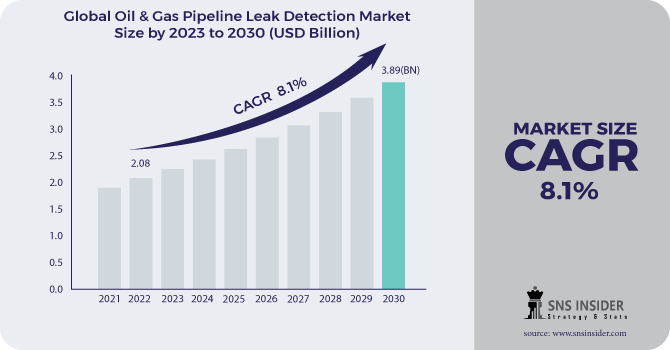

The Oil & Gas Pipeline Leak Detection Market size was valued at USD 2.24 Billion in 2023. It is expected to grow to USD 4.19 Billion by 2031 and grow at a CAGR of 8.1% over the forecast period of 2024-2031.

Preventing leaks in oil and gas pipelines is critical for meeting global energy needs while avoiding environmental harm and financial penalties for organizations. Various governments worldwide have implemented rules and legislations necessitating the maintenance and deployment of leak detection systems due to the adverse impacts of leakages. For instance, the Pipeline and Hazardous Materials Safety Administration (PHMSA) introduced a rule to enhance guidelines for hazardous liquid pipelines. This regulation establishes new compliance standards for system operators and owners, emphasizing the importance of maintaining pipe integrity to prevent leak incidents.

To get more information on Oil & Gas Pipeline Leak Detection Market - Request Free Sample Report

Leakages, often caused by pipeline corrosion, pose significant challenges and depend on the nature of the conveyed fluid. Implementing robust leak detection systems and adhering to stringent compliance standards are crucial steps in safeguarding the integrity of oil and gas pipelines, minimizing environmental risks, and ensuring the sustainability of the energy infrastructure. Oil and gas are finite natural resources that require large investments in order to be extracted successfully. Furthermore, oil and gas leaks can cause significant property damage and, in some cases, death, in addition to having a long-term negative impact on the environment. As a result, it is critical for stakeholders in the oil and gas business to have effective detection procedures. The reliance on these pipelines to supply regularly is growing as the demand for oil and gas rises. Because of the consequences of oil and gas pipeline leaks, governments in major nations have enacted rules and legislation requiring the maintenance and deployment of leak detection systems. The Pipeline and Hazardous Materials Safety Administration (PHMSA) has adopted a rule to enhance hazardous liquid pipeline restrictions. It established additional compliance criteria for system operators and owners with the goal of maintaining pipe integrity and preventing leaks.

Drivers

Upstream, middle, and downstream oil and gas leaks are all common.

Around the world, current channels are being expanded and renovated, while new channels are being built.

Government laws require the installation of a leak detection system.

Leaks are a common occurrence in all phases of the oil and gas industry, including upstream, middle, and downstream operations. These leaks can result in environmental hazards, financial losses, and operational disruptions.

Globally, there is a continual effort to expand, renovate, and construct new channels for oil and gas transportation. This expansion is driven by the increasing demand for energy resources and the need for efficient and reliable transportation infrastructure. Recognizing the environmental and economic risks associated with oil and gas leaks, governments worldwide have enacted laws mandating the installation of leak detection systems. These regulations emphasize the importance of early detection and swift response to prevent or minimize the impact of leaks.

Restraint

Fiber optic solutions are limiting the expansion of the oil and gas leak detection business.

Sensor and interrogator system installation expenses are rising.

Despite their potential, fiber optic solutions pose limitations to the expansion of the oil and gas leak detection business. While these solutions offer advantages such as high sensitivity and real-time monitoring, their deployment can be constrained by factors such as cost, complexity, and the specific challenges of the operational environment.

