Tool Holder Market Report Scope & Overview:

To get more information on Tool Holder Market - Request Free Sample Report

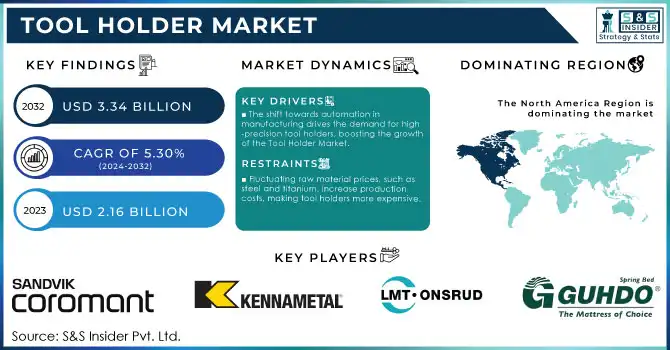

The Tool Holder Market Size was esteemed at USD 2.16 billion in 2023 and is supposed to arrive at USD 3.34 billion by 2032 and develop at a CAGR of 5.30% over the forecast period 2024-2032.

The Tool Holder Market is undergoing significant transformation, driven by technological advancements and the growing demand for high-precision machining solutions across sectors like automotive, aerospace, and manufacturing. High-precision tool holders now constitute 55% of total sales, reflecting industries' shift towards automation and digitalization, particularly in CNC machining. To reduce downtime, 70% of businesses are investing in tool holders with enhanced durability and stability, essential for robotic arms and automated systems. A notable trend is the rise of modular tool holders, preferred in over 45% of industries like aerospace, for their flexibility and compatibility with various cutting tools. Smart technology integration is another key driver, with 30% of global tool holders featuring real-time monitoring and diagnostics, enabling predictive maintenance and operational efficiency.

Material innovation is also shaping the market, with advanced alloys, ceramics, and composites now comprising over 40% of high-performance tool holders, catering to high-speed and heat-resistant applications. Sustainability efforts have led to 20% of tool holders being produced from recyclable materials. Furthermore, miniaturization trends have resulted in 25% of tool holders being designed for compact, lightweight applications, supporting intricate machining processes without compromising strength. These advancements in technology, design, and materials underscore the dynamic evolution of the Tool Holder Market.

Tool Holder Market Dynamics

DRIVERS

-

The shift towards automation in manufacturing drives the demand for high-precision tool holders, boosting the growth of the Tool Holder Market.

As industries continue to adopt advanced manufacturing techniques, such as robotics, CNC (Computer Numerical Control) systems, and automated assembly lines, the need for high-precision, reliable, and durable tool holders has significantly risen. Automation demands a higher level of accuracy and efficiency in production processes, which places an emphasis on using high-performance tools that are securely held in place for optimal performance. Tool holders, which provide the necessary stability and precision to cutting tools, become indispensable in automated systems, especially when high-speed machining and complex operations are involved.

The growing trend toward automation across industries like automotive, aerospace, and electronics increases the need for advanced tool holders capable of handling the demands of automated machinery. The shift toward fully automated factories, where machines operate with minimal human intervention, further propels the demand for specialized tool holders, such as quick-change and vibration-damping systems, which enhance operational efficiency and reduce machine downtime. Consequently, the expansion of automation in manufacturing directly boosts the demand for tool holders, making them a critical component in modern industrial production. This surge in automation has a substantial positive impact on the Tool Holder Market, driving its growth as industries strive for higher precision and greater efficiency.

RESTRAIN

-

Fluctuating raw material prices, such as steel and titanium, increase production costs, making tool holders more expensive.

