Smart AR Safety Glasses Market Size & Trends:

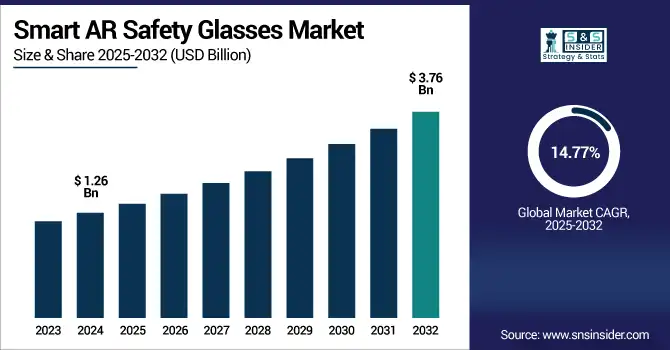

The Smart AR Safety Glasses Market Size was valued at USD 1.26 billion in 2024 and is expected to reach USD 3.76 billion by 2032 and grow at a CAGR of 14.77% over the forecast period 2025-2032.

To Get more information on Smart-AR-Safety-Glasses-Market - Request Free Sample Report

The global Smart AR Safety Glasses Market is witnessing rapid growth in demand due to the preference for advanced wearable solutions in dangerous and high-risk surroundings. Sectors are embracing hands-free, real-time operation data tools that are designed to make the field worker safer and more productive, and provide better decision-making capability. Improvements to AR systems, display resolution, battery life, and IoT integration are driving acceptance even faster. Furthermore, rising demand for workplace safety and proliferation of AR applications at work in numerous industries are augmenting the growth of the world market.

The U.S. Smart AR Safety Glasses Market size was USD 0.31 billion in 2024 and is expected to reach USD 0.79 billion by 2032, growing at a CAGR of 12.50% over the forecast period of 2025–2032.

The US smart AR safety glasses market demand from manufacturing, logistics and construction sectors will witness substantial growth owing to higher adoption of real-time data and hands-free operations to improve workforce efficiency and safety. Government regulations and investment in AR integrated PPE driving demand across US market Government mandates around workplace safety and investment in AR integrated PPE are also driving demand across the US market with innovation-focused companies pushing for deployments across essential operational functions.

According to research, about 48% of logistics and warehousing companies in the U.S. have adopted AR-based solutions for real-time inventory tracking and worker safety.

Smart AR Safety Glasses Market Dynamics

Key Drivers:

-

Growing Integration Of AR With IoT and AI Technologies Improves The Functionality And Adoption Of Smart Safety Wearables.

As IoT and AI become central to industrial automation, their integration with AR wearables is driving market growth. Smart AR glasses now offer features like object recognition, hazard alerts, predictive maintenance, and gesture-controlled interfaces. These advanced capabilities enable proactive decision-making and reduce equipment downtime. The synergy of AI-AR-IoT ecosystems makes these glasses indispensable tools in connected operations, facilitating seamless collaboration and smarter workflows, thereby encouraging enterprises to scale up deployment across large-scale facilities.

According to Deloitte, integrating AI-powered AR tools with real-time sensors can lead to a reduction of up to 40% in workplace accidents by enhancing situational awareness and proactive safety interventions.

Restrain:

-

Technical Limitations, Such As Battery Life, Connectivity Issues, And Field-Of-View Constraints, Reduce Product Effectiveness In Certain Work Conditions.

Although AR safety glasses have evolved, challenges like limited battery life, slow processing speeds, and unreliable connectivity affect their usability. In industries with continuous operations or environments with electromagnetic interference, such as mining or heavy manufacturing, these limitations restrict effective deployment. Additionally, narrow field-of-view and lack of compatibility with certain safety helmets or prescription lenses further limit their acceptance. These technical hurdles necessitate ongoing R&D investment, delaying adoption and undermining end-user confidence in current-generation products.

Opportunities:

-

Expansion Of Smart Cities And Infrastructure Projects Fuels Demand For Advanced AR Safety Tools In Construction And Urban Planning.

With governments globally investing in smart city initiatives, infrastructure development is seeing rapid technological integration. AR safety glasses provide engineers, site managers, and field workers with live blueprints, hazard alerts, and guided instructions on-site. Their use in inspection, asset tracking, and quality assurance is growing. These glasses enhance real-time decision-making during complex builds, reduce project delays, and improve safety compliance, creating substantial opportunities for vendors to supply smart eyewear solutions tailored for civil engineering and urban planning environments.

According to research, augmented reality can enhance construction productivity by up to 30% while reducing project errors and delays by approximately 25% to 35% through real-time guidance and improved visualization.

Challenges:

-

Regulatory And Certification Complexities Across Regions Create Entry Barriers For Manufacturers Entering Safety-Critical AR Markets.

