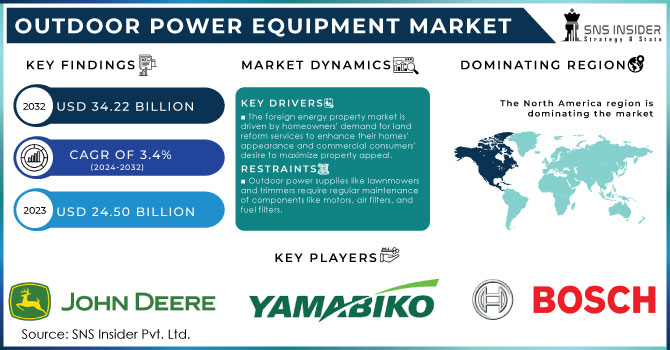

Outdoor Power Equipment Market Size:

The Outdoor Power Equipment Market Size was valued at USD 31.88 Billion in 2023 and is expected to reach USD 45.87 Billion by 2032 and grow at a CAGR of 4.2% over the forecast period 2024-2032. Include adoption rates of electric and battery-powered equipment, shifts in consumer preference toward eco-friendly alternatives, increased demand for smart equipment, such as robotic lawnmowers, in the market. Rising metrics of outdoor recreational activities, growth in the landscaping industry, and power efficiency innovations are some of the important insights. Moreover, noise reduction technologies and emission-free devices data can highlight trends in sustainability and convenience in the market.

Get More Information on Outdoor Power Equipment Market - Request Sample Report

Need any Customization as Per Your Business Requirement on Outdoor Power Equipment Market - Enquiry Now

Key Players

Some of the major players in the Outdoor Power Equipment Market are:

-

Kaercher (High-Pressure Cleaners, Surface Cleaners)

-

Yamabiko Corporation (Chainsaws, Trimmers & Brush Cutters)

-

Husqvarna Group (Lawn Mowers, Chainsaws)

-

Andreas Stihl AG & Company KG (Chainsaws, Hedge Trimmers)

-

Techtronic Industries (Lawn Mowers, Cordless Trimmers)

-

Maruyama U.S., Inc. (Backpack Blowers, Brush Cutters)

-

Stanley Black & Decker (Chainsaws, Hedge Trimmers)

-

MTD Products (Lawn Mowers, Snow Throwers)

-

Makita Group (Cordless Blowers, Chainsaws)

-

VB Emak (Lawn Mowers, Hedge Trimmers)

-

Toro Company (Lawn Mowers, Snow Throwers)

-

Hikoki (Cordless Trimmers, Chainsaws)

-

Deere (Lawn Mowers, Snow Throwers)

-

Jonsered (Lawn Mowers, Chainsaws)

-

Bosch (Hedge Trimmers, Cordless Leaf Blowers)

-

Honda (Lawn Mowers, Snow Throwers)

-

Cub Cadet (Lawn Mowers, Snow Throwers)

-

Troy-Bilt LLC (Lawn Mowers, Tillers & Cultivators)

Recent Trends

-

January 2025: Toro introduced three new electric machines for indoor construction and demolition work. These machines are built on the concept of improving performance even in hostile environments with control over reduced emissions and noise generation. The innovation deals with operators looking at eco-friendly alternatives that are powerful within the indoor construction sector and captures Toro's commitment to eco-friendly solutions.

-

October 2024: The company launched four new robotic lawnmowers for professional turf management, which were aimed at sports fields, golf courses, and facilities. They came with advanced GPS and AI capabilities, without a boundary wire for mowing. The models will be able to increase efficiency while reducing the costs of operation; they also include solar panel compatibility and AI-driven upgrades to be released later on, increasing their commercial viability.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 31.88 Billion |

| Market Size by 2032 | US$ 45.87 Billion |

| CAGR | CAGR of 4.2 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Source (Gasoline, Battery, Electric Corded) • By End-Use (Residential, Commercial/Government) • By Type (Lawn Mower [Walk-Behind Lawn Mowers, Ride-on Lawn Mowers, Robotic Lawn Mowers, Zero-Turn Mowers], Chainsaw, Trimmer & Edger [Trimmers & Brush Cutter, Hedge Trimmers, Walk-Behind Edgers & Trimmers], Blowers [Snow, Leaf], Tillers & Cultivators, Snow Throwers, Others) • By Sales Channel (E-commerce, Direct Purchase) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Kaercher, Yamabiko Manufactures, Husqvarna Group, Andreas Stihl Ag Company Kg, Techtronic Industries, Maruyama U.S., Inc., Stanley Black & Decker, MTD Products, Makita Group, Vb Emak, Toro Company, Hikoki, Deere, Jonsered, Bosch, Honda, Cub Cadet, Troy Blit LLC. |