Parcel Sorter Market Report Scope & Overview:

The Parcel Sorter Market size was estimated at USD 3.6 billion in 2023 and is expected to reach USD 9.1 billion by 2032 at a CAGR of 10.8% during the forecast period of 2024-2032. The Parcel Sorter Market is witnessing progressive growth due to the increased need for efficient logistics and rapid e-commerce expansion. As such, global e-commerce sales keep growing, which increasingly motivates logistics providers to invest in novel parcel sorting technologies. The tendency indicates that the market experiences significant expansion, as the process necessitates fast, accurate, and versatile solutions to customers’ escalating expectations concerning prompt delivery. The primary trends in this market include the application of artificial intelligence and machine learning to enhance sorting accuracy and efficiency.

To get more information on Parcel Sorter Market - Request Free Sample Report

Overall, the incorporation of AI algorithms in automated systems has the effect of optimizing the sorting process and reducing human error, as well as minimizing the time of parcel handling. Furthermore, the widespread implementation of robotics and advanced conveyor systems affects the market significantly, leading to high-speed sorting and reduced need for manual sorting. Finally, the Parcel Sorter Market is significantly affected by the intensive expansion and growing popularity of omni-channel retailing. As such, for retailers to effectively sell goods using multiple sales channels, they need to be seamlessly integrated. One of the challenges in the market is the increasing focus on the application of “green” technologies. For companies, this implies that they should aim to minimize their environmental effect by employing energy-saving technologies and sustainable materials. Finally, another significant factor contributing to the market growth is increasing international expansion, particularly prominent in the case of emerging markets, which implies that logistics infrastructure develops timely alongside growing e-commerce demand.

In the United States, the main issue has to do with the growing complexity and volume of e-commerce shipments. The given factor influences the demand for improved sorting technologies and, importantly, the timeliness of delivery, thus increasing demand for automation and AI applications among logistics companies. Also, labor shortages and expensive operational costs have an effect on the effectiveness of sorting operations. Finally, various environmental requirements also affect the process, as companies are increasingly required to implement green technologies and materials. Regardless of these factors, the U.S. Parcel Sorter Market demonstrates significant commitment to innovative applications, obvious from the frequent temporary upgrades of its hardware solutions, which indicates serious long-term investments in the field.

MARKET DYNAMICS

DRIVERS

-

The rapid expansion of e-commerce has significantly increased parcel volumes and consumer expectations for faster delivery and real-time tracking, driving the demand for more efficient automated parcel sorting solutions.

The logistics and, especially, the parcel delivery industry have been immensely affected by the rapid development of e-commerce. The increasing popularity and widespread adoption of online shopping give rise to the growing number of parcels that require processing and delivery. At the same time, the rapidly rising customer expectations regarding delivery time make the need for more efficient and scalable solutions pressing. It is widely acknowledged that while the development of e-commerce solutions, such as electronic commerce and web processing, which make shopping accessible from various devices, is the first factor causing these changes, the primary driver of these changes is the consumer expectations. Specifically, nowadays, customers do not only expect fast delivery but also expect to be provided with real-time tracking information, which is now considered the norm rather than a rarity. As a result, more and more both e-commerce businesses and the logistics industry start to invest in automated solutions that would facilitate the sorting of large numbers of parcels, efficiently and timely.

The assignment of parcels has been typically performed manually; however, today, the logistics providers and other interested companies start moving towards automated parcel sorting solutions. These solutions leverage a variety of advanced technologies, such as machine vision, artificial intelligence, and robotics, which allow achieving significantly superior results compared to manual sorting. They ensure timely and accurate sorting of parcels of various sizes and destinations. By employing these solutions, companies can optimize their operations and, therefore, reduce the costs related to manual labor, while also ensuring timely deliveries and, therefore, meeting customer expectations.

-

Automated parcel sorters enhance operational efficiency by reducing labor costs and human error while optimizing warehouse space and increasing throughput.

