Oilfield Integrity Management Market Report Scope & Overview:

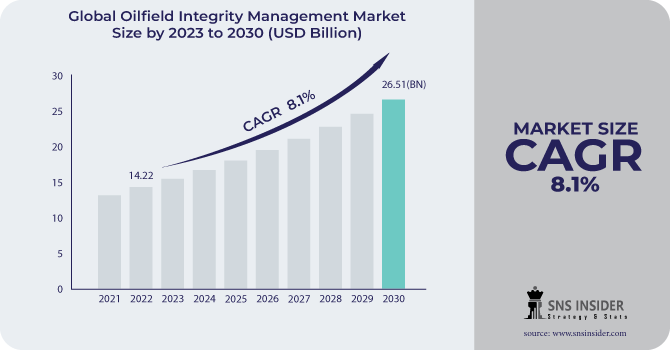

The Oilfield Integrity Management Market size was valued at USD 14.22 billion in 2022 and is expected to grow to USD 26.51 billion by 2030 and grow at a CAGR of 8.1 % over the forecast period of 2023-2030.

The field of oil Asset Integrity Management System, a more general term, includes a subset called integrity management. Maintaining an oil field's integrity entails not only maintaining the facility's infrastructure but also taking care of the safety requirements of those who work there. Deep sea oil drilling is a common practise, and machine maintenance is the most important task. Steel constructions are regularly forced off the road and cause delays due to salinity, ocean acidity, and coastal air oxidation. Additionally, maintaining the workforce generally becomes crucial in remote areas since they pose particular health issues in a dangerous environment. Integrity Management prevents unjustified work stoppages by keeping the upkeep of people and equipment at the center of operations. It is important to highlight that despite the fact that sustainable development has compelled industrial thought to turn to alternative energy sources, the usage of fossil fuels appears to be only slightly set to decline in the next years.

To Get More Information on Oilfield Integrity Management Market - Request Sample Report

MARKET DYNAMICS

KEY DRIVERS:

-

Growing focus on remote monitoring

-

Rising production and exploration activities

RESTRAIN:

-

Volatility in oil prices.

The main factor affecting the whole oil and gas value chain is the price of crude oil. Due to a variety of variables, including shifting crude oil demand, OPEC and non-OPEC supply, fierce competition between the US and OPEC nations, and the shale gas revolution, the oil and gas business is always seeing variations in crude oil prices. In addition, corporations that produce oil and gas are seeing a decline in revenue, profitability, and operating margins as a result of the falling prices.

OPPORTUNITY:

-

Digitalization in Oilfield Integrity

-

Focused on expanding its product line and Utilize channels to market new products

Numerous small and major businesses have supplied goods for a variety of applications, changing the competitive environment. These players mostly operate at the national and regional levels, which restricts their ability to successfully meet international demands. To hold a significant presence globally, some of the company profiles for well-known organisations, including Baker Hughes Company, Schlumberger Limited, Halliburton, and Oceaneering International, Inc., among others, have a significant integration with local sales partners.

CHALLENGES:

-

While making purchases of various oilfield services because of fluctuations in oil prices.

IMPACT OF RUSSIAN-UKRAINE WAR

Russia's invasion of Ukraine has had a significant impact on people, the economy, and industry. Along with supply networks, industries, and economies, it has disturbed people's lives and way of life. Like many other industries, the energy sector is currently undergoing uncertainty. Even before the battle really escalated, oil prices were increasing all across the world. But after Russia invaded Ukraine, the cost of crude oil on the international market soared, rising from around $76 per barrel at the beginning of January 2022 Because of increased demand brought on by the world economies' recovery from the COVID-19 pandemic and insufficient investment in the oil and gas sector, the price of crude oil was already high even before the conflict.

IMPACT OF ONGOING RECESSION

Currently, oil prices are falling due to the pessimistic outlook for global growth, with Brent futures trading at about Prior to Russia's invasion of Ukraine, the USD was at a low of USD 92/b. Prices have dropped more than 30% since reaching a top of USD 139/b for the year in March, and they seem certain to stay at least at these levels through the end of 2022. We are dropping our perspective for WTI to USD 90/b from USD 110/b and cutting our projections for average Q4 all prices to USD 100/b in Brent from USD 115/p earlier.

KEY MARKET SEGMENTATION

By Management Type

-

Planning

-

Predictive Maintenance & Inspection

-

Data Management

-

Corrosion Management

-

Monitoring System

By Component

-

Hardware

-

Software

-

Services

By Application

-

Onshore

-

Offshore

.png)

Do You Need any Customization Research on Oilfield Integrity Management Market - Enquire Now

REGIONAL ANALYSIS

Europe is predicted to develop quicker throughout the projected period. Due to investments made by nations like Norway and the U.K. in the exploration of new offshore hydrocarbon deposits to boost domestic production. Due to increased investments in onshore and offshore exploration and production operations to enhance crude oil output to meet future energy demand, Asia Pacific is anticipated to have the second-largest market share for oilfield integrity management.

Latin American nations are continuously concentrating on expanding offshore exploration efforts to meet their rising oil demand. Due to the significant expenditures made in oil and gas exploration, Brazil and Argentina are anticipated to dominate the regional market.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The Major Players are Schlumberger, Halliburton, Baker Hughes Company, Siemens, Emerson, IBM, Oracle, Aker Solutions, Wood Group, SGS, Oceaneering International, TechnipFMC, and other players.

Halliburton (US)-Company Financial Analysis

| Report Attributes | Details |

| Market Size in 2022 | US$ 14.22 Bn |

| Market Size by 2030 | US$ 26.51 Bn |

| CAGR | CAGR of 8.1 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Management Type (Planning, Predictive Maintenance & Inspection, Data Management, Corrosion Management, Monitoring System) • By Component (Hardware, Software, Services) • By Application (Onshore, Offshore) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Schlumberger (US), Halliburton (US), Baker Hughes Company (US), Siemens (Germany), Emerson (US), IBM (US), and Oracle (US), Aker Solutions (Norway), Wood Group (UK), SGS (Switzerland), Oceaneering International (US), TechnipFMC (UK) |

| Key Drivers | • Growing focus on remote monitoring • Rising production and exploration activities |

| Market Restraints | • Volatility in oil prices. |