OEM Insulation Market Report Scope & Overview:

Get More Information on OEM Insulation Market - Request Sample Report

The OEM Insulation Market size was valued at USD 38.80 Billion in 2023 and is expected to reach USD 62.80 Billion by 2032, growing at a CAGR of 5.50% over the forecast period 2024-2032.

The OEM Insulation Market is set for growth, influenced by several key factors. Our report analyses raw material supply chain dynamics and the impact of energy efficiency regulations on innovation. It highlights environmental sustainability trends and evaluates performance metrics of insulation materials. Additionally, insights into price fluctuations, a cost-benefit analysis for OEMs, and advanced insulation products for niche applications will provide a comprehensive understanding of the market landscape.

Market Dynamics

Drivers

-

Increasing demand for energy-efficient solutions across automotive, construction, and industrial applications drives OEM insulation market growth

Demand for energy-efficient solutions across automotive, construction, and industrial sectors is hugely driving the OEM insulation market. With increasing rules and regulations to control energy usage and a mounting concern for sustainability, OEMs are opting more for insulation solutions to minimize the consumption of energy and to raise the overall efficiency of the application. In automotive, electric vehicles are emerging strongly, which mandates advanced insulation material to ensure it maintain its level of energy efficiency, thermal management, and acoustics performance. The construction industry is increasingly adopting green building standards and energy-efficient designs, hence leading to the growth of insulation needs. The imperative to reduce heating, ventilation, and air conditioning (HVAC) energy consumption has boosted the widespread use of high-performance insulation materials. Another reason is the sector of industrial applications such as power plants and manufacturing facilities that require special thermal and sound protection and safety insulation, all factors that increase the demand for these products.

Restraints

-

Technical challenges in integrating new insulation materials into existing manufacturing processes limit market growth

A technical challenge that hampers market growth is the integration of new insulation materials into already existing manufacturing processes. The major reason is that many manufacturers do not embrace innovative insulation materials, as this will require them to modify the already existing production lines, receive further training, or acquire new equipment, which can be expensive. For organizations that have production lines already in place for automotive or construction companies, using different insulation-related solutions may need to discontinue the ongoing manufacturing process, delaying production. Moreover, some insulation types require more advanced and specialized handling or even expert service to ensure proper performance, which can be quite a hindrance for manufacturers lacking such resources. Therefore, the complexity of change in new insulation technologies may constrain the overall use of advanced materials across the diverse OEM sectors.

Opportunities

-

Rising popularity of electric vehicles and renewable energy driving demand for high-performance insulation solutions

The increasing number of electric vehicles (EVs) in production and a global push toward renewable energy are significant opportunities for the OEM insulation market. During this period, OEMs will need to provide far more advanced insulation solutions to tackle temperature control and increase efficiency in energy use as demand for EVs remains rocket high. Electric vehicles need highly efficient thermal management systems, where advanced insulation materials, such as aerogels or composite insulation, are used to protect batteries and ensure optimal performance. In parallel, the renewable energy sector, particularly solar and wind energy, is increasingly adopting high-performance insulation materials for energy storage systems and transmission lines to improve energy efficiency. These emerging sectors provide a tremendous market opportunity for insulation manufacturers to develop innovative products that meet these industries' special needs.

Challenge

-

Supply chain disruptions and geopolitical tensions impacting the consistency of raw material availability for OEM insulation production

Supply chain disruption due to geopolitical issues, trade barriers, and natural conditions is one of the most significant threats found in OEM insulation markets. Global suppliers provide many raw materials to the insulation industry, which also include fiberglass, polyurethane, and mineral wool. Geopolitical instability, including trade wars or regional conflicts, can severely interrupt the availability and cost of these staple materials, causing bottlenecks in supply chains. Moreover, the ongoing challenges of COVID-19 and subsequent supply chain interruptions have brought to the fore the fragility of the insulation market. This may lead to a delay in production, increased raw material prices, and an overall inability to meet market demand, all of which are factors that impede the growth of the OEM insulation market.

Segmental Analysis

By Material

The glass wool segment accounted for the largest share in the OEM insulation market in 2023, holding a market share of approximately 30%. Glass wool finds more application owing to its better thermal and acoustic insulation characteristics, thus a requirement for various sectors, including construction and HVAC systems. Organizations such as the U.S. DOE promote the use of glass wool in building codes and standards for insulation for its energy efficiency, thus saving heating and cooling expenses. Additionally, the construction industry is increasingly becoming sustainable, which goes well with the high performance of glass wool insulation in energy conservation. Availability of glass wool insulation products from prominent manufacturers such as Owens Corning and Saint-Gobain also strengthens its market position, since these companies are continuously innovating and enhancing the properties of their glass wool solutions.

By Application

In 2023, the thermal insulation segment dominated and accounted for the largest market share of around 55%. Thermal insulation is very important in reducing heat pathways, which is why it is one of the primary concerns ion many different fields, especially construction and HVAC systems. An increasing focus on energy efficiency and sustainability in building codes, backed by institutions such as the International Energy Agency (IEA), has been a key driver of the thermal insulation solutions market. Examples include LEED and BREEAM-based building standards that reward the installation of high-performance thermal insulation for energy-saving purposes. Additionally, the development of new thermal insulation materials, including aerogels and high-performance foams, is increasing the attractiveness of the market, enabling manufacturers to comply with strict energy efficiency regulations while improving overall building performance.

