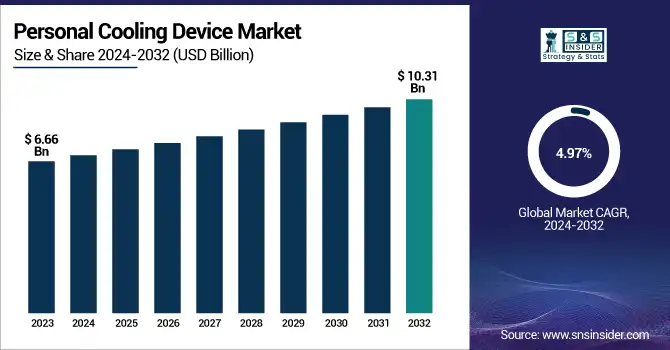

Personal Cooling Device Market Size & Growth:

The Personal Cooling Device Market was valued at USD 6.66 billion in 2023 and is projected to reach USD 10.31 billion by 2032, growing at a CAGR of 4.97% from 2024 to 2032. The Personal Cooling Device Market is driven by rising temperatures and climate change, leading to more frequent heatwaves, particularly in regions like Southern Asia and the Middle East. This has increased demand for cooling solutions.

In the U.S., the market, valued at USD 1.83 billion in 2023, is expected to reach USD 2.39 billion by 2032. Technological innovations, including wearable cooling devices, smart cooling systems, and solar-powered solutions, are appealing to eco-conscious and tech-savvy consumers. The growing awareness of health and wellness is driving the need for devices that prevent heat-related illnesses during outdoor activities. Additionally, consumers are opting for sustainable, energy-efficient products, with a preference for renewable materials and solar energy. Urbanization and heat island effects further contribute to the demand for portable cooling solutions, particularly among younger, environmentally aware populations.

To Get more information on Personal Cooling Device Market - Request Free Sample Report

Personal Cooling Device Market Dynamics:

Drivers:

-

Growing Demand for Personal Cooling Devices Amid Climate Change and Workplace Heat Stress

The demand for personal cooling devices has surged due to rising temperatures caused by global warming. According to the World Health Organization, heat stress is expected to cause 38,000 additional deaths annually between 2030 and 2050, leading to an increased demand for user-friendly, energy-efficient cooling solutions. Workers in high-temperature environments are increasingly turning to handheld cooling devices to reduce heat and cold stress, which affect both comfort and productivity. As a result, handheld cooling devices are becoming one of the fastest-growing products in the market, often featuring Thermoelectric Cooler (TEC) modules for instant cooling. Similarly, personal air conditioners, offering portability and effective airflow, are gaining popularity for everyday use in hot climates. However, the widespread use of HVAC systems as a more cost-effective alternative in workplaces limits the growth of personal cooling devices. Despite this, personal cooling solutions remain a more economical choice for individual use, sustaining their demand in the forecast period.

Restraints:

-

Limitations of Personal Cooling Devices in Providing Adequate Cooling in Extreme Heat

Personal cooling devices, including handheld fans and wearable coolers, are designed to provide portable and convenient relief from heat. However, they often fall short when compared to traditional air conditioning systems in terms of cooling capacity. These devices can offer comfort in moderately warm conditions but are not capable of delivering the same level of cooling required in extremely hot environments. In regions with consistently high temperatures, personal cooling devices may struggle to provide adequate relief, making them less effective for long-term use. While compact and energy-efficient, their limited cooling performance means they are better suited for short-term use or personal comfort rather than as a primary cooling solution in extreme heat. As a result, consumers needing consistent and powerful cooling may turn to air conditioners or larger, more robust cooling solutions, limiting the broader adoption of personal cooling devices in certain climates.

