Network Security Market Report Scope & Overview:

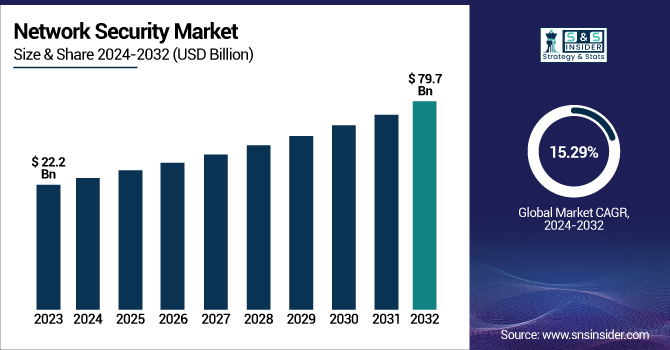

The Network Security Market was valued at USD 22.2 billion in 2023 and is expected to reach USD 79.7 billion by 2032, growing at a CAGR of 15.29% from 2024-2032.

To Get more information on Network Security Market - Request Free Sample Report

The adoption of network security solutions is accelerating across industries, with BFSI, IT & telecom, and healthcare leading due to their high data protection needs. Regionally, the increasing implementation of Zero Trust Architecture reflects a shift toward more stringent security protocols to tackle evolving cyber threats. A review of network security breach incidents from 2020 to 2023 highlights rising vulnerabilities, driving demand for advanced solutions. Additionally, the market is witnessing a growing preference for cloud-based deployments due to their scalability and operational flexibility. The report also delves into future investment trends, emerging technologies, and the competitive landscape shaping the network security market.

The U.S. network security market is driven by the increasing frequency of sophisticated cyberattacks, expanding digital infrastructure, and rising adoption of cloud-based services. With organizations prioritizing data protection, demand for advanced security frameworks like Zero Trust Architecture, multi-factor authentication (MFA), and AI-powered threat detection is accelerating.

Network Security Market Dynamics

Drivers

-

Increasing cyber threats and rising awareness of data breach risks are driving demand for advanced network security solutions.

The increasing frequency of cyber attacks, such as ransomware attacks, phishing attacks, and DDoS attacks, is one of the major factors driving the growth of the network security market. The vulnerabilities: Thanks to digital transformation initiatives, remote working arrangements, and increased connectivity of Internet of Things devices, organizations are more susceptible to cyber breaches now than ever. Hence, organizations are making big investments in forward-looking security solutions like zero-trust architecture, end-point security, and security platforms covering cloud-based networks to safeguard critical assets. Moreover, the increasing awareness of financial and reputational risks owing to data breaches is propelling enterprises to go for proactive threat detection, encryption protocols, and managed security services to harden their network safeguards.

Restraints

-

High deployment costs, integration challenges, and a shortage of skilled cybersecurity professionals limit market adoption.

High costs related to the deployment of advanced security solutions is one of the significant restraints for the network security market. Budget constraints also pose a challenge for small and medium-sized enterprises that must implement extensive security measures. Other challenges include complex or custom configurations, integration with legacy systems, and the recurring cost of maintenance. There is also a shortage of skilled cybersecurity professionals, which further hampers implementations and increases inefficiencies. To this end, impacting the overall growth of the market, the latest and advanced suite of solutions may witness poor adoption as organizations struggle to strike an optimal balance between costs and cybersecurity needs, especially in developing regions.

Opportunities

-

AI and machine learning-based security tools offer real-time threat detection, automation, and predictive security capabilities.

AI and ML adoption is on the rise, which represents a huge opportunity in the network security sector. IBM Security: AI-powered security tools analyze network traffic, identify anomalies, and help bolster threat detection with real-time alerts. It minimizes the response time and enhances the overall productivity of cybersecurity frameworks. In addition, SecOps automation allows organizations to react to cyber incidents with less human interaction. Given the complexity of the cyber landscape and the ever-growing volume of network data, AI and ML as automated solutions are going to be the major players in the future of network security to bring prediction capabilities, self-grounded action to incidents and enhance endpoint protection.

Challenges

-

Rapidly evolving cyber threats, including fileless malware and AI-driven attacks, make it difficult for organizations to maintain robust security.

