detection, and incident response. As cybersecurity threats become more complex, businesses are investing heavily in comprehensive solutions to secure their networks. These solutions provide organizations with the necessary capabilities to proactively identify and address potential vulnerabilities.

The Services segment, however, is expected to grow at the fastest CAGR of about 15.58% from 2025 to 2032. This growth is driven by the rising demand for expert consulting, implementation, and managed services to optimize network forensics solutions. As organizations face growing cybersecurity challenges, the need for specialized services that ensure effective deployment and continuous monitoring is set to increase.

By Deployment, On-Premise dominated in 2023 with 65% revenue share. Cloud is expected to grow fastest with 15.69% CAGR.

In 2024, the On-Premise segment led the network forensics market with a 65% revenue share, driven by organizations’ preference for full control over sensitive data. On-premise solutions offer enhanced security, customization, and compliance with regulatory standards. Many industries, especially those dealing with critical data, prioritize on-site infrastructure for data privacy and risk management. This preference for in-house control continues to dominate the market.

The Cloud segment, however, is expected to grow at the fastest CAGR of 15.69% from 2025 to 2032. As businesses increasingly migrate to cloud environments, the demand for cloud-based network forensics solutions rises. Cloud solutions offer scalability, cost-effectiveness, and flexibility, providing real-time monitoring and seamless integration with cloud infrastructure. Their ability to support remote access and reduce overhead costs makes them increasingly attractive to organizations.

By Organization Size, Large Enterprises dominated in 2023 with 71% revenue share. SMEs are expected to grow fastest with 15.88% CAGR

In 2024, the Large Enterprises segment dominated the network forensics market with a 71% revenue share. Their extensive IT infrastructure and higher cybersecurity investments contribute to this dominance. Large enterprises face complex security threats and require robust solutions for real-time monitoring and compliance. Their ability to allocate larger budgets for advanced network forensics tools drives continued market leadership.

The Small and Medium Enterprises segment is expected to grow at the fastest CAGR of 15.88% from 2025 to 2032. SMEs are increasingly adopting cost-effective, scalable network forensics solutions to protect their data. Cloud-based solutions and managed services make these tools more accessible. As SMEs expand their digital operations, the need for affordable network security tools drives their rapid growth in the market.

By Application, Endpoint Security dominated in 2023 with 40% revenue share. Datacenter Security is expected to grow fastest with 17.01% CAGR.

In 2024, the Endpoint Security segment led the network forensics market, capturing about 40% of the revenue share. This is due to the growing number of endpoint devices within organizations, which are frequent targets for cyber threats. Endpoint security solutions monitor and secure these devices, enabling early threat detection and mitigation. As cyberattacks become more advanced, businesses prioritize endpoint protection to safeguard their networks.

The Datacenter Security segment is expected to grow at the fastest CAGR of 17.01% from 2025 to 2032. As cloud computing and data center operations expand, the need for robust security solutions has increased. With sensitive data being processed in data centers, organizations are investing in advanced security measures. This growing reliance on data centers for business operations drives the rapid expansion of this segment.

By End Use, BFSI dominated in 2023 with 24% revenue share. IT & Telecom is expected to grow fastest with 17.11% CAGR.

In 2024, the BFSI (Banking, Financial Services, and Insurance) segment led the network forensics market with a 24% revenue share. This dominance is driven by the sector's need to protect sensitive financial data and meet regulatory compliance. Financial institutions face increasing cyber threats, prompting significant investments in network forensics solutions. These solutions help secure data and maintain trust in an industry highly vulnerable to cyberattacks.

The IT and Telecom segment is expected to grow at the fastest CAGR of 17.11% from 2025 to 2032. As digital communication and data transfer expand, the telecom and IT sectors face growing cyber risks. The demand for network forensics solutions is rising to protect vast data networks and ensure real-time threat detection. The increasing reliance on digital infrastructure fuels rapid growth in this segment.

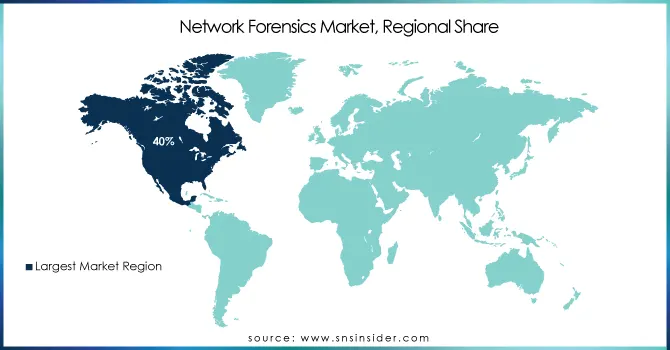

Network Forensics Market Regional Analysis

North America Network Forensics Market Insights

In 2024, North America dominated the network forensics market with a revenue share of approximately 40%. This is largely due to the region’s advanced technological infrastructure, high cybersecurity awareness, and significant investments in protecting critical digital assets. The presence of major financial, healthcare, and technology sectors, which require robust security measures, further drives the demand for network forensics solutions. Additionally, strict regulatory requirements in North America promote the adoption of advanced security technologies.