Opportunities:

-

Rising Demand for Sustainable and Energy-Efficient Cooling Solutions

With increasing awareness of global warming, consumers are looking for the sustainable and energy-efficient products. This trend leaves a broad opportunity for the personal cooling device market to capitalize on by developing products made from renewable materials powered by solar energy. These sustainable solutions with less environmental impact resonate well among conscientious consumers looking for substances with less environmental pollution. Implementing green technologies sets manufacturers apart from competitors, curating to the growing demand for environmentally sustainable products. Just like Issimo, the use of solar-powered devices and recyclable materials is a very sustainable approach that can also lead to energy savings, which should resonate with environmentally conscious consumers eager for practical yet responsible solutions to cooling.

Challenges:

-

Impact of High Costs on Accessibility of Advanced Personal Cooling Devices

While personal cooling devices are generally more affordable than traditional air conditioners, the introduction of advanced features such as smart technology, solar power, and energy-efficient solutions has led to higher-priced models. These devices offer more functionality, but are sometimes more expensive for consumers. This restricts their reach to a wider audience, especially in emerging economies or among price-sensitive consumers, as advanced features such as integration with mobile applications, customized one-step cooling settings, and solar-powered options can be expensive. The challenge for manufacturers is to navigate the fine line between innovation and affordability, keeping these products within the reach of consumers, particularly in demographics with low purchasing power.

Personal Cooling Device Industry Segment Analysis:

By Product

The Personal Air Conditioner/Desk Fans segment dominated the personal cooling device market in 2023, capturing around 68% of the revenue share. The growing demand for portable air conditioning units in residential and office applications is driving their market capture, resulting in a relatively large share of this market segment. These systems are preferred because they endow a custom cooling experience at a much lesser price than the air conditioner. Furthermore, desk fans and personal air conditioners are compact and portable, making them suitable to the reality of urban life, where space and ease of movement are crucial. This has helped them to maintain a lead in the market.

Handheld cooling devices are expected to experience significant growth over the forecast period from 2024 to 2032, driven by increasing demand for portable and personalized cooling solutions. These devices, often equipped with thermoelectric coolers (TEC) and compact designs, offer a convenient and energy-efficient way to beat the heat, especially in hot climates. Their portability, ease of use, and affordability make them popular among consumers for both outdoor activities and work environments. As technological advancements continue to improve cooling efficiency and battery life, the handheld cooling device segment is anticipated to see strong market expansion, particularly in regions with rising temperatures and heat stress concerns.

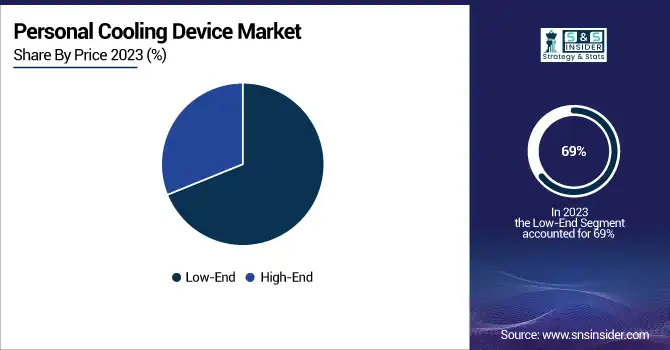

By Price

The Low-End segment of the personal cooling device market dominated with a substantial 69% of the revenue share in 2023. This dominance is largely due to the affordability and wide accessibility of low-end devices, which appeal to a large consumer base seeking economical cooling solutions. These devices typically offer basic features, making them ideal for price-sensitive consumers in both developed and emerging markets. Their simplicity, compactness, and ease of use contribute to their popularity, especially in regions with moderate to high temperatures. Additionally, the growing trend of increased outdoor activity during hot weather has further fueled demand for these cost-effective, portable cooling devices, enabling them to capture the largest share of the market.

The High-End segment is the fastest-growing in the personal cooling device market over the forecast period from 2024 to 2032. This growth is driven by the increasing demand for advanced features such as smart technology, solar-powered solutions, and energy-efficient designs. High-end personal cooling devices offer enhanced customized cooling, longer battery life, and integration with mobile apps, making them particularly appealing to tech-savvy consumers. As disposable income increases and consumers seek more sophisticated, eco-friendly solutions, the high-end segment is expected to capture a significant portion of the market, especially in developed regions where consumers prioritize innovation and sustainability in their purchasing decisions.