One of the major challenges of the network security market is the ever-changing nature of cyber threats. A new wave of attackers is using advanced tactics like fileless malware, AI-based attacks, and cryptojacking to get around traditional security measures. This requires regular updates and upgrades to existing network security solutions, which places both operational and financial strains on organizations. Furthermore, with the increase in cloud adoption, remote access, and IoT devices, the attack surface has expanded, and organizations are struggling to ensure that security policy is enforced uniformly across distributed networks. In a world where threats evolve, security is as much about proactive response mechanisms as it is about preventive measures to protect against emerging risks and attack vectors.

Network Security Market Segmentation Analysis

By Deployment

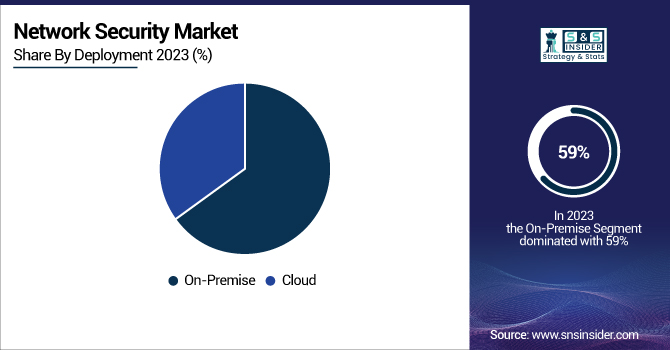

The on-premise segment dominated the market and accounted for 59% of revenue share owing to control over sensitive data in various organizations, especially in the banking, government, and healthcare sectors. On-premise solutions are employed by companies to adhere to strict regulatory compliance and lower the chance of a competitive breach external to the company. They provide configurability according to users’ needs and greater data privacy — advantages for enterprises with sensitive infrastructure.

Cloud is expected to register the fastest CAGR during the forecast period, owing to the increasing adoption of on-cloud applications, hybrid work models, and scalable security solutions. The trends of digital transformation are increasing, especially in SMEs, which push the need for economical, elastic, and remote access networking security services. Cloud-based solutions also have rapid deployment, automatic updates, and better threat intelligence.

By Type

Firewalls dominated the market and accounted for significant revenue share in 2023 as they form the first line of defense against unauthorized access, malware, and cyberattacks. Advanced firewalls are utilized in packet filtering, threat detection, and real-time network monitoring across sectors. This growth is being fuelled by the increasing adoption of the next-generation firewall, an integrated network hardware solution that combines features such as deep packet inspection, intrusion prevention, and application control. Firewalls are expected to register the fastest CAGRs as enterprises rapidly invest in NGFWs to secure hybrid networks and cloud environments. The growth is driven by the increasing deployment of virtualized and cloud-based firewalls, which offer scalable security for remote employees and cloud-native applications.

By Enterprise Type

The large enterprise segment dominated the market and accounted for a 59% revenue share in 2023, as they have complex IT infrastructures and high data volumes, which increase their exposure to cyberattacks. They turn to advanced security solutions, such as intrusion detection, endpoint protection, and zero-trust models, to protect sensitive data. As organizations move to digitize their operations faster and adopt more and more cloud services, large enterprises are still spending big bucks on multi-layered security frameworks and AI-driven threat supervision platforms.

SMEs are expected to register the fastest CAGR during the forecast period, owing to increasing awareness regarding cyber threats and the growing affordability of cloud-based security solutions. As the transition to digital acceleration continues in this vertical, SME are exposed to rising risks from ransomware, phishing, and malware incidents, leading to increasing spending floor over secure and cost-effective network security features such as firewalls, VPNs, and endpoint protection.

By Industry

The IT and telecommunications segment dominated the market and accounted for significant revenue share in 2023, owing to huge dependence on massive data networks and high vulnerability to cyber assaults. As these organizations expand their cloud infrastructure, adopt 5G, and manage an increasing amount of customer data, they are investing heavily in sophisticated tools like firewalls, intrusion detection systems, and zero-trust architecture.

The manufacturing sector is expected to register the fastest CAGR during the forecast period due to the growth caused by the adoption of Industrial Internet of Things and smart factory technologies. With digitization of manufacturing processes, operational technology and the supply chain are major attack targets for all kinds of cyberattacks. This has caused a surge in demand for cybersecurity solutions that protect both the IT and the OT environments. Moreover, regulatory requirement and industry standards are guiding manufacturers to strengthen their network defenses.

