Neurocognitive Assessment and Rehabilitation Market Report Scope & Overview:

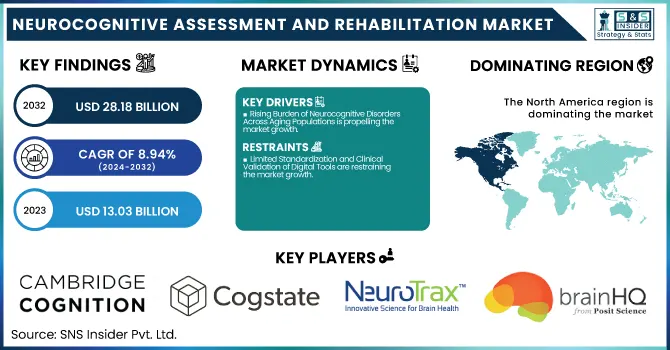

The Neurocognitive Assessment and Rehabilitation Market was valued at USD 13.03 billion in 2023 and is expected to reach USD 28.18 billion by 2032, growing at a CAGR of 8.94% from 2024-2032.

To Get more information on Neurocognitive Assessment and Rehabilitation Market - Request Free Sample Report

This report presents a distinctive view of the Neurocognitive Assessment and Rehabilitation Market by emphasizing key data-driven insights. It provides the most recent neurocognitive disorder prevalence statistics and usage patterns of cognitive evaluation tools and therapy interventions in healthcare and research environments. Further, it monitors the number of assessments and rehabilitation sessions performed regionally, along with funding and investment in neurocognitive technologies. The report further mentions the rising integration of digital health and telehealth solutions, providing a foresight perspective on virtual cognitive care adoption worldwide.

The U.S. Neurocognitive Assessment and Rehabilitation Market was valued at USD 2.94 billion in 2023 and is expected to reach USD 6.16 billion by 2032, growing at a CAGR of 8.56% from 2024-2032. The United States possesses the largest percentage of the Neurocognitive Assessment and Rehabilitation Market in North America. This is influenced by the country's well-developed healthcare infrastructure, high-level government support for mental health initiatives, and the presence of major neurotechnology firms and research institutions.

Market Dynamics

Drivers

-

Rising Burden of Neurocognitive Disorders Across Aging Populations is propelling the market growth.

The rising incidence of neurodegenerative and cognitive diseases among the world's aging population is the principal growth driver of the market for neurocognitive assessment and rehabilitation. More than 55 million individuals globally had dementia in 2023, and close to 10 million new cases are added every year, a high percentage of which are due to age-related cognitive decline, states the World Health Organization. In America alone, the Alzheimer's Association estimates that almost 13 million Americans will have Alzheimer's disease by 2050. Governments and healthcare professionals are being driven towards early screening and bespoke rehabilitation processes by this increasing burden. Recent developments like America's U.S. NIH's "BRAIN Initiative" and the European Union's "Neurodegeneration Research Project" also underscore the increasing focus on creative, scalable neurocognitive care solutions to address this need.

-

Advancement in Digital Therapeutics and Remote Cognitive Tools is driving the market growth.

The recent boom in digital health technologies has transformed neurocognitive rehabilitation and assessment by increasing the availability of tools, scalability, and data richness. Digital therapeutics platforms like Pear Therapeutics' reSET and Cambridge Cognition's CANTAB Connect have demonstrated strong clinical effects by integrating cognitive training with data-driven feedback. As per the Digital Therapeutics Alliance, worldwide deployment of digital cognitive health tools increased by more than 30% in 2023, spurred mainly by home care demand and telehealth growth. Moreover, wearable EEG headsets and cognition apps on phones have made in-home real-time assessment and home therapy delivery a reality. Key examples include EEG headsets offered by Emotiv, utilized today in clinician and consumer cognitive monitoring. These developments not only enhance compliance among patients but also enable real-time monitoring, resulting in earlier intervention and better outcomes, particularly among underserved or rural populations.

