Network Management System Market Size & Trends:

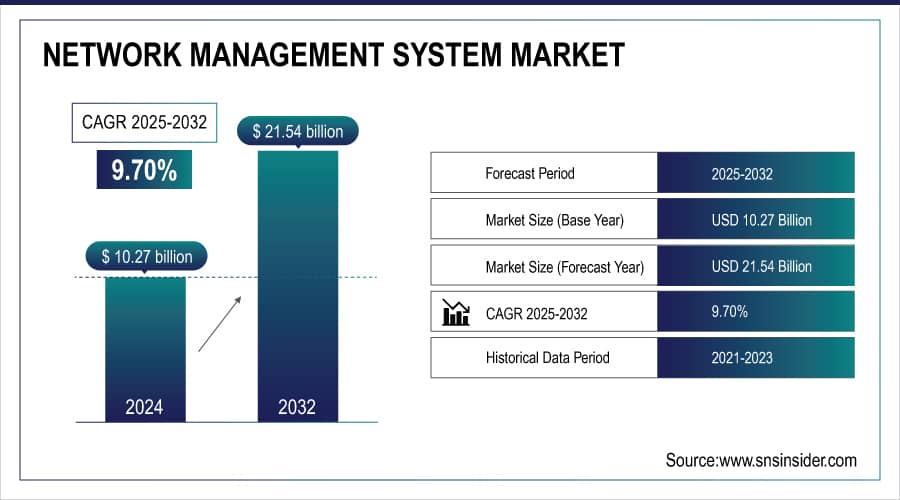

The Network Management System Market was valued at USD 11.26 Billion in 2025E and is projected to grow at 9.70% CAGR to reach USD 23.62 Billion by 2033.

The Network Management System (NMS) market is experiencing significant growth driving the Network Management System (NMS) Market With modern demands outstripping the capabilities of traditional network tools, organizations are rapidly transitioning to advanced NMS platforms that enable features such as dynamic network environments, multi-cloud installations, and AI-driven operations. The surge in data traffic, rising data centers and the dependence upon digital services by the industries is driving the market. The trend towards o pen source and software-defined networking solutions are beginning to change how networks are monitored, managed and secured. Together, these trends point to a healthy future for NMS, one full of innovation and enterprise-scale adoption.

To Get More Information On Network Management System Market - Request Free Sample Report

NetBox Labs raised USD 35M in Series B funding to meet surging demand for modern network infrastructure management driven by AI and automation needs. The open-source platform is becoming a standard for network visibility, compliance, and planning across enterprises.

Market Size and Forecast: 2025E

-

Market Size in 2025E USD 11.26 Billion

- Market Size by 2033 USD 23.62 Billion

- CAGR of 9.70% From 2026 to 2033

- Base Year 2025E

- Forecast Period 2026-2033

- Historical Data 2021-2024

Network Management System Market Trends:

• Rapid adoption of cloud-native and software-defined NMS platforms to manage complex 5G Open RAN and multi-cloud telecom environments

• Increasing integration of AI and machine learning in NMS for predictive maintenance automated fault detection and proactive performance optimization

• Growing deployment of private 5G networks across utilities and critical infrastructure driving demand for secure real-time network monitoring solutions

• Rising convergence of IT and OT networks in smart grids and industrial systems requiring unified and scalable network management platforms

• Expansion of IoT and edge devices in telecom and utility networks increasing the need for centralized visibility automation and lifecycle management

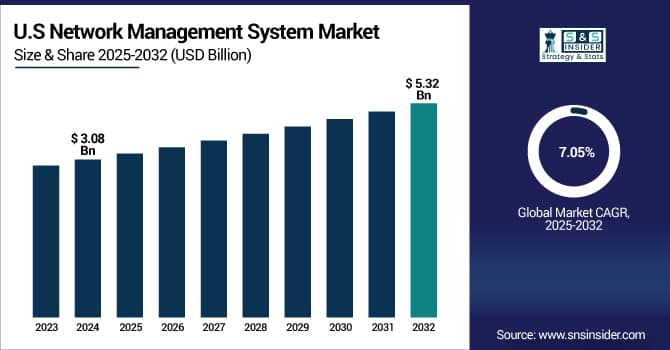

The U.S Network Management System Market size was valued at USD 3.08 Billion in 2025E and is projected to reach USD 5.32 Billion by 2033, growing at a CAGR of 7.05%, during 2026-2033.