Automated parcel sorters increase overall operational efficiency within many warehouses. This type of technology allows for all sorting to be done directly on the belts thanks to the use of advanced technology, such as conveyers, sensors, and robotics. Packages are sorted by size, destination, or other means directly and with little to no human intervention. By having to forgo any and all manual intervention, businesses can save both time, which is especially important in the transportation industry, and reduce errors. The latter allows to make better use of space within the warehouse and make any storage solutions more compact and organized. This type of system increases the overall throughput and allows for more products to sorted and handled in less time. Overall, the use of automated sorter mechanisms increases sorting accuracy and speed that allows to fulfill orders more quickly, increasing customer satisfaction and the efficiency of the warehouse overall.

RESTRAIN

-

Integrating new parcel sorting systems with existing infrastructure can be challenging and costly due to system compatibility issues and the need for customized solutions, which may lead to operational disruptions.

Integrate new sorting systems into the existing scope of infrastructure are often of non-negligible intricacy and expensiveness. Due to the specifics of new technologies, which are likely to be different from those applied previously in the company, a considerable amount of editing and customization may be required to ensure that these systems can function together. As a result, between the costs of customization and complexities of the added details, additional resources are required in the process, which is likely to imply the need for extra expenses. Furthermore, while implementing a change, it is challenging to ensure that some issues with compatibility do not arise in the process, which can make the implemented system unable to interact effectively with the existing one. To that effect, during the process of change, some delays are possible, which may affect organizational performance, as well as result in customer dissatisfaction. As a result, when making decisions, organizations should weigh potential benefits of the advanced sorting systems against the above-mentioned challenges and make a reasonable decision on whether these could be applied in the given circumstances.

KEY MARKET SEGMENTATION

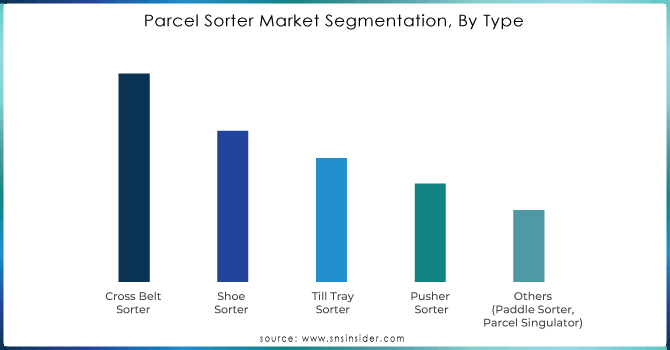

By Type

The Cross Belt Sorter segment dominated the market share over 32.08% in 2023. Cross belt sorters are widely used due to their high-speed sorting capabilities, accuracy, and ability to handle a diverse range of products, including parcels, small items, and larger packages. They are particularly favored in logistics and distribution centers for their efficiency and reliability.

Need any customization research on Parcel Sorter Market - Enquiry Now

By End-user

The E-Commerce segment currently dominated the market share of over 38.02% in 2023, across many industries due to the surge in online shopping and the increasing demand for efficient logistics solutions. E-commerce companies drive significant demand for automated systems and technology to handle large volumes of orders, manage inventory, and streamline supply chains.

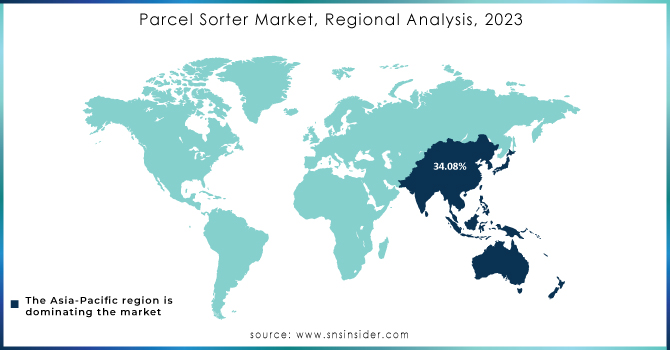

REGIONAL ANALYSES

Asia Pacific led the market share over 34.08% in 2023, due to evolving customer behaviors and rising disposable incomes among end-users. As consumers in this region increasingly embrace online shopping, the number of internet users has surged, facilitating the purchase of products through digital platforms. This shift is further supported by heightened automation in warehouses and distribution centers, particularly with the adoption of advanced sorting systems, which is anticipated to drive substantial market growth.