Fluctuating raw material prices significantly impact the growth of the Tool Holder Market, as tool holders are primarily made from high-grade materials like steel, titanium, and other alloys. These materials are essential for ensuring the durability, precision, and performance of tool holders in various industrial applications. However, the volatility in the prices of these raw materials can lead to increased production costs, which in turn can affect the overall pricing strategy of manufacturers. When raw material costs rise, manufacturers may face the challenge of maintaining competitive pricing without compromising on quality, especially in a market that increasingly demands high-performance, precision-engineered products. This can lead to higher prices for end consumers, which may limit the affordability of tool holders for small and medium-sized enterprises (SMEs) or companies in price-sensitive markets. Additionally, manufacturers who rely on cost-effective production methods may find it difficult to pass on these higher costs to customers, potentially squeezing profit margins. As a result, fluctuations in raw material prices not only hinder the ability to offer affordable solutions but also create uncertainty in the market, delaying investment decisions and slowing down the adoption of advanced tool holders.

Tool Holder Market Segmentation Overview

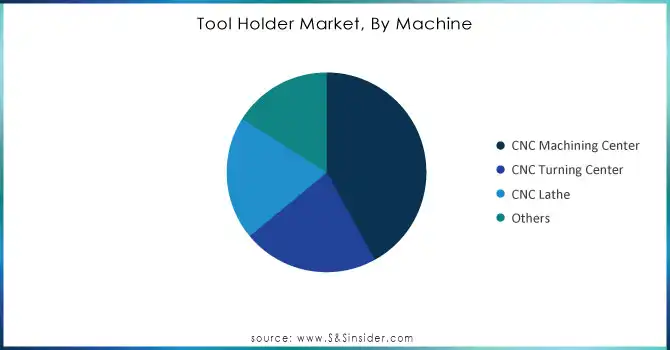

By Machine

The CNC Machining Center segment dominated with the market share over 42% in 2023, due to its widespread application across industries that demand high precision and automation. These centers are integral to manufacturing sectors like aerospace, automotive, and medical, where intricate parts with tight tolerances need to be produced efficiently. The CNC Machining Center offers advanced capabilities, including multi-axis movements, which enhance its versatility and precision. This increased efficiency, combined with automation, makes it a preferred choice for manufacturers looking to streamline production while maintaining quality. As a result, the demand for tool holders that can accommodate these high-performance machines remains robust.

Need any customization research on Tool Holder Market - Enquiry Now

By Tool Holder

The R8 tool holder segment dominated with the market share over 34% in 2023, due to its widespread adoption in diverse machining applications, particularly for small- to medium-sized machines. This tool holder type is highly favored because of its versatility and compatibility with various machines, making it a go-to choice for manufacturers across different industries. The R8 tool holder offers several advantages, such as easy installation, stable clamping, and precise tool positioning, which are essential for maintaining the quality and consistency of machining operations. Its affordability also plays a significant role in its dominance, as it provides a cost-effective solution without compromising on performance.

Tool Holder Market Analysis

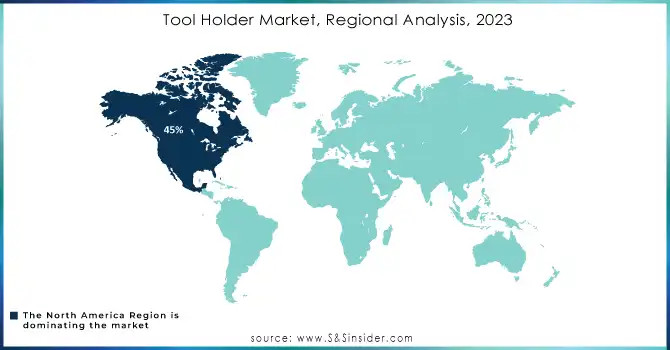

North America region dominated with the market share over 45% in 2023, largely due to its strong manufacturing sector, which is driven by the widespread adoption of advanced machinery and cutting-edge technologies. The region's well-established infrastructure supports high precision and efficiency in manufacturing processes, making it a key player in the tool holder market. Additionally, government initiatives such as the US Advanced Manufacturing Partnership further fuel market growth by encouraging technological innovation and research. These efforts focus on improving manufacturing capabilities and fostering the development of advanced tools, helping businesses stay competitive in the global market.

