Asset Integrity Management Market Report Scope & Overview:

The Asset Integrity Management Market size was valued at USD 22.37 billion in 2023 and is expected to grow to USD 34.11 billion by 2032 and grow at a CAGR of 4.8% over the forecast period of 2024-2032.

Get more information on Asset Integrity Management Market - Request Sample Report

The global asset integrity management (AIM) market is growing with stringent regulatory norms, as well as safety concerns and demands for operational efficiency across diverse industries. It has driven the need to get upgraded due to aging infrastructure, strict regulations, as well as advancement in technology, and is expanding its market growth. Oil & gas, power generation, manufacturing, and aerospace are the key application sectors fuelling AIM solutions demand. Growing digitalization and implementation of IoT transform the market by facilitating real-time tracking, and predictive maintenance strategies. Adoption of Asset Integrity Management solutions through cloud technologies for new offshore areas and increasing demand from the market. Despite increasing costs and configuration complexities still being major market restraints.

Asset integrity management services are important for monitoring of investments throughout their lifecycle, aiding in maintenance decisions to prevent breakdowns and reduce risks. Companies such as GE are making significant investments in AIM technologies in the energy, aviation, and healthcare sectors by employing platforms like Predix for asset performance management. Government Commitment, The US Department of Energy, has funded $75M to AIM projects across the energy landscape, and recent news reports that up to 500 USD billion will be invested in infrastructure modernization within the US Infrastructure Investment and Jobs Act to improving critical asset integrity. Moreover, prominent industry players such as Baker Hughes are making substantial investments in AI and IoT-based AIM solutions to enhance the reliability of assets. These initiatives highlight the increasing role AIM is playing in supporting operational efficiency and regulatory compliance across global industries.

Drivers

-

Increasing need to maintain and upgrade aging infrastructure in industries such as oil & gas, power, and chemical.

-

Integration of advanced technologies such as IoT, AI, and big data analytics for real-time monitoring and predictive maintenance.

-

Growing emphasis on safety and risk management to prevent accidents and environmental hazards.

-

Increasing energy consumption driving the need for efficient asset management in the energy sector.

The increasing need to manage aged assets in high-risk industries is a significant factor that propels the growth of the asset integrity management market. The susceptibility of aging infrastructure and equipment is deteriorating at an accelerated pace, creating higher operational reliability and safety risks. This is where Achieving Effective AIM becomes important, especially in industries such as Oil and Gas, Petrochemicals & Power that are usually exposed to a harsh operating environment with its business imperative of complying with the ever-toughened regulatory requirements. Whilst a risk-based approach is employed to prioritize the allocation of resources and interventions based on asset criticality, potential failure modes and preservation of heritage assets with extended lifespan combined with performance optimization are facilitated by proactive maintenance strategies. Aging assets most often denote a high-risk facility and the organizations that operate in such facilities are consistently looking for ways to reduce downtime and improve safety while optimizing the value of their assets - making aging asset maintenance one of its top priorities and underscoring an urgent need for AIM solutions, especially within high-risk industries.

The growth of the power sector in developing countries presents lucrative opportunities for the AIM market. Increasing demand for power generation and distribution infrastructure in developing countries on account of rapid industrialization and urbanization The Checking of Critical assets like Power plants, Transmission lines, and Substations requires robust AIM practices for Cost-Effective growth with Reliability, Safety & Regulatory Compliance. Furthermore, several emerging economies have not developed asset management frameworks so AIM providers can offer customized solutions and expertise to help in the development and optimization of power infrastructure. These growth opportunities can help AIM companies increase their market share by efficiently supplying the rising power needs among emerging nations.

Restraints

-

Significant upfront investment is required for implementing asset integrity management systems and technologies.

-

Challenges associated with integrating new technologies with existing legacy systems, and Lack of skilled professionals.

-

Ongoing maintenance and operational costs associated with asset integrity management systems.

The asset integrity management (AIM) system faces restrain in installation complexity, and the high cost is a major constraint to this market. Integrating AIM systems is a complex proposition that generally requires very specific expertise and resources to implement, proving costly for organizations. The implementation cost (including software, hardware, and training) is an entry barrier to small enterprises with constrained budgets. As a result, such complexity and high costs make it difficult for AIM solutions to become more pervasive in organizations which is especially the case when most of those companies are on limited budgets and resources.

Segment Analysis

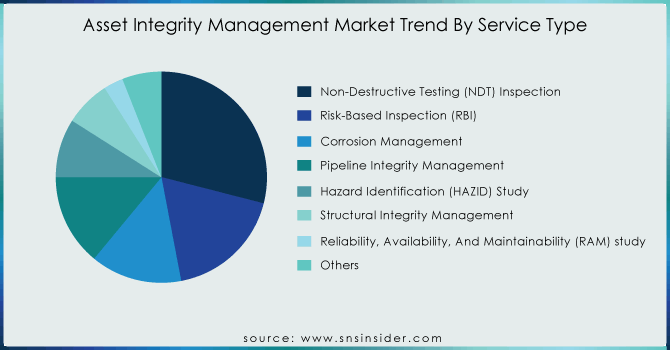

By Service Type

In 2023, the non-destructive testing (NDT) inspection segment is dominated the asset integrity management market It accounted for a higher share of more than 29% as it plays an important role in maintaining the safety, reliability & compliance of industrial assets across multiple industries. NDT methods are good for the assessment of assets as they allow a full examination without harm - compared to conventional approaches. The versatility of NDT as a technology for finding flaws, defects, and weaknesses in materials, welds, or components without interrupting operations delivers necessary insights into asset condition. The importance of safety, regulatory compliance, and cost savings in the industry is set to increase the requirement for NDT inspection services with NDT inspection maintaining its dominance.

