Medical Isotope Market Report Scope & Overview:

Get More Information on Medical Isotope Market - Request Sample Report

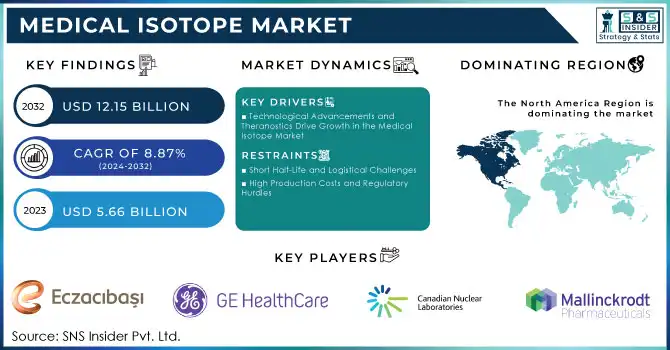

The Medical Isotope Market was valued at USD 5.66 billion in 2023 and is expected to reach USD 12.15 billion by 2032, growing at a CAGR of 8.87% over the forecast period 2024-2032.

The medical isotope market is growing rapidly, with the global demand for molybdenum-99 (Mo-99) alone exceeding 12,000 six-day curies per week, according to data from the OECD Nuclear Energy Agency. This isotope, essential for producing technetium-99m (Tc-99m), is used in over 40 million diagnostic imaging procedures annually, including cardiac stress tests and cancer staging scans.

Innovations in production technology are transforming the industry. For instance, cyclotron-based methods for producing isotopes like gallium-68 and fluorine-18 are enabling localized production, reducing reliance on reactor-based sources. A notable example is Canada’s adoption of non-reactor-based Mo-99 production using linear accelerators, which has enhanced supply security while minimizing environmental impacts. The market is also witnessing a surge in theranostic applications. Lutetium-177, a therapeutic isotope, is increasingly used in targeted cancer therapies, such as for neuroendocrine tumors and prostate cancer. Companies like Novartis are leveraging this isotope in products like Lutathera, which reported global sales exceeding USD 650 million in 2023.

Challenges persist, including a limited number of global production facilities and the short half-life of isotopes like Tc-99m, which requires precise logistics for delivery. However, organizations like the IAEA are addressing these challenges by supporting research into alternative production methods and facilitating international cooperation. The integration of robotics and artificial intelligence into isotope processing is further enhancing efficiency. For instance, the U.S. Department of Energy's Argonne National Laboratory has deployed automated systems to streamline isotope production, ensuring higher yields and reduced waste.

With advancements in precision medicine and the growing adoption of nuclear imaging technologies, the medical isotope market is expected to maintain robust growth, driven by innovative applications and solutions to supply chain constraints.

Market Dynamics

Drivers

-

Technological Advancements and Theranostics Drive Growth in the Medical Isotope Market

The medical isotope market is propelled by technological breakthroughs, increasing applications in targeted therapies, and advancements in imaging diagnostics. A significant driver is the rising adoption of theranostic approaches, which combine therapeutic and diagnostic capabilities using isotopes like lutetium-177 and iodine-131. These applications are revolutionizing cancer treatment by enabling precision-targeted therapies that minimize side effects while improving patient outcomes. Another pivotal factor is the growing use of isotopes in emerging medical imaging techniques. Isotopes such as fluorine-18 are integral to PET imaging, offering superior diagnostic accuracy for conditions like neurological disorders and oncology cases. This has led to a surge in demand for isotopes tailored to advanced imaging modalities.

Sustainability-focused innovations in isotope production are also transforming the market. For example, particle accelerators and cyclotron-based systems are reducing dependency on nuclear reactors, offering scalable and environmentally friendly solutions. These technologies ensure a stable supply of key isotopes like gallium-68 and yttrium-90, critical for diagnostics and treatments. Additionally, government and private-sector initiatives are fostering market growth. Programs aimed at securing domestic isotope production, such as the National Nuclear Security Administration’s efforts in the U.S., are mitigating global supply chain vulnerabilities.

