Electronic Chemicals CDMO & CRO Market Report Scope & Overview:

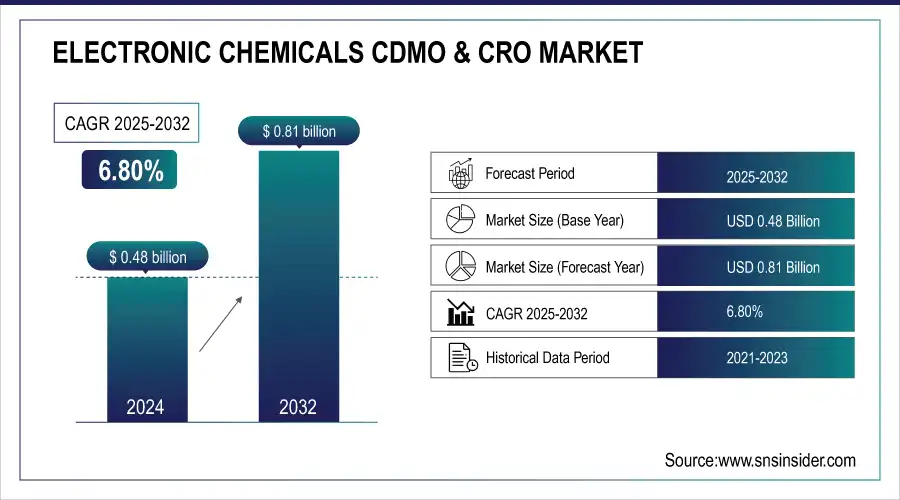

The Electronic Chemicals CDMO & CRO Market Size was valued at USD 0.48 Billion in 2024 and is expected to reach USD 0.81 Billion by 2032, growing at a CAGR of 6.80% over the forecast period of 2025-2032.

To Get more information on Electronic Chemicals CDMO & CRO Market - Request Free Sample Report

The Electronic Chemicals CDMO & CRO Market is evolving rapidly, driven by innovation, sustainability, and cost efficiency. Our report explores a comprehensive supply chain analysis, mapping key suppliers and manufacturing hubs that influence market dynamics. As investments surge, investment and funding trends highlight major mergers, acquisitions, and strategic collaborations shaping the competitive landscape. Cost pressures continue to rise, and cost structure analysis breaks down raw material, production, and logistics expenses. With a shift toward efficiency, raw material substitution trends examine emerging alternatives transforming chemical formulations. Meanwhile, sustainability is at the forefront, and sustainability and green chemistry trends uncover the growing adoption of eco-friendly processes and regulatory influences driving the future of electronic chemicals manufacturing.

Electronic Chemicals CDMO & CRO Market Size and Forecast:

-

Market Size in 2024: USD 0.48 Billion

-

Market Size by 2032: USD 0.81 Billion

-

CAGR: 6.80% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Key Electronic Chemicals CDMO & CRO Market Trends:

-

Rising demand for high-purity electronic chemicals drives contract development and manufacturing outsourcing to enhance product quality and reduce operational costs.

-

Advancements in process chemistry and precision synthesis improve yield, consistency, and scalability, enabling more complex semiconductor and electronic material production.

-

Integration of AI, automation, and digital monitoring in CDMO & CRO facilities enhances process optimization, predictive maintenance, and quality assurance.

-

Growing adoption of environmentally sustainable and low-waste chemical processes supports regulatory compliance and reduces ecological impact in semiconductor and electronics manufacturing.

-

Expansion of semiconductor, display, and battery industries fuels increased demand for customized chemical solutions from contract development and manufacturing organizations.

-

Collaborations between OEMs and CDMO/CRO providers accelerate R&D, shorten time-to-market, and facilitate innovation in next-generation electronic materials.

-

Focus on high-reliability applications, such as memory chips, processors, and advanced displays, drives demand for specialized, high-performance chemicals.