The Network Management System (NMS) Market growth is determined by the demand for network visibility in real-time, automation, and complexity in IT infrastructure among enterprises. NMS solutions play a critical role in monitoring performance, configuration management, and operations efficiency and as the world moves toward more digitalization, cloud adoption and AI integrations, these trends will benefit the market as an integral part as well.

Network Management System Market Growth Drivers:

-

Telecom Cloud Transition Driving Growth in Network Management Systems

The increase in telecom providers shifting towards cloud-native and AI-enabled infrastructure is one of the factors that are driving the Network Management System (NMS) market. Emerging users like 5G and LTE-A will result in very huge frills and move-founded access frameworks that were not only smart Segregate-based mostly, but in addition need nimble and noteworthy NMS method for ongoing traffic, performance and security optimization. This trend is being accelerated by key factors such as the championing of Open RAN, greater demand for multi-cloud operations, and the requirement of predictive maintenance. To gain the digital economy and shorten the business disruption time, telecom operators are investing in new age infrastructure that can be managed better and can give life cycle advantage. The momentum in this market mirrors a larger change in telecom network design, leading to the long-term requirement of advanced NMS platforms that enable future-proof, software-defined networking landscapes.

Dell has unveiled a cloud transformation and AI-powered network monitoring program for telecom providers, streamlining modernization and automation. The initiative features new AI-optimized servers, lifecycle services, and expanded certification to support scalable, intelligent networks.

Network Management System Market Restraints:

-

Visibility Gaps in Distributed and High-Risk Network Environments

The lack of visibility and control of networks that operate solely in some inaccessible region, underpin some remote environment, or even hide in the dark will emerge as a major restraint for the Network Management System (NMS) market during the forecast period. As a result, network assets will remain in limbo since tracking is disabled, instruments lack interoperability, or can not interface with centralized systems. This prevents NMS platforms from issuing updates in real-time, identifying configuration drift or checking security compliance. Add to that, there are no enforcement mechanisms and no interoperability among distributed systems, which makes it that much harder to manage traffic. Consequently this contributes to critical blind spots for organizations in maritime, defense and global logistics sectors, weakening the overall impact of NMS in high-risk or mission-critical operations.

A recent C4ADS report revealed that 69% of Chinese squid vessels off South America operate “dark,” exploiting regulatory gaps—highlighting the real-world risks of limited network visibility.

Network Management System Market Opportunities:

-

Grid Modernization Driving Demand for Advanced Network Management Solutions

Increasing grid modernization trends, such as MLGW's deal with Nokia to launch a private 5G network, is a major driver for the growth of NMS market. The growing need for real-time communication, automation, and secure integration of smart infrastructure across utility services is propelling the demand for mobile NMS platforms. Utility networks have become quite complicated; hence, these systems are specifically designed for fault detection, remote monitoring, and for making IoT devices a cohesive unit. With increasing investments from municipalities and utilities alike into digital transformation, strong and resilient infrastructure, the NMS solutions market is expected to grow at a very high pace to support key infrastructure performance, continuity, and long-term efficiencies.

Nokia will deploy the first-ever standalone private 5G network for a U.S. municipal utility, partnering with Memphis Light, Gas and Water to enhance grid modernization and operational efficiency. The project aims to improve resilience, automate operations, and support future technologies across electric, gas, and water services.

Network Management System Market Segment Analysis:

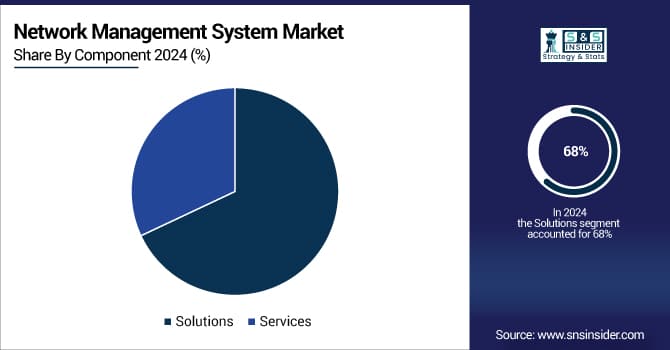

By Component:

The Solutions segment held a dominant Network Management System (NMS) market share of around 68% in 2025E, due to the increasing need for centralized network monitoring, automation, and real-time network visibility. Higher deployments of cloud, AI, and IoT technologies has ramped up the demand for scalable, integrated solutions that offer optimum network performance across complex, hybrid IT environments.

