Nitrocellulose Market Scope & Overview:

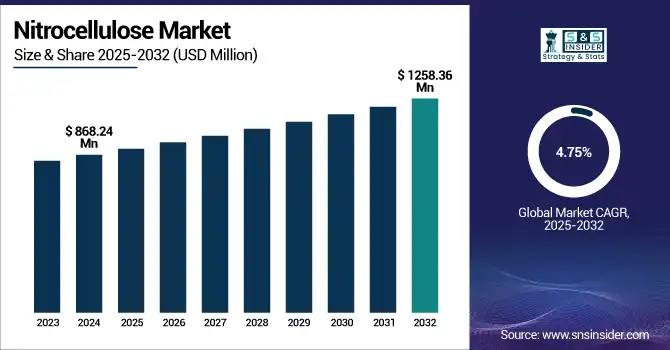

The Nitrocellulose Market size was valued at USD 904.78 million in 2024 and is expected to reach USD 1258.36 million by 2032, growing at a CAGR of 4.21% over the forecast period of 2025-2032.

The strong growth market of nitrocellulose is driven by increasing industrial nitrocellulose applications in digital printing, sustainable packaging, and automotive coatings. The nitrocellulose market is driven by increasing usage of nitrated cellulose derivatives in conductive inks and eco-friendly finishes, due to low-VOC regulations proposed by the U.S. EPA. Leading nitrocellulose companies, including DuPont de Nemours and Synthesia a.s., are focused on R&D to develop bio-based solvents in order to increase their nitrocellulose market share.

In May 2023, production at EURENCO's Bergerac site re-commenced and by 2024 an upgraded capacity of 1,200 tons/year is expected to be reached, with the intention to reach €1 billion in sales by 2030. These factors, along with continuous nitrocellulose market research & development and innovation, are aiding the expansion of the cellulose nitrate market size over the packaging, automotive, and electronics sectors.

To Get more information on Nitrocellulose Market - Request Free Sample Report

Key Nitrocellulose Market Trends

-

Rising demand in paints & coatings for quick-drying and glossy finishes

-

Increasing use in printing inks driven by packaging industry growth

-

Shift toward bio-based and sustainable raw material sourcing

-

Expanding applications in cosmetics, especially nail varnishes

-

Higher regulatory focus on safety, storage, and environmental compliance

-

Development of specialty grades for explosives and defense applications

Nitrocellulose Market Growth Drivers

-

Rising Demand for Low-VOC Coatings Accelerates Industrial Nitrocellulose Uses Across Sectors

Stricter air emission regulations in the U.S. and Europe have increased the demand for low-VOC coatings. Nitrocellulose coatings, applied broadly in automotive and wood finishing, dry quickly and achieve a high gloss while maintaining a low environmental impact. This is based by the media release stating that low-VOC coatings are experiencing growth of over 7% per year from 2020 to 2023, according to the American Environmental Protection Agency’s National Emissions Inventory. Trends in the nitrocellulose market now reflect a consistent shift toward eco-friendly formulations. Key players, such as Synthesia and DuPont, are investing in compliant nitrocellulose products, thereby enhancing their market share growth within the regulatory framework and innovating in nitrated cellulose derivatives.

-

Surge in Digital Printing Fuels Adoption of Nitrated Cellulose Derivatives in Packaging

The expanding market of digital printing has opened new ways for nitrated cellulose derivatives, notably in fast-drying, flexible inks. Global digital packaging print output in 2023 was USD 27 billion, according to the International Digital Printing Association. According to market surveys, some 40% of packaging inks are now based on nitrocellulose due to its adhesion and fast-drying properties. These features make it well-suited for print-on-demand labeling, e-commerce, and retail branding scenarios. With the trend toward individualized and high-quality printing reaching the masses, the nitrocellulose market is taking a turn in flexible packaging with the strong versatility of products in the cellulose nitrate market in digital spaces.