Electronic Chemicals CDMO & CRO Market Drivers:

-

Integration of Artificial Intelligence and Automation in Chemical Development for Improved Efficiency and Precision

The integration of artificial intelligence (AI) and automation in chemical development is revolutionizing the Electronic Chemicals CDMO and CRO Market by enhancing efficiency, reducing production errors, and accelerating formulation optimization. AI-driven chemical synthesis and automated laboratories enable precise control over reaction conditions, ensuring consistent product quality and purity. Advanced data analytics help identify new chemical formulations that meet stringent semiconductor industry requirements. Additionally, automation streamlines process scalability, allowing manufacturers to meet increasing demand without compromising quality. The incorporation of AI also reduces waste and energy consumption, aligning with sustainability goals in chemical manufacturing. Companies in the electronic chemicals sector are leveraging AI-based predictive modeling to enhance material performance, improve yield rates, and meet evolving customer specifications. As the semiconductor industry continues to demand highly specialized chemicals, AI-driven innovations in contract chemical development and manufacturing services will become a key growth driver for the market.

Electronic Chemicals CDMO & CRO Market Restraints:

-

High Initial Investment and Operating Costs for Setting Up Specialized Chemical Development Facilities

Establishing and operating electronic chemical development and manufacturing facilities requires substantial investment, which acts as a major restraint in market expansion. Electronic Chemicals CDMO and CRO companies must invest in high-purity production equipment, cleanroom environments, regulatory compliance measures, and quality control systems to meet the stringent requirements of semiconductor and electronics manufacturing. The cost of specialized raw materials, precision synthesis processes, and waste management infrastructure adds to the financial burden. Small and medium-sized enterprises (SMEs) often struggle to compete due to these high entry barriers. Additionally, fluctuations in raw material prices and the need for continuous technological upgrades further increase operational costs. These financial challenges limit new market entrants and slow down the expansion of existing players, affecting overall industry growth.

Electronic Chemicals CDMO & CRO Market Opportunities:

-

Expansion of 5G, IoT, and Electric Vehicles Fueling Demand for Advanced Electronic Chemicals

The rapid expansion of 5G networks, Internet of Things (IoT) applications, and electric vehicles (EVs) is driving demand for advanced electronic chemicals, presenting a lucrative opportunity for Electronic Chemicals CDMO and CRO firms. These emerging technologies require highly specialized chemicals for semiconductor fabrication, printed circuit board (PCB) manufacturing, and sensor development. 5G infrastructure, in particular, relies on high-frequency semiconductor materials, while IoT devices demand miniaturized components with precise chemical coatings. Additionally, the growing adoption of electric vehicles necessitates innovative battery materials, advanced etchants, and deposition chemicals to enhance energy storage efficiency. As these industries expand, contract chemical manufacturers and research organizations specializing in high-purity and custom chemical formulations will witness increasing collaborations with technology companies, boosting market growth.

Electronic Chemicals CDMO & CRO Market Challenges:

-

Intense Competition and Differentiation Struggles Among Electronic Chemicals Contract Manufacturers

The highly competitive nature of the Electronic Chemicals CDMO and CRO Market presents a major challenge for companies striving to differentiate their offerings. As demand for outsourced chemical development services grows, an increasing number of players are entering the market, leading to pricing pressures and reduced profit margins. Established manufacturers with strong R&D capabilities and proprietary chemical formulations have a competitive edge, while smaller firms struggle to establish credibility and secure long-term contracts. Differentiation in terms of unique product formulations, technological innovation, and sustainability practices is critical for market success. Additionally, maintaining high-quality standards while keeping costs competitive remains a challenge, as semiconductor and electronics manufacturers demand precision and consistency. Companies must invest in innovation, regulatory compliance, and customer-centric solutions to gain a sustainable competitive advantage.

Electronic Chemicals CDMO & CRO Market Segmentation Analysis:

By Type, High-Purity Solvents Dominate Electronic Chemicals CDMO & CRO Market with 28.1% Share in 2024

High-purity solvents dominated the Electronic Chemicals CDMO and CRO Market in 2024 with a 28.1% market share, driven by their critical role in semiconductor fabrication, display manufacturing, and advanced electronics. The Semiconductor Industry Association (SIA) highlighted the increasing demand for ultra-clean solvents in photolithography, wafer cleaning, and etching processes, particularly for advanced nodes below 5nm. Additionally, the U.S. government’s CHIPS and Science Act, which allocates $52 billion for domestic semiconductor production, has boosted solvent demand for new fabrication plants. Leading chemical suppliers, including BASF and Entegris, have expanded their high-purity solvent production facilities to meet the rising needs of semiconductor manufacturers. With the growing emphasis on defect-free chip production and the miniaturization of electronic components, high-purity solvents remain indispensable in maintaining process efficiency and product quality.