The installation expenses associated with sensor and interrogator systems are on the rise. This increase in costs can be attributed to various factors, including the complexity of the systems, the need for specialized expertise, and the integration of advanced technologies. As a result, companies investing in leak detection infrastructure may face higher upfront costs, impacting the overall economics of such installations.

Opportunities

In recent years, many oil and gas deposits have been discovered across the world.

At the site, a sophisticated processing facility for natural gas treatment has been built.

In recent years, there has been a notable increase in the discovery of oil and gas deposits worldwide. Advances in exploration technologies and increased focus on energy security have contributed to the identification of new and substantial reserves across various regions. To harness the potential of these discoveries, sophisticated processing facilities have been established at extraction sites, particularly for natural gas treatment. These facilities employ advanced technologies to process and refine natural gas, ensuring the extraction of valuable components while meeting environmental and safety standards.

The combination of increased exploration success and the establishment of cutting-edge processing facilities signifies the ongoing evolution and growth of the oil and gas industry. These developments play a crucial role in meeting global energy demands and optimizing the utilization of newly discovered reserves.

Challenges

The majority of leak detection methods available are not totally adequate for cold settings.

They should be inexpensive regardless of flow conditions, and they should be simple to manufacture and install.

In cold settings, the majority of existing leak detection methods face limitations. Cold temperatures can affect the performance and reliability of traditional leak detection technologies, necessitating the development of solutions specifically designed to operate effectively in colder environments.

An ideal leak detection method for cold settings should prioritize cost-effectiveness under various flow conditions. The economic viability of implementing leak detection solutions is crucial for widespread adoption, and solutions must be designed to deliver reliable results without significant cost escalation, ensuring affordability for operators. The effectiveness of leak detection methods in cold settings is enhanced by simplicity in both manufacturing and installation. Solutions that are easy to manufacture and install facilitate quicker deployment and reduce operational complexities, contributing to the practicality and efficiency of leak detection systems in challenging environments.

The conflict may lead to supply chain disruptions, affecting the production and distribution of materials required for pipeline construction and maintenance, including leak detection systems. Disruptions in the supply chain could impact the timely implementation of these technologies. Geopolitical uncertainties may influence the investment decisions of oil and gas companies, impacting infrastructure development projects, including those related to pipeline leak detection. Delays or alterations in investment plans could affect the adoption of advanced leak detection solutions.

Changes in geopolitical dynamics often have ripple effects on the regulatory environment. Governments may enact new policies or modify existing regulations related to pipeline safety and leak detection. Companies operating in the market may need to adapt to evolving regulatory requirements. The need for enhanced security and resilience in the face of geopolitical tensions may drive increased adoption of innovative leak detection technologies. Companies may invest in more sophisticated systems to ensure the integrity and safety of their pipeline networks.

During an economic downturn, companies in the oil and gas sector may experience reduced capital expenditure. This could result in delays or cancellations of pipeline projects, including those involving the implementation of advanced leak detection systems.

Economic uncertainties often lead to caution among industry players, causing delays or cancellations of infrastructure projects. Pipeline construction and maintenance projects, including those focused on improving leak detection capabilities, may be particularly susceptible to postponement. Companies may face budget constraints during economic downturns, limiting their ability to invest in costly technologies. The affordability of advanced leak detection systems could be a significant factor influencing purchasing decisions. Changes in economic conditions may influence regulatory environments. Governments might reassess priorities, potentially introducing new regulations or altering existing ones. This could impact the compliance requirements related to pipeline safety, including leak detection standards.

MARKET ESTIMATION:

Pipelines transmit various types of oil and condensates, as well as natural gas, across great distances, necessitating the most precise leakage monitoring and detection techniques. Modern leak detection systems used in oil and natural gas production facilities and transmission pipelines contain E-RTTM as one of the most extensively utilized technologies. This device is devoid of false alarms and delivers reliable information on leaks. As a result, the market's E-RTTM category is expected to develop at the fastest rate over the forecast period. The E-RTTM technology can detect minor leaks (less than 1% of the flow), precisely identify leak sizes, and simulate all dynamic fluid features (flow, pressure, and temperature). Furthermore, the time it takes to discover leaks is longer.

