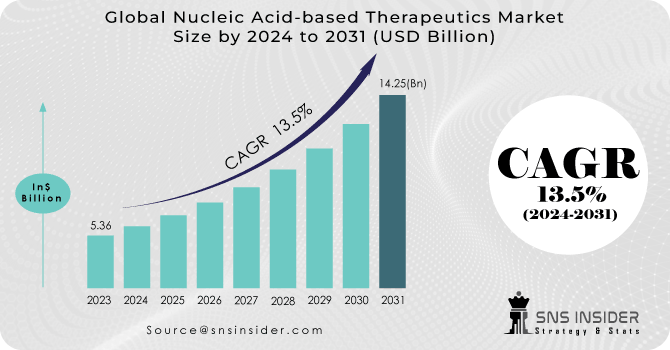

Nucleic Acid-based Therapeutics Market Size Analysis:

The Nucleic acid-based therapeutics market size was USD 5.01 Billion in 2023 and is expected to reach USD 14.98 Billion by 2032 and grow at a CAGR of 12.93 % over the forecast period of 2024-2032. The Nucleic Acid-based Therapeutics Market report provides in-depth statistical insights and emerging trends shaping the industry. It analyzes production capacity and utilization by country and type, along with raw material price fluctuations impacting manufacturing costs. The report examines regulatory developments influencing PE foam applications and explores sustainability metrics, including recycling rates and bio-based foam adoption. Additionally, it highlights innovation and R&D investments driving advancements in lightweight and high-performance PE foams. Lastly, the report tracks market demand trends across key end-use industries such as automotive, packaging, and construction.

Get more information on Nucleic Acid-based Therapeutics Market - Request Sample Report

Market Dynamics

Drivers

-

Rising demand for personalized medicine which drives market growth.

The growing demand for personalized medicine owing to the ability of these therapies to attract a specific treatment to the unique genetic profile of an individual. Nucleic acid-based therapeutics, such as mRNA therapies, antisense oligonucleotides (ASOs), and small interfering RNA (siRNA) facilitate precision medicine by targeting the underlying pathogenesis of genetic disorders and chronic diseases, a breakthrough from traditional one-size-fits-all treatments. Novel genomics sequencing techniques and expected biomarker discovery may allow the design of therapies that target only the defective genes responsible, minimizing off-target effects and maximizing patient benefit. Enormous funding is being bestowed for precision medicine initiatives such as the U.S. Precision Medicine Initiative as well as the 1+ Million Genomes Project in Europe, further driving the market expansion. Moreover, custom RNA-based medicines for cancer, rare genetic diseases, and neurodegenerative diseases are released by pharmaceutical companies that amplify the adoption of nucleic acid-based gain. The nucleic acid-based therapeutics market is projected to grow further, driven by technological progress and rapid regulatory approvals amid a rising demand for personalized medicine.

Restraint

-

High cost associated with the nucleic acid-based therapeutics which may hamper the market growth.

It is due to their complicated manufacturing processes, advanced delivery systems, and large-scale clinical trial that make market accessibility difficult. Currently, nucleic acid-based therapies–including gene therapies, mRNA vaccines, and antisense oligonucleotides (ASOs)–utilize advanced technology pipelines such as CRISPR, lipid nanoparticles (LNPs), and viral/non-viral vectors that are costly to manufacture, which is not the case for traditional drugs. Then again, R&D expenditures are huge, with firms pouring an enormous amount of cash into creating thoroughly safe sound, and efficient formulations, frequently with no guarantee of approval from regulators. Besides, the decentralized scalability of nucleic acid-based drug production and the requirement for specialized storage and distribution infrastructure further add to costs. Although some costs are being subsidized through government-funded reimbursement programs, the expensive price tag continues to be a significant factor that prevents more widespread adoption and could ultimately hinder market growth.

Opportunity

-

Advancements in gene editing technologies create an opportunity in the market.

These technologies enable scientists to fix genetic mutations right at the level of DNA and should yield cures for inherited disorders, cancer, and other rare genetic diseases. Meanwhile, the gradual approvals of gene-editing therapies gave additional justification to their commercial prospective. In addition, developments in base editing and prime editing are rendering these gene therapies more efficient and with lower off-target effects, bringing them within a broader, more clinically relevant set of applications. Propelled by growing government support, including NIH funds for genome-editing research and the European Union allocating funding for CRISPR-based therapies, the market is poised for rapid growth. Gene editing will become more precise and more widely available, leading to more treatment options, fueling new pharmaceutical innovations, and creating more space for strategies to guide the development of precise and effective nucleic acid-based therapeutics.