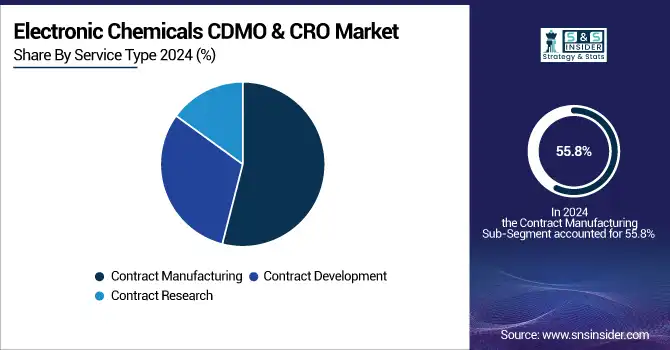

By Service Type, Contract Manufacturing Leads Electronic Chemicals CDMO & CRO Market with 55.8% Share in 2024

Contract manufacturing dominated the Electronic Chemicals CDMO and CRO Market in 2024 with a 55.8% share, owing to the increasing outsourcing of chemical production by semiconductor and electronics companies. The trend is fueled by the high cost of in-house chemical synthesis and the need for regulatory compliance, driving companies to partner with specialized CDMO firms such as Fujifilm Electronic Materials and Merck KGaA. The European Chemical Industry Council (CEFIC) has reported a rise in contract-based chemical production due to stringent environmental regulations requiring sustainable manufacturing practices. Furthermore, the expansion of semiconductor fabrication plants in Asia-Pacific, supported by government initiatives such as China’s "Made in China 2025" plan, has driven demand for contract manufacturing services to ensure a reliable supply of specialty electronic chemicals.

By Application, Etchants Hold Largest Share in Electronic Chemicals CDMO & CRO Market at 21.3% in 2024

Etchants dominated the Electronic Chemicals CDMO and CRO Market in 2024, accounting for 21.3%, due to their essential role in semiconductor and printed circuit board (PCB) fabrication. The International Semiconductor Industry Association (ISIA) has emphasized the increasing use of advanced etching chemicals for high-density chip designs and 3D NAND memory applications. The growing adoption of deep reactive-ion etching (DRIE) for microelectromechanical systems (MEMS) and sensor manufacturing has further boosted demand. Government-funded semiconductor research programs, such as the European Union’s “Chips for Europe” initiative, are encouraging innovation in etching technologies, fueling growth in the segment. Key industry players, including Honeywell and Solvay, have expanded their etchant production capabilities to cater to next-generation semiconductor manufacturing processes.

By End-Use Industry, Integrated Circuits Drive Electronic Chemicals CDMO & CRO Market with 32.5% Share in 2024

Integrated circuits dominated the Electronic Chemicals CDMO and CRO Market in 2024 with a 32.5% market share, driven by the rising demand for high-performance chips in artificial intelligence (AI), automotive electronics, and 5G applications. According to the World Semiconductor Trade Statistics (WSTS), global semiconductor sales reached $527 billion in 2024, highlighting the increasing consumption of electronic chemicals for IC production. The U.S. and European governments have introduced policies to boost domestic semiconductor manufacturing, such as the CHIPS Act and the European Semiconductor Initiative, further increasing demand for high-purity chemicals. Leading semiconductor fabs, including TSMC and Intel, have ramped up production, creating a surge in demand for electronic chemicals tailored to integrated circuit fabrication, reinforcing the segment's dominance.

