Observability Tools And Platforms Market Report Scope & Overview:

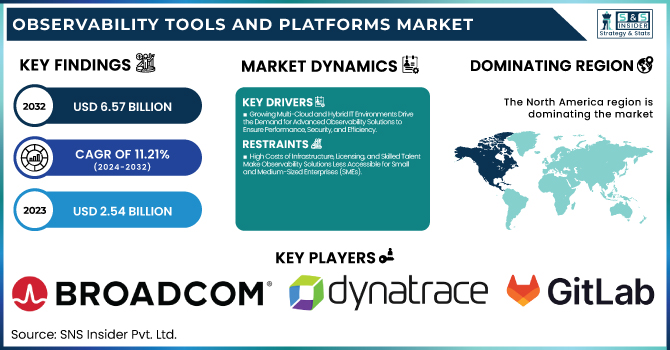

The Observability Tools And Platforms Market was valued at USD 2.54 billion in 2023 and is expected to reach USD 6.57 billion by 2032, growing at a CAGR of 11.21% from 2024-2032.

To Get more information on Observability Tools And Platforms Market - Request Free Sample Report

This report includes insights on key trends shaping the market, including the reduction of security incidents through advanced monitoring, increased automation utilization, and the rising demand for microservices monitoring. Additionally, the impact of multi-cloud adoption is driving the need for robust observability solutions, ensuring seamless performance across hybrid environments. Organizations are also leveraging these tools to minimize downtime costs, improving operational efficiency and reliability. As businesses continue to scale digital infrastructure, observability platforms play a critical role in enhancing system performance, security, and cost savings. The market’s growth is fueled by the increasing complexity of IT ecosystems and the demand for proactive issue resolution.

U.S. Observability Tools And Platforms Market was valued at USD 0.72 billion in 2023 and is expected to reach USD 1.88 billion by 2032, growing at a CAGR of 11.20% from 2024-2032. The U.S. Observability Tools and Platforms Market is experiencing significant growth due to the increasing complexity of IT infrastructures and the widespread adoption of multi-cloud environments. Businesses are prioritizing security incident reduction, leveraging advanced monitoring tools to detect and mitigate threats in real-time. The rising automation utilization rate is driving demand for observability solutions that enhance system performance and efficiency. Additionally, microservices adoption is fueling the need for in-depth monitoring to ensure seamless application performance. Organizations are also investing in observability tools to minimize downtime costs, improve operational resilience, and gain actionable insights, making them essential for digital transformation initiatives.

Observability Tools And Platforms Market Dynamics

Drivers

-

Growing Multi-Cloud and Hybrid IT Environments Drive the Demand for Advanced Observability Solutions to Ensure Performance, Security, and Efficiency.

The rapid adoption of multi-cloud, hybrid cloud, and container-based environments has multiplied the complexity of IT infrastructure many times over. With organizations transitioning to distributed architecture, legacy monitoring tools are no longer able to offer end-to-end visibility into heterogeneous environments. The demand for real-time intelligence, uninterrupted performance monitoring, and proactive problem detection is fueling the growth of observability platforms. Organizations need end-to-end observability to identify anomalies, improve resource utilization, and provide faultless application performance across cloud-native and on-premises infrastructure. As microservices, Kubernetes, and serverless computing increase, enterprises are deploying smart observability solutions to make systems more resilient, speed up incident resolution, and keep operations efficient in an ever-evolving digital environment.

Restraints

-

High Costs of Infrastructure, Licensing, and Skilled Talent Make Observability Solutions Less Accessible for Small and Medium-Sized Enterprises (SMEs).

The adoption of sophisticated observability tools requires high-cost investment in infrastructure, licenses, and support, which becomes a challenge for small and medium-sized enterprises (SMEs) with limited budgets. In addition to the cost of software, organizations will also need to invest in expert personnel who will be able to configure observability data efficiently, manage, and analyze it. The lack of experience in AI-based analytics, cloud-native monitoring, and real-time data processing further increases operational expenses. Moreover, continuous scalability and customization costs render it challenging for small companies to find justification in return on investment. As organizations make cost-benefit trade-off considerations, the high initial and ongoing costs for full-scale observability implementation result in delayed uptake or use of fundamental monitoring tools instead.

Opportunities

-

Growing Adoption of Cloud-Native and Serverless Architectures Increases Demand for Scalable, Intelligent, and Real-Time Observability Solutions.

While enterprises are rushing to adopt cloud-native infrastructures, Kubernetes clusters, and serverless computing, the conventional method of monitoring them is found lacking. These next-generation architectures call for real-time visibility, AI-driven anomaly detection, and forecasting analytics to drive flawless performance. Organizations are increasingly embracing dynamic, event-driven applications that need observability platforms which scale as needed, correlate distributed telemetry, and deliver actionable insights within complicated ecosystems. The explosive growth of microservices-based deployments further drives the demand for solutions which track dependencies, optimize resource utilization, and make systems more reliable. As companies put resilience, automation, and operation at the top of their agenda, cloud-native-focused observability platforms and serverless environments are gaining traction.

