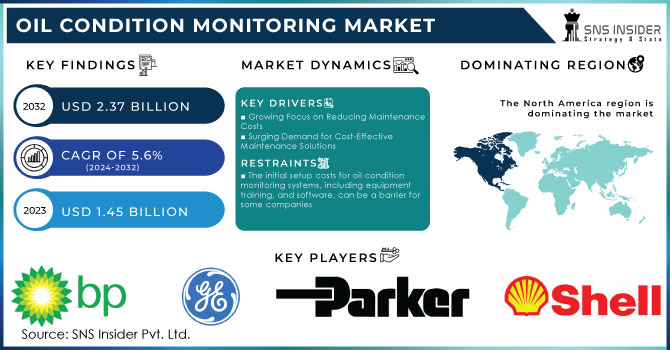

Oil Condition Monitoring Market Size Analysis:

The Oil Condition Monitoring Market Size was valued at USD 1.45 billion in 2023 and is expected to reach USD 2.37 billion by 2032 and grow at a CAGR of 5.6% over the forecast period 2024-2032. The oil condition monitoring market is experiencing growth driven by two main forces the growing need for cost-effective maintenance solutions and growing industry awareness of its benefits. Manufacturing, power generation and transportation companies recognize the power of oil analysis. Early detection of equipment problems through oil condition monitoring can prevent catastrophic failures, and studies show an 80% reduction in downtime. This means significant savings. In addition, the integration of big data analytics into oil condition monitoring unlocks a new level of insight that enables predictive maintenance and further optimizes equipment performance. As the industry strives for efficiency and adopts advanced technologies, the oil condition monitoring market offers significant opportunity for growth and savings.

Get more information on Oil Condition Monitoring Market - Request Sample Report

Oil Condition Monitoring Market Dynamics:

KEY DRIVERS:

-

Growing Focus on Reducing Maintenance Costs

-

Surging Demand for Cost-Effective Maintenance Solutions

Businesses are increasingly focused on optimizing maintenance costs. Oil condition monitoring allows for preventive maintenance, reducing the risk of unexpected equipment failures and costly repairs.

RESTRAINTS:

-

The initial setup costs for oil condition monitoring systems, including equipment, training, and software, can be a barrier for some companies

-

Lack of Skilled Personnel can be barrier for the market growth.

Implementing and interpreting oil condition monitoring data requires skilled personnel trained in oil analysis techniques. A shortage of such skilled workers can hinder the wider adoption of this technology. Research suggests this lack of skilled personnel could potentially hamper 10% of the market's growth.

OPPORTUNITIES:

-

Integration of oil condition monitoring systems with IIoT allows for real-time data collection and remote monitoring.

-

The Growing Adoption of Big Data Analytics

The increasing use of big data analytics in conjunction with oil condition monitoring allows for deeper insights into machine health. This enables predictive maintenance, leading to improved efficiency and reduced downtime.

CHALLENGES:

-

Integration with Existing Systems can be a Challenging task.

Integrating oil condition monitoring systems with existing maintenance and asset management software can be a complex task, requiring technical expertise and potentially delaying implementation.

IMPACT OF RUSSIA-UKRAINE WAR

The war is causing disruptions in the supply chains of oil analysis equipment and sensors, which is leading to delays and high prices. Due to this supply chains disruption of the new equipment, it extending the useful life of existing machinery which becomes crucial. Monitoring the condition of the oil enables preventive maintenance, extends the service life of the equipment and reduces dependence on possible infrequent changes. Rising oil prices may also force companies to prioritize immediate operating costs. Investments in new technologies such as oil condition monitoring could be halted. The impact of war on energy costs underscores the need for operational efficiency. Monitoring the oil condition helps prevent equipment breakdowns and unplanned downtime, which ultimately saves money in the long run.

IMPACT OF ECONOMIC SLOWDOWN

Economic slowdown leads to reduce budgets. Companies might delay or reduce investments in new technologies like oil condition monitoring, especially for high-cost, high-tech segments like continuous online monitoring systems. On the other hand, Maximizing equipment performance becomes crucial during economic slowdowns. Oil condition monitoring allows for preventive maintenance, ensuring equipment operates efficiently and avoids costly breakdowns that disrupt production and lead to lost revenue. However, the economic slowdown could also lead to an increased adoption of the more affordable segment offline analysis with periodic sampling. This offers a cost-effective way to reap the benefits of oil condition monitoring without a significant upfront investment.

Oil Condition Monitoring Market Segment Overview:

By Product Type

Based on Product Type, the Oil Condition Monitoring Market is sub divided into Compressor, Turbine, Engine, Hydraulic System and Other. The Turbine segment is expected to respond with the largest market share of oil conditioning monitoring by 2030. Turbine oil analysis is one of the most commonly used methods of adjustment forecasting technology. Turbines are used in a variety of applications, which require systematic testing in order to function properly. Turbines used in industries such as power generation and transport operate under very high pressure. In addition, there is a need to constantly monitor oil quality to ensure the efficiency of turbines.