Challenges

-

Limited drug delivery efficiency may challenge the market growth.

One of the significant challenges faced by the Nucleic Acid-based Therapeutics market is the supply chain disruptions and logistics challenges that have resulted in the unavailability of raw materials, production schedules, and the overall growth of the market. Disruption in the supply of polyethylene resins global ambiguities like geostrategic conflicts, trade barriers, and unstable crude oil rates have led to the disruption of PE foam grade polyethylene resins, which serves, as the major beginning material for producing PE foam. Furthermore, transportation delays, labor shortages as well as high freight costs are directly affecting the fast and effective delivery of PE foams among the end-use industries including packaging, automotive, and building & construction. This appears to have led a lot of manufacturers to regionalize sourcing strategies and optimize supply chains. Production has seemingly responded well, with fresh production being added to the market but logistical constraints remain and continue to destabilize prices and impact the timely matching of demand.

Segmentation Analysis

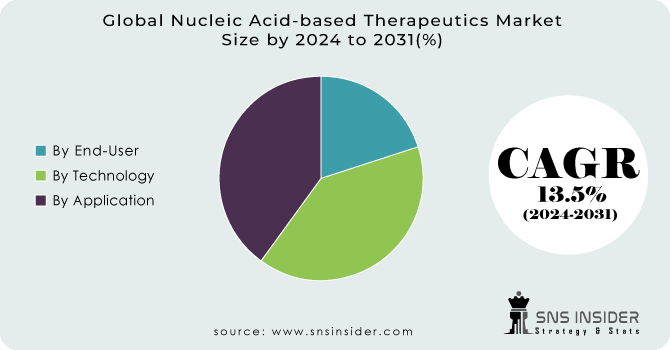

By Technology

RNA-targeted therapeutics held the largest market share around 35% in 2023. It is owing to a wide range of therapeutic applications, improving RNA technology, and successful commercialization of RNA-based drugs. The introduction of mRNA vaccines, antisense oligonucleotides (ASOs), and small interfering RNA (siRNA) therapies has changed the way we face infectious diseases, genetic disorders, and cancers. Compared to DNA gene therapies, which offer permanent changes to the genome, RNA-based drugs can achieve a reversible genetic outcome, limiting adverse effects seen with long-lasting changes to DNA itself. Technological advancements, including lipid nanoparticle (LNP) delivery systems, coupled with synthetic RNA modifications, have further enhanced the functional stability of these therapeutics.

By Application

Cancer held the largest market share around 32% in 2023. the rising incidence of several cancer types and greater adoption of RNA-based therapies, gene silencing approaches, and targeted cancer immunotherapy increased demand for these products. Cancer is among the leading causes of death around the world, killing around 10 million people in 2022 alone, according to the World Health Organization (WHO). Motivated by the need for personalized and precision medicine, nucleic-acid-based drugs including mRNA-based cancer vaccines, antisense oligonucleotides (ASOs), and small interfering RNA therapies that target specific cancer-related genetic alterations have been developed and are becoming more available. These factors include the increasing number of clinical trials and investments in cancer research, and advancements in the lipid nanoparticle (LNP) delivery systems, which further boosted the dominancy of the cancer segment. Thanks to the development of gene-editing technologies such as CRISPR, nucleic acid-based therapeutics will further become a dominant force in cancer treatments.

By End Use Industry

The hospitals & clinics held the largest market share around 54% in 2023. The provision of necessary healthcare infrastructure, and rising penetration of precision medicine. Capitalizing on these advanced molecular diagnostics, genetic analysis tools, and a highly qualified workforce, these healthcare facilities seamlessly enable the rapid delivery of RNA-based therapeutics, gene-editing interventions, and antisense oligonucleotide (ASO) vectors for oncology, genetic diseases, and auto-inflammatory conditions. Moreover, hospitals and clinics account for the wellspring of clinical trials, and of FDA-approved therapies, assuring that patients receive the latest in nucleic acid-based therapeutic strategies. The rising incidence rate of chronic and rare diseases is again a major factor in the worldwide growth of personalized medicine and gene-based therapies which are still best practiced within treatment centers, such as hospitals & clinics. Furthermore, these advanced therapies are integrated with hospital treatment protocols as the government funding and reimbursement policies in developed countries tend to support the integration of advanced therapies into treatment protocols in hospitals.

