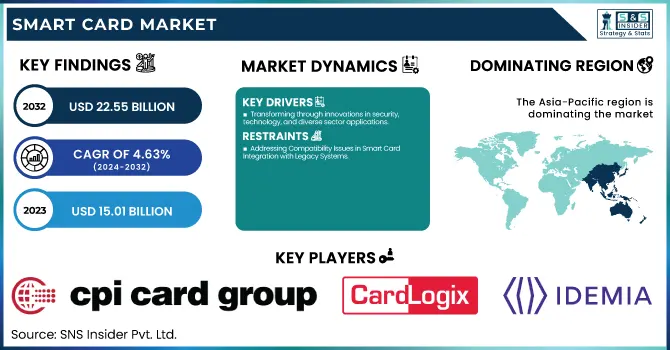

Smart Card Market Size & Industry Growth:

The Smart Card Market was valued at USD 15.01 billion in 2023 and is projected to reach USD 22.55 billion by 2032, growing at a CAGR of 4.63% from 2024 to 2032. Key drivers for this growth include technology adoption, with innovations like contactless payments and biometric integration, as well as regulatory and compliance factors driving the need for secure identification and transaction systems globally.

To Get more information on Smart Card Market - Request Free Sample Report

Additionally, emerging trends such as blockchain integration and the growing demand for secure digital transactions are accelerating market development. Consumer behavior is also evolving, with increased demand for convenience and security in payment and identity solutions. In the U.S. market, the value was USD 2.68 billion in 2023 and is expected to grow to USD 4.36 billion by 2032, at a CAGR of 5.55%, driven by rising adoption of smart card technology in banking, government services, and healthcare, alongside growing demand for secure and efficient digital payment solutions.

Smart Card Market Dynamics:

Drivers:

-

Transforming through innovations in security, technology, and diverse sector applications.

The smart card industry is rapidly evolving, driven by increasing cybersecurity needs and technological advancements across various sectors. Financial institutions and businesses are prioritizing robust security systems to counter rising threats, creating significant opportunities for secure digital identification and transactions. The integration of smart cards with existing infrastructure is essential for enhancing security while maintaining operational efficiency. Smart cards are incorporating advanced features like biometric verification and multi-factor authentication, with contactless technology being widely adopted. For example, in the UK, 123 million of the 159 million debit and credit cards now feature contactless functionality. Additionally, smart card solutions are expanding into urban mobility systems, such as Miami's 2023 contactless open fare payment system, indicating a shift toward smart city solutions. The industry is also innovating in areas like cryptocurrency, with companies like CardLab and eSignus developing secure smart card-based digital asset management solutions, further enhancing the versatility of smart cards.

Restraints:

-

Addressing Compatibility Issues in Smart Card Integration with Legacy Systems

A significant issue in the Smart Card Market is the integration of smart card solutions with existing systems and infrastructure, particularly for organizations relying on outdated or legacy technologies. Smart cards often necessitate hardware and software upgrades, such as advanced readers and transaction systems, which may not be compatible with older infrastructures. This mismatch can lead to substantial additional costs for businesses that must invest in upgrading or replacing their legacy systems. Moreover, some older systems lack support for modern features like contactless payments and biometric authentication, restricting the full potential of smart cards. As a result, businesses must thoroughly assess their current infrastructure before implementing smart card solutions to prevent integration bottlenecks and ensure smooth functionality.

Opportunities:

-

Biometric integration in smart cards, including fingerprint and facial recognition, is revolutionizing security, with the financial sector driving adoption.

The integration of advanced biometric technologies with smart cards has transformed personal identification and access control across various industries. According to the Biometrics Institute's 2022 survey, facial recognition is expected to see the most significant growth, while fingerprint identification, though the most established, is anticipated to experience modest growth with only 3% of respondents forecasting a major increase. This shift has spurred the development of smart cards incorporating multiple biometric authentication methods like fingerprint scanning, iris recognition, and facial recognition, offering organizations robust security solutions that are virtually impossible to breach. The financial sector has been particularly active in adopting these advanced biometric smart cards for better security and authentication. In 2023, China Construction Bank (CCB) launched biometric ‘hard wallet’ smart cards for secure digital currency transactions using fingerprint authentication, and the partnership between MoriX Co. and Fingerprint Cards AB resulted in the creation of biometric payment cards with enhanced security features. These developments demonstrate how smart cards are evolving beyond traditional identification systems, integrating multi-factor authentication to enhance security while ensuring user privacy and convenience.

Challenges:

-

User adoption of smart cards is hindered by concerns over privacy, convenience, and unfamiliarity with the technology, limiting widespread acceptance.

