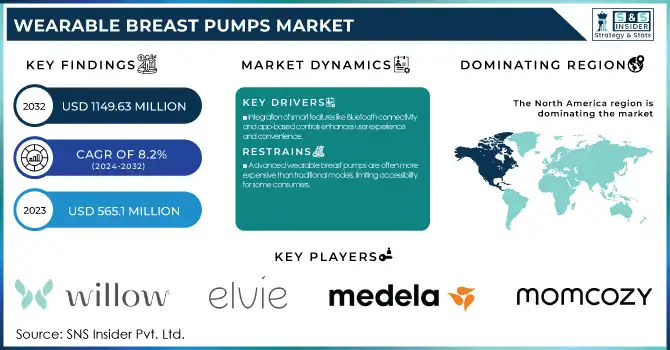

Wearable Breast Pumps Market Size & Overview:

The Wearable Breast Pumps Market Size was valued at USD 565.1 million in 2023 and is expected to reach USD 1149.63 million by 2032, growing at a CAGR of 8.2% over the forecast period 2024-2032.

Get more information on Wearable Breast Pumps Market - Request Sample Report

The wearable breast pumps market report delivers some crucial insights based on the adoption rates across different segments of the target audience including working mothers and first-time users. It analyzes device shipments by volume through 2020-2023 to monitor the growth of the market. By tracking consumer demographics and usage, trends are identified based on age, employment status, and frequency of use. Pricing and cost analysis detail affordability, local price differences, and insurance coverage Technological advancements focus on innovations like silent operation, app connectivity, and hands-free functionality. Regulatory & compliance trends which include FDA approvals, CE markings, and other regional safety standards affecting market penetration. Key drivers of the global wearable breast pumps market include the changing lifestyle of women with their increasing participation in the female workforce and their growing awareness of the benefits that a breast pump provides in a breastfeeding environment.

Wearable Breast Pumps Market Dynamics

Drivers

-

Integration of smart features like Bluetooth connectivity and app-based controls enhances user experience and convenience.

The wearable breast pumps market has undergone tremendous transformation owing to technological advancements, which enable breastfeeding mothers to be more convenient and efficient. Modern wearable breast pumps, such as the Willow and Elvie models, have revolutionized the pumping experience by offering discreet, hands-free operation. These devices are integrated into a bra so mothers can pump milk without external tubes or wires, the mobile, flexible option. A prominent aspect of these sophisticated pumps is the implementation of smart technology. For example, the Elvie pump connects to a smartphone app, providing real-time milk volume monitoring and pumping history tracking and allowing control of the device remotely. This means not only better use of experience but also a amount of data to help mothers manage their breastfeeding routines more effectively. Furthermore, the development of quieter motors and improved suction mechanisms has addressed common concerns associated with traditional breast pumps. Elvie pump is known for its silent function, which helps mothers to pump in public places without getting noticed.

Retsrain

-

Advanced wearable breast pumps are often more expensive than traditional models, limiting accessibility for some consumers.

The high cost of wearable breast pumps remains a significant barrier to widespread adoption, as premium models with advanced features can range from USD 200 to USD 500 or more. Many consumers find these devices expensive compared to traditional electric or manual pumps, which are available at lower price points. In a 2024 consumer survey, cost was cited by about 42% of new moms as a critical factor influencing their purchase decisions. Moreover, the price of insurance is not homogenous across parts of the world, as only 30% of the similar U.S. insurance policies compensated for all costs generated by a smart wearable breast pump, while others compensated only partially. Long term ownership cost is driven up by the high initial price tag, as well as the costs for replacement accessories like collection cups and valves. However, the affordability hurdle is even more pronounced in emerging markets, with disposable income levels severely limiting market penetration despite an increased level of awareness for the benefits associated with wearable breast pumps.

Opportunity

-

Increasing product reach through effective marketing strategies, such as Willow Innovations' "Pumping IS Breastfeeding" campaign launched in August 2024.