Get Customized Report as per your Business Requirement - Request For Customized Report

Regional Analysis

North America held the largest market share around 46% in 2023. The Nucleic Acid-based Therapeutics Market was dominated by North America, led by the high biotechnology industry, improved healthcare infrastructure, and notable commitment to genomic medicine. Many of the world’s top pharma and biotech companies have come to call this region home including Moderna, Pfizer, Biogen, and Alnylam Pharmaceuticals which have made their greatest advances with mRNA vaccines, gene therapies, and RNA-based drugs. Moreover, the proximity to leading research institutes, government funding initiatives, and regulatory agencies provides rapid approval of these nucleic acid-based therapies. In addition, the high recurrence of cancer, genetic disorders, and infectious diseases in North America, along with a robust reimbursement framework and patient access to advanced therapies, has propelled this region to the market leader position. As North America continues to dominate the sector in terms of clinical trials, drug approvals, and investments in biopharmaceuticals, it is likely to continue as the leading continent for the nucleic acid-based therapeutics market.

Asia Pacific held a significant market share in 2023. increasing number of clinical trials in the region are some of the factors boosting the market. Thus, the Asia-Pacific region dominated the Nucleic Acid-based Therapeutics Market with a significant market share. The European Union (EU) and Region UK and US market due to support by the gov. from many countries particularly China, Japan, South Korea and India, has progressed greatly through gene therapy, RNA-based drugs, and mRNA vaccine developers because of the policy of financial support, manpower and the policy of regulation. China's "Made in China 2025" and Japan's AMED (Japan Agency for Medical Research and Development) have boosted R&D in the fields of genetic medicine and biopharmaceuticals, among other areas. In addition, the significant patient pool along with the high prevalence of cancer, genetic disorders, and infectious diseases in the Asia Pacific region has resulted in increased demand for advanced nucleic acid-based therapies.

Key Players

-

Alnylam Pharmaceuticals (Onpattro, Givlaari)

-

Ionis Pharmaceuticals (Spinraza, Tegsedi)

-

Moderna Inc. (mRNA-1273, mRNA-1647)

-

BioNtech SE (BNT162b2, BNT111)

-

Sarepta Therapeutics (Exondys 51, Vyondys 53)

-

Wave Life Sciences (WVE-120101, WVE-120102)

-

Arrowhead Pharmaceuticals (ARO-AAT, ARO-HBV)

-

Dicerna Pharmaceuticals (Nedosiran, Belcesiran)

-

Translate Bio (MRT5005, MRT5201)

-

ProQR Therapeutics (Sepofarsen, QR-421a)

-

Stoke Therapeutics (STK-001, STK-002)

-

Silence Therapeutics plc (SLN360, SLN124)

-

Arcturus Therapeutics (ARCT-810, ARCT-021)

-

Regulus Therapeutics (RG-012, RGLS4326)

-

Voyager Therapeutics (VY-AADC, VY-HTT01)

-

Avidity Biosciences (del-brax, AOC 1001)

-

Akcea Therapeutics (Waylivra, Tegsedi)

-

Aro Biotherapeutics (Centyrin-siRNA Conjugates, ABX1100)

-

CureVac AG (CVnCoV, CV7202)

-

eTheRNA Immunotherapies (TriMix, ECI-006)

Recent Development:

-

In December 2024, Ionis received FDA approval for Tryngolza (olezarsen), its first independently launched drug in 35 years, designed to treat familial chylomicronemia syndrome (FCS).

-

In October 2024, Wave Life Sciences announced positive interim results from a mid-stage trial of its Duchenne muscular dystrophy treatment, WVE-N531, demonstrating significant dystrophin expression in patients.

-

In September 2023, Aldevron collaborated with Integrated DNA Technologies to provide essential CRISPR components for cell and gene therapy developers, aiming to speed up therapeutic advancements.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.01 Billion |

| Market Size by 2032 | US$ 14.98 Billion |

| CAGR | CAGR of 12.93 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (RNA targeted therapeutics, Gene therapies, Epigenetic and micro-RNA modulating therapies, Genome editing therapies, and Others) • By End-user (Hospitals & Clinics, Academic & Research Institutes, and Others) • By Application (Autoimmune Disorders, Infectious Diseases, Genetic Disorders, Cancer, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Alnylam Pharmaceuticals, Ionis Pharmaceuticals, Moderna Inc., BioNTech SE, Sarepta Therapeutics, Wave Life Sciences, Arrowhead Pharmaceuticals, Dicerna Pharmaceuticals, Translate Bio, ProQR Therapeutics, Stoke Therapeutics, Silence Therapeutics, Arcturus Therapeutics, Regulus Therapeutics, Voyager Therapeutics, Avidity Biosciences, Akcea Therapeutics, Aro Biotherapeutics, CureVac AG, eTheRNA Immunotherapies |