Despite the growing adoption of smart cards, user reluctance remains a significant challenge due to concerns around privacy, convenience, and unfamiliarity with the technology. Many consumers are wary of sharing personal data through smart cards, fearing potential breaches or misuse of sensitive information. Additionally, some users find the transition from traditional methods to smart card systems inconvenient, as it requires adjustments in daily routines, such as learning new usage protocols or investing in new devices like contactless card readers. Furthermore, a lack of awareness and understanding of smart card benefits can deter adoption, especially among older generations or those not accustomed to digital security solutions. This hesitation can slow the widespread acceptance of smart card technology, impacting its overall market growth and integration across various sectors.

Smart Card Market Segment Analysis:

By Type

The MPU (Microprocessor) segment dominated the smart card market with a significant share of around 55% in 2023. This is due to the increasing demand for high-performance, secure, and versatile smart card solutions across industries such as finance, healthcare, and telecommunications. Microprocessor-based smart cards offer enhanced security features, including data encryption, secure storage, and multi-layered authentication, which make them highly suitable for applications requiring stringent security protocols, such as payment systems, access control, and digital identity verification. The robust performance, durability, and ability to support complex applications are key drivers of their dominance in the market. Additionally, the continuous advancements in microprocessor technology, enabling faster processing and improved security, further boost their adoption, contributing to the large market share in 2023.

The memory segment is poised to be the fastest-growing in the smart card market over the forecast period from 2024 to 2032. Financial institutions primarily use the maturing demand for smart cards with higher storage capabilities in order to play more sophisticated applications like secure data storage, digital transactions and hybrid authentication and all of this and companies, all contribute to this growth. With different sectors such as banking, healthcare, and government adopting smart cards for safe verification and payment systems, a larger memory capacity was no more an option but a necessity. The increasing use of contactless payment and digital identity verification is also driving growth in these areas where smart cards with extended memory are needed.

By Interface

The contactless segment dominated the smart card market with the largest revenue share of approximately 59% in 2023. This dominance is largely driven by the increasing consumer preference for convenient, fast, and secure payment solutions. Contactless smart cards allow users to make payments simply by tapping their cards near a reader, eliminating the need for physical contact, which is especially valued in environments requiring speed and efficiency, such as public transportation and retail. Their ease of use, speed, and enhanced security features continue to contribute to their widespread adoption, securing their leading position in the market.

The dual interface segment is expected to experience the fastest growth in the smart card market from 2024 to 2032. The growth is due to the rising demand for smart cards that are capable of performing contactless as well as contact-based applications, which give users and organizations enhanced flexibility. Dual interface smart cards are perfect for multi-use applications like banking, public transportation, and identification. They offer the speed and convenience of contactless tech with the security and reliability of contact-based solutions. The dual interface card is one of the key drivers of growth in the smart card market due to the increasing need for more versatile and multi-purpose cards and the advancements in security protocols.

By Functionality

The communication segment dominated the smart card market with the largest revenue share of around 55% in 2023. This dominance is driven by the widespread use of smart cards in communication-intensive applications, including mobile payments, telecommunications, and secure access control. Communication-enabled smart cards facilitate seamless data exchange, enabling secure transactions and user authentication over networks. With the growth of contactless payment systems, mobile wallets, and digital identity verification, the demand for smart cards with communication capabilities has surged. Additionally, advancements in communication technologies, such as NFC (Near Field Communication) and Bluetooth, have enhanced the functionality of these cards, making them integral to various industries. The increasing reliance on digital communication solutions further contributes to the continued growth of this segment.

The transaction segment is the fastest-growing segment in the smart card market over the forecast period from 2024 to 2032. The growth is predominantly attributed to the rising usage of smart cards offering secure and convenient payment solutions across the physical and virtual world. An increase in demand for smart cards to enable fast and secure transactions is being driven by the rise of contactless payments, mobile wallets, and online transactions. Transaction-based smart cards are thus proving invaluable when it comes to preventing fraud and securing the financial services we all rely on – though the old-fashioned stripe still points to the past. The transition to digital payment systems for all industries, together with a worldwide effort to find secure methods for financial transactions, is anticipated to impel the growth of transaction segment in the coming years.

By Application

The telecommunication segment dominated the smart card market with the largest revenue share of around 40% in 2023. This is largely due to the extensive use of smart cards in SIM cards for mobile phones, which enable secure communication, data storage, and subscriber authentication. With the ongoing expansion of mobile networks and the growing demand for secure mobile services, smart cards continue to play a crucial role in telecom services. The need for enhanced security, encryption, and efficient communication systems further boosts the adoption of smart cards in the telecommunications industry. As mobile technology advances with 5G and IoT applications, the demand for secure and reliable smart cards in telecom is expected to remain strong.