The wearable breast pumps market presents a significant opportunity through increasing product reach via effective marketing strategies. For example, Willow Innovations introduced the "Pumping IS Breastfeeding" campaign in August 2024 to broaden the breastfeeding dialogue and shift the narrative toward making pumping a normal part of the breastfeeding conversation. This is powered by the increasing women's employment rate globally. According to data released in December 2022, over 993,000 mothers were employed in the United States, and the participation rate for women in the labour force reached 77.0 %. Also, the U.S. Bureau of Labor Statistics says the U.S. unemployment rate for women has fallen from 13.9% in 2020 to 3.3% in 2023.

The awareness and support for working mothers who breastfeed are also to help the market. As an example in Australia in 2023, women accounted for 60.4% of the total employment population. To capture this chance, the company is taking advantage of digital marketplace and marketing channels. Popular platforms including Amazon, Bodily, and Haakaa have reduced prices plus speedy customer support on a wide range of breast pumps and also breast-feeding extras. Moreover, smart wearable breast pumps connected to mobile applications that provide data on milk volume, history of the last pumping, and pumping time can be crucial information that encourages women to carry them in places without pumping spaces.

Challenge

-

Limited battery capacity and suction along with leakage issues, can affect the overall user experience and adoption rates.

The main challenges in the wearable breast pumps market are limited battery capacity and suction, along with concerns regarding leakage. Recent data from 2025 indicates that battery life remains a concern for many users. For example, the Elvie Pump one of the best wearable breast pumps has a battery life of around 2.5 hours. Although this is better than the earlier models, it still needs regular charging, which may not be possible during a busy mother's schedule. Another challenge is the suction strength, namely that the suction strength of wearable pumps is generally much weaker than that of traditional wall pumps. As a result, some users may not fully empty the breast and this could affect some users' milk supply. Additionally, leakage issues persist in some models. The Elvie Pump, for example, requires careful handling to prevent milk from spilling back into the flange area when removing the pump. These challenges can affect the overall user experience and adoption rates of wearable breast pumps.

Wearable Breast Pumps Market Segmentation Insights

By Component

In 2023, wearable pumps held the largest market share of 67%. This growth is driven by the convenience and portability offered by wearable pumps that align perfectly with the needs of modern, active mothers. Such devices enable hidden milk pumping in different settings, such as offices and public areas, resolving obstacles for employed mothers. In addition, new technologies have markedly improved the capabilities of wearable pumps. With features like app connectivity, customizable settings, or noise reduction, their appeal has grown. Consumer confidence was supported by clearance of a number of novel wearable pump designs by the U.S. Food and Drug Administration. Moreover, the Affordable Care Act's requirement for insurance coverage of breast pumps has made the devices available to a wider population. The Centers for Disease Control and Prevention (CDC) reported that 84.1% of infants born in 2022 were breastfed at some point, indicating a strong market for breastfeeding accessories .

By technology

In 2023, Battery-operated wearable breast pumps dominated the market and held the largest revenue share of about 59%. There are several major factors that contribute to this dominance. Battery-operated pumps offer a perfect balance between portability and performance, making them ideal for mothers who need to pump on the go or in various settings. In 2023, 81.9% of employed mothers with children younger than 3 years old were full-time workers, according to the U.S. Department of Labor, showcasing the ever-growing need for pump solutions that fit within busy lifestyles.

The technological advancements in battery life and efficiency have significantly improved the usability of these pumps. Many models now offer extended operation times on a single charge, aligning with typical workday durations. The quiet operation of battery-powered pumps also contributes to their popularity, allowing for discreet use in various environments. Furthermore, the Centers for Disease Control and Prevention (CDC) reported that in 2022, 58.3% of mothers were still breastfeeding at 6 months postpartum, indicating a sustained need for efficient pumping solutions over extended periods.