Nitrocellulose Market Restraints

-

Safety Concerns regarding nitrocellulose handling impede industry-wide adoption in emerging economies

Nitrocellulose is a hazardous material, and its production and storage are subject to strict regulations. In each of the past three years, the U.S. Occupational Safety and Health Administration recorded about 15 mishaps classified as involving nitrocellulose storage. Manufacturers eyeing the above solutions for emerging markets in countries that do not have the hazmat infrastructure and the enforcement that it takes to handle these technologies, the newsletters claim they are not the solution. These questions drive up the cost of insurance, the cost of facility upgrades, and create logistical obstacles. Thus, according to the nitrocellulose market trends, its adoption is witnessing a slower rate in Southeast Asia and a few parts of Latin America, despite an upsurge in demand. This can restrain the market share of nitrocellulose across developing regions with high growth potential.

Nitrocellulose Market Segment Analysis:

By Type

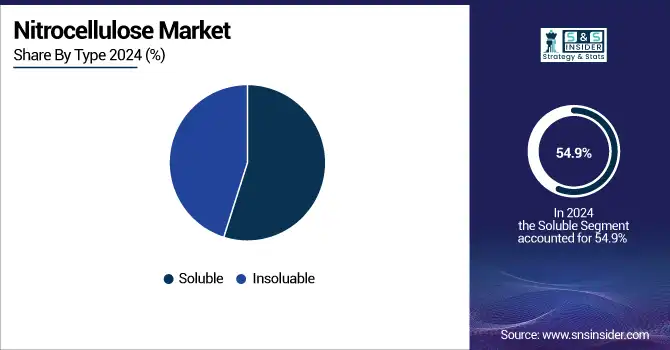

Soluble nitrocellulose dominated the nitrocellulose market in 2024 with a 54.9% share. It is commonly used for printing inks and coatings due to its organic solvent solubility and good resin compatibility. According to the U.S. Environmental Protection Agency, the demand for low-VOC coatings will grow 7% annually between 2020 and 2023, which will continue to promote more widespread usage. Big nitrocellulose companies, Synthesia a.s. or DuPont, have increased their production of soluble nitrocellulose. This market dominance of this segment is due to the growing industrial nitrocellulose use for eco-friendly applications, especially in countries that have adopted stringent environmental legislations, thereby promoting a stable nitrocellulose market growth and increased nitrocellulose market share globally.

Insoluble nitrocellulose emerged as the fastest-growing type in the forecast period of 2025-2032 with a CAGR of 4.98%. It finds value in defense and aerospace by its high nitrogen content and energetic properties. DoD funding for advanced propellants grew 15% in 2023, helping drive the segment’s growth. The nitrocellulose market report reveals that firms like Nitro Química and EURENCO are planning to invest in high-purity nitrated cellulose derivatives. Soluble nitrocellulose will always have a market due to its flexibility with other resins and its cost effectiveness, but in the future, the demand for insoluble nitrocellulose, which can also be applied in military grade products, can only increase, pointing towards a clear trend in specialist performance areas within industrial nitrocellulose applications.

By Application

Printing inks dominated the nitrocellulose market and held the largest share in 2024, accounting for 37.1%. Nitrocellulose-based inks are favored for their rapid drying, excellent adhesion, and brilliant print quality on flexible packaging and labels. Low-VOC ink use grew to 8% in 2022, according to the U.S. Environmental Protection Agency. Leading nitrocellulose companies, including Flint Group and Siegwerk, have increased their portfolios in response to demand from the food and e-commerce markets. Printing inks are a key application area in the cellulose nitrate market, indicating the sustained use of the demand in the packaging and branding sectors, in particular, in regional markets that are looking for sustainable and compliant printing solutions.

Wood coatings recorded the highest CAGR of 6.41% in the forecast period of 2025-2032 in the nitrocellulose market. These coatings are known for a high gloss finish, fast drying, and long life in furniture, cabinetry, and interior design. The U.S. Department of Housing and Urban Development reported a 9% increase in single-family housing as compared to 2022, driving demand for premium wood finishes. Nitrocellulose market analysis demonstrates the rise in innovation initiatives by companies such as PPG and Sherwin-Williams in crafting nitrocellulose lacquers that are resistant to scratches. This inflow indicates movement towards aesthetic and performance-oriented applications in residential and commercial buildings and thereby fuelling industrial nitrocellulose uses in the construction industry.

