DRAM - Dynamic Random Access Memory Market Size Analysis:

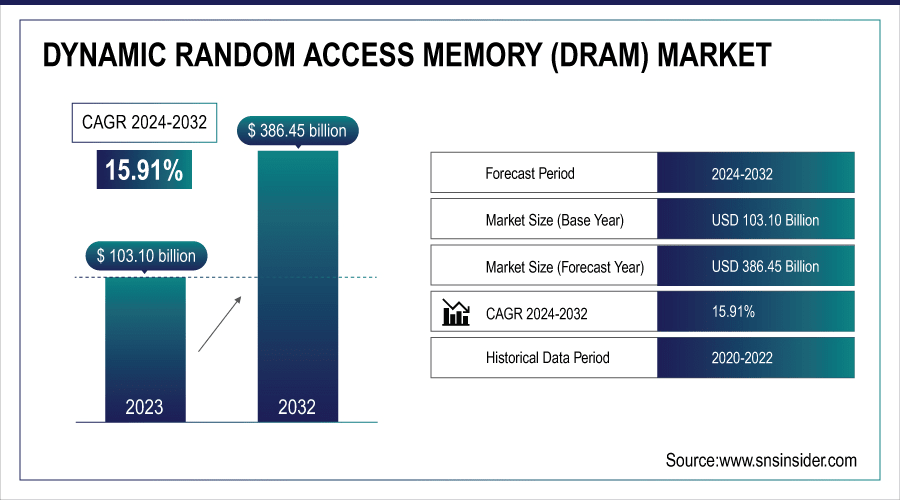

The Dynamic Random Access Memory (DRAM) Market was valued at USD 103.10 billion in 2023 and is expected to reach USD 386.45 billion by 2032, growing at a CAGR of 15.91% over the forecast period 2024-2032. The DRAM market is going through a rapid technology evolution, driven by technology node shrinkage that improves speed and performance. As one of the fastest-growing trends in automotive applications, DRAM is supporting high-end features such as autonomous driving and infotainment. Compactness and High-density designs dominate the trends in DRAM module form factors.

Also, energy-efficient DRAM solutions are expected to thrive on the back of power efficiency and ESG efforts, with the increasing environmental footprint of the electronics ecosystem components. In 2024, the DRAM market grew incredibly for the U.S. Top-tier makers, including Samsung, SK hynix, and Micron, have logged large revenue increases as a result of an increase in shipments and average selling prices (ASP). Micron, for example, forecasted record first-quarter revenue of about USD 8.7 billion, raised further by high demand for chips to boost AI computing, including its high-bandwidth memory (HBM) chips. The dramatic increase illustrates the importance of the U.S. in the worldwide DRAM market, especially in key areas such as AI and data centers.

To Get More Information On Dynamic Random Access Memory (DRAM) Market - Request Free Sample Report

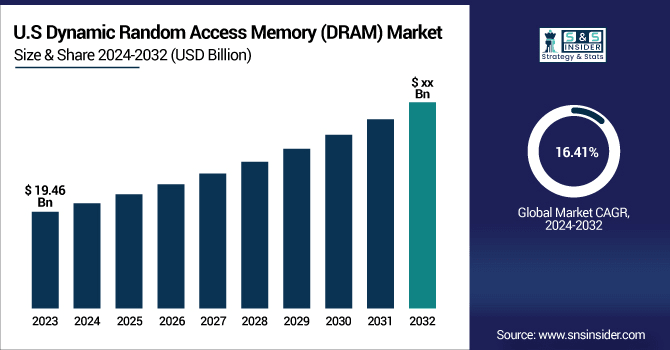

The U.S. Dynamic Random Access Memory Market is estimated to be USD 19.46 billion in 2023 and is projected to grow at a CAGR of 16.41%. U.S. Dynamic Random Access Memory (DRAM) market expansion is due to several reasons. Many of these AI and ML applications have high-performance memory demands. Autonomous driving is another area where automotive technologies are driving the requirements for high-end memory components. Another factor that drives the need for DRAM is the growth of data centers and the availability of cloud computing services.

Dynamic Random Access Memory Market Dynamics

Key Drivers:

-

Exploring the Driving Forces Behind DRAM Market Growth in AI 5G Cloud and Automotive Industries

The surging growth of data creation in areas including cloud, artificial intelligence (AI), and 5G is the primary artery of the DRAM market. Given the need for faster and more efficient memory solutions in data centers and high-performance computing platforms, advanced DRAM technologies such as DDR5 and HBM (High Bandwidth Memory) are also experiencing rapid implementation. Secondly, the growth of smartphones, laptops, and gaming consoles is keeping consumer electronics market demand of DRAM robust. Automotive is also proving to be a growth opportunity as the proliferation of ADAS (Advanced Driver Assistance Systems), infotainment systems, and electric vehicle (EV) architectures demands real-time data processing capabilities.