By Industry Vertical

Based on Industry Vertical, the Oil Condition Monitoring Market is sub divided into Industrial, Mining, Transportation, Oil & Gas and Power Generation. Power generation is one of the few emerging industries that is experiencing the rapid adoption of oil conditioning monitoring. The power generating sector employs a variety of machinery, equipment, and components. Appliances such as engines, wind turbines, gearboxes, and compressors operate at high temperatures and pressures, thus reducing the quality of the oil used in the equipment. Monitoring the oil condition helps to identify minor problems inside the equipment before any catastrophic failure.

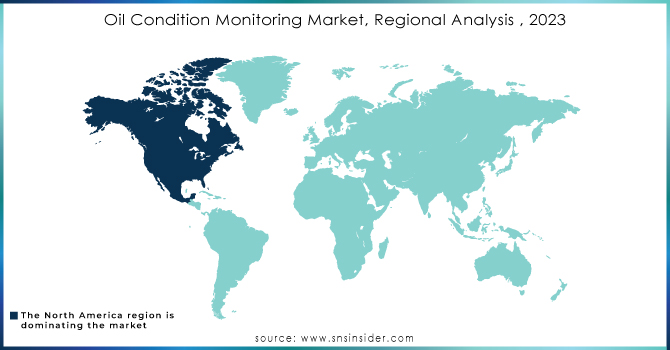

Oil Condition Monitoring Market Regional Analysis:

North America held the largest market share in 2023, and is estimated to continue to do so during the forecast period. 2024- 2031. This dominance can be attributed to several key factors that drive a strong demand for these systems and solutions. There is a growing emphasis on optimizing asset utilization. Businesses across various sectors are striving to get the most out of their equipment, and oil condition monitoring empowers them to achieve this by identifying potential issues early on, preventing costly breakdowns and maximizing uptime. Secondly, stringent government regulations play a crucial role. North American governments prioritize workplace and personnel safety, and oil condition monitoring helps ensure compliance with these regulations by proactively detecting equipment malfunctions that could pose safety risks. Finally, industries like oil and gas, transportation, and manufacturing operate under strict quality control measures. Oil condition monitoring becomes a vital tool in these sectors, enabling them to maintain the highest quality standards in their operations by ensuring optimal equipment performance. As these factors continue to hold significant weight, North America is poised to remain a leading force in the Oil Condition Monitoring Market in the future.

The Asia Pacific (APAC) region is expected fastest growth in the Oil Condition Monitoring Market during the forecasted period 2024-2031. The booming manufacturing sector in countries like China, India, and South Korea necessitates efficient equipment maintenance practices. Oil condition monitoring offers a proactive approach to ensure optimal equipment performance and avoid costly downtime. Investments in infrastructure development across APAC create a demand for reliable equipment in sectors like construction, power generation, and transportation. Oil condition monitoring helps maintain this equipment and ensure project timelines are met. also, Some APAC governments are actively promoting the adoption of advanced technologies for industrial maintenance. This can include subsidies or tax breaks for companies implementing oil condition monitoring systems.

Get Customized Report as per your Business Requirement - Request For Customized Report

KEY PLAYERS:

The key player in the Oil Condition Monitoring Market are General Electric, BP plc, Parker-Hannifin Corporation, Shell plc, Bureau Veritas, Intertek Group plc, Eaton Corporation, Chevron Corporation, SGS SA, TotalEnergies & Other Players.

RECENT DEVELOPMENT

-

In 18 August 2021, Shell launched VitalyX in . This smart service uses advanced data analysis to monitor oil condition and machine health in ships. It combines Shell's oil expertise with Bently Nevada's monitoring technology.

-

In June 2021, a significant development occurred in the industrial verification and certification landscape. Bureau Veritas, a French leader in testing, inspection, and certification, signed a three-year framework agreement with Veolia, a global environmental solutions powerhouse.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.45 Bn |

| Market Size by 2032 | US$ 2.37 Bn |

| CAGR | CAGR of 5.6 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Compressor, Turbine, Engine, Hydraulic System, Other) • By Sampling Type (On-Site, Off-Site) • By Industry Vertical (Industrial, Mining, Transportation, Oil & Gas, Power Generation) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | General Electric, BP plc, Parker-Hannifin Corporation, Shell plc, Bureau Veritas, Intertek Group plc, Eaton Corporation, Chevron Corporation, SGS SA and TotalEnergies |

| Key Drivers | • Growing Focus on Reducing Maintenance Costs • Surging Demand for Cost-Effective Maintenance Solutions |

| Restraints | • The initial setup costs for oil condition monitoring systems, including equipment, training, and software, can be a barrier for some companies • Lack of Skilled Personnel can be barrier for the market growth. |