Nursing Products Market Size Analysis:

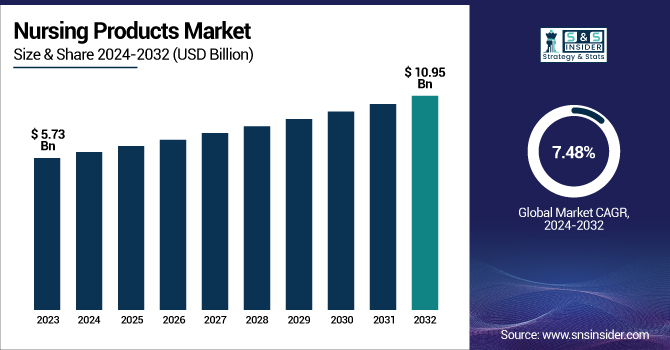

The global Nursing Products Market, valued at USD 5.73 billion in 2023, is projected to grow at a 7.48% CAGR, reaching USD 10.95 billion by 2032. The Nursing Products Market Report provides key statistical insights and trends shaping the industry. It also describes the incidence and prevalence of chronic conditions that are driving the demand for nursing care. The utilization of wound care, incontinence, and mobility aids is seen in regional prescription trends. Due to the key demographic trends of aging populations, which are driving an increased demand for home-based nursing products in industrialized countries, the report examines. It provides analysis on the quantities of drugs produced and used for pain management and infection control. It also provides data on the trends in healthcare spending on nursing products by the government, insurers, and out-of-pocket spending. In conclusion, it explores the technological advancement field of smart nursing devices and AI-powered care solutions that will drive the future of nursing support. Thanks to rising awareness regarding maternity care, developing technologies, and a growing preference for high-end products, the global nursing products market is booming.

To Get more information on Nursing Products Market - Request Free Sample Report

Nursing Products Market Dynamics

Drivers:

-

The increasing aging population necessitates advanced nursing products to cater to their healthcare needs.

The rising aging population is one of the most significant aspects driving the nursing products market since the change in demographic towards the elder population increases the demand for focused healthcare goods and services. Globally, the number of individuals aged 65 and older has surpassed 800 million, exceeding the entire population of Latin America and the Caribbean. In Japan, the world's fastest-aging country, nearly 30% of the population is over 65, with projections indicating a decline to 87 million by 2070. In China, a population decrease of nearly 1.4 million has been reported in 2024, the third year in a row with a decreasing population. These trends highlight the benefits of nursing products targeted at the elderly population, such as mobility aids, home healthcare products, chronic disease management products, etc.

An older population is also linked with increased occurrence of chronic conditions such as hypertension, diabetes, cardiovascular diseases, etc., that require continuous medical care and specialized nursing services. Such a scenario enhances the demand for nursing products to control these conditions. Additionally, the growing proportion of the aged population stresses healthcare systems, leading to a gradual turn toward at-home care solutions. Nursing products that facilitate home care, such as remote monitoring devices and assistive technologies, are becoming increasingly vital in managing the health of older adults while alleviating the burden on traditional healthcare facilities.

Restraints:

-

Strict regulatory standards and compliance requirements hinder rapid product innovation and market entry.

Regulatory standards and compliance are two significant challenges for the nursing products market. In the US, stringent regulations exist surrounding these pharmaceutical design processes under 21 CFR Part 820, known as the Quality System Regulation (QSR) and enforced by the Food and Drug Administration (FDA). This requires medical device manufacturers, including nursing product manufacturers, to implement and sustain a comprehensive Quality Management System (QMS) to ensure that products are safe and effective. There are specific components that make up the QSR, including design controls, production processes, and corrective actions that need to be documented and followed carefully. The implementation and maintenance of compliance with these regulations require significant resources. Manufacturers must invest in continuous employee training, regular audits, and updates to existing processes to align with evolving standards. For smaller companies that run on tighter budgets, this resource allocation can be especially burdensome, stifling innovation and slowing new product time-to-market.

The Ministry of Health and Family Welfare (MoHFW) is responsible for formulating health policies and implementing them, while the Central Drugs Standard Control Organization (CDSCO) regulates drugs and medical devices to ensure they meet safety and quality standards. Adherence to these rules is essential for market entry and ensuring public confidence. Compliance efforts are further complicated by the dynamic nature of healthcare regulations. Regulatory changes and updates take place frequently, and manufacturers have to be on their toes for continuous compliance. Noncompliance can lead to significant consequences, including penalties, product withdrawals, and reputational harm, which underscore the vital need for effective regulatory compliance strategies within the nursing products sector.

Opportunities:

-

Technological advancements, such as IoT integration in nursing devices, enhance patient care and open new market avenues.