During the forecast period, the natural gas sector of the oil & gas leak detection market is expected to develop at a faster rate than the oil and condensate segment. One of the main reasons for the increased demand for leak detection methods and systems from natural gas production plants is the growing number of government restrictions aimed at reducing carbon dioxide emissions. In natural gas production facilities, software-based dynamic modeling monitors, such as E-RTTM, are employed for leak detection. The ability to monitor continually without interfering with pipeline operations is one of the primary benefits of E-RTTM-based systems. Furthermore, the rising use of natural gas throughout the world has led to the construction of additional pipeline infrastructure.

By Technology

Acoustic/Ultrasonic

E-RTTM

Mass/Volume Balance

Thermal Imaging

Laser Absorption and LiDAR

Vapor Sensing

Categorized by technology, the oil & gas pipeline leak detection market comprises acoustic sensors, flowmeters, cable sensors, vapor sensors, and other innovations. Acoustic sensors technology takes the lead with the most substantial market share. It plays a pivotal role in leak detection by identifying the sound generated by the leak. Additionally, sensors like cable sensors or vapor sensors also command a noteworthy portion of the market, driven by the increasing incorporation of advanced technologies such as the Internet of Things (IoT).

By Medium

Oil and condensate

Natural gas

By Location

Onshore

Offshore

The oil & gas pipeline leak detection market is categorized into onshore and offshore segments based on location. The onshore sector holds the predominant market share due to the significant impacts of oil and gas leaks on human life and property on land. Conversely, the offshore segment is anticipated to demonstrate the most substantial growth rate throughout the forecast period. This growth projection is attributed to the escalating deployment of oil and gas pipelines in offshore locations.

.png)

Need any customization research on Oil & Gas Pipeline Leak Detection Market - Enquiry Now

Over the projected period, the North American oil and gas pipeline leak detection equipment market is predicted to grow at a high rate. This is due to rising demand for leak detectors in the oil and gas industry, as well as ongoing pipeline construction in several nations throughout the area. Furthermore, throughout the forecast period, the target market in North America is predicted to rise due to increased R&D efforts and the installation of smart leak detection systems. Furthermore, due to increased oil and gas import and export operations, technical improvements, and high regulatory and environmental requirements throughout the region, countries such as China and India have seen considerable growth in the oil and gas pipeline leak detection equipment market. Due to various government efforts and advances made by prominent industry players operating in the target market, the oil and gas pipeline leak detection equipment market in Europe is likely to expand significantly. Asia Pacific region has the maximum demand for energy owing to which the utilization of leak detection equipment's at onshore locations has increased in recent years and will continue to rise. In Latin America and the Middle East Region, the presence of major oil reserves in the region and the increasing exploration activities are expected to fuel the demand for oil and gas pipeline leak detection equipment.

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

The major key players are Honeywell International, Inc., Atmos International Inc., Siemens AG, FLIR Systems Inc., Schneider Electric SA, Bridger Photonics Inc., ClampOn AS, Pentair PLC, Pure Technologies Ltd., Ttk-Leak Detection System, Yokogawa Electric Corporation.

Honeywell International, Inc-Company Financial Analysis

Pipelines transmit various types of oil and condensates, as well as natural gas, across great distances, necessitating the most precise leakage monitoring and detection techniques. Modern leak detection systems used in oil and natural gas production facilities and transmission pipelines contain E-RTTM as one of the most extensively utilized technologies. This device is devoid of false alarms and delivers reliable information on leaks. As a result, the market's E-RTTM category is expected to develop at the fastest rate over the forecast period. The E-RTTM technology can detect minor leaks (less than 1% of the flow), precisely identify leak sizes, and simulate all dynamic fluid features (flow, pressure, and temperature). Furthermore, the time it takes to discover leaks is longer.