The Asia-Pacific region is expected to experience the fastest growth due to increasing industrialization, particularly in China and India. As these nations continue to expand their manufacturing capabilities, there is an increasing demand for advanced machinery and precision tools, including tool holders. Government initiatives play a key role in fostering this growth, with significant investments in infrastructure development and policies that attract foreign direct investment (FDI). These measures not only enhance manufacturing capacity but also create a favorable business environment for global companies.

Some of the major key players of Tool Holder Market

-

GUHDO (Tool Holders, Shrink Fit Tool Holders, Precision Tool Holders)

-

Bilz Tool (Shrink Fit Tool Holders, Tooling Systems, Clamping Systems)

-

LMT Onsrud (Precision Tool Holders, High-Speed Tooling, CNC Tool Holders)

-

TAC Rockford (Tool Holders, Chucks, Spindle Systems)

-

Gem Precision Tool (Precision Tool Holders, High-Performance Tooling)

-

Kennametal (Tool Holders, Cutting Tools, Workholding Solutions)

-

Sandvik Coromant (Tool Holders, Milling Tools, Turning Tools)

-

KTA Spindle Toolings (Tool Holders, CNC Tooling, Custom Tool Holders)

-

CERATIZIT (Tool Holders, Drilling Tools, Milling Tools)

-

SECO (Tool Holders, Milling Tools, Precision Cutting Tools)

-

Haimer (Shrink Fit Tool Holders, Balance Systems, Precision Tool Holders)

-

BIG Kaiser (Tool Holders, Precision Tooling Systems, Boring Tools)

-

Wright Tool (Tool Holders, Machine Tool Accessories, Industrial Tools)

-

Dormer Pramet (Tool Holders, Cutting Tools, Threading Tools)

-

Mitsubishi Materials (Tool Holders, Cutting Tools, Drilling Tools)

-

Röhm (Tool Holders, Workholding Solutions, Clamping Devices)

-

Bison-Bial (Tool Holders, Clamping Tools, Lathe Chucks)

-

Tool-Flo Manufacturing (Tool Holders, Cutting Tools, Carbide Inserts)

-

Schunk (Tool Holders, Workholding Systems, Clamping Systems)

-

Guhring (Tool Holders, Drills, End Mills, Tooling Solutions)

RECENT DEVELOPMENT

-

In February 2024: Sandvik AB launched its Intelligent Tool Holder System, which leverages Internet of Things (IoT) technology to monitor tool condition and enhance machining processes. This innovation enables preventative maintenance and real-time adjustments, reducing downtime and boosting productivity.

-

In April 2024: BIG KAISER Precision Tooling Inc. partnered with a prominent software company to create AI-powered tool selection platforms. This collaboration aims to simplify the tool selection process for operators, minimizing human error and ensuring the best tool choices for every task.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.16 billion |

| Market Size by 2032 | USD 3.34 billion |

| CAGR | CAGR of 5.30% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (R8, V-Flange Taper, NMTB, HSK, Others) • By Tool Holder (Collet Chuck, Hydraulic Tool Holder, Milling Chuck, Others) • By Machine (CNC Machining Center, CNC Turning Center, CNC Lathe, Others) • By Industry (Automotive, Aviation & Defense, Electrical & Electronics, Construction, Heavy Engineering, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GUHDO, Bilz Tool, LMT Onsrud, TAC Rockford, Gem Precision Tool, Kennametal, Sandvik Coromant, KTA Spindle Toolings, CERATIZIT, SECO, Haimer, BIG Kaiser, Wright Tool, Dormer Pramet, Mitsubishi Materials, Röhm, Bison-Bial, Tool-Flo Manufacturing, Schunk, Guhring. |

| Key Drivers | • The shift towards automation in manufacturing drives the demand for high-precision tool holders, boosting the growth of the Tool Holder Market. • Advancements in tool holder technology, like vibration-damping and quick-change systems, enhance machining efficiency, driving the demand for more advanced and customized tool holders in the market. |

| RESTRAINTS | • Fluctuating raw material prices, such as steel and titanium, increase production costs, making tool holders more expensive and potentially slowing market growth, especially for cost-sensitive manufacturers. |