IoT products in nursing help to gain more opportunities to both patients care and streamline healthcare operations. The development of IoT-enabled devices for medical applications has introduced innovative solutions that improve diagnostics and monitoring technology. For example, Impedimed is using data analytics and cloud-based software to develop a medical device for the quick and accurate diagnosis of breast cancer-related lymphedema, which is faster and more accurate than traditional methodology. The growth of the IoT in healthcare is demonstrated by the rise of smart hospital technology. Hospitals across the globe are turning to IoT devices to leap to "smart hospital" status in a bid to improve the quality of care provided to patients as well as streamline resource management. IoT, Robotics, and AI are different technologies that allow patients to alter room settings and receive medical plans through their smart gadgets while hospitals manage patient data and quickly oversee the entire operation. One of the real-life implementations includes Nottingham University Hospitals NHS Trust, which has been using voice-controlled systems, while Cleveland Clinic employs AI algorithms to predict sepsis risk, all thanks to the internet of things enhancing healthcare capabilities. The increasing adoption of remote patient monitoring (RPM) solutions further indicates the opportunities provided by IoT in nursing products. Smartwatches and other fitness trackers are wearable devices that constantly keep track of your vital signs like heart rate, blood pressure, etc., which helps in the early detection of abnormalities and thus reduces the need to visit the hospital very often. Such constant monitoring can allow the provider to intervene early and create a tailor-made treatment plan for a patient to stay healthy, especially patients with chronic conditions or patients in remote areas.

Challenges:

-

High competition and market saturation make it difficult for companies to differentiate their products and maintain profitability.

The nursing products market is experiencing several of the challenges associated with high competition and market saturation over the past few years. With a significant number of key players such as Ameda Inc., Pigeon Corporation, and Koninklijke Philips N.V. competing for market share by launching innovative and diversified products, it is a highly competitive market. The North American and Europe markets are considerably mature as consumers are aware of the benefits of SMS based health management services, with a high number of service providers already in place. The saturation creates significantly high competition, and companies are driven to consistently innovate and deliver differentiated value propositions to beat the competition. But the unrelenting demand for novelty inflates research and development costs, crimping profit margins and threatening the sustainability of many firms. Emerging Markets, like Asia-Pacific, bring alight opportunities with challenges. Although these regions are poised for strong growth because of increased investment in healthcare and a sizable aging population, the influx of many more companies seeking to benefit from this growth has increased competition. This presents a challenge for individual companies to have a strong presence and a significant share of the market. Finally, the emergence of technologies that offer on-demand shifts in nursing, such as CareRev or ShiftKey, complicates the situation further. These platforms seek to minimize costs but tend to lead to problems with low pay and capricious deactivation that echo the problems other gig sectors, such as ride-sharing, have faced. Not only does this impact the quality of care provided, but it also creates additional competition for traditional nursing product companies, as they must adapt to the changing dynamics of the workforce and service delivery models.

Nursing Products Market Segmentation Analysis

By Type

In 2023, the breast pump segment accounted for a 52% revenue share of the nursing products market. A combination of reasons accounts for this large market share. The increase in the participation of women in the workforce has increased the demand for efficient and convenient breast pumping solutions. The labour force participation rate for mothers with children younger than 18 was 71.2% in 2022, according to the U.S. Bureau of Labor Statistics. Advancements in technology have resulted in more modern breast pumps with improved efficiency, comfort, and portability, making them a better option for working mothers. Many have also integrated smart technology that enables better tracking and management of breastfeeding schedules. The breast pump segment's dominance has also been significantly attributed to the support of healthcare systems. Under the Affordable Care Act, health insurance policies must include coverage for breastfeeding support and equipment, like breast pumps, making it all the more available to a wider population. Increased awareness of the benefits of breastfeeding and the recommendations of public health campaigns and health care providers have also fueled demand for breast pumps. A large number of hospitals also provide rental services for good quality breast pumps, which is driving the market growth and exposure to these products.

The nipple cream segment is expected to grow with a notable CAGR in the forecast period. This growth can be attributed to increasing breastfeeding rates, with the Centers for Disease Control and Prevention (CDC) reporting that 84.1% of infants born in 2019 were breastfed at some point. There is also a growing emphasis on a more holistic view of postpartum care, including the prevention and treatment of any pain that comes from breastfeeding. Product innovations, including organic, natural, and hypoallergenic nipple creams, appeal to health-conscious consumers as well as those with sensitive skin. Increased availability and accessibility of nipple creams through online platforms, and accordingly the growth of e-commerce, has helped in the expansion of nipple creams market. Additionally, nipple creams are often combined with education about proper breastfeeding techniques, contributing towards increased adoption of the product since several lactation consultants and healthcare providers now recommend these products as a part of general breastfeeding assistance.