Electronic Chemicals CDMO & CRO Market Regional Analysis:

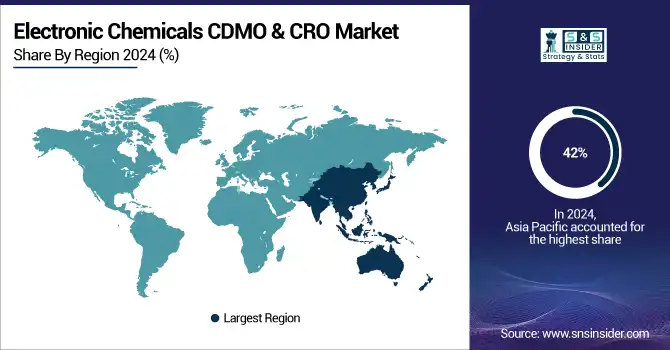

Asia Pacific Dominates Electronic Chemicals CDMO & CRO Market in 2024

Asia Pacific holds an estimated 42% market share in 2024, driven by the rapid expansion of semiconductor fabrication, advanced electronics manufacturing, and government-backed incentives. This causes increased demand for high-purity solvents, etchants, and contract manufacturing services, accelerating CDMO and CRO adoption across the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

China Leads Asia Pacific’s Electronic Chemicals CDMO & CRO Market

China dominates due to aggressive investments in semiconductor and display manufacturing, supported by the “Made in China 2025” initiative. Growing domestic demand for integrated circuits, MEMS, and advanced electronics fuels the need for high-purity chemicals and outsourced manufacturing. Leading CDMOs and chemical suppliers have expanded production facilities locally, ensuring a reliable supply for next-generation semiconductor nodes. China’s strategic focus on self-reliance in electronic materials positions it as the primary driver of Asia Pacific’s electronic chemicals CDMO and CRO market.

North America is the Fastest-Growing Region in Electronic Chemicals CDMO & CRO Market in 2024

The region is expected to grow at a CAGR of 7.2% from 2025–2032, driven by government funding, domestic semiconductor expansion, and increased outsourcing of chemical production. This causes rising adoption of contract development and manufacturing services to meet stringent quality and regulatory requirements.

-

United States Leads North America’s Electronic Chemicals CDMO & CRO Market

The U.S. dominates due to the CHIPS and Science Act, which supports domestic semiconductor manufacturing and R&D. Rising production of ICs, advanced displays, and next-generation electronic components drives demand for high-purity solvents, etchants, and process chemicals. Major CDMO players have expanded facilities to meet the quality and compliance standards of domestic fabs. U.S. focus on innovation, supply chain reliability, and advanced electronics manufacturing makes it the key contributor to North America’s electronic chemicals CDMO and CRO market.

Europe Electronic Chemicals CDMO & CRO Market Insights, 2024

Europe is witnessing steady growth, fueled by semiconductor research, advanced electronics manufacturing, and sustainable chemical production practices. Germany’s investment in semiconductor innovation and eco-friendly chemical processes improves production efficiency, causing higher CDMO and CRO adoption across Europe.

-

Germany Leads Europe’s Electronic Chemicals CDMO & CRO Market

Germany dominates due to strong R&D in semiconductors, early adoption of high-purity chemicals, and emphasis on sustainable manufacturing. Leading chemical suppliers support integrated circuit, MEMS, and PCB production with precision chemicals, while government initiatives promote domestic semiconductor capabilities. Germany’s leadership in process efficiency, quality, and regulatory compliance positions it as Europe’s largest contributor to the electronic chemicals CDMO and CRO market.

Middle East & Africa and Latin America Electronic Chemicals CDMO & CRO Market Insights, 2024

The market in these regions is expanding steadily, supported by growing electronics manufacturing, government-backed initiatives, and partnerships with global chemical suppliers. Countries such as the UAE and Saudi Arabia focus on semiconductor and advanced electronics hubs, while Brazil and Mexico increase the adoption of high-purity chemicals and contract manufacturing. Strategic collaborations and local production facilities enhance supply reliability, improve process efficiency, and drive adoption of CDMO and CRO services across the Middle East, Africa, and Latin America.