By Distribution Channel

The Online segment dominated the personal cooling device market, accounting for around 69% of the revenue in 2023. This dominance has largely been driven by the rise of e-commerce and the ongoing trend that drove shoppers to the online shopping space. The home market was further gaining rewarding demand owing to the ease and convenience enjoyed by consumers, which allows them to buy personal cooling devices from the comfort of their home and avail better options and offers ranging from deals, promotions to diverse product selection. With eCommerce, there is also visibility into customer reviews and ratings, allowing buyers to make informed choices. Online platforms are available throughout the world; hence, this has also lead to the growth of the market, enabling manufacturers to target consumers from various areas. With an increasing number of consumers choosing the speed and convenience of online shopping, this segment is anticipated to continue to dominate the market throughout the forecast period.

The Offline segment is expected to see steady growth in the personal cooling device market over the forecast period from 2024 to 2032. Despite the rise of online shopping, many consumers still prefer purchasing personal cooling devices through brick-and-mortar stores due to the ability to physically inspect and test products before buying. Additionally, offline channels provide a personalized shopping experience, with sales representatives offering expert advice and guidance, which appeals to consumers seeking hands-on experiences. The availability of these products in electronics retailers, department stores, and specialty shops enhances accessibility, particularly in regions where internet penetration is low or consumers are less inclined to shop online. The offline segment will continue to cater to a diverse customer base, particularly among those who value immediacy and face-to-face customer service.

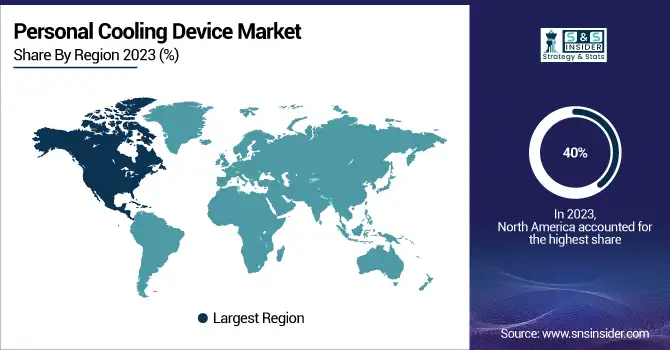

Personal Cooling Device Market Regional Outlook:

In 2023, the North America region dominated the personal cooling device market, accounting for around 40% of the revenue. The demand for personal cooling solutions is surging due to increasing temperatures and rising awareness about heat-related health concerns, and these factors are mainly driving this dominance. The region's infrastructure and high consumer spending power contributes to the market in a positive aspect, as consumers are more open to buying innovative, energy-efficient, and smart cooling devices. Moreover, there is an increasing demand for personal cooling items due to global warming and overall rise in high-temperature climate events. A wide base of key manufacturers and e-commerce platforms operating in the region also make these devices easily available to a wider audience. North America is projected to follow the organic trend of the market due to the growing consumer demand for portable, convenient cooling solutions for residential and commercial applications.

The Asia-Pacific region is poised to be the fastest-growing market for personal cooling devices from 2024 to 2032. The demand for personal cooling solutions is increasing due to rapid urbanization, rising temperatures, and increasing disposable incomes in China, India, and Japan. The region’s hot, humid climate and increasing awareness of health hazards associated with heat are also driving consumers to try to find portable, energy-efficient cooling devices. The growth of the market is also driven by the growing middle class and the rising demand for eco-friendly products. Technological and manufacturing advancements will drive significant innovation in the Asia-Pacific market for personal cooling devices, specifically affordable yet high-quality devices, with a broad consumer base.

Get Customized Report as per Your Business Requirement - Enquiry Now

Major Players in Personal Cooling Device Market are:

-

Honeywell International Inc. (USA): Portable air conditioners, fans, air purifiers, and cooling systems.

-

Dyson Ltd. (UK): Bladeless fans, air purifiers, cooling fans, and humidifiers.