In November 2021: Schneider Electric, French energy, and automation digital solution provider, and Prisma Photonics, an Israeli next-generation fiber sensing for smart infrastructure, announced their partnership to provide real-time intelligence and precise monitoring of oil and infrastructure.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.24 Billion |

| Market Size by 2031 | US$ 4.19 Billion |

| CAGR | CAGR 8.1% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Technology (Acoustic/Ultrasonic, E-RTTM, Fiber Optic, Mass/Volume Balance, Thermal Imaging, Laser Absorption, and LiDAR, Vapor Sensing) • by Medium (Oil and condensate and Natural gas) • by Location (Onshore and offshore) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Honeywell International, Inc., Atmos International Inc., Siemens AG, FLIR Systems Inc., Schneider Electric SA, Bridger Photonics Inc., ClampOn AS, Pentair PLC, Pure Technologies Ltd., Ttk-Leak Detection System, Yokogawa Electric Corporation. |

| Key Drivers | • Upstream, middle, and downstream oil and gas leaks are all common. • Government laws require the installation of a leak detection system. |

| Restraints | •Sensor and interrogator system installation expenses are rising. |

Ans: - Oil & Gas Pipeline Leak Detection Market Size was valued at USD 2.24 Bn in 2023.

Ans: - Upstream, middle, and downstream oil and gas leaks are all common.

Ans: - 3 segments of the Oil & Gas Pipeline Leak Detection Market.

Ans: - The major key players of the market are Altus Intervention, Calfrac Well Services Ltd., Baker Hughes Company, Halliburton, Step Energy Services, Key Energy Services, Llc., Oceaneering International, Inc., Schlumberger Limited, Trican, Weatherford International Plc

Ans: - Key Stakeholders Considered in the study are Raw material vendors, Regulatory authorities, including government agencies and NGOs, Commercial research, and development (R&D) institutions, Importers and exporters, etc.

TABLE OF CONTENT

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact Of Russia Ukraine Crisis