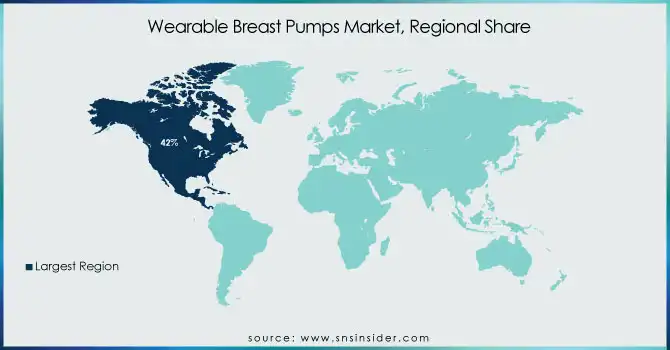

Wearable Breast Pumps Market Regional Analysis

The North American region dominated and held 42% share of the wearable breast pumps market in 2023. The dominance of North America can be majorly attributed to high awareness regarding the benefits of breastfeeding along with favourable policies and advanced healthcare infrastructure. The U.S. Centers for Disease Control and Prevention reported that 84.1% of infants born in 2022 were breastfed at some point, indicating a strong culture of breastfeeding support. The region's high female labor force participation rate, which stood at 56.8% in 2023 according to the U.S. Bureau of Labor Statistics, has driven demand for convenient pumping solutions. Moreover, the Affordable Care Act requires that insurance cover the cost of breast pumps.

Asia-Pacific region is anticipated to grow at the highest CAGR throughout the forecast period, 2024 -2032. The rapid growth in the Asia-Pacific region where urbanization is occurring at an unprecedented rate along with higher disposable incomes and improving awareness of breastfeeding benefits are the key factors driving the market. The World Bank also stated that female labor force participation in East Asia and Pacific was 59.4% in 2023, thus reflecting a significant potential market. In addition, the market for breastfeeding products in the region is benefiting from government initiatives encouraging breastfeeding, such as China's national nutrition plan (2017-2030) which seeks to boost the exclusive breastfeeding rate to 50% in the nation by the year 2030.

Need any customization research on Wearable Breast Pumps Market - Enquiry Now

Key Players

Key Service Providers/Manufacturers

-

Willow Innovations, Inc.: (Willow Go, Willow 360)

-

Elvie: (Elvie Pump, Elvie Stride)

-

Medela LLC: (Freestyle Hands-free Breast Pump, Swing Maxi Hands-free)

-

Lansinoh Laboratories Inc.: (Lansinoh Wearable Pump)

-

Momcozy: (S12 Pro, S9 Pro)

-

Paruu: (P3 Wearable Pump, X2 Wearable Pump)

-

Spectra Baby: (Spectra Wearable Breast Pump)

-

LuvLap: (Melody Wearable Electric Breast Pump)

-

Fraupow: (Fraupow Wearable Breast Pump)

-

Tommee Tippee: (Made for Me Wearable Breast Pump)

Users:

-

Working mothers in corporate sectors

-

Healthcare professionals

-

Flight attendants

-

Teachers

-

Retail workers

-

Freelancers and remote workers

-

Military personnel

-

Athletes

-

Students

Recent developments:

-

In March 2024, Medela announced its latest "Freestyle Hands-free" breast pump, which is wearable, and silent through new noise reduction technology and offers a companion app that creates individualized pumping schedules. The launch led to a 15% increase in the company's sales of its wearable pump.

-

In November 2023, market leader Elvie announced its expansion into a U.S. manufacturing facility in order to meet increasing consumer demand. There was its reported U.S. sales growth, with the company's seeing a 30% year-over-year gain for its wearable pumps.

-

In February 2025, Willow Innovations added features such as longer battery life and better milk flow sensors and called it the next-generation wearable pump, the Willow Go 2.0. Pre-orders for the new model were 40% higher than expected, the company reported.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5651 Million |

| Market Size by 2032 | USD 1149.6 Million |

| CAGR | CAGR of 8.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Wearable Pumps, Accessories) • By Technology (Manual Wearable Breast Pump, Battery Operated Wearable Breast Pump, Smart Wearable Breast Pump) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Willow Innovations, Inc., Elvie, Medela LLC, Lansinoh Laboratories Inc., Momcozy, Paruu, Spectra Baby, LuvLap, Fraupow, Tommee Tippee |