Nutritional Analysis Market Report Scope & Overview:

Get More Information on Nutritional Analysis Market - Request Sample Report

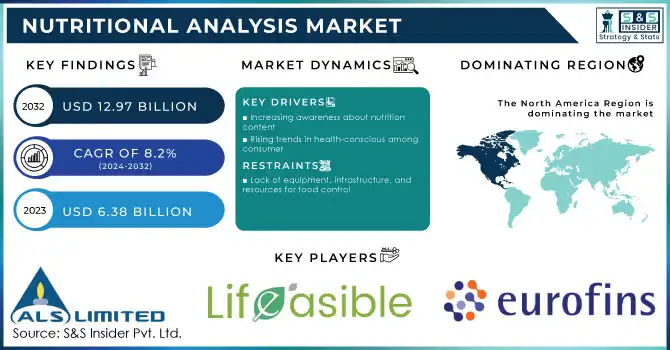

The Nutritional Analysis Market size was valued at USD 6.38 billion in 2023 and is expected to grow to USD 12.97 billion by 2032, at a CAGR of 8.2% over the forecast period of 2024-2032.

The nutritional analysis consists of testing food and beverages for various components such as proteins, carbohydrates, fats, sodium, vitamins & minerals, and others to create nutritional labeling for the back of product packaging. To ensure infant food safety, regulatory authorities have placed severe standards on organic baby foods. Because nutrition is essential for child growth, providing nutritional information will impact product buying decisions. Infant meals are frequently tested for adulteration and purity. As a result of these factors, the nutritional analysis market has grown at a faster rate.

Creating a product entails estimating cost and ingredient composition, and establishing the ingredient composition necessitates many lab investigations. The nutritional information about a product will also influence the consumer's purchase decision. As a result, when developing a food product, formulators have depended on nutritional analysis for trial samples.

Due to rising health concerns, consumers desire clean, mineral and vitamin enriched water that is always fresh. Water hardness test strips will therefore become much more common in the future. National primary drinking water regulations with enforced restrictions on the number of contaminants that could be harmful to human health have been developed by the Environmental Protection Agency. While supplying water to its customers, all civil and municipal authorities that offer public water must abide by these regulations.

MARKET DYNAMICS

KEY DRIVERS

-

Increasing awareness about nutrition content

-

Rising trends in health-conscious among consumer

Various cultural, economic, psychological, and lifestyle aspects have always had an impact on how consumers make their purchasing decisions for food and grocery items. This awareness relates to consumer health, disease, and diet. Consumers can learn more about the ingredients of food goods through the food labels that are presented on the package. Consumers may rely heavily on television commercials as a source of information.

Increasing awareness among consumers of food nutrition is another important market driver. A nutritional analysis lab offers food product testing services for the development of new products, supporting businesses in upholding the nutritional content of their new products as a standard.

RESTRAIN

-

Lack of equipment, infrastructure, and resources for food control

Developing countries lack the sophisticated organizations and necessary technologies for nutrient testing. Due to scarce resources, constrained technology, and subpar management, the infrastructure of food inspection laboratories in developing nations is anticipated to be bare. The market for nutritional analysis has been constrained by problems such lack of institutional coordination, a lack of knowledge to implement regulations at low levels, tools, and updated standards. Particularly in nations like Cuba, Bangladesh, and Ethiopia, food control laboratories are ill-equipped and lack qualified analytical staff.

OPPORTUNITY

-

Stringent food and drink regulations of the Regulatory Authorities

Food producers are subject to rules from governments all over the world that require them to list the nutritional content of their products. Nutritional analysis services are in demand as a result, and they can assist food producers in adhering to the rules. Calories, fat, carbs, protein, fiber, sugar, salt, vitamins, and minerals are among the nutritional data that must be listed on food labels. Nutritional analysis tests are in demand from the food and beverage industry. The market for nutritional analysis is developing in emerging nations as a result of fast industrialization, flourishing food trade with North America and Europe (free trade agreements), increased need for better water, and greater regulatory attention to safeguarding consumer wellness.

CHALLENGES

-

Time-consuming testing procedures and inconsistent food nutritional labeling laws

Traditional nutritional analysis techniques, such as laboratory testing, can be time- and money-consuming. Food producers who need to launch new goods or make changes to existing items fast may find this to be a hindrance. There isn't a single set of rules for food nutrition labeling that is widely followed. Because of this, it may be challenging for food makers to follow international rules.