Safety equipment must meet strict industry standards and regional certification requirements before deployment, and AR safety glasses are no exception. However, the hybrid nature of these devices, combining wearables, electronics, and optics, makes compliance more complex. Navigating varying safety codes, data privacy regulations, and wireless communication standards across regions delays time-to-market. These compliance burdens are particularly challenging for startups or new entrants, often requiring costly product reengineering and limiting fast market penetration globally.

Smart AR Safety Glasses Market Segment Analysis:

By Type

Binocular segment dominated the highest Smart AR Safety Glasses Market share of about 58.23% in 2024, owing to its ability to offer an immersive, wide-angle view of augmented data overlays for both eyes. This enhances spatial awareness, visual precision, and comfort in demanding work environments. It is favored in industries requiring detailed visual information, such as aerospace, automotive, and medical fields. Smart AR Safety Glasses Companies like Microsoft, with its HoloLens series, have significantly contributed to the popularity of binocular AR systems in professional environments.

Hybrid segment is expected to grow at the fastest CAGR of about 16.18% from 2025–2032 due to its combination of both assisted reality and full AR capabilities, enabling users to switch modes based on task complexity. This flexibility is attractive to enterprise users who require both simple data prompts and advanced visualization. Magic Leap is actively advancing hybrid AR technologies that serve multifunctional roles across logistics, manufacturing, and defense sectors. Continuous hardware miniaturization and software optimization are driving further demand for such versatile smart glasses.

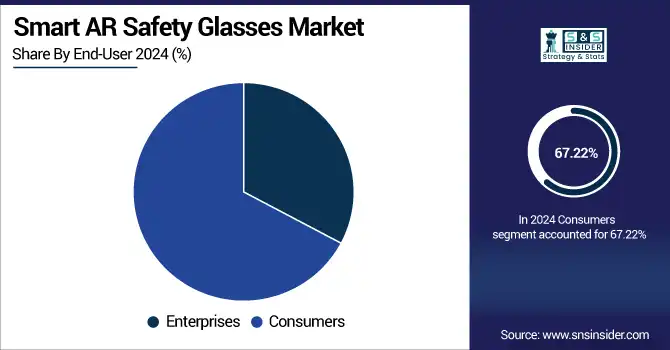

By End-User

Consumers segment dominated the Smart AR Safety Glasses Market with the highest revenue share of about 67.22% in 2024, primarily due to growing demand for immersive digital experiences in gaming, fitness, and personal safety applications. Wearables integrated with AR functionalities are becoming increasingly popular in lifestyle electronics. With rising consumer interest in smart gadgets and health-focused AR eyewear, Rokid has emerged as a key player, delivering innovative consumer-focused AR glasses through retail and e-commerce platforms.

Enterprises segment is expected to grow at the fastest CAGR of about 15.83% from 2025–2032, propelled by industrial digitization and rising deployment of AR glasses for workforce optimization and safety monitoring. Use cases in sectors like warehousing, field service, utilities, and energy have expanded, with companies leveraging smart eyewear for real-time analytics, remote support, and equipment diagnostics. RealWear has gained strong traction by offering rugged, voice-controlled AR glasses tailored for enterprise-grade field operations and compliance-driven environments.

By Application

Industrial segment dominated the Smart AR Safety Glasses Market with the highest revenue share of about 32.92% in 2024, driven by the need for real-time data access, worker safety, and operational efficiency in hazardous or complex work environments. Use in sectors such as manufacturing, mining, and utilities has surged due to benefits like improved workflow navigation, quality checks, and remote collaboration. Vuzix has been instrumental in supporting industrial deployments with its smart glasses that integrate well with enterprise resource systems.

Automotive segment is expected to grow at the fastest CAGR of about 16.63% from 2025–2032 due to growing applications in assembly line automation, maintenance, and design visualization. Smart AR safety glasses aid in real-time diagnostics, remote expert assistance, and 3D model interaction, enhancing accuracy and productivity. Bosch, a key innovator in automotive technologies, has been advancing AR integration for automotive workflows, helping transform assembly and service operations through smart glasses.

By Connectivity

Wi-Fi segment dominated the Smart AR Safety Glasses Market with the highest revenue share of about 35.63% in 2024, as it provides reliable connectivity for real-time data transmission and remote operations in controlled environments. Industries operating within structured facilities prefer Wi-Fi-based AR glasses for seamless integration with local networks, facilitating remote guidance, task tracking, and cloud access. Google, through its enterprise-focused Google Glass editions, has capitalized on Wi-Fi-connected solutions for industrial and corporate users.

Cellular segment is expected to grow at the fastest CAGR of about 15.72% from 2025–2032, fueled by increasing demand for AR usage in outdoor and remote environments where Wi-Fi is unavailable. With the rollout of 5G, cellular-connected smart glasses can now support high-speed, low-latency data exchange, enabling real-time video streaming, cloud computing, and AR-enabled field support. Epson, through its Moverio series, is enhancing mobile and cellular-connected AR experiences suited for field-based industries and on-the-go professionals.