By End-User Industry

Packaging is the dominating end-user segment in 2024 with a 38.2% nitrocellulose market share. This increase is being fueled in part by greater reliance on flexible packaging for consuming food, beverages and pharmaceuticals. Nitrocellulose delivers quick drying and can be applied to a variety of substrates. According to Eurostat, sustainable packaging penetration increased from 2021 to 2023 by 12% in the EU. Companies in the nitrocellulose business, such as Siegwerk, are developing low-VOC, recyclable inks and coatings specifically for this market. The influence of this packaging-centric trend illustrates the increased consumer demand for environmentally friendly and cost-effective materials, thus underlining the relevance of nitrated cellulose derivatives in the context of future packaging advancements.

The automotive segment is projected to be the fastest-growing sector with a CAGR of 5.57% in the forecast period of 2025-2032 in the nitrocellulose market. The auto painting industry has a high demand for gloss, hard-dry, and fast-dry coatings for automobiles. Vehicle exports in India rose 8% in 2023, according to the Indian Ministry of Commerce and Industry, boosting demand for premium coatings. PPG, Sherwin-Williams, and others are developing nitrocellulose automotive coatings that have improved ultraviolet (UV) and chemical resistance. Analysis of the nitrocellulose market also reveals a strong demand for vehicle manufacturing and refinish, which has given automotive a hindrance as one of the fastest-growing industrial nitrocellulose uses in developing countries, where the automotive industry is experiencing explosive growth.

Nitrocellulose Market Regional Insights

Asia Pacific Nitrocellulose Market Insights

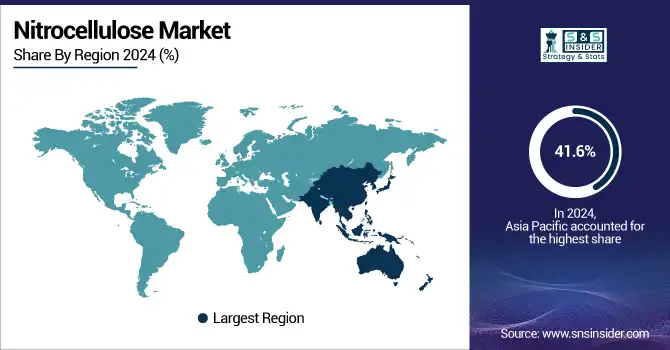

Asia Pacific holds a major share of the nitrocellulose market with 41.6%, which is primarily driven by the rapid industrialization growth and the growing automotive & electronics commercial sectors in countries, such as China, Japan & India. Chinese governmental initiatives towards the indigenous production of cellulose nitrate and advancements in the cellulose nitrate derivatives are driving the growth of the market. Asia Pacific nitrocellulose market size indicates a surge in the utilization of nitrocellulose for coatings and inks in packaging, due to increasing consumer preference and manufacturability. Due to the heightened demand, key players, such as Synthesia and Nippon Paint are further expanding their production capacities, facilitating strong market growth of nitrocellulose while bolstering Asia Pacific’s dominance in the industrial nitrocellulose applications.

North America Nitrocellulose Market Insights

The market in North America, anticipated to register a growth rate of 5.54% during the period between 2025 and 2032, as evidenced by a solid focus on industrial nitrocellulose applications in the automotive and packaging fields. The U.S. is a major nitrocellulose market with a market size valued at USD 132.84 million and a market share of 67% in 2024, due to regulatory support for low-VOC coatings supplemented by policies of the Environmental Protection Agency (U.S.) toward the sustainability of nitrocellulose-based products. To meet increasing demand, Canadian manufacturers are increasing their production of cellulose nitrate. The surge in demand is predominantly attributed to the development of nitrated cellulose derivatives for environmentally friendly printing inks and automotive paints, and by growing capital inflow from prominent nitrocellulose manufacturers concentrating on modern cellulose nitrate market developments.