4.2 Impact of Economic Slowdown on Major Countries

4.2.1 Introduction

4.2.2 United States

4.2.3 Canada

4.2.4 Germany

4.2.5 France

4.2.6 UK

4.2.7 China

4.2.8 Japan

4.2.9 South Korea

4.2.10 India

5. Value Chain Analysis

6. Porter’s 5 Forces Model

7. Pest Analysis

8.Oil & Gas Pipeline Leak Detection Market, By Technology

8.1 Acoustic Sensors

8.2 E-RTTM

8.3 Fiber Optic

8.4 Mass/Volume Balance

8.5 Thermal Imaging

8.6 Laser Absorption and LiDAR

8.7 Vapor Sensing

9. Oil & Gas Pipeline Leak Detection Market, By Medium

9.1 Oil and condensate

9.2 Natural gas

10. Oil & Gas Pipeline Leak Detection Market, By Location

10.1 Onshore

10.2 Offshore

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 Trend Analysis

11.2.2 North America Oil & Gas Pipeline Leak Detection Market by Country

11.2.3 North America Oil & Gas Pipeline Leak Detection Market By Technology

11.2.4 North America Oil & Gas Pipeline Leak Detection Market By Medium

11.2.5 North America Oil & Gas Pipeline Leak Detection Market By Location

11.2.6 USA

11.2.6.1 USA Oil & Gas Pipeline Leak Detection Market By Technology

11.2.6.2 USA Oil & Gas Pipeline Leak Detection Market By Medium

11.2.6.3 USA Oil & Gas Pipeline Leak Detection Market By Location

11.2.7 Canada

11.2.7.1 Canada Oil & Gas Pipeline Leak Detection Market By Technology

11.2.7.2 Canada Oil & Gas Pipeline Leak Detection Market By Medium

11.2.7.3 Canada Oil & Gas Pipeline Leak Detection Market By Location

11.2.8 Mexico

11.2.8.1 Mexico Oil & Gas Pipeline Leak Detection Market By Technology

11.2.8.2 Mexico Oil & Gas Pipeline Leak Detection Market By Medium

11.2.8.3 Mexico Oil & Gas Pipeline Leak Detection Market By Location

11.3 Europe

11.3.1 Trend Analysis

11.3.2 Eastern Europe

11.3.3.1 Eastern Europe Oil & Gas Pipeline Leak Detection Market by Country

11.3.3.2 Eastern Europe Oil & Gas Pipeline Leak Detection Market By Technology

11.3.3.3 Eastern Europe Oil & Gas Pipeline Leak Detection Market By Medium

11.3.3.4 Eastern Europe Oil & Gas Pipeline Leak Detection Market By Location

11.3.3.5 Poland

11.3.3.5.1 Poland Oil & Gas Pipeline Leak Detection Market By Technology

11.3.3.5.2 Poland Oil & Gas Pipeline Leak Detection Market By Medium

11.3.3.5.3 Poland Oil & Gas Pipeline Leak Detection Market By Location

11.3.3.6 Romania

11.3.3.6.1 Romania Oil & Gas Pipeline Leak Detection Market By Technology

11.3.3.6.2 Romania Oil & Gas Pipeline Leak Detection Market By Medium

11.3.3.6.4 Romania Oil & Gas Pipeline Leak Detection Market By Location

11.3.3.7 Turkey

11.3.3.7.1 Turkey Oil & Gas Pipeline Leak Detection Market By Technology

11.3.3.7.2 Turkey Oil & Gas Pipeline Leak Detection Market By Medium

11.3.3.7.3 Turkey Oil & Gas Pipeline Leak Detection Market By Location

11.3.3.8 Rest of Eastern Europe

11.3.3.8.1 Rest of Eastern Europe Oil & Gas Pipeline Leak Detection Market By Technology

11.3.3.8.2 Rest of Eastern Europe Oil & Gas Pipeline Leak Detection Market By Medium

11.3.3.8.3 Rest of Eastern Europe Oil & Gas Pipeline Leak Detection Market By Location

11.3.3 Western Europe

11.3.3.1 Western Europe Oil & Gas Pipeline Leak Detection Market by Country

11.3.3.2 Western Europe Oil & Gas Pipeline Leak Detection Market By Technology

11.3.3.3 Western Europe Oil & Gas Pipeline Leak Detection Market By Medium

11.3.3.4 Western Europe Oil & Gas Pipeline Leak Detection Market By Location

11.3.3.5 Germany

11.3.3.5.1 Germany Oil & Gas Pipeline Leak Detection Market By Technology

11.3.3.5.2 Germany Oil & Gas Pipeline Leak Detection Market By Medium

11.3.3.5.3 Germany Oil & Gas Pipeline Leak Detection Market By Location

