Oil Storage Market Report Scope & Overview:

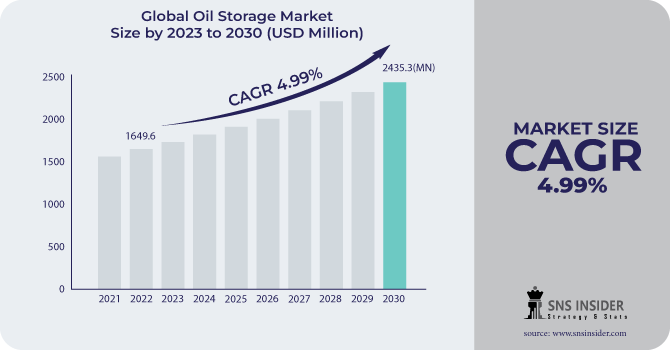

The Oil Storage Market size was valued at 1649.6 MCM in 2022 and is expected to grow to 2435.3 MCM by 2030 and grow at a CAGR of 4.99 % over the forecast period of 2023-2030. The main purpose of oil storage facilities is to keep a lot of for a considerable amount of time, crude oil. These facilities, which include oil tanks, containers, boats, and other things, must do routine cleaning and upkeep, The traditional techniques used to remove toxic deposits include solvent liquefaction, hot water spraying, and land agricultural disposal. Conventional pumping techniques are useless and expensive to use when trying to remove excessively viscous oil sludge. Additionally, the use of such systems generates a large volume of hazardous oil waste that calls for sophisticated disposal techniques.

To Get More Information on Oil Storage Market - Request Sample Report

The midstream division of the oil industry includes oil storage. Upstream oil is initially extracted by firms that handle exploration and production. Petroleum is moved, stored, and marketed wholesale in the midstream industry items produced after extraction. Prior to distribution downstream to refineries and merchants, goods are gathered in oil storage. Storage tanks may also be used by downstream industries to gather oil for later processing and selling. Oil storage tanks come in a variety of sizes and shapes. Early storage tanks were just big barrels made of wood and metal bands. As technology developed, storage tanks got bigger and could hold more oil. There are both fixed roof and floating roof tank designs, depending on the requirements and usage.

MARKET DYNAMICS

KEY DRIVERS:

-

Precarious pricing for crude oil

-

Increasing attention towards the development of essential oil storage

-

Increasing domestic crude oil processing capacity

Due to a lack of supplies throughout the world, oil prices continue to be highly volatile and are likely to see abrupt jumps and drops. The construction of vital oil storage facilities is receiving more attention as a result of the variability in crude oil supply and pricing. Refiners are working on major projects in the US to expand domestic crude oil processing capacity by the end of 2023.

RESTRAIN:

-

High cost of installation

-

Renewable energy prices are decreasing rapidly

OPPORTUNITY:

-

Increasing energy output and oil trading activity

-

Requirement for more storage space

CHALLENGES:

-

Involvement of high complex in storage facilities

-

Installation and developments

The installation and deployment expenses for building oil storage tanks are quite expensive. Large-scale investments in the field of renewable fuels might potentially prevent the business from adding further capacity. Additionally, the cost of renewable energy is falling quickly, making it more affordable than oil and other fossil fuels. Such elements might lead to obstacles that prevent the expansion of oil capacity and impede the industry's development.

IMPACT OF RUSSIA-UKRAINE WAR

Russia's invasion of Ukraine has had a significant impact on people, the economy, and industry. Along with supply networks, industries, and economies, it has disturbed people's lives and way of life. Like many other industries, the energy sector is currently undergoing uncertainty. Even before the battle really escalated, oil prices were increasing all across the world. But after Russia invaded Ukraine, the cost of crude oil on the international market soared, rising from around $76 per barrel at the beginning of January 2022 Because of increased demand brought on by the world economies' recovery from the COVID-19 pandemic and insufficient investment in the oil and gas sector, the price of crude oil was already high even before the conflict.

KEY MARKET SEGMENTATION

By Product

-

Open Top

-

Fixed Roof

-

Floating Roof

-

Others

By Application

-

Crude Oil

-

Middle Distillates

-

Gasoline

-

Others

.png)

Do You Need any Customization Research on Oil Storage Market - Enquire Now

REGIONAL ANALYSIS

In 2021, the Middle East and Africa held the highest market share, accounting for almost 34.5% of the total volume. It is anticipated that the need for storage tanks in the area would continue to increase as a result of the demand for petroleum and distillates in the commercial and industrial sectors. Due to the expanding need for oil stockpiling in the area, North America held a sizeable portion of the worldwide market in 2021 and represented the second-largest volume share.

China is expected to have the highest market share in Asia Pacific, which is expected to see the quickest CAGR throughout the forecast period. The market is expected to be driven by increased investments in offshore and onshore operations as well as the expanding demand for oil and gas from the region's major economies, including China and India.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

RECENT DEVELOPMENT

-

in June 2022, Royal Vopak and N.V. Nederlandse Gasuni in Northwest Europe inked a contract for the production of three LNG gate terminals. The goal of this partnership was to guarantee the security and resilience of the supply chain. This initiative, slated to begin in the second half of 2023, will increase the firms' visibility in the industry.

KEY PLAYERS

The Major Players are VTTI, Royal Vopak, Oiltanking GmbH, Buckeye Partners LP, Containment Solutions, Inc., Shawcor, Belco, CST Industries, Superior Tank Co., Inc., DELTA OIL TANKING BV, and other players

Royal Vopak-Company Financial Analysis

| Report Attributes | Details |

| Market Size in 2022 | US$ 1649.6 MCM |

| Market Size by 2030 | US$ 2435.3 MCM |

| CAGR | CAGR of 4.99 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Open Top, Fixed Roof, Floating Roof, Others) • By Application (Crude Oil, Middle Distillates, Gasoline, Aviation Fuel, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | VTTI, Royal Vopak, Oiltanking GmbH, Buckeye Partners LP, Containment Solutions, Inc., Shawcor, Belco, CST Industries, Superior Tank Co., Inc., DELTA OIL TANKING BV |

| Key Drivers | • Precarious pricing for crude oil • Increasing attention towards the development of essential oil storage • Increasing domestic crude oil processing capacity |

| Market Restraints | • High cost of installation • Renewable energy prices are decreases rapidly |