Challenges

-

Rising Volume of Logs, Metrics, and Traces Increases Data Management Complexities, Making Storage, Processing, and Insight Extraction More Challenging.

The increasing scale of modern IT environments, cloud-native applications, and distributed systems is generating an overwhelming volume of logs, metrics, and traces. Handling this real-time data flow needs high-performance storage, indexing, and real-time processing to provide meaningful insights without overwhelming the system. Filtering out relevant signals from noise, correlating different data sources, and optimizing resource utilization are problems faced by organizations. With businesses needing real-time anomaly detection and performance monitoring, conventional data handling techniques fall short. There is growing demand for automated data aggregation, AI-driven analytics, and storage at economical cost, with the goal of finding a balance between end-to-end observability and operational effectiveness without incurring excess overhead and latency.

Observability Tools And Platforms Market Segment Analysis

By Component

The Solutions segment dominated the Observability Tools and Platforms Market in 2023, commanding about 69% of the revenue share. The reason for this dominance is the increasing demand for AI-powered analytics, real-time monitoring, and cloud-native observability platforms that maximize IT infrastructure management. Companies spend more on complete observability solutions to maximize performance, identify anomalies, and enhance system resilience. Moreover, the increasing complexity of hybrid and multi-cloud environments has created demand for automated and scalable observability tools.

The Services segment is also expected to expand at the fastest CAGR of around 12.75% during 2024-2032, driven by rising demand for consulting, deployment, and managed services. With enterprises finding it difficult to integrate, configure, and manage observability platforms, they require professional assistance to improve operational efficiency. The rising use of cloud-based observability solutions and the requirement for tailored implementations, continuous monitoring, and training services further drive the growth of this segment.

By Deployment

The Cloud segment dominated Observability Tools and Platforms Market in 2023 with around 65% of the revenue share. The leadership is fueled by the extensive use of cloud-native architectures, multi-cloud strategies, and serverless computing. Organizations are adopting scalable, AI-driven observability solutions to comprehend complex cloud environments more and more. The shift towards remote operations, digital transformation, and cost-effective SaaS-based monitoring has further increased cloud-based observability adoption, which provides real-time insights, automation, and seamless integration across distributed systems.

The On-premises segment is anticipated to grow at the fastest CAGR of around 12.58% during 2024-2032 because of increasing data security, compliance, and regulatory requirements concerns. Sectors dealing with sensitive data, including finance, healthcare, and government, focus on on-premises observability solutions to have control over data and minimize cybersecurity threats. Second, organizations with historic IT infrastructures prefer on-premises implementations to provide secure integration, minimal latency monitoring, and adherence to industry-specific norms and regulations in addition to enjoying complete operational control.

By Organization Size

Large Enterprises segment of the Observability Tools and Platforms Market led with around 68% of revenue share in 2023, due to complexity of IT infrastructure, high levels of data volumes, and burgeoning cybersecurity threats at large organizations. Companies invest big in AI-driven observability solutions to maximize real-time monitoring, anomaly detection, and performance optimization of distributed systems. Moreover, the increasing use of multi-cloud, hybrid environments, and DevOps practices further fueled the demand for enterprise-level observability platforms.

The SMEs segment is expected to grow at the fastest CAGR of around 12.64% from 2024 to 2032, fueled by growing digital transformation efforts and cloud adoption. With small and medium-sized enterprises scaling their cloud-native and microservices-based infrastructures, they need cost-efficient, scalable observability solutions to improve system reliability and security. The increased availability of low-cost SaaS-based observability tools, automation features, and managed services is making it possible for SMEs to deploy advanced monitoring solutions without substantial infrastructure investments.

By Vertical

The BFSI segment dominated the Observability Tools and Platforms Market in 2023, holding approximately 27% of the revenue share. This dominance is driven by the sector’s strict regulatory compliance, high-security requirements, and need for real-time monitoring to prevent fraud and operational disruptions. Financial institutions rely on AI-driven observability tools to enhance cybersecurity, risk management, and seamless transaction processing across digital banking, payment gateways, and trading platforms, ensuring system uptime, data integrity, and customer trust in a highly sensitive environment.

The Healthcare segment is expected to grow at the fastest CAGR of approximately 13.74% from 2024 to 2032, driven by the increasing adoption of digital health solutions, IoT-enabled medical devices, and telemedicine platforms. Healthcare providers require real-time observability solutions to ensure patient data security, regulatory compliance, and uninterrupted service delivery. The growing reliance on electronic health records (EHRs), AI-driven diagnostics, and cloud-based healthcare applications further fuels the demand for advanced monitoring and predictive analytics in the sector.