The BFSI (Banking, Financial Services, and Insurance) segment is the fastest-growing segment in the smart card market over the forecast period from 2024 to 2032. This growth is driven by the rise in demand for secure, contactless payment solutions, and digital banking services. Smart Cards for Infrastructure Development Another vertical that is seeing increasing smart card adoption is smart cards for civil society for infrastructure development including electronic travel authorization, tax collection, parking slots, smart bathrooms, city management, and transportation management among others. The introduction of innovative technologies such as biometric authentication and increased encryption technologies further boosts the adoption of smart cards in the BFSI sector. The increasing adoption of digital payments, mobile wallets, and secured card-based solutions in banking and financial services is likely to propel the segment growth in the upcoming years.

Smart Card Market Regional Analysis:

The Asia-Pacific (APAC) region dominated the largest share of revenue in the smart card market, accounting for around 40% in 2023. This dominance is attributed to the rapid adoption of smart cards across various sectors such as telecommunications, banking, and transportation. Countries like China, India, and Japan have been at the forefront, where smart card solutions are widely used for secure transactions, digital payments, and identity verification. The APAC region also benefits from strong government initiatives to implement smart card technologies for public services, including healthcare and transportation systems. Furthermore, the increasing demand for contactless payment solutions and mobile wallets has accelerated the growth of the smart card market in this region. As digital transformation and urbanization continue in APAC, the region is expected to maintain a leading position in the market.

The North America region is the fastest-growing market for smart cards over the forecast period from 2024 to 2032 The growth is attributed to rising demand for secure payment solutions, identity verification, and contactless technology. North America is experiencing the largest adoption of smart cards in banking, healthcare, and transportation sectors, with a powerful focus on digital transformation. Government programs, developing fintech ecosystem, and optimizing biometric and mobile wallets technology in Canada and the US are leading the charge. However, due to the sectors wanting to achieve higher protection and operational efficiency, the smart card industry for North America is expected to grow tremendously throughout the timeline.

Get Customized Report as per Your Business Requirement - Enquiry Now

Smart Card Market - Leading Players along with their Products:

-

Block, Inc. (USA): Square Payment Solutions, Square Reader, Square Terminal

-

CardLogix Corporation (USA): Smart Cards, EMV Solutions

-

CPI Card Group Inc. (USA): EMV Cards, Prepaid Cards

-

Giesecke+Devrient GmbH (Germany): SIM Cards, Mobile Security Solutions

-

HID Global Corporation (USA): Identity Management, Access Control Solutions

-

IDEMIA (France): Biometric Solutions, Secure Identity Products

-

INTELIGENSA (Mexico): NFC Payment Solutions, Smart Cards

-

Samsung Electronics Co., Ltd. (South Korea): Biometric Authentication, Mobile Security Solutions

-

Sony Corporation (Japan): RFID Tags, Smart Cards

-

Thales (France): Payment Cards, Data Security Solutions

-

Gemalto (Amsterdam, Netherlands): (Smart Cards, Digital Security Solutions)

-

IDEMIA (Courbevoie, France): (Smart Card Solutions, Biometric Security)

-

NXP Semiconductors (Eindhoven, Netherlands): (Smart Card ICs, RFID Solutions)

-

Infineon Technologies (Neubiberg, Germany): (Smart Card Chips, Security Solutions)

List of companies that provide raw materials and components for the smart card market:

-

Avery Dennison

-

3M

-

Mitsubishi Gas Chemical Company

-

Dow Chemical Company

-

NXP Semiconductors

-

Infineon Technologies

-

STMicroelectronics

-

Thales Group

-

Atmel

-

Texas Instruments

Recent Development:

-

On September 14, 2024, Fingerprint Cards and Infineon Technologies unveiled the SECORA Pay Bio biometric payment card solution, streamlining production with simplified manufacturing and enhanced reliability, ready for mass production.

-

On November 27, 2024, Idemia Secure Transactions and GlobalFoundries announced a two-year partnership to develop a 100% European value chain for next-generation smart card technology.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 15.01 Billion |

| Market Size by 2032 | USD 22.55 Billion |

| CAGR | CAGR of 4.63% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Memory, MPU Microprocessor), By Interface(Contact, Contactless, Dual Interface), By Functionality(Transaction, Communication, Security & Access Control) • By Application(BFSI, Telecommunication, Government & Healthcare, Retail & E-commerce, Transportation, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Block, Inc. (USA), CardLogix Corporation (USA), CPI Card Group Inc. (USA), Giesecke+Devrient GmbH (Germany), HID Global Corporation (USA), IDEMIA (France), INTELIGENSA (Mexico), Samsung Electronics Co., Ltd. (South Korea), Sony Corporation (Japan), Thales (France), Gemalto (Amsterdam, Netherlands), IDEMIA (Courbevoie, France), NXP Semiconductors (Eindhoven, Netherlands), Infineon Technologies (Neubiberg, Germany). |