Nursing Products Market Regional Insights

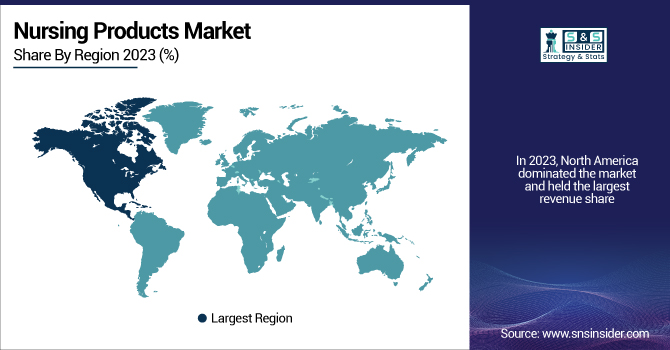

North American region held a significant share and is growing with a significant CAGR over the forecast period. This growth is driven by their well-developed health infrastructures - in both the US and Canada, health systems emphasize the care of the mother and infant population. In 2022, there were 6,120 hospitals in the U.S. with 31,555,807 hospital admissions, indicating a robust healthcare network supporting the use of nursing products. High healthcare expenditure also contributes to the region's market leadership, with CMS reporting that U.S. healthcare spending reached $4.9 trillion in 2023, or $14,570 per person. Establishment of North American regulatory structure governed by the likes of the FDA is fostering the generation of quality and standards of nursing products that are trusted by consumers, leading to market growth. The region is also ahead in developing and adopting advanced nursing products, particularly in the breast pump segment, thus strengthening its market dominance.

The Asia Pacific region led the market with a 36% revenue share in 2023. This rapid growth is driven by several key factors, including the region's large population base. With their high birth rates, China and India are leading in this regard, making a huge market for nursing products. Increased awareness regarding maternity care and breastfeeding benefits is anticipated to drive product adoption across the region. The growing middle-class) population in countries like China and India is increasing spending on premium nursing products. Moreover, some Asian nations are enforcing policies supporting maternal health along with breastfeeding, thereby indirectly growing the nursing products market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Nursing Products Market

-

Smith & Nephew (Allevyn Dressings, Opsite Film Dressings)

-

ResMed (AirSense 10 CPAP Machine, AirFit N20 Nasal Mask)

-

Fisher & Paykel Healthcare (ICON+ Auto CPAP Machine, Simplus Full Face Mask)

-

Abbott Laboratories (FreeStyle Libre Glucose Monitoring System, Ensure Nutritional Shakes)

-

Philips Avent (Natural Baby Bottle, Comfort Breast Pump)

-

Medline Industries (CURAD Bandages, FitRight Adult Briefs)

-

Cardinal Health (Kangaroo Feeding Pumps, Protexis Surgical Gloves)

-

Baxter International (Sigma Spectrum Infusion System, IV Solutions)

-

3M Healthcare (Tegaderm Dressings, Littmann Stethoscopes)

-

Becton, Dickinson and Company (BD) (Alaris Infusion Pumps, BD SafetyGlide Needles)

-

Johnson & Johnson (Band-Aid Brand Adhesive Bandages, Tylenol)

-

Stryker Corporation (Mistral-Air Warming Blankets, Prime Series Stretchers)

-

Hill-Rom Holdings (Progressa Bed System, Welch Allyn Vital Signs Monitors)

-

Invacare Corporation (Platinum Mobile Oxygen Concentrator, TDX SP2 Power Wheelchair)

-

Coloplast (SpeediCath Catheters, SenSura Mio Ostomy Products)

-

Molnlycke Health Care (Mepilex Foam Dressings, Biogel Surgical Gloves)

-

ConvaTec Group (AQUACEL Ag Dressings, Esteem+ Ostomy System)

-

Kimberly-Clark Health Care (Huggies Diapers, Kleenex Tissues)

-

Paul Hartmann AG (Hydrofilm Wound Dressings, MoliCare Incontinence Products)

-

Nipro Corporation (SafeTouch Safety Needles, Elisio Dialyzers)

Recent Developments in the Nursing Products Market

-

In January 2024, Koninklijke Philips N.V. announced the launch of a new line of smart breast pumps featuring AI-powered personalization technology. The pumps aim to enhance mothers' pumping experience.

-

In September 2023, Medela AG launched a hospital-grade breast pump rental program through key U.S. healthcare providers to help get high-quality pumps into the hands of new mothers as conveniently as possible.

-

In March 2023, Pigeon Corporation launched biodegradable nursing pads and organic cotton nursing bras in an effort to meet increased consumer demand for eco-friendly nursing products.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.73 Billion |

| Market Size by 2032 | USD 10.95 Billion |

| CAGR | CAGR of 7.48% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Breast Pump, Nursing Bra, Nipple Cream, Pumping Accessories, Nursing Pillow, Nursing Cover, Nursing Pad, Nursing Station, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Smith & Nephew, ResMed, Fisher & Paykel Healthcare, Abbott Laboratories, Philips Avent, Medline Industries, Cardinal Health, Baxter International, 3M Healthcare, Becton Dickinson and Company (BD), Johnson & Johnson, Stryker Corporation, Hill-Rom Holdings, Invacare Corporation, Coloplast, Molnlycke Health Care, ConvaTec Group, Kimberly-Clark Health Care, Paul Hartmann AG, Nipro Corporation |