IMPACT OF RUSSIAN-UKRAINE WAR

The war is having a huge detrimental impact on food security and nutrition content globally. According to the World Food Programme (WFP), food costs have risen by 30% since the start of the war. The war has made it more difficult to acquire accurate results on food availability, nutritional content analysis, and consumption. This is because food markets have been disrupted and people have been uprooted from their homes. As a result, tracking changes in dietary nutritional status is more difficult. Because of increased food prices, some people may be eating less meat and more plant-based foods as a result of the war. Furthermore, consumers may be eating more processed foods since they are more convenient.

IMPACT OF ONGOING RECESSION

Food prices tend to rise during recessions when demand falls and supply remains constant or falls. People may find it more difficult to afford healthful meals as a result of this. Recessions can cause dietary shifts as consumers opt for less expensive, less nutritious meals. This increases the danger of malnutrition, particularly among vulnerable populations like children and the elderly. According to a study conducted by the United Nations Food and Agriculture Organization, the number of people facing acute food insecurity grew by 100 million owing in part to the COVID-19 pandemic and the ensuing economic recession.

MARKET SEGMENTATION

by Parameter

-

Fat Profile

-

Vitamin Profile

-

Mineral Profile

-

Proteins

-

Total Dietary Fiber

-

Sugar Profile

-

Cholesterol

-

Calories

by Product Type

-

Bakery & Confectionery

-

Snacks

-

Dairy & Desserts

-

Meat & Poultry

-

Baby Food

-

Others

by Objective

-

New Product Development

-

Product Labelling

-

Quality Control

-

Regulation Compliance

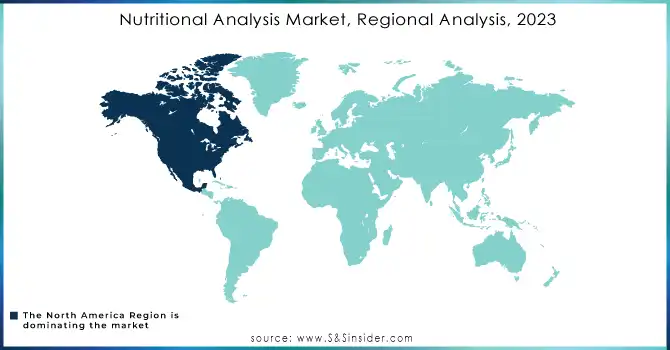

REGIONAL ANALYSIS

North America has dominated the nutritional analysis market and will continue to do so during the projection period due to high product consumption in the United States and Canada, as well as stringent product labeling requirements. Many developing countries are becoming more aware of nutritional and health issues.

The Asia-Pacific region will experience the fastest growth due to rising levels of usage of protein-rich food items, increased consumer awareness of the benefits, improvements in food nutrition and product labeling policies, a growing population, changing lifestyles, and rising personal disposable income. Poor nutritional health practices and Malnutrition are being addressed by government entities in the Asia Pacific region.

Europe's regional market has a significant growth owing to an increase in food safety standards and regulations. There is a growing awareness about the nutritional content of food products.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

ALS Limited, Lifeasible, Eurofins Scientific, TUV SUD AG, Opal Research and Analytical Services, Pat-Chem Laboratories LLC, SGS SA, Microbac Laboratories, Inc., Intertek Group plc, Compu-Food Analysis, and other key players are mentioned in the final report.

RECENT DEVELOPMENTS

In 2022 Nestle SA will begin displaying the nutritional value of its portfolio items as part of its annual reports published beginning with the 2022 annual report. The Nestle team will use the method of Health Star Rating to evaluate the nutrition content of its food and beverage items.

In 2022 Intertek, a global Total Quality Assurance provider, announces the launch of an enhanced adulteration panel analysis service created and supplied exclusively by our dietary supplements and organic product testing facility in Champaign, Illinois.

| Report Attributes | Details |

| Market Size in 2023 | US$ 6.38 Billion |

| Market Size by 2032 | US$ 12.97 Billion |

| CAGR | CAGR of 8.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Parameter (Fat Profile, Vitamin Profile, Mineral Profile, Proteins, Moisture, Total Dietary Fiber, Sugar Profile, Cholesterol, Calories) • By Product Type (Bakery and confectionery, Snacks, Dairy and desserts, Meat and poultry, baby food, Others) • By Objective (New Product Development, Product Labelling, Quality Control, Regulation Compliance) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | ALS Limited, Lifeasible, Eurofins Scientific, TUV SUD AG, Opal Research and Analytical Services, Pat-Chem Laboratories LLC, SGS SA, Microbac Laboratories, Inc., Intertek Group plc, Compu-Food Analysis |

| Key Drivers | • Increasing awareness about nutrition content • Rising trends in health-conscious among consumer |

| Market Challenges | • Time-consuming testing procedures and inconsistent food nutritional labeling laws |