By End-use Industry

In 2023, the building and construction category dominated and accounted for the largest share of the OEM insulation market, with a share of approximately 40%. One of the leading contributions to this dominancy is elucidated as the sharp increase in building facilities across the globe specifically in residential and commercial. The increasing momentum of green building and energy-saving practices, supported by government initiatives and regulations for reducing carbon footprints, has resulted in a high demand for insulation solutions in this sector. Policies such as the U.S. Energy Star, for example, promote the application of insulation materials on new structures for better energy efficiency. Competitive Landscape Building and construction insulation products market is a fragmented market. This has led companies like Knauf Insulation, and Rockwool International to promote various types of innovative insulation development for the building and construction industry.

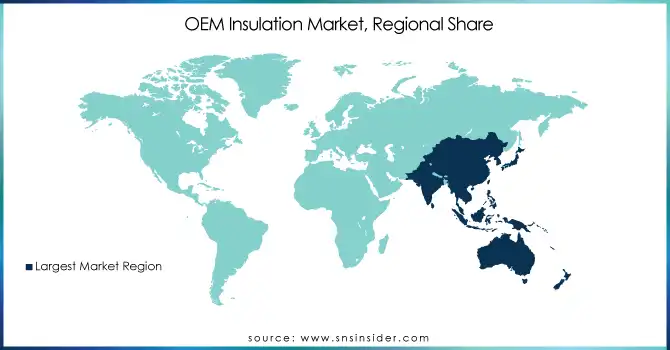

Regional Analysis

In 2023, Asia Pacific dominated and accounted for a market share of around 45% of the OEM insulation industry, due to the fast urbanization and industrialization in countries including China, India, and Japan. As the largest market, China is driving such energy-efficient buildings through various government policies including the "13th Five-Year Plan for Ecological and Environmental Protection." The demand for insulation products is further enhanced on account of India’s flourishing infrastructure and real estate sectors. In Japan, the expansion of its manufacturing industries, especially in automotive and electronics, increases the demand for insulation in OEM applications. The region’s growth looks set to continue, backed by tougher energy efficiency standards, according to the Asian Development Bank. Major players such as Owens Corning and Rockwool are expanding their operations in Asia Pacific to cater to the growing demand. Trend Classifies the Region as the major contributing Factor for the Global OEM Insulation Market

Get Customized Report as per Your Business Requirement - Request For Customized Report

Moreover, North America emerged as the fastest growing region in the OEM insulation market in 2023 and was the fastest growing region, registering high year-on-year growth at 6.7%, in terms of value sales. However, this is primarily due to growing government rules for energy efficiency and the adoption of sustainable construction. In the United States, programs like Energy Star are promoting the use of insulation in residential and commercial buildings. Furthermore, the growing use of thermal insulation in the automotive industry, more specifically, for electric vehicles (EVs) is also adding traction to the market. In addition, Canada is pushing for green building regulations, which are contributing to the growth in the demand for OEM insulation products. The drive for advanced insulation technologies such as aerogels and environmentally friendly foams being led by the U.S. Department of Energy is driving rapid growth. Major players such as Saint-Gobain, Owens Corning, and 3M are developing new solutions to meet this demand. This region exhibits substantial regulatory support, with increasing requirements for industrial and residential insulation in the upcoming timeframe positively impacting the overall growth.

Recent Highlights:

-

March 2024: IC Group announced the acquisition of RSL Group, a UK-based distributor of heating, ventilation and air conditioning (HVAC) products by IPCOM, a Belgium-based independent insulation company with the aim of expanding in the HVAC sector. The acquisition fits IPCOM’s mission for energy efficiency and saw Seamus Kerr, RSL’s technical director, joining IPCOM’s board. The deal ends RSL’s 116-year leadership by David Cherrill and Gerry McDonagh.

Key Players

-

Owens Corning (Thermafiber, PINK Insulation)

-

Rockwool A/S (Rockwool Insulation, Comfortboard)

-

Covestro AG (Baytherm, Baydur)

-

Armacell (Armaflex, ArmaSound)

-

Huntsman Corporation (Polyurethane Insulation, Dymel)

-

Saint-Gobain ISOVER (Isover Insulation, Climaver)

-

Rogers Corporation (Rogers Poron, RO4000 Series)

-

Recticel Group (Europur, Recticel Insulation)

-

Aspen Aerogels Inc (Pyrogel, Spaceloft)

-

Morgan Advanced Materials PLC (Thermal Ceramics, Morgan Insulation)

-

Knauf Insulation (Knauf Earthwool, EcoBatt)

-

Johns Manville (JM Fiberglas, JM Insulation)

-

Kingspan Group (Kingspan Insulation, Kooltherm)

-

3M (3M Thinsulate, 3M Fire Protection)

-

BASF (Elastopipe, BASF Polyurethane)

-

Paroc Group (Paroc Stone Wool, Paroc Sandwich Panels)

-

China Jushi Co., Ltd. (Fiberglass Insulation, Jushi Glass Wool)

-

ACH Foam Technologies LLC (Achieve Foam, Foamular)

-

Demilec Inc. (Sealection, Heatlok)

-

Honeywell International, Inc. (Thermal Ceramics, Honeywell Fiber Insulation)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 38.80 Billion |

| Market Size by 2032 | USD 62.80 Billion |

| CAGR | CAGR of 5.50% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Material (Glass Wool, Mineral Wool, Reflective Insulation, Ceramic Insulation, Foamed Plastic, Elastomeric Foam, Others) •By Application (Thermal Insulation, Acoustic Insulation, Electrical Insulation, Others) •By End-use Industry (Aerospace, Automotive, Marine, Building and Construction, Consumer Appliances, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Owens Corning, Rockwool A/S, Covestro AG, Armacell, Huntsman Corporation, Saint-Gobain ISOVER, Rogers Corporation, Recticel Group, Aspen Aerogels Inc, Morgan Advanced Materials PLC and other key players |