Asia Pacific Network Forensics Market Insights

The Asia Pacific region is expected to grow at the fastest CAGR of 16.76% from 2025 to 2032. This rapid growth is fueled by the increasing digitization of businesses and the rising frequency of cyberattacks in emerging markets. As governments and enterprises in Asia Pacific prioritize cybersecurity, the demand for network forensics solutions to safeguard critical infrastructure and data grows. The region’s expanding IT and telecom sectors also contribute to the fast-paced adoption of these solutions.

Europe Network Forensics Market Insights

Europe Network Forensics Market is witnessing steady growth, driven by rising cyber threats and increasing adoption of advanced cybersecurity solutions across enterprises. The region’s focus on regulatory compliance, data protection, and critical infrastructure security is fueling demand for network forensics tools. Additionally, investments in AI-powered threat detection and real-time monitoring solutions are enhancing market expansion. Growing awareness and government initiatives further strengthen Europe’s position in the network forensics landscape.

Middle East & Africa and Latin America Network Forensics Market Insights

Middle East & Africa and Latin America Network Forensics Market are experiencing gradual growth due to increasing cybercrime and the need for robust cybersecurity solutions. Rising adoption of network forensics tools in banking, government, and telecommunications sectors is driving market expansion. Additionally, initiatives to strengthen digital infrastructure, combined with investments in threat detection and incident response solutions, are supporting market development. Awareness programs and regulatory compliance are further fueling demand in these regions.

Need any customization research on Network Forensics Market - Enquiry Now

Network Forensics Market Competitive Landscape:

Cisco Systems

Cisco Systems, founded in 1984 and headquartered in San Jose, California, is a global leader in networking, cybersecurity, and enterprise solutions. The company provides a comprehensive portfolio of products and services, including routers, switches, firewalls, and cloud security solutions. Cisco emphasizes innovation in AI-driven security, hybrid cloud environments, and zero trust architectures, helping enterprises detect threats, protect data, and maintain resilient, scalable, and secure IT infrastructures across industries worldwide.

-

June 2024: Cisco enhanced its Security Cloud with AI-powered capabilities, including Cisco Hypershield, a next-gen firewall series, and AI-driven Security Cloud Control, focusing on threat detection, hybrid environment security, and zero trust collaboration with partners like Google.

Palo Alto Networks

Palo Alto Networks, founded in 2005 and headquartered in Santa Clara, California, is a global cybersecurity leader specializing in next-generation firewalls, cloud security, and AI-powered threat prevention solutions. The company focuses on protecting enterprises against advanced cyber threats through automation, machine learning, and integrated security platforms. Palo Alto Networks empowers organizations to secure AI-driven infrastructure, cloud environments, and critical networks while ensuring compliance and operational resilience in increasingly complex cyber landscapes.

-

May 2024: Palo Alto Networks unveiled AI-powered security solutions, including AI Access Security, AI-SPM, and AI Runtime Security, leveraging Precision AI to protect AI-driven infrastructures and counter advanced threats like zero-day attacks and DNS hijacking.

Key Players

Some of the Network Forensics Market Companies

-

IBM Corporation (QRadar, X-Force Incident Response)

-

FireEye (now Trellix) (FireEye Helix, Network Security and Forensics)

-

RSA Security LLC (NetWitness Suite, RSA SecurID)

-

Netscout Systems Inc. (Arbor Edge Defense, nGeniusONE)

-

Symantec Corporation (Broadcom Inc.) (DeepSight Intelligence, Security Analytics)

-

Viavi Solutions Inc. (Observer, Network Performance Management)

-

LogRhythm, Inc. (LogRhythm NextGen SIEM, LogRhythm NetMon)

-

Niksun (NetDetector, NetVCR)

-

Fortinet, Inc. (FortiAnalyzer, FortiSIEM)

-

Proofpoint, Inc. (Threat Response, Targeted Attack Protection)

-

Cisco Systems, Inc. (Stealthwatch, Secure Network Analytics)

-

Accenture Federal Services (Managed Security Services, Cyber Defense Platform)

-

Trustwave Holdings Inc. (Trustwave Fusion, Managed Detection and Response (MDR))

-

Packet Forensics LLC (Packet Sentry, Interceptor)

-

Dell Technologies (VMware NSX (via Dell), Secureworks Threat Detection)

-

SonicWall (SonicWall Capture ATP, Network Security Manager)

-

OpenText Corporation (EnCase Endpoint Investigator, Security Solutions)

-

ManageEngine (NetFlow Analyzer, OpManager)

-

Corelight Inc. (Corelight Sensors, Zeek Network Security Monitor)

-

Darktrace (Darktrace Enterprise Immune System, Antigena Network)

-

Palo Alto Networks, Inc. (Cortex XDR, PAN-OS)

| Report Attributes | Details |

| Market Size by 2024 | USD 3.06 billion |

| Market Size by 2032 |

USD 9.06 billion |

| CAGR |

CAGR of 14.54% From 2025 to 2032 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Historical Data |

2021-2023 |

| Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Components (Solution, Services) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM Corporation, FireEye, RSA Security LLC, Netscout Systems Inc., Symantec Corporation, Viavi Solutions Inc., LogRhythm, Inc., Niksun, Fortinet, Inc. , Proofpoint, Inc., Cisco Systems, Inc., Accenture Federal Services, Trustwave Holdings Inc. |