Restrain:

-

Overcoming Technology Complexity and Thermal Challenges in the Evolving DRAM Market for Next-Gen Systems

Technology complexity is one of the key restraints for the growth of the DRAM market. This creates the biggest challenges for manufacturers to have stability across vast workloads because as DRAM architectures move from DDR4 to DDR5, DDR6, and beyond. Precision engineering and extensive testing are a must for these next-gen modules, especially when they will be integrated into mission-critical systems like some data centers, self-driving cars, and medical devices. Moreover, thermal and power issues are still one of the most important problems, especially in high-density DRAM, where excessive heat poses a threat to the performance and service life of the device. These technical barriers can delay the deployment of products and industry-wide adoption.

Opportunity:

-

Exploring Growth Opportunities for DRAM in Healthcare IoT Edge Computing and Emerging Market Regions

New applications in the healthcare and medical devices space will also provide favorable growth opportunities for DRAM manufacturers. As smart wearables, portable diagnostic tools, and telehealth platforms emerge, so too do the opportunities for embedded, low-power DRAM-based solutions. At the same time, the growth of edge computing and the Internet of Things (IoT) is driving the need for fast and efficient memory at the edge of the network. The growth prospects lie particularly in developing regions like Asia Pacific and Latin America, where digital transformation initiatives might be on the rise and telecommunications infrastructure may still be growing. With new use cases emerging, this is expected to create new revenue opportunities and spur advancement in memory technologies.

Challenges:

-

Addressing Data Security Challenges and Emerging Technologies Shaping the Future of DRAM Market Growth

DRAM is becoming more susceptible to data integrity and security threats. Common use in effective applications from government systems to healthcare gadgets has made it essential for data safety, cyber threats, and error correction. In addition, the semiconductor industry is cyclical by nature, leading to supply chain and inventory challenges caused by varying demand and periodically overcapacity situations. The quick evolution of alternative memory technologies such as MRAM and ReRAM similarly represents a longer-term risk by potentially shrinking the addressable market for DRAM in some applications. To fulfil the performance demands of different applications, manufacturers are required to constantly innovate and evolve to remain relevant in the long run and maintain a competitive edge.

DRAM Market Segments Analysis

By Type

Synchronous DRAM contributed a major market share of 61.2% in 2023 and is likely to witness the fastest CAGR through to 2032. Its ubiquity in numerous high-performance applications, including personal computers, servers, and mobile devices that prioritize speed, efficiency, and reliability is mostly responsible for this dominance. Synchronous DRAM works in tandem with the system clock, enabling quicker data processing and superior system responsiveness, making it more common in today´s computing environments. The ability of the technology to keep up with advancing generations of memory standards and high-speed data access (and high-bandwidth) demand also solidifies wider market adoption. Synchronous DRAM conveniently satisfies the growing demand for high-capacity and high bandwidth memory that continues to expand as cloud computing, AI, and big data analytics evolve. Continued advancements and implementation in new applications ensure a robust and consistent growth phase over the forecast period for this domain.

By Technology

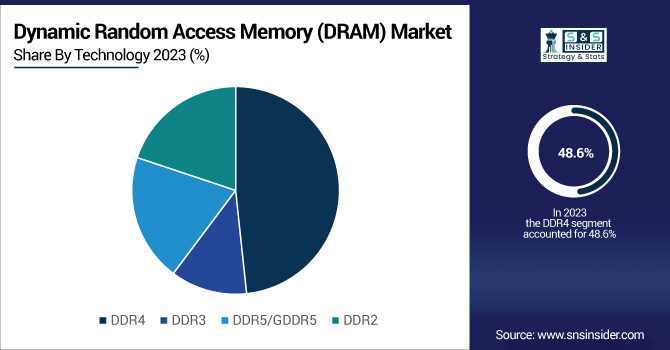

DDR4 market share stood at 48.6% in 2023, due to the mass implementation of DDR4 in consumer electronics as well as enterprise servers & computing devices. This had been the industry standard for several years due to its excellent performance, power efficiency, and cost efficiency. Compared to earlier generations of RAM, DDR4 provides increased memory bandwidth and lower latency, and is used in a variety of applications, including gaming, data centers, and high-performance workstations.

DDR5/GDDR5 is estimated to witness the highest growth rate in terms of CAGR between the years 2024–2032 due to rising demands for advanced computing solutions, high-performance computing workloads, and emerging next-generation gaming platforms. DDR5 features very substantial advantages and benefits of DDR4 utilization over DDR4, including higher bandwidth, higher efficiency, and higher capacity, great for data-intensive applications. Demand remains for GDDR5, with its specialized design for graphics applications, in many GPUs and gaming consoles.

By End-Use

In 2023, the DRAM market for IT and Telecommunication accounted for 38.3% of the total value due to rapid developments in cloud computing, 5G infrastructure, data centers, and enterprise-level applications. Other industries, such as telecommunications, depend on high-speed, high-capacity memory to handle millions of real-time data points and help networks operate smoothly. Virtualization has since grown, and with AI/ML use cases proliferating, DRAM demand in the IT infrastructure will likely be sustained as well. Leading technology companies keep investing in scaling memory capabilities to address the demands of ever-growing and complex workloads.