Restraint

-

Limited Standardization and Clinical Validation of Digital Tools are restraining the market growth.

One of the major constraints in the Neurocognitive Assessment and Rehabilitation Market is the absence of standardized procedures and extensive clinical validation for most digital tools and therapy platforms. Although there are several mobile apps, wearables, and artificial intelligence-powered cognitive assessment solutions that have reached the market, they have not all been subject to extensive peer-reviewed trials or regulatory certifications. This introduces inconsistency in clinical results and challenges healthcare providers to implement these technologies in various patient populations. Additionally, in the absence of standardized guidelines, it becomes challenging to compare tools, which impedes their incorporation into mainstream healthcare systems. For example, inconsistency in methodologies used by platforms such as BrainCheck or NeuroTrax can impact diagnostic accuracy. This constraint also affects reimbursement entitlement, since payers insist on explicit proof of effectiveness before coverage approval, ultimately hindering mass adoption and confidence in nascent digital neurocognitive technologies.

Opportunities

-

The convergence of artificial intelligence (AI) and machine learning (ML) in neurocognitive testing presents a transformative potential for the market.

AI-based solutions can process massive volumes of data from EEG, eye-tracking, speech patterns, and behavioral inputs to identify subtle impairments much earlier than conventional techniques. Solutions such as Cambridge Cognition's AI-augmented CANTAB and SyncThink's EYE-SYNC are already leveraging predictive analytics to enhance diagnosis speed and accuracy. Furthermore, machine learning allows for customization of rehabilitation protocols, improving therapy outcomes over time. With advances in cloud computing and real-time processing, these AI solutions can be implemented even in remote or resource-constrained environments. This opens up immense potential for worldwide expansion, particularly in early screening programs, clinical trials, and remote patient monitoring, ultimately enabling more proactive, scalable neurocognitive care.

Challenges

-

Data Privacy and Ethical Concerns in Cognitive Monitoring are challenging the market growth.

As digital neurocognitive devices gather sensitive brain information, behavioral measurements, and health histories, providing strong data privacy and ethical use has become a major issue. These systems tend to depend upon cloud-based environments, AI algorithms, and cross-platform data interchange, which is causing concerns over data ownership, informed consent, and abuse. For instance, wearable EEG headsets or mobile mental health applications might collect ongoing biometric and cognitive information that could be used against individuals if not appropriately protected. There are regulatory systems like HIPAA (United States) and GDPR (Europe) that have stringent compliance mandates, but many of these new technologies remain in areas of legal ambiguity. This gives healthcare organizations and patients pause, especially in the realm of mental health, where stigma and trust are essential. Not addressing these issues may inhibit user uptake and constrain the wider integration of digital neurocognitive technologies into mainstream care systems.

Segmentation Analysis

By Assessment Type

The Cognitive Assessment segment dominated the neurocognitive assessment and rehabilitation market with a 56.20% market share in 2023 because of its ubiquitous use in the early diagnosis, monitoring, and treatment planning of neurological and psychiatric disorders. Cognitive assessments are critical instruments utilized to assess basic brain functions, including memory, attention, language, and executive function, which are frequently compromised in disorders such as Alzheimer's disease, ADHD, traumatic brain injury (TBI), and schizophrenia. The increasing worldwide burden of such diseases, along with growing awareness and the trend towards early intervention, strongly propelled the demand for cognitive testing. Solutions like CANTAB Connect, Cogstate Brief Battery, and MindStreams were highly embraced by hospitals, research centers, and even digital health platforms. Additionally, the development of digital cognitive assessment solutions—providing remote, real-time, and AI-based assessments—further solidified this segment's leadership in 2023.