11.3.3.6 France

11.3.3.6.1 France Oil & Gas Pipeline Leak Detection Market By Technology

11.3.3.6.2 France Oil & Gas Pipeline Leak Detection Market By Medium

11.3.3.6.3 France Oil & Gas Pipeline Leak Detection Market By Location

11.3.3.7 UK

11.3.3.7.1 UK Oil & Gas Pipeline Leak Detection Market By Technology

11.3.3.7.2 UK Oil & Gas Pipeline Leak Detection Market By Medium

11.3.3.7.3 UK Oil & Gas Pipeline Leak Detection Market By Location

11.3.3.8 Italy

11.3.3.8.1 Italy Oil & Gas Pipeline Leak Detection Market By Technology

11.3.3.8.2 Italy Oil & Gas Pipeline Leak Detection Market By Medium

11.3.3.8.3 Italy Oil & Gas Pipeline Leak Detection Market By Location

11.3.3.9 Spain

11.3.3.9.1 Spain Oil & Gas Pipeline Leak Detection Market By Technology

11.3.3.9.2 Spain Oil & Gas Pipeline Leak Detection Market By Medium

11.3.3.9.3 Spain Oil & Gas Pipeline Leak Detection Market By Location

11.3.3.10 Netherlands

11.3.3.10.1 Netherlands Oil & Gas Pipeline Leak Detection Market By Technology

11.3.3.10.2 Netherlands Oil & Gas Pipeline Leak Detection Market By Medium

11.3.3.10.3 Netherlands Oil & Gas Pipeline Leak Detection Market By Location

11.3.3.11 Switzerland

11.3.3.11.1 Switzerland Oil & Gas Pipeline Leak Detection Market By Technology

11.3.3.11.2 Switzerland Oil & Gas Pipeline Leak Detection Market By Medium

11.3.3.11.3 Switzerland Oil & Gas Pipeline Leak Detection Market By Location

11.3.3.1.12 Austria

11.3.3.12.1 Austria Oil & Gas Pipeline Leak Detection Market By Technology

11.3.3.12.2 Austria Oil & Gas Pipeline Leak Detection Market By Medium

11.3.3.12.3 Austria Oil & Gas Pipeline Leak Detection Market By Location

11.3.3.13 Rest of Western Europe

11.3.3.13.1 Rest of Western Europe Oil & Gas Pipeline Leak Detection Market By Technology

11.3.3.13.2 Rest of Western Europe Oil & Gas Pipeline Leak Detection Market By Medium

11.3.3.13.3 Rest of Western Europe Oil & Gas Pipeline Leak Detection Market By Location

11.4 Asia-Pacific

11.4.1 Trend Analysis

11.4.2 Asia-Pacific Oil & Gas Pipeline Leak Detection Market by country

11.4.3 Asia-Pacific Oil & Gas Pipeline Leak Detection Market By Technology

11.4.4 Asia-Pacific Oil & Gas Pipeline Leak Detection Market By Medium

11.4.5 Asia-Pacific Oil & Gas Pipeline Leak Detection Market By Location

11.4.6 China

11.4.6.1 China Oil & Gas Pipeline Leak Detection Market By Technology

11.4.6.2 China Oil & Gas Pipeline Leak Detection Market By Medium

11.4.6.3 China Oil & Gas Pipeline Leak Detection Market By Location

11.4.7 India

11.4.7.1 India Oil & Gas Pipeline Leak Detection Market By Technology

11.4.7.2 India Oil & Gas Pipeline Leak Detection Market By Medium

11.4.7.3 India Oil & Gas Pipeline Leak Detection Market By Location

11.4.8 Japan

11.4.8.1 Japan Oil & Gas Pipeline Leak Detection Market By Technology

11.4.8.2 Japan Oil & Gas Pipeline Leak Detection Market By Medium

11.4.8.3 Japan Oil & Gas Pipeline Leak Detection Market By Location

11.4.9 South Korea

11.4.9.1 South Korea Oil & Gas Pipeline Leak Detection Market By Technology

11.4.9.2 South Korea Oil & Gas Pipeline Leak Detection Market By Medium

11.4.9.3 South Korea Oil & Gas Pipeline Leak Detection Market By Location

11.4.10 Vietnam

11.4.10.1 Vietnam Oil & Gas Pipeline Leak Detection Market By Technology

11.4.10.2 Vietnam Oil & Gas Pipeline Leak Detection Market By Medium

11.4.10.3 Vietnam Oil & Gas Pipeline Leak Detection Market By Location

11.4.11 Singapore

11.4.11.1 Singapore Oil & Gas Pipeline Leak Detection Market By Technology

11.4.11.2 Singapore Oil & Gas Pipeline Leak Detection Market By Medium