Regional Analysis

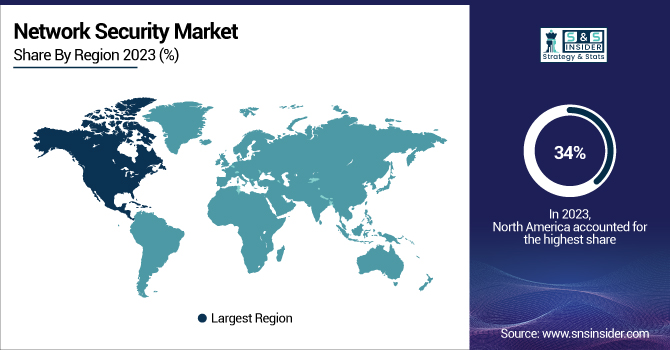

North America dominated the market and accounted for 34% of revenue share, owing to increasing utilization of advanced technologies like Cloud IoT and 5G along with the rise in cyber threats. Support of cybersecurity vendors, well defined regulatory landscapes (like CCPA, HIPAA), and investment in Zero trust architecture have made the region sit on the top.

The Asia Pacific region is projected to exhibit the fastest CAGR from 2024 to 2032, owing to the rapidly increasing pace of digital transformation across a range of industries, the growing adoption of cloud services, and rising awareness regarding cybersecurity. Countries such as China, India, and Japan are heavily investing in network infrastructure and security technologies to counter the increasing cyberattacks, especially on critical sectors such as manufacturing, BFSI, and government. Additionally, the helpful efforts of the government and regulations like CERT-IN in India are encouraging security expenditures.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players

The major key players along with their products are

-

Cisco Systems, Inc. – Cisco Secure Firewall

-

Palo Alto Networks, Inc. – Prisma Access

-

Fortinet, Inc. – FortiGate Next-Generation Firewall

-

Check Point Software Technologies Ltd. – CloudGuard Network Security

-

Juniper Networks, Inc. – SRX Series Firewalls

-

IBM Corporation – IBM QRadar

-

McAfee LLC – McAfee Total Protection

-

Symantec Corporation (Broadcom Inc.) – Symantec Endpoint Protection

-

Trend Micro Inc. – Deep Security

-

Sophos Group plc – Sophos Intercept X

-

Kaspersky Lab – Kaspersky Security Center

-

Zscaler, Inc. – Zscaler Internet Access

-

F5, Inc. – BIG-IP Advanced Firewall Manager

-

Proofpoint, Inc. – Proofpoint Email Security

-

Barracuda Networks, Inc. – Barracuda Web Application Firewall

Recent Developments

-

June 2024: Check Point Software Technologies introduced CloudGuard WAF-as-a-Service, an AI-powered, fully managed web application firewall designed to protect cloud applications and APIs from cyber threats.

-

March 2024: Island, a Dallas-based startup specializing in secure enterprise browsers, secured $175 million in Series D funding, bringing its valuation to $3 billion. This funding aims to enhance development and expand its workforce.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 22.2 Billion |

| Market Size by 2032 | USD 79.7 Billion |

| CAGR | CAGR of 15.29% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment (Cloud, On-premise) • By Type (Firewalls, Antivirus and Antimalware Software, VPN, Wireless Security, Others - Data Loss Prevention, Intrusion Prevention Systems, etc.)) • By Enterprise Size (Small & Medium Enterprises (SMEs), Large Enterprises) • By Industry (BFSI, IT and Telecommunications, Retail, Healthcare, Government, Manufacturing, Travel and Transportation, Energy and Utilities, Others - Education, etc.) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cisco Systems, Inc., Palo Alto Networks, Inc., Fortinet, Inc., Check Point Software Technologies Ltd., Juniper Networks, Inc., IBM Corporation, McAfee LLC, Symantec Corporation (Broadcom Inc.), Trend Micro Inc., Sophos Group plc, Kaspersky Lab, Zscaler, Inc., F5, Inc., Proofpoint, Inc., Barracuda Networks, Inc. |