Regional Analysis

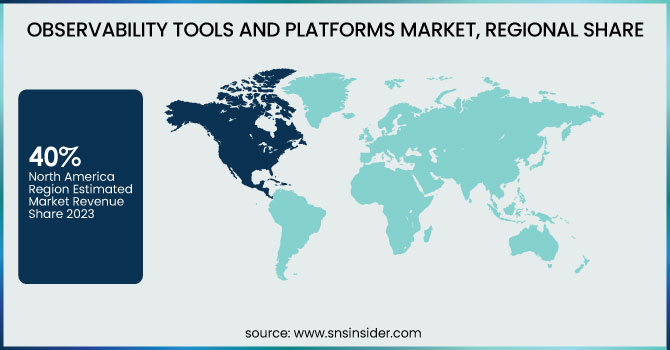

The North America region dominated the Observability Tools and Platforms Market in 2023, holding approximately 40% of the revenue share. This leadership is driven by rapid cloud adoption, strong presence of key market players, and high investment in AI-driven observability solutions. Enterprises across BFSI, healthcare, and IT sectors prioritize real-time monitoring, cybersecurity, and compliance to enhance system resilience. Additionally, the region’s advanced IT infrastructure, early adoption of DevOps, and increasing digital transformation initiatives further fuel market growth.

The Asia Pacific region is expected to grow at the fastest CAGR of approximately 13.22% from 2024 to 2032, driven by rapid digitalization, expanding cloud infrastructure, and increasing adoption of AI-powered observability tools. Enterprises in IT, telecom, and manufacturing sectors are embracing cloud-native applications and DevOps practices, driving demand for advanced monitoring solutions. Additionally, the rise of smart cities, IoT deployments, and growing SME investments in digital transformation further accelerates the region’s market expansion.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Broadcom [DX APM, DX NetOps]

-

Dynatrace, Inc. [Dynatrace Platform, Davis AI]

-

GitLab B.V. [GitLab CI/CD, GitLab Observability]

-

International Business Machines Corporation [Instana, Turbonomic]

-

LogicMonitor Inc. [LM Envision, LM Logs]

-

Microsoft [Azure Monitor, Application Insights]

-

Monte Carlo [Monte Carlo Data Observability, Monte Carlo AI]

-

Riverbed Technology [AppResponse, NetProfiler]

-

ScienceLogic [SL1 Platform, SL1 AIOps]

-

Splunk Inc. [Splunk Observability Cloud, Splunk Infrastructure Monitoring]

-

AppDynamics (a Cisco company) [AppDynamics APM, AppDynamics Cloud]

-

Datadog [Datadog APM, Datadog Log Management]

-

Elastic (formerly ElasticSearch) [Elastic Observability, Kibana]

-

Grafana Labs [Grafana, Loki]

-

Graylog [Graylog Enterprise, Graylog Security]

-

Honeycomb [Honeycomb Observability Platform, Honeycomb Metrics]

-

Instana [Instana APM, Instana Infrastructure Monitoring]

-

LightStep [Lightstep Observability, Lightstep Incident Response]

-

LogicMonitor [LM Intelligence, LM AIOps]

-

New Relic [New Relic One, New Relic APM]

-

SolarWinds [AppOptics, Loggly]

-

Sumo Logic [Sumo Logic Observability Suite, Sumo Logic Cloud SIEM]

Recent Developments:

-

2024: Dynatrace announced integration with Amazon Bedrock to enhance observability and security for GenAI applications. This collaboration enables real-time monitoring, anomaly detection, and compliance enforcement, ensuring safe and trustworthy AI-driven workloads.

-

March 2025: LogicMonitor introduced new observability innovations to modernize data centers for AI. Enhancements include AI workload visibility, cost optimization, embedded logs for faster troubleshooting, and GenAI-powered root cause analysis with Edwin AI.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.54 Billion |

| Market Size by 2032 | USD 6.57 Billion |

| CAGR | CAGR of 11.21% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solutions, Services) • By Deployment (Cloud, On-premises) • By Organization Size (Large Enterprises, SMEs) • By Vertical (Manufacturing, Retail & E-commerce, Government & Public Sector, IT & Telecommunications, Healthcare & Life Sciences, BFSI, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Broadcom, Dynatrace Inc., GitLab B.V., International Business Machines Corporation, LogicMonitor Inc., Microsoft, Monte Carlo, Riverbed Technology, ScienceLogic, Splunk Inc., AppDynamics (a Cisco company), Datadog, Elastic (formerly ElasticSearch), Grafana Labs, Graylog, Honeycomb, Instana, LightStep, LogicMonitor, New Relic, SolarWinds, Sumo Logic |