11.4.11.3 Singapore Oil & Gas Pipeline Leak Detection Market By Location

11.4.12 Australia

11.4.12.1 Australia Oil & Gas Pipeline Leak Detection Market By Technology

11.4.12.2 Australia Oil & Gas Pipeline Leak Detection Market By Medium

11.4.12.3 Australia Oil & Gas Pipeline Leak Detection Market By Location

11.4.13 Rest of Asia-Pacific

11.4.13.1 Rest of Asia-Pacific Oil & Gas Pipeline Leak Detection Market By Technology

11.4.13.2 Rest of Asia-Pacific Oil & Gas Pipeline Leak Detection Market By Medium

11.4.13.3 Rest of Asia-Pacific Oil & Gas Pipeline Leak Detection Market By Location

11.5 Middle East & Africa

11.5.1 Trend Analysis

11.5.2 Middle East

11.5.2.1 Middle East Oil & Gas Pipeline Leak Detection Market by Country

11.5.2.2 Middle East Oil & Gas Pipeline Leak Detection Market By Technology

11.5.2.3 Middle East Oil & Gas Pipeline Leak Detection Market By Medium

11.5.2.4 Middle East Oil & Gas Pipeline Leak Detection Market By Location

11.5.2.5 UAE

11.5.2.5.1 UAE Oil & Gas Pipeline Leak Detection Market By Technology

11.5.2.5.2 UAE Oil & Gas Pipeline Leak Detection Market By Medium

11.5.2.5.3 UAE Oil & Gas Pipeline Leak Detection Market By Location

11.5.2.6 Egypt

11.5.2.6.1 Egypt Oil & Gas Pipeline Leak Detection Market By Technology

11.5.2.6.2 Egypt Oil & Gas Pipeline Leak Detection Market By Medium

11.5.2.6.3 Egypt Oil & Gas Pipeline Leak Detection Market By Location

11.5.2.7 Saudi Arabia

11.5.2.7.1 Saudi Arabia Oil & Gas Pipeline Leak Detection Market By Technology

11.5.2.7.2 Saudi Arabia Oil & Gas Pipeline Leak Detection Market By Medium

11.5.2.7.3 Saudi Arabia Oil & Gas Pipeline Leak Detection Market By Location

11.5.2.8 Qatar

11.5.2.8.1 Qatar Oil & Gas Pipeline Leak Detection Market By Technology

11.5.2.8.2 Qatar Oil & Gas Pipeline Leak Detection Market By Medium

11.5.2.8.3 Qatar Oil & Gas Pipeline Leak Detection Market By Location

11.5.2.9 Rest of Middle East

11.5.2.9.1 Rest of Middle East Oil & Gas Pipeline Leak Detection Market By Technology

11.5.2.9.2 Rest of Middle East Oil & Gas Pipeline Leak Detection Market By Medium

11.5.2.9.3 Rest of Middle East Oil & Gas Pipeline Leak Detection Market By Location

11.5.3 Africa

11.5.3.1 Africa Oil & Gas Pipeline Leak Detection Market by Country

11.5.3.2 Africa Oil & Gas Pipeline Leak Detection Market By Technology

11.5.3.3 Africa Oil & Gas Pipeline Leak Detection Market By Medium

11.5.3.4 Africa Oil & Gas Pipeline Leak Detection Market By Location

11.5.3.5 Nigeria

11.5.3.5.1 Nigeria Oil & Gas Pipeline Leak Detection Market By Technology

11.5.3.5.2 Nigeria Oil & Gas Pipeline Leak Detection Market By Medium

11.5.3.5.3 Nigeria Oil & Gas Pipeline Leak Detection Market By Location

11.5.3.6 South Africa

11.5.3.6.1 South Africa Oil & Gas Pipeline Leak Detection Market By Technology

11.5.3.6.2 South Africa Oil & Gas Pipeline Leak Detection Market By Medium

11.5.3.6.3 South Africa Oil & Gas Pipeline Leak Detection Market By Location

11.5.3.7 Rest of Africa

11.5.3.7.1 Rest of Africa Oil & Gas Pipeline Leak Detection Market By Technology

11.5.3.7.2 Rest of Africa Oil & Gas Pipeline Leak Detection Market By Medium

11.5.3.7.3 Rest of Africa Oil & Gas Pipeline Leak Detection Market By Location

11.6 Latin America

11.6.1 Trend Analysis

11.6.2 Latin America Oil & Gas Pipeline Leak Detection Market by country

11.6.3 Latin America Oil & Gas Pipeline Leak Detection Market By Technology

11.6.4 Latin America Oil & Gas Pipeline Leak Detection Market By Medium

11.6.5 Latin America Oil & Gas Pipeline Leak Detection Market By Location