Competitive Landscape for Electronic Chemicals CDMO & CRO Market:

Actylis

Actylis is a global provider of specialty electronic chemicals, offering contract development and manufacturing services for semiconductors, displays, and advanced electronics. The company focuses on high-purity solvents, etchants, and custom chemical formulations, serving clients across the semiconductor and electronics industries. Actylis operates a network of R&D and production facilities, delivering scalable, compliant, and environmentally responsible chemical solutions. Its role in the market is critical, as it enables semiconductor manufacturers to access specialized chemicals and outsource complex production processes, ensuring quality, efficiency, and regulatory compliance.

-

In 2024, Actylis expanded its high-purity solvent production capacity to support next-generation semiconductor nodes, enhancing process reliability and throughput for global customers.

Adesis Inc.

Adesis Inc. is a U.S.-based contract manufacturer and developer of specialty electronic chemicals, including etchants, photoresists, and surface treatment solutions. The company provides end-to-end CDMO services, covering R&D, scale-up, and full-scale production, with strong emphasis on quality control and regulatory compliance. Its role in the electronic chemicals market is significant, helping clients optimize manufacturing efficiency, reduce production costs, and meet stringent semiconductor industry standards.

-

In 2024, Adesis Inc. introduced custom formulations for 3D NAND memory and advanced logic chips, enabling semiconductor fabs to improve yield and process consistency.

AGC Inc.

AGC Inc., headquartered in Japan, is a leading supplier of high-performance electronic chemicals, including ultra-pure solvents, acids, and specialty materials for semiconductor and display manufacturing. AGC’s CDMO services combine advanced chemical engineering, large-scale production, and stringent quality standards. Its role in the market is vital, supporting semiconductor manufacturers with reliable chemical supply and innovative solutions for next-generation electronics.

-

In 2024, AGC Inc. enhanced its etchant and solvent portfolio to support sub-3nm semiconductor nodes, driving higher adoption in Asia-Pacific and global fabs.

Azelis

Azelis is a global distributor and CDMO partner for electronic chemicals, providing tailored formulations, process optimization, and technical support to semiconductor, display, and advanced electronics manufacturers. The company focuses on sustainability, regulatory compliance, and supply chain reliability. Azelis’s role in the market is central, as it bridges chemical innovation with manufacturing needs, ensuring high-quality production and enabling faster time-to-market for semiconductor and electronics clients.

-

In 2024, Azelis launched a series of environmentally compliant high-purity chemicals for IC and PCB fabrication, strengthening its presence in Europe and Asia-Pacific.

Electronic Chemicals CDMO & CRO Market Key Players:

-

Actylis

-

Adesis Inc.

-

AGC Inc.

-

Azelis

-

Boulder Scientific Company

-

CABB Group GmbH

-

Central Glass Co., Ltd.

-

Entegris, Inc.

-

FUJIFILM Wako Pure Chemical Corporation

-

Gelest, Inc. (Mitsubishi Chemical Group)

-

Inventys Research Company

-

JSR Corporation

-

Kanto Chemical Co., Inc.

-

LinkChem Technology Co., Ltd.

-

Mitsui Chemicals

-

Navin Fluorine International Limited

-

SACHEM, Inc.

-

Sajjan India Ltd.

-

Shin-Etsu Chemical Co., Ltd.

-

Sumitomo Chemical Co., Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 0.48 Billion |

| Market Size by 2032 | USD 0.81 Billion |

| CAGR | CAGR of 6.80% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (High-Purity Solvents, Specialty Gases, Wet Chemicals, Photoresists & Ancillaries, Deposition Materials, Others) •By Service Type (Contract Development, Contract Manufacturing, Contract Research) •By Application (Photoresists, Etchants, Dopants, Cleaning Agents, Deposition Materials, Others) •By End-Use Industry (Integrated Circuits, Discrete Semiconductors, Sensors, Optoelectronics, Printed Circuit Boards (PCBs), Displays, Others)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AGC Inc., Navin Fluorine International Limited, CABB Group GmbH, LinkChem Technology Co., Ltd., Actylis, Adesis Inc., Sajjan India Ltd., Inventys Research Company, Merck Group, BASF and other key players |