-

LG Electronics Inc. (South Korea): Portable air conditioners, cooling fans, dehumidifiers, and air purifiers.

-

O2COOL LLC (USA): Handheld fans, desk fans, and personal cooling fans.

-

Evapolar Ltd. (Russia): Personal evaporative air coolers and portable coolers.

-

Personal Cooling Technologies LLC (USA): Wearable cooling devices, neck coolers, and handheld fans.

-

Holmes Products Corp. (USA): Portable air coolers, fans, and humidifiers.

-

Sunpentown International Inc. (USA): Portable air conditioners, fans, dehumidifiers, and cooling devices.

-

The Coleman Company Inc. (USA): Portable coolers, fans, and air conditioning units.

-

NewAir LLC (USA): Portable air conditioners, fans, and coolers.

-

Symphony Limited (India): Air coolers, personal coolers, and room coolers.

-

Havells India Ltd. (India): Fans, coolers, air purifiers, and air conditioners.

-

De'Longhi S.p.A. (Italy): Portable air conditioners, fans, and air purifiers.

-

Bajaj Electricals Ltd. (India): Fans, coolers, and portable air conditioners.

-

Gree Electric Appliances Inc. of Zhuhai (China): Air conditioners, fans, and cooling devices.

-

Orient Electric Limited (India): Fans, air coolers, and air conditioners.

-

Symphony Comfort Systems Ltd. (India): Air coolers and personal cooling devices.

-

Breezair Pty Ltd. (Australia): Evaporative coolers and swamp coolers.

-

Vornado Air LLC (USA): Air circulators, fans, and coolers.

-

Climate Wizard Pty Ltd. (Australia): Evaporative cooling systems.

-

Fujitsu General Limited (Japan): Portable air conditioners and air conditioning systems.

-

Carrier Global Corporation (USA): Air conditioners, portable coolers, and cooling systems.

-

Mitsubishi Electric Corporation (Japan): Air conditioning units and cooling devices.

-

Haier Group Corporation (China): Portable air conditioners, cooling fans, and air purifiers.

-

Panasonic Corporation (Japan): Air conditioners, cooling fans, and portable air coolers.

List of companies that provide raw materials and components for the personal cooling device market:

-

3M Company

-

Honeywell International Inc.

-

LG Chem Ltd.

-

DuPont de Nemours, Inc.

-

GREE Electric Appliances Inc.

-

Mitsubishi Electric Corporation

-

Samsung Electronics Co., Ltd.

-

Panasonic Corporation

-

Nidec Corporation

-

Sinclair Group

Recent Development

-

Nov. 25, 2024 Honeywell International Inc. has agreed to sell its personal protective equipment (PPE) business to Protective Industrial Products Inc. for over $1.3 billion, with the deal expected to close by mid-2025.

-

October 9, 2024, Dyson air purifiers are offering major discounts during Amazon Prime Day, making it the perfect opportunity to invest in premium air purifiers known for their exceptional performance and smart features.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.66 Billion |

| Market Size by 2032 | USD 10.31 Billion |

| CAGR | CAGR of 4.97% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type(Personal Air Conditioner/ Desk Fans, Handheld Cooling Device) • By Price(Low-End, High-End) • By Distribution Channel(Online, Offline) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Honeywell International Inc. (USA), Dyson Ltd. (UK), LG Electronics Inc. (South Korea), O2COOL LLC (USA), Evapolar Ltd. (Russia), Personal Cooling Technologies LLC (USA), Holmes Products Corp. (USA), Sunpentown International Inc. (USA), The Coleman Company Inc. (USA), NewAir LLC (USA), Symphony Limited (India), Havells India Ltd. (India), De'Longhi S.p.A. (Italy), Bajaj Electricals Ltd. (India), Gree Electric Appliances Inc. of Zhuhai (China), Orient Electric Limited (India), Symphony Comfort Systems Ltd. (India), Breezair Pty Ltd. (Australia), Vornado Air LLC (USA), Climate Wizard Pty Ltd. (Australia), Fujitsu General Limited (Japan), Carrier Global Corporation (USA). |