11.6.6 Brazil

11.6.6.1 Brazil Oil & Gas Pipeline Leak Detection Market By Technology

11.6.6.2 Brazil Oil & Gas Pipeline Leak Detection Market By Medium

11.6.6.3 Brazil Oil & Gas Pipeline Leak Detection Market By Location

11.6.7 Argentina

11.6.7.1 Argentina Oil & Gas Pipeline Leak Detection Market By Technology

11.6.7.2 Argentina Oil & Gas Pipeline Leak Detection Market By Medium

11.6.7.3 Argentina Oil & Gas Pipeline Leak Detection Market By Location

11.6.8 Colombia

11.6.8.1 Colombia Oil & Gas Pipeline Leak Detection Market By Technology

11.6.8.2 Colombia Oil & Gas Pipeline Leak Detection Market By Medium

11.6.8.3 Colombia Oil & Gas Pipeline Leak Detection Market By Location

11.6.9 Rest of Latin America

11.6.9.1 Rest of Latin America Oil & Gas Pipeline Leak Detection Market By Technology

11.6.9.2 Rest of Latin America Oil & Gas Pipeline Leak Detection Market By Medium

11.6.9.3 Rest of Latin America Oil & Gas Pipeline Leak Detection Market By Location

12. Company Profiles

12.1 Honeywell International, Inc.

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.1.5 The SNS View

12.2 Atmos International Inc.

12.2.1Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.2.5 The SNS View

12.3 Siemens AG

12.3.1Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.3.5 The SNS View

12.4 FLIR Systems Inc.

12.4.1Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.4.5 The SNS View

12.5 Schneider Electric SA

12.5.1Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.5.5 The SNS View

12.6 Bridger Photonics Inc

12.6.1Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.6.5 The SNS View

12.7 ClampOn AS

12.7.1Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.7.5 The SNS View

12.8 Pentair PLC

12.8.1Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.8.5 The SNS View

12.9 Pure Technologies Ltd

12.9.1Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.9.5 The SNS View

12.10 Ttk-Leak Detection System

12.10.1Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

12.10.5 The SNS View

12.11 Yokogawa Electric Corporation.

12.11.1Company Overview

12.11.2 Financial

12.11.3 Products/ Services Offered

12.11.4 SWOT Analysis

12.11.5 The SNS View

13. Competitive Landscape

13.1 Competitive Bench marking

13.2 Market Share Analysis

13.3 Recent Developments

13.3.1 Industry News

13.3.2 Company News

13.3.3 Mergers & Aquistions

14. Use Case and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Tool Holder Market Size was esteemed at USD 0.79 billion in 2022 and is supposed to arrive at USD 1.21 billion by 2030 and develop at a CAGR of 5.5% over the forecast period 2023-2030.

The Intelligent Vending Machines Market size was estimated at USD 24.4 billion in 2022 and is expected to reach USD 70.08 billion by 2030 at a CAGR of 14.1% during the forecast period of 2023-2030.

Actuators Market size was valued at USD 62.89 Bn in 2023 and is expected to reach at USD 108.7 Bn by 2031 and grow at a CAGR of 7.08 % over the forecast period 2024-2031.

The Modular Robotics Market size was estimated at USD 10.5 billion in 2022 and is expected to reach USD 40.68 billion by 2030 at a CAGR of 18.1% during the forecast period of 2023-2030.

The Parcel Sorter Market size was estimated USD 10.5 billion in 2022 and is expected to reach USD 7.5 billion by 2030 at a CAGR of 3.4% during the forecast period of 2023-2030.

The Electric Fireplace Market size was estimated at USD2.25 billion in 2022 and is expected to reach USD3.03 billion by 2030 at a CAGR of 3.8% during the forecast period of 2023-2030.

Hi! Click one of our member below to chat on Phone