By Application

The Educational Settings segment is the fastest growing at the highest rate in the forecast years in the Neurocognitive Assessment and Rehabilitation Market, owing to various major reasons. One of the primary reasons is growing awareness of the significance of early cognitive evaluation to diagnose learning disabilities, ADHD, and other neurodevelopmental conditions in students. Educational institutions are finding growing use of neurocognitive instruments for adapting learning interventions and enhancing student performance. The use of digital technologies within classrooms and the increased utilization of cognitive-progress-tracking education apps are supporting the growth in this segment. Universities and schools are employing cognitive tests to measure attention, memory, and problem-solving abilities so that students get a tailored learning experience. The COVID-19 pandemic also hastened the adoption of digital platforms in education, widening the use of remote cognitive testing and rehabilitation solutions. With increasing awareness of cognitive health among children and adolescents, educational institutions are becoming central settings for neurocognitive intervention and rehabilitation, fueling strong growth in this segment.

By Therapy Type

The Cognitive Behavioral Therapy (CBT) dominated the Neurocognitive Assessment and Rehabilitation Market with a 58.46% market share in 2023 because of its strong established success in the treatment of a broad spectrum of cognitive and behavioral disorders. CBT is an evidence-supported, standard therapy that targets the recognition and modification of negative thought processes, which is advantageous for treating disorders such as depression, anxiety, schizophrenia, PTSD, and ADHD. Its ability to treat both the cognitive and affective components of these disorders also makes it an ideal approach in clinical and rehab environments. CBT's increasing merger with digital interfaces, such as virtual therapy sessions, mobile apps, and AI-based tools, has made it more accessible and popular. Accessibility is particularly crucial following the pandemic, where telehealth and remote therapy services experienced a boom. Its cost-effectiveness, capacity to achieve long-term outcomes, and growing body of research substantiating the effectiveness of CBT were responsible for its market leadership in 2023, as healthcare professionals were looking for evidence-based and scalable therapies.

By End User

The Hospitals segment dominated the Neurocognitive Assessment and Rehabilitation Market with 62.30% market share in 2023, owing to the pivotal function of hospitals in offering thorough, specialized treatment for patients with neurocognitive disorders. Hospitals possess the required infrastructure, clinical skills, and multidisciplinary teams to conduct detailed cognitive exams and provide various forms of rehabilitation therapies for patients suffering from conditions such as Alzheimer's disease, stroke, TBI, and schizophrenia. Hospitals are generally the point of entry for patients looking to be diagnosed and treated for cognitive impairment. Demand for neurocognitive testing and interventions will be greatest in such environments because of the presence of specialized diagnostic equipment, including neuroimaging and sophisticated cognitive testing, as well as trained personnel to provide test interpretation. Hospitals also provide one-stop care solutions, integrating cognitive testing with therapy options such as cognitive behavioral therapy (CBT), occupational therapy, and speech therapy. While the number of patients with neurocognitive disorders is on the rise, hospitals remain the most sought-after health providers for quality, comprehensive care, solidifying their market leadership.

Regional Analysis

North America dominated the Neurocognitive Assessment and Rehabilitation Market with a 32.10% market share in 2023, as it has an advanced healthcare setup, early incorporation of cutting-edge neurotechnologies, and dominance by major industry players like Cambridge Cognition Ltd., Cogstate Ltd., and Pear Therapeutics. High expenditures on healthcare, large investments in mental health initiatives, and far-reaching awareness among people of neurological disorders such as Alzheimer's disease and schizophrenia benefit the region. Moreover, strong clinical research operations, supportive reimbursement policies, and growing demand for digital cognitive tests in clinical and educational institutions support North America's dominant market share. The availability of high-tech medical equipment and trained personnel also complements the region's position. Further, continuous innovation in neurocognitive interventions and government-sponsored mental illness programs supports market penetration.