The fastest-growing application segment for the market between 2024 and 2032 is projected to be Consumer Electronics, primarily due to increasing demand for smartphones, tablets, smart TVs, and wearable devices worldwide. As such, the transition to connected lifestyles and the smart home ecosystem is driving a growing demand for memory solutions that are small in size, power-efficient, and fast. In addition, more frequent product refresh cycles and increased adoption of technology-rich features such as AI cameras and AR/VR capabilities are propelling DRAM demand in this segment even further.

DRAM (Dynamic Random Access Memory) Market Regional Outlook

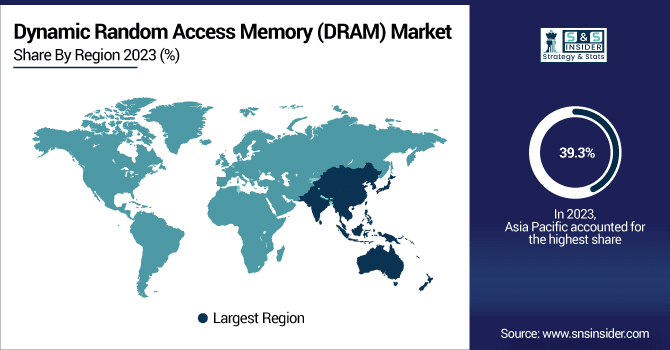

Asia Pacific region accounted for 39.3% of the total share in the DRAM market during 2023, owing to a huge manufacturing base along with the existence of major players such as Samsung, SK Hynix, and Micron. It hosts the world's best semiconductor manufacturers, making it possible for cost-effective production and fast-paced innovation in memory technologies. Key players in the DRAM supply chain are South Korea and Japan, as well as Taiwan, reflecting strengthening demand in consumer electronics, automotive, and data center fields. As an example, we have the semiconductor manufacturing facilities in South Korea of Samsung, which supply massive DRAM production for everything from smartphones to the largest HPC systems globally.

Between 2024 and 2032, North America will attain the fastest CAGR, finding large adoption of DRAM in data centers, AI, and 5 G networks. Demand for high-performance memory solutions is being driven by the strong tech ecosystem, which includes heavyweights like Intel, NVIDIA, and Apple. As an example, NVIDIA, one of the biggest users of DRAM as a major player in the AI and machine learning sector, uses DRAM heavily in the GPUs that drive its AI and machine learning tasks. Also, the steady increase in demand for cloud services and a significant influx of autonomous vehicles in North America are expected to boost DRAM consumption to new heights. The growth in cloud services is also fueled by the trend of Google and Amazon providing increasingly high volumes of data centers to the cloud market, which will certainly reflect on cloud computing memory demand.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Key Players in the Dynamic Random Access Memory (DRAM) Market are:

-

Samsung Electronics (DDR5 DIMM)

-

SK hynix (LPDDR5)

-

Micron Technology (Crucial DDR4)

-

Nanya Technology Corporation (DDR4 UDIMM)

-

Winbond Electronics Corporation (W948D6CBC7N)

-

Powerchip Semiconductor Manufacturing Corp. (PSMC) (DDR3 SDRAM)

-

Infineon Technologies AG (TwinDie DRAM - legacy)

-

Intelligent Memory (IM-DDR4-UDIMM)

-

Etron Technology Inc. (EM6HE16EW)

-

Alliance Memory (AS4C256M8D3)

-

ADATA Technology Co., Ltd. (XPG Lancer DDR5)

-

Corsair Components, Inc. (Vengeance LPX DDR4)

-

Kingston Technology Corporation (FURY Beast DDR5)

-

Patriot Memory LLC (Viper Steel DDR4)

-

Team Group Inc. (T-Force Delta RGB DDR5)

Dynamic Random Access Memory Market Trends

-

In October 2024, Samsung unveiled the industry’s first 24Gb GDDR7 DRAM, delivering speeds over 40Gbps to power next-gen AI, data centers, and autonomous systems. Mass production is expected to begin early next year.

-

In November 2024, SK hynix began mass production of the world’s first 321-layer 4D NAND, offering improved speed, power efficiency, and productivity. Shipments to customers will start in the first half of 2025.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 103.10 Billion |

| Market Size by 2032 | USD 386.45 Billion |

| CAGR | CAGR of 15.91% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Synchronous DRAM, Burst Extended Data, Output Extended Data, Output Asynchronous DRAM, Fast Page Mode) • By Technology (DDR4, DDR3, DDR5/GDDR5, DDR2) • By End-Use (IT and Telecommunication, Defense and Aerospace, Media and Entertainment, Medical and Healthcare, Consumer Electronics) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Samsung Electronics, SK hynix, Micron Technology, Nanya Technology Corporation, Winbond Electronics Corporation, Powerchip Semiconductor Manufacturing Corp. (PSMC), Infineon Technologies AG, Intelligent Memory, Etron Technology Inc., Alliance Memory, ADATA Technology Co., Ltd., Corsair Components, Inc., Kingston Technology Corporation, Patriot Memory LLC, Team Group Inc. |