The Services segment is expected to experience the fastest growth in Network Management System (NMS) market over 2026-2033 with a CAGR of 11.47%, This growth is fueled by rising demand for managed services, system integration, and continuous support across complex, multi-cloud networks. As enterprises prioritize outsourcing for cost efficiency, scalability, and real-time monitoring, service-based models are becoming essential for maintaining secure and optimized network operations.

By Deployment

The On-Premises segment held a dominant Network Management System (NMS) market share of around 69% in 2025E, due to high demand from large enterprises with a priority data control, security, and compliance. Due to their importance in terms of critical infrastructure and access to sensitive data, industries like healthcare, finance, and government remain rooted in on-premises deployments based on stability and customization advantages, even as many enterprises are flocking to cloud-based solutions.The Cloud-Based segment is expected to experience the fastest growth in Network Management System (NMS) market over 2026-2033 with a CAGR of 10.95%, Growing adoption of cloud, demand for scalability, and agile–driven need for remote access and real-time network monitoring are some key factors influencing cloud base segment growth over the forecast period. Cloud-based NMS is a preferred solution for SMEs and digitally transforming enterprises being lower in terms of upfront costs, easy to deploy, auto updates and seamless integration with modern IT infrastructures.

By Enterprises

The Large Enterprises segment held a dominant Network Management System (NMS) market share of around 73% in 2025E, due to the large, complex and susceptible nature of network infrastructure & the need for advanced monitoring, automation and security. Such organizations invest heavily into NMS platforms to maintain continuous operations, meet regulatory obligations and manage resources. The deep pockets and embrace of technology (early and often) also help keep them on the forefront. The Small & Medium Enterprises segment is expected to experience the fastest growth in Network Management System (NMS) market over 2026-2033 with a CAGR of 15.65%, owing to growing trends for digitalisation and cloud adoption with growing number of sectors aiming for affordable yet scalable network solutions. Small to Medium-sized Enterprises (SMEs) are increasingly adopting automated and user-friendly Network Monitoring System (NMS) platforms to ensure better performance, security, and operational efficiency of their network, without the need for having a large workforce in the IT department.

By Verticals

The IT & Telecom segment held a dominant Network Management System (NMS) market share of around 22% in 2025E, driven by the industry's high reliance on robust, scalable, and real-time network performance. With vast data traffic, critical uptime requirements, and the rapid rollout of 5G and cloud services, IT and telecom providers heavily invest in advanced NMS solutions to ensure service continuity, fault detection, and efficient network optimization. The Healthcare segment is expected to experience the fastest growth in Network Management System (NMS) market over 2026-2033 with a CAGR of 13.84%, This growth is driven by increasing digitalization of healthcare services, adoption of telemedicine, and the need for secure, reliable network infrastructure. Hospitals and clinics are investing in advanced NMS to ensure data privacy, minimize downtime, and support real-time communication across critical medical systems.

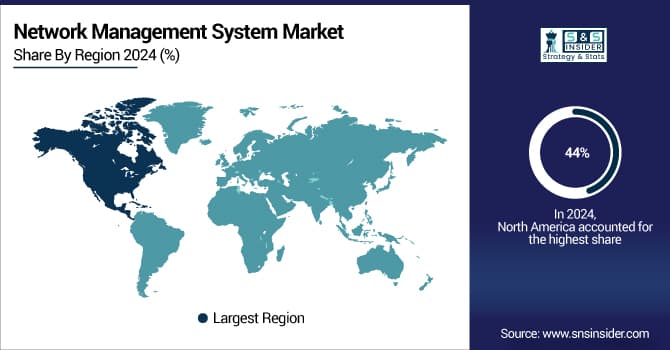

Network Management System Market Regional Analysis:

North America Network Management System Market Insights

In 2025E, North America dominated the Network Management System (NMS) market and accounted for 44% of revenue share, driven by early technology adoption, strong presence of major NMS vendors, and widespread use of advanced IT infrastructure. The region’s focus on cybersecurity, cloud integration, and enterprise automation further supports its leadership in deploying scalable and intelligent network management solutions.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific Network Management System Market Insights

Asia-Pacific is expected to witness the fastest growth in the Network Management System (NMS) market over 2026-2033, with a projected CAGR of 11.41%, driven by fast digital transformation, growing telecom infrastructure level, and high investments in smart cities and cloud technologies. The demand for real-time monitoring, automation, and scalable IT systems from the emerging economies is assisting the NMS to proliferate throughout the region.