Smart AR Safety Glasses Market Regional Overview:

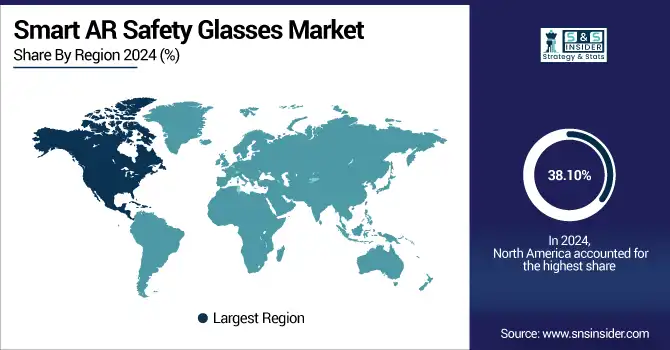

North America dominated the Smart AR Safety Glasses Market with the highest revenue share of about 38.10% in 2024, driven by the strong presence of advanced digital infrastructure, high adoption of AR technologies across industries, and significant investments in workplace safety innovations. The region benefits from supportive regulatory frameworks, early technology adoption in sectors like manufacturing and defense, and a well-established ecosystem for enterprise wearables. High R&D spending and a skilled workforce further reinforce North America’s leadership in driving innovation and widespread implementation of AR safety solutions.

-

The U.S. leads in North America due to advanced technological infrastructure, early adoption of AR wearables, and strong demand from industrial sectors like manufacturing, defense, and logistics, supported by high R&D investments and stringent workplace safety regulations.

The Asia Pacific segment is expected to grow at the fastest CAGR of about 16.13% from 2025–2032, owing to rapid industrial expansion, increasing labor safety awareness, and growing government investments in smart manufacturing. Countries such as China, Japan, and South Korea are leading the region’s adoption of AR technologies across automotive, electronics, and logistics sectors. The rollout of 5G networks, rising consumer tech engagement, and a surge in digital transformation initiatives are also fueling demand for smart AR safety glasses across industrial and commercial settings in Asia Pacific.

-

China dominates the Asia Pacific market owing to its large-scale manufacturing base, government-backed smart industry initiatives, rapid adoption of AR in factories, and presence of leading hardware producers accelerating local production and deployment of smart AR safety glasses.

Europe is witnessing steady growth in the Smart AR Safety Glasses Market, driven by strong safety compliance regulations, increasing automation in industries, and rising investments in digital transformation. Countries like Germany, France, and the UK are adopting AR wearables in sectors such as automotive, energy, and healthcare to enhance worker efficiency, reduce risks, and support remote operations.

-

Germany dominates the European Smart AR Safety Glasses Market due to its strong industrial and automotive sectors, advanced manufacturing infrastructure, and leadership in Industry 4.0 adoption. High emphasis on worker safety and automation further drives demand for AR-integrated safety solutions across German industries.

The Middle East & Africa Smart AR Safety Glasses Market is led by the UAE, driven by its smart infrastructure projects and growing use of AR in oil, gas, and construction sectors. In Latin America, Brazil dominates due to industrial expansion, rising safety standards, and increased adoption of AR in manufacturing environments.

Get Customized Report as per Your Business Requirement - Enquiry Now

Smart AR Safety Glasses Companies are:

Major Key Players in Smart AR Safety Glasses Market are Microsoft, Google, Meta, Vuzix, Epson, RealWear, Magic Leap, Lenovo, Iristick, Snap and others.

Recent Development:

-

In October 2024, RealWear rolled out Firmware 2.0 for its Navigator 500/520 Series, introducing an upgrade to Android 13. This update enhanced device security, optimized voice recognition, extended battery performance, and added support for robust 4G LTE connectivity, improving overall functionality in industrial AR applications.

-

In June 2025, Vuzix announced a strategic AI partnership with Ramblr to upgrade its M400 smart glasses with real-time AI-powered guidance and documentation features. Previously, in September 2022, the company launched Blade 2 as ANSI Z87.1-certified AR eyewear, reinforcing its suitability for industrial safety applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.26 Billion |

| Market Size by 2032 | USD 3.76 Billion |

| CAGR | CAGR of 14.77% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Monocular, Binocular, Hybrid) • By End-User (Enterprises, Consumers) • By Application (Industrial, Healthcare, Automotive, Aerospace & Defense, Construction, Others) • By Connectivity (Wi-Fi, Bluetooth, Cellular, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Microsoft, Google, Meta, Vuzix, Epson, RealWear, Magic Leap, Lenovo, Iristick, Snap. |