Need any customization research/data on Asset Integrity Management Market - Enquiry Now

By Industry

The asset integrity management market is led by the power sector, with an accounted revenue share of more than 23.5% in 2023. The growing acceptance of renewable energy sources is leading to this, in turn increasing demand for efficient asset management tools. Further, the increasing globalization of power infrastructure is driving demand for monitoring and maintenance solutions to satisfy regulatory needs while simultaneously managing risk as global infrastructures continue to age. Increased electricity requirements in developing countries, coupled with the expansion of power infrastructure are subsequently driving demand for asset management services. Further, the advent of digitalization and smart grid technologies in the industry demand advanced monitoring & maintenance solutions that support the power sector to lead the asset integrity management market.

Regional analysis

The growth of the asset integrity management market in North America is increasing because of the presence of many oil and gas, manufacturing, power generation, and aerospace industries in the area which results in to increase in demand for asset integrity management services that will ensure operational reliability and safety. NA held the revenue share of more than 34% in 2023, Sophisticated asset monitoring and maintenance solutions will see increased adoption in North America as a result of advanced technological capabilities and mature/regulatory framework. Its commitment to innovation and infrastructure modernization has also solidified its place as a leader in the market. Rising focuses on sustainability and environmental stewardship further solidify North American dominance. The US asset integrity management market is expected to grow heavily by 2032. Increasing need for asset integrity management in oil and gas pipelines, power plants, and bridges among other critical assets driving the growth of the market. The demand for pipeline integrity management is fuelled by extensive oil and gas sector infrastructure networks, with the need to monitor leaks, corrosion as well as other possible factors causing disruption in case of any casualty. AIM is also important for the development and expansion of renewable energy production, overall system operation as well as needed grid reinforcement around a modernized power sector further bolstering market demand.

The Asia Pacific region is expected to grow at the highest CAGR in the asset integrity management market, as rapid industrialization and infrastructure development will lead to an increased demand for efficient AIM solutions that can provide operational safety and reliability. The oil & gas, manufacturing, and power generation industries have been increasingly adopting advanced technologies such as IoT and AI which could pave the way for real-time monitoring along with predictive maintenance activities thereby fuelling the market growth. Furthermore, rising energy consumption in developing markets and renewable investments increase the requirement for comprehensive AIM services. High CAGR in this region is expected to be driven by stringent regulatory requirements and increased awareness of asset optimization & safety. For instance, Shell announced $1 billion over five years to invest in digital technology, including AIM for AI and IoT use cases like predictive maintenance, real-time monitoring of things that go boom, etc. The asset-intensive make-in-India initiative of the Indian govt has made mandatory to use of AIM technologies for achieving optimum levels of Safety & Performance in industry, where it is enabling several private companies also by way of an economic investment-benefit with a few collaborations, implementing advanced AIM solutions. In the UK, £100m of funding has been earmarked by the government under its Industrial Strategy Challenge Fund for innovation in AIM technologies to aid research on digital twins and AI for asset management. The European Union has set aside €1 billion for digital transformation efforts such as AIM projects under its Horizon Europe program aimed at fostering innovation in areas like predictive maintenance, digital twins, and remote monitoring technologies within the process industry.

Key Players

The Major players in the market are SGS, Rosen Swiss, Bureau Veritas, MISTRAS Group Inc., TWI, Intertek Group, TechnipFMC, Aker Solutions, LifeTech, Genesis Oil and Gas Consultants, EM&I, Metegrity, FORCE Technology, Lloyd's Register, RINA, TÜV SÜD, and others in the final report.

Recent Developments

-

In October 2023 Applus+, under its diagnostics Services delivery line was awarded a contract (Master agreement) covering inspection & expediting activities throughout the globe with one major Oil & Gas player operating out from Italy. The agreement includes Applus+ specialists in oil and gas drilling and production solutions, who also offer asset integrity services to ensure regulatory compliance meets or exceeds standards for increased safety efficiency.

-

Harbour Energy secured a five-year contract with Fluor Corporation for Integrated Asset Integrity Services for the AELE hub and extension of service offering into Solan, J-Area Great Britannia Area, up to 7 Years of Work. This partnership solidifies Stork's commitment to fully integrated integrity services within the offshore oil and gas industry.

-

Baker Hughes and BP p.l.c. collaborated to develop CordantTM, integrated asset performance management solutions, and process optimization suite In March 2023, with an emphasis on reliability improvements to increase efficiency while reducing risks.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 22.37 billion |

| Market Size by 2032 | US$ 43.11 Billion |

| CAGR | CAGR of 4.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Non-Destructive Testing (NDT) Inspection, Risk-Based Inspection (RBI), Corrosion Management, Pipeline Integrity Management, Hazard Identification (HAZID) Study, Structural Integrity Management, Reliability, Availability, And Maintainability (RAM) study, Others) • By Industry (Oil & gas, Power, Mining, Aerospace, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | SGS, Rosen Swiss, Bureau Veritas, MISTRAS Group Inc., TWI, Intertek Group, TechnipFMC, Aker Solutions, LifeTech, Genesis Oil and Gas Consultants, EM&I, Metegrity, FORCE Technology, Lloyd's Register, RINA, TÜV SÜD |

| Key Drivers | • Increasing need to maintain and upgrade aging infrastructure in industries such as oil & gas, power, and chemical. • Integration of advanced technologies such as IoT, AI, and big data analytics for real-time monitoring and predictive maintenance. |

| RESTRAINTS | • Significant upfront investment is required for implementing asset integrity management systems and technologies. |