North America is expected to experience the highest growth rate, fueled by robust economies and a significant presence of manufacturers specializing in packet and parcel sorting systems. The region's growth is underpinned by widespread automation in manufacturing units, with innovations such as artificial intelligence (AI) and the Internet of Things (IoT) enhancing operational efficiency. This technological advancement supports the region’s leadership in adopting cutting-edge sorting technologies, contributing to its accelerated market expansion.

Key Players

The major key players Koerber AG, Beumer Group, Pitney Bowes Inc, Vanderlande Industries B.V., Dematic, Honeywell International Inc., Interroll Group, Intralox, Fives Group (France), National Presort Inc, Siemens AG, MHS Global, Swisslog Holding AG, BEUMER Group, Jungheinrich AG, SICK AG, Adept Technology Inc, Omron Corporation, KUKA AG, Sortation Systems Inc, and others.

RECENT DEVELOPMENT

In July 2024: Tompkins Robotics has introduced the latest addition to its tSort family, the pedestal tSortPost. Designed for parcel sortation, this new autonomous mobile robot (AMR) features an adjustable post that enables sorting into containers at various heights, requiring minimal infrastructure. The tSortPost is powered by Tompkins Robotics’ Transcend software suite and integrates with existing systems, aiming to enhance efficiency in last mile, regional hubs, and fulfillment centers.

In January 2024: PT Pos Indonesia has introduced the t-Sort robotic parcel sorting system from Libiao Robotics at its Surabaya processing center. The integration of the system with existing IT and RFID technologies enhances parcel tracking and boosts automation. The upgrade allows for reconfiguration with minimal disruption, optimizing throughput and energy efficiency. Notably, 80% of the staff have been reassigned to more profitable roles due to the automation transition.

In August 2023: DTDC Express Limited has announced a strategic partnership with Falcon Autotech to enhance its parcel sorting operations at its Chennai facility. This collaboration aims to implement advanced automation technology, improving efficiency and accuracy in parcel handling. The new system will streamline sorting processes, reduce operational costs, and boost overall service quality.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.6 Billion |

| Market Size by 2032 | USD 9.1 Billion |

| CAGR | CAGR of 10.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Cross Belt Sorter, Shoe Sorter, Till Tray Sorter, Pusher Sorter, Others) • By Direction (Linear Parcel Sortation System, Loop Parcel Sortation System) • By End-user (Logistics, E-Commerce, Pharmaceutical & Medical Supply, Airports, Food & Beverages, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Koerber AG, Beumer Group, Pitney Bowes Inc, Vanderlande Industries B.V., Dematic, Honeywell International Inc., Interroll Group, Intralox, Fives Group (France), National Presort Inc, Siemens AG, MHS Global, Swisslog Holding AG, BEUMER Group, Jungheinrich AG, SICK AG, Adept Technology Inc, Omron Corporation, KUKA AG, Sortation Systems Inc |

| Key Drivers | • The rapid expansion of e-commerce has significantly increased parcel volumes and consumer expectations for faster delivery and real-time tracking, driving the demand for more efficient automated parcel sorting solutions. • Automated parcel sorters enhance operational efficiency by reducing labor costs and human error while optimizing warehouse space and increasing throughput. |

| RESTRAINTS | • Integrating new parcel sorting systems with existing infrastructure can be challenging and costly due to system compatibility issues and the need for customized solutions, which may lead to operational disruptions |