The Asia Pacific is the fastest-growing region with a 9.44% CAGR throughout the forecast period and is spurred on by increasing healthcare expenditure, expanding elderly population, and rising awareness of mental health and neurodegenerative diseases. China, India, and Japan are heavily investing in healthcare digitalization and rehab services, which are spurred by government incentives and increasing numbers of cognitive impairments. In addition, rising use of mobile health technologies, enhanced access to diagnostic equipment, and an uptick in clinical research partnerships with international companies are driving the growth of the market in the region. Urbanization and expanding middle-class populations are also generating demand for affordable and accessible neurocognitive solutions. Moreover, growing funding in AI-based healthcare innovations is facilitating the accelerated adoption of cognitive assessment tools into standard care.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Market Players

-

Cambridge Cognition Ltd. (CANTAB Mobile, CANTAB Connect)

-

Cogstate Ltd. (Cogstate Brief Battery, Cogstate Clinical Trials)

-

NeuroTrax Corp. (MindStreams, NeuroTrax Cognitive Assessment)

-

Posit Science Corporation (BrainHQ, DriveSharp)

-

Pear Therapeutics, Inc. (reSET, reSET-O)

-

Medtronic plc (Deep Brain Stimulation System, Percept PC Neurostimulator)

-

NeuroSky, Inc. (MindWave Mobile, MindWave EEG Headset)

-

Elekta AB (Gamma Knife Icon, Elekta Neuromag)

-

BrainCheck, Inc. (BrainCheck Sport, BrainCheck Memory)

-

HeadCheck Health, Inc. (HeadCheck Pro, HeadCheck Concussion App)

-

NeuroPace, Inc. (RNS System, NeuroPace Clinician Programmer)

-

NovaVision, Inc. (NeuroEyeCoach, Vision Restoration Therapy)

-

Compumedics Limited (Somte PSG, Grael HD-EEG)

-

Emotiv Inc. (EmotivPRO, Insight EEG Headset)

-

Lumos Labs, Inc. (Lumosity, Lumosity for Teams)

-

Braintale (Braintale-care, Braintale-score)

-

SyncThink Inc. (EYE-SYNC, EYE-SYNC Portal)

-

MyndYou Inc. (MyndYou Voice Analytics, MyndYou Remote Care)

-

Oxford Cognitive Labs (CognICA, VSTMemory)

-

Neuroelectrics (Starstim, Enobio)

Suppliers (These suppliers commonly provide microprocessors, sensors, and integrated circuits (ICs) essential for EEG headsets, brain monitoring systems, and digital therapeutics platforms.) in the Neurocognitive Assessment and Rehabilitation Market

-

Texas Instruments

-

Analog Devices, Inc.

-

Intel Corporation

-

NXP Semiconductors

-

STMicroelectronics

-

Qualcomm Technologies, Inc.

-

ON Semiconductor

-

Micron Technology, Inc.

-

Broadcom Inc.

-

TDK Corporation

Recent Developments

-

January 2025 – Cambridge Cognition has praised Bristol Myers Squibb on the FDA approval of Cobenfy (KarXT), a newly synthesized schizophrenia drug. The medication has reported encouraging outcomes in clinical trials, representing a breakthrough in managing the condition.

-

In October 2023, BrainCheck, Inc. officially released its BrainCheck Screen platform at the Clinical Trials on Alzheimer's Disease (CTAD) conference in Boston, Massachusetts. This release represented a major milestone in the company's continued effort to advance its full-service, end-to-end cognitive care solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 13.03 Billion |

| Market Size by 2032 | US$ 28.18 Billion |

| CAGR | CAGR of 8.94 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Assessment Type (Cognitive Assessment, Behavioral Assessment, Functional Assessment) •By Application (Clinical Evaluation, Educational Settings, Research Development) •By Therapy Type (Cognitive Behavioral Therapy, Occupational Therapy, Speech Therapy) •By End User (Hospitals, Rehabilitation Centers, Research Institutions) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cambridge Cognition Ltd., Cogstate Ltd., NeuroTrax Corp., Posit Science Corporation, Pear Therapeutics, Inc., Medtronic plc, NeuroSky, Inc., Elekta AB, BrainCheck, Inc., HeadCheck Health, Inc., NeuroPace, Inc., NovaVision, Inc., Compumedics Limited, Emotiv Inc., Lumos Labs, Inc., Braintale, SyncThink Inc., MyndYou Inc., Oxford Cognitive Labs, Neuroelectrics, and other players. |