The increasing prevalence of chronic diseases, including cardiovascular disorders and cancer, is further driving demand. The global focus on early diagnosis and non-invasive treatment methods underscores the need for isotopes, solidifying their role in advancing nuclear medicine and shaping the future of healthcare.

Restraints

-

Short Half-Life and Logistical Challenges

The short half-life of key isotopes like technetium-99m poses significant logistical challenges, requiring sophisticated infrastructure for rapid production, distribution, and utilization. This limitation often leads to supply chain inefficiencies and high operational costs.

-

High Production Costs and Regulatory Hurdles

The production of medical isotopes involves advanced technologies and stringent regulatory compliance, contributing to elevated costs. Additionally, reliance on aging nuclear reactors and the complexity of transitioning to alternative production methods further constrain market growth.

Key Segmentation

By Type

Radioisotopes dominated the medical isotope market in 2023, capturing approximately 65.0% of the market share. This dominance is primarily due to their extensive applications in both diagnostic and therapeutic procedures. Radioisotopes such as technetium-99m are pivotal for nuclear imaging, accounting for a significant proportion of diagnostic nuclear medicine procedures globally. Additionally, isotopes like iodine-131 and lutetium-177 are critical for targeted cancer treatments, further driving their widespread use and market leadership.

Stable isotopes are the fastest-growing segment within the type category, driven by their rising adoption in advanced medical research, including metabolic studies and drug development. Their applications in non-invasive diagnostic tools, such as those utilizing carbon-13 for breath tests and oxygen-18 for water metabolism analysis, are increasing. This growth is further bolstered by advancements in isotope separation technologies and expanding research initiatives in precision medicine.

By Application

The diagnostic segment led the market in 2023, holding a significant share of approximately 70.0%. The dominance of diagnostics is fueled by the high utilization of isotopes like technetium-99m in imaging technologies, including PET and SPECT scans, which are vital for early disease detection. Increased healthcare investments and the demand for non-invasive diagnostic tools have also supported this segment's leadership.

Nuclear therapy is the fastest-growing application segment due to the increasing use of isotopes such as lutetium-177 and yttrium-90 in targeted cancer treatments. The rise of theranostic approaches, which combine diagnostic and therapeutic functions, has expanded the role of nuclear therapy in personalized medicine. The growing prevalence of cancer and innovations in isotope-based therapeutic solutions are key drivers for this segment's rapid growth.

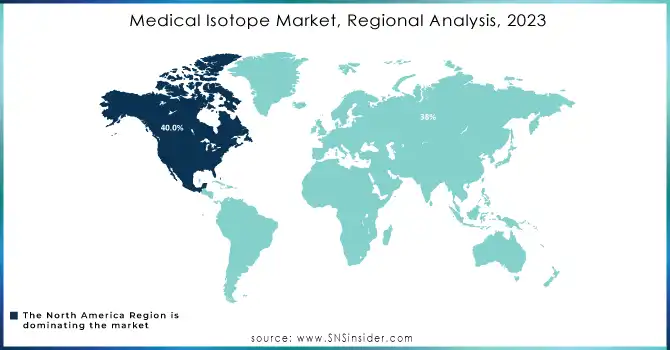

Regional Analysis

North America led the medical isotope market in 2023, accounting for approximately 40.0% of the global market share. This dominance was attributed to the region’s robust healthcare infrastructure, high adoption of advanced nuclear medicine, and the presence of major industry players. The United States, in particular, played a crucial role with substantial investments in isotope production technologies and government-backed initiatives aimed at securing domestic supply chains. The National Nuclear Security Administration’s efforts to develop non-reactor-based isotope production further strengthened regional capabilities.

