Electrolytic Manganese Dioxide Market Report Scope & Overview:

The Electrolytic Manganese Dioxide Market size was valued at USD 1.58 billion in 2023 and is expected to grow to USD 2.81 billion by 2031 and grow at a CAGR of 7.4 % over the forecast period of 2024-2031.

The crucial cathode material in contemporary alkaline, lithium, and sodium batteries, as well as electrochemical capacitors and hydrogen production, is electrolytic manganese dioxide (EMD). EMD is probably going to continue to be the favoured energy material for the next generation in terms of cost and environmental concerns, as it has been in recent decades. The need to obtain energy from sustainable sources has been prompted by the depletion of fossil fuels and rising oil prices. A niche exists in the market for portable electronics and alternative and affordable energy sources, such as low-grade manganese ores. Unexpectedly, India primarily imports EMD to meet its demand despite having abundant manganese resources and current efforts to produce modified EMD components from secondary sources. Retaining with this in mind, a thorough study on the synthesis, physical, and electrochemical characterization of EMD generated from secondary sources and synthetic solutions has been prepared. This review provides an overview of the global EMD sources, including Indian deposits, as well as recent investigations of fundamental advancements in understanding the electrochemical mechanism involved in aqueous rechargeable batteries and electrochemical capacitors, which have improved energy storage performance, which is crucial for their long-term use in storing renewable energy.

.png)

To Get More Information on Electrolytic Manganese Dioxide Market - Request Sample Report

MARKET DYNAMICS

KEY DRIVERS:

-

Strict guidelines and laws governing the usage of electrolytic manganese dioxide

-

Increasing demand as a result of widespread battery use

Due to its widespread application in lithium ion and zinc-carbon batteries, electrolytic manganese dioxide is experiencing an increase in demand. One of the main market drivers for electrolytic manganese dioxide is batteries. This is motivating businesses to increase their production of Manganese dioxide electrolysis. This is expected to increase market demand for electrolytic manganese dioxide.

RESTRAIN:

-

High-rate capability

OPPORTUNITY:

-

Technological Advancement

-

Demand for water treatment is increasing.

In water treatment facilities, electrolytic manganese dioxide is utilized in electrodes to separate waste from water. Rising demand for electrolytic manganese dioxide for water treatment is another element anticipated to fuel growth in the target market in the upcoming years.

CHALLENGES:

-

Increase in strategic collaboration

-

Increase in number of product innovation

IMPACT OF RUSSIAN-UKRAINE WAR

Manganese ore and concentrate imports fell by 7% to 1.2 million tonnes in 2011, totaling US$497 million. Only roughly 136,700 tonnes of imported manganese concentrates and domestically produced manganese ore were used to make ferroalloys a shipment of manganese ore and concentrates worth US$18.05 million left Ukraine and saw Russia import 231,210 tonnes of manganese ore from a number of nations the following countries: South Africa (218,000 tonnes), Gabon (5 tonnes), Brazil (19 tonnes), India (76 tonnes), and 13,110 tonnes from foreign nations.

KEY MARKET SEGMENTATION

By Application

-

Batteries

-

Alkaline Batteries

-

Zinc-carbon Batteries

-

Li-ion Batteries

-

-

Water Treatment

-

Others

Do You Need any Customization Research on Electrolytic Manganese Dioxide Market - Enquire Now

REGIONAL ANALYSIS

In terms of revenue share, North America held a commanding position in 2022 with a share of more than 45%. Throughout the projection period, it is anticipated that the region will dominate the market. The region's need for primary and secondary batteries, notably for electric vehicles, is being driven by the widespread use of electrolytic manganese dioxide in battery cathodes for power generation. This is the major factor that is anticipated to drive the market over the forecast period.

Governments in Europe are constantly investing in lithium-ion battery charging stations to improve vehicle sustainability, which is anticipated to significantly boost demand for battery-powered cars in the years to come.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The Major Players are Xiangtan Electrochemical Scientific Ltd (China), ERACHEM (Belgium), Tosoh Corporation (Japan), Delta EMD Pty Ltd (South Africa), Cegasa (Spain), Tronox holdings plc (US), Minera Autlan (Mexico), Guangxi Guiliu Chemical Co., Ltd. (China), Guangxi Jingxi County Yizhou Manganese Industry Co., Ltd (china), Guizhou Red Star Developing Co, Ltd (China), MOIL Limited (India), and other players

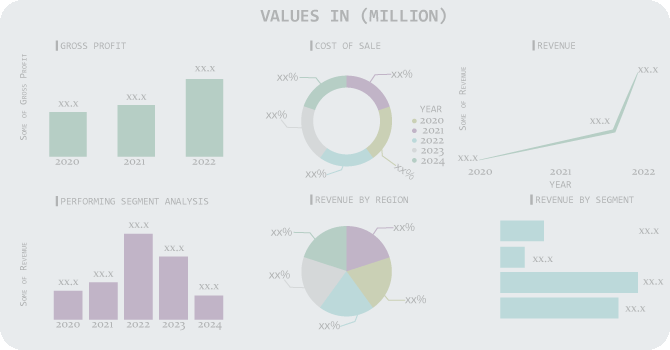

ERACHEM (Belgium)-Company Financial Analysis

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.58 Bn |

| Market Size by 2031 | US$ 2.81 Bn |

| CAGR | CAGR of 7.4% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Batteries, Water Treatment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Xiangtan Electrochemical Scientific Ltd (China), ERACHEM (Belgium), Tosoh Corporation (Japan), Delta EMD Pty Ltd (South Africa), Cegasa (Spain), Tronox holdings plc (US), Minera Autlan (Mexico), Guangxi Guiliu Chemical Co., Ltd. (China), Guangxi Jingxi County Yizhou Manganese Industry Co., Ltd (china), Guizhou Red Star Developing Co, Ltd (China), MOIL Limited (India) |

| Key Drivers | • Strict guidelines and laws governing the usage of electrolytic manganese dioxide • Increasing demand as a result of widespread battery use |

| Market Restraints | • High-rate capability |