Europe Nitrocellulose Market Insights

Europe is the second-dominant region and accounts for a market share of 19.4% nitrocellulose, owing to strict environmental norms promoting the use of green nitrated cellulose derivatives in the packaging industry and wood finishes. Market participants including Germany and France are the prominent contributors, with government efforts supporting eco-friendly industrial nitrocellulose applications in coatings and inks. Eurostat’s statistics indicate the growth of the cellulose nitrate market driven by elevated recycling obligations. EU nitrocellulose manufacturers are developing low-emission formulations in compliance with regional nitrocellulose market trends that favor environment-friendly low low-volatile organic compound (VOC) emitting products, thereby helping to sustain a steady growth in the nitrocellulose market in the region.

Latin America (LATAM) and Middle East & Africa (MEA) Nitrocellulose Market Insights

The nitrocellulose market in LAMEA is a developing growth region, with an increase in automotive production, packaging, and construction applications in Brazil, Mexico, the UAE, and Saudi Arabia. Government efforts towards environment-friendly industrial uses of nitrocellulose, like incentives to environmentally safe cellulose nitrate-based coatings, have helped accelerate developments from indigenous nitrocellulose firms. Information from the Ministry of Industry of Brazil and the report of Saudi Vision 2030 suggest the increasing use of nitrated cellulose derivatives in wood coatings, printing inks, and infrastructure. The increasing awareness toward environmental compliance and economic diversification endeavors has also lent hinderance to the growth of the nitrocellulose market and investment opportunities in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Competitive Landscape for Nitrocellulose Market

International Flavors & Fragrances (IFF)

IFF is a global leader in specialty chemicals, fragrances, and ingredients, with a diverse product portfolio serving food, beverage, and industrial applications. The company also operated in chemical intermediates such as nitrocellulose before divestment.

-

In May 2025, IFF sold its German nitrocellulose business to the Czechoslovak Group, enabling the latter to expand its chemical manufacturing portfolio and strengthen its position in nitrated cellulose derivatives across Europe.

Rheinmetall AG

Rheinmetall is a leading defense and automotive supplier, providing advanced weapons, ammunition, and material solutions, including nitrocellulose-based propellants for the defense sector.

-

In April 2025, Rheinmetall secured nitrocellulose supplies amid European ammunition shortages, ensuring steady production of military propellants and supporting defense readiness during heightened geopolitical tensions in the region.

BAE Systems

BAE Systems is a global defense, aerospace, and security company, specializing in advanced weapons systems, ammunition, and explosives technologies.

-

In April 2025, BAE Systems developed explosives without nitrocellulose or nitroglycerin, enhancing safety and reducing environmental impact, marking a significant advancement in eco-friendly military explosives technology.

Nitrocellulose Market Comapnies are:

-

DuPont de Nemours, Inc.

-

Synthesia a.s.

-

EURENCO

-

TNC Industrial Co., Ltd.

-

Hagedorn-NC GmbH

-

Hengshui Orient Chemical Co., Ltd.

-

Sichuan Nitrocell Corporation

-

Nobel NC

-

Nitrochemie Aschau GmbH

-

North Sichuan Nitrocellulose Co., Ltd.

-

IVM Chemicals Srl

-

Nantong Tailida Chemical Co., Ltd.

-

Anhui Tiger Coatings Co., Ltd.

-

Nitro Química (Brazil) (keep global identity distinct from regional ops if needed)

-

DowDuPont Specialty Products (Coatings division)

-

Nitrocellulose Group GmbH

-

KC Nitrocellulose Pvt. Ltd.

-

Nitrochemia SA

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 904.78 million |

| Market Size by 2032 | USD 1,258.36 million |

| CAGR | CAGR of 4.21% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Soluble, Insoluble) •By Application (Printing Inks, Automotive Paints, Wood Coatings, Leather Finishes, Nail Varnishes, Others) •By End-User Industry (Automotive, Electronics, Packaging, Textiles, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Nitro Química, DuPont de Nemours, Inc., Synthesia a.s., EURENCO, TNC Industrial Co., Ltd., Nitrex Chemicals India Ltd., Hagedorn-NC GmbH, Hengshui Orient Chemical Co., Ltd., Sichuan Nitrocell Corporation, and Nobel NC |