Europe also represented a significant share of the market, driven by its strong emphasis on research and development in radiopharmaceuticals and the widespread use of isotopes in diagnostics and therapies. Countries like Germany, the UK, and France were leaders in nuclear medicine, leveraging isotopes like technetium-99m and iodine-131 for various medical applications. The region’s stringent regulatory standards and focus on quality control in isotope production bolstered its position in the market. Additionally, collaborative efforts between academic institutions, research organizations, and private companies promoted innovation, reinforcing Europe’s key role in the global market.

In the future, the Asia-Pacific region is expected to emerge as a rapidly growing market for medical isotopes. Countries like Japan, China, and India are set to increase their investments in nuclear medicine, particularly in diagnostics and cancer therapies. With improving healthcare infrastructure, rising awareness of nuclear medicine benefits, and increasing demand for early diagnostic tools, the Asia-Pacific market is expected to witness significant growth. Additionally, advancements in isotope production technologies and government initiatives to improve healthcare access will contribute to the region’s expansion in the coming years.

Need any customization research on Medical Isotope Market - Enquiry Now

Key Players and Their Related Medical Isotope Products

-

Eczacibasi-Monrol Nuclear Products

-

Technetium-99m (Tc-99m) generators, Iodine-131 (I-131), Gallium-68 (Ga-68)

-

-

-

PET and SPECT radiopharmaceuticals, including Fluorine-18 (F-18) for PET imaging, Technetium-99m (Tc-99m) generators

-

-

-

Iodine-131 (I-131), Molybdenum-99 (Mo-99), Technetium-99m (Tc-99m), Lutetium-177 (Lu-177)

-

-

Canadian Nuclear Laboratories (CNL)

-

Molybdenum-99 (Mo-99) and Technetium-99m (Tc-99m) generators

-

-

Mallinckrodt Pharmaceuticals

-

Iodine-131 (I-131), Xenon-133 (Xe-133), Technetium-99m (Tc-99m)

-

-

IBA Radiopharma Solutions

-

Fluorine-18 (F-18) for PET imaging, Gallium-68 (Ga-68) for diagnostics

-

-

Northstar Medical Radioisotopes, LLC

-

Molybdenum-99 (Mo-99) and Technetium-99m (Tc-99m) generators

-

-

Curium

-

Technetium-99m (Tc-99m), Lutetium-177 (Lu-177), Iodine-131 (I-131)

-

-

Nordion Inc.

-

Cobalt-60 (Co-60), Iodine-131 (I-131), Molybdenum-99 (Mo-99)

-

-

Isotopen Technologien München (ITM)

-

Lutetium-177 (Lu-177), Yttrium-90 (Y-90), Gallium-68 (Ga-68)

-

Recent Development

-

In Nov 2024, Bruce Power, in collaboration with the government, announced plans to build a medical isotope processing facility either on-site or near the Bruce Energy Centre. This will allow for faster processing of isotopes, eliminating the need for overseas shipping to Germany and ensuring quicker delivery to patients.

-

In Nov 2024, Cellectar Biosciences and NorthStar Medical Radioisotopes formed a partnership to supply Actinium-225, a promising isotope for targeted cancer therapies. This collaboration aimed to enhance the availability of Actinium-225 for medical applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.66 Billion |

| Market Size by 2032 | US$ 12.15 Billion |

| CAGR | CAGR of 8.87% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Stable Isotopes, Radioisotopes) • By Application (Diagnostic, Nuclear Therapy) • By End-user (Hospitals, Diagnostic Centers, Research Institutes) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Eczacibasi-Monrol Nuclear Products, GE Healthcare, Jubilant Radiopharma, Canadian Nuclear Laboratories (CNL), Mallinckrodt Pharmaceuticals, IBA Radiopharma Solutions, NorthStar Medical Radioisotopes, LLC, Curium, Nordion Inc., Isotopen Technologien München (ITM) |

| Key Drivers | • Technological Advancements and Theranostics Drive Growth in the Medical Isotope Market |

| Restraints | • Short Half-Life and Logistical Challenges • High Production Costs and Regulatory Hurdles |