Europe Network Management System Market Insights

In 2025E, Europe emerged as a promising region in the Network Management System (NMS) market, driven by growing investments in digital infrastructure, increasing adoption of cloud-based services, and stringent data privacy regulations. The region is witnessing rising demand for advanced network monitoring and automation solutions across sectors such as BFSI, healthcare, and manufacturing.

Germany led the regional market, supported by its strong industrial base, robust IT infrastructure, and focus on Industry 4.0 initiatives.

Latin America (LATAM) and Middle East & Africa (MEA) Network Management System Market Insights

LATAM and MEA are experiencing steady growth in the Network Management System (NMS) market, driven by increasing investments in telecom infrastructure, rising internet penetration, and the growing need for network automation across developing economies. Governments and enterprises in these regions are gradually adopting digital transformation strategies, which boost demand for scalable and cost-effective NMS solutions to enhance connectivity, security, and operational efficiency across various industries.

Network Management System Market Key Players:

The Network Management System (NMS) market companies are Cisco Systems, Inc., IBM, Broadcom, Inc., Riverbed Technology, Inc., SolarWinds Worldwide, LLC, BMC Software, Inc., Nokia Corporation, Oracle Corporation, Paessler AG, Viavi Solutions Inc., NetScout Systems, Inc., Colasoft, Inc., Huawei Technologies Co., Ltd., Hewlett Packard Enterprise Company, Dell Technologies, Inc., Juniper Networks, Inc., Micro Focus, ManageEngine (Zoho Corporation), Extreme Networks, Inc., AppNeta, Inc., BMC Software and Others.

Competitive Landscape for Network Management System Market:

Cisco Systems, Inc. is a leading provider of network management system solutions, offering advanced software platforms for network monitoring, performance optimization, automation, and security. Its AI-driven and cloud-based NMS tools support telecom operators, enterprises, and data centers in managing complex, software-defined, and multi-cloud network environments efficiently.

-

In Jun 2024, Cisco is advancing its AI-driven networking strategy through major partnerships with Nvidia, Microsoft, and BlackRock to build secure AI data centers. Additionally, it has patched critical vulnerabilities in its Unified CM and ISE platforms, reinforcing its focus on secure, AI-integrated enterprise infrastructure.

Oracle Corporation provides network management system solutions integrated with its cloud infrastructure, enabling centralized monitoring, performance management, and automation across complex networks. Its AI- and analytics-driven platforms support telecom operators and enterprises in managing cloud-native, virtualized, and hybrid network environments with high reliability and security.

-

In March 2025, Oracle has introduced advanced features in its Utilities Network Management System to enhance DER orchestration, grid forecasting, and outage response. These upgrades support utilities in managing renewable energy, improving reliability, and optimizing grid performance.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 11.26 Billion |

| Market Size by 2033 | USD 23.62 Billion |

| CAGR | CAGR of 9.70% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component(Solutions, Services) • By Deployment (On-Premises, Cloud-Based) • By Enterprises(Large Enterprises, Small & Medium Enterprises) • By Vertical(IT & Telecom, BFSI, Government, Manufacturing, Healthcare, Transportation & Logistics, Retail, Media & communication, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | The Network Management System (NMS) market companies are Cisco Systems, Inc., (IBM), Broadcom, Inc., Riverbed Technology, Inc., SolarWinds Worldwide, LLC, BMC Software, Inc., Nokia Corporation, Oracle Corporation, Paessler AG, Viavi Solutions Inc., NetScout Systems, Inc., Colasoft, Inc., Huawei Technologies Co., Ltd., Hewlett Packard Enterprise Company, Dell Technologies, Inc., Juniper Networks, Inc., Micro Focus, ManageEngine (Zoho Corporation), Extreme Networks, Inc., AppNeta, Inc., BMC Software and Others. |