Oligonucleotide Synthesis Market Overview:

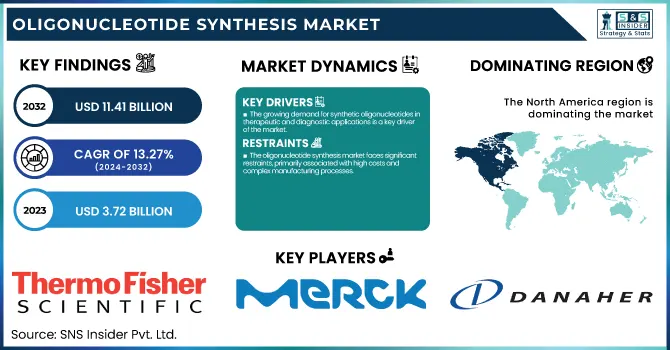

The Oligonucleotide Synthesis Market size was valued at USD 3.72 billion in 2023 and is projected to reach USD 11.41 billion by 2032, growing at a 13.27% CAGR over the forecast period of 2024-2032.

Get more information on Oligonucleotide Synthesis Market - Request Free Sample Report

This report points to the incidence and prevalence of target diseases, which fuel demand for oligonucleotide therapeutics in genetic disorders, infectious diseases, and oncology. R&D and drug development pipeline trends, including rising investment in RNA-based treatment modalities and gene-editing platforms, are fueling innovation, while synthesis technology trends, including advances in automation and high-throughput methods, are enhancing efficiency and scalability. The report discusses healthcare and biopharma investment trends with a focus on increasing financial backing for oligonucleotide-based drug development. Additionally, regulatory advancements and oligonucleotide-based drug approvals are reviewed, in line with the increased clinical utilization of these therapies.

The U.S. Oligonucleotide Synthesis Market was valued at USD 1.21 billion in 2023 and is expected to reach USD 3.38 billion by 2032, growing at a CAGR of 12.13% over the forecast period of 2024-2032. In the United States, the market is experiencing accelerated growth based on robust government support for genetic research, increasing alliances between pharmaceutical companies and biotech players, as well as a conducive regulatory environment encouraging speedy drug approvals.

Oligonucleotide Synthesis Market Dynamics

Drivers

-

The growing demand for synthetic oligonucleotides in therapeutic and diagnostic applications is a key driver of the market.

As the incidence of genetic disorders, cancer, and infectious diseases is on the rise, oligonucleotide-based therapeutics like antisense oligonucleotides, siRNA, and CRISPR-based gene editing are on the rise. Various oligonucleotide-based drugs have been approved by the U.S. FDA, such as Nusinersen for spinal muscular atrophy and Inclisiran for cholesterol lowering, which is further driving market growth. Moreover, the development of automated synthesis technologies has enhanced the efficiency of production, making it cost-effective and more scalable. Growing usage of polymerase chain reaction (PCR) and next-generation sequencing (NGS) in clinical diagnostics has also spurred the use of oligonucleotides, particularly PCR primers and sequencing reagents. Growing investments in genomic research and drug discovery by biotech and pharma firms are also boosting oligonucleotide synthesis innovation. The combination of artificial intelligence (AI) and machine learning in oligonucleotide optimization and design is speeding up drug discovery while enhancing the effectiveness of custom synthesis services. Additionally, the increasing adoption of personalized medicine and precision therapeutics is poised to ensure long-term growth in this market. The growth of more partnerships between biotech companies and contract synthesis businesses is expanding the accessibility and geographic reach of the market further.

Restraints

-

The oligonucleotide synthesis market faces significant restraints, primarily associated with high costs and complex manufacturing processes.

Synthesis of high-purity oligonucleotides involves costly raw materials, specialized equipment, and rigorous quality control, contributing to higher costs of production. For instance, phosphoramidites, the key building blocks for oligonucleotide synthesis, are expensive and sensitive to storage conditions, affecting supply chain efficiency. Regulatory barriers also represent a significant limitation, with strict guidelines by regulatory bodies such as the FDA and EMA requiring stringent validation and compliance, prolonging product approvals. Moreover, concerns over the safety and efficacy of oligonucleotide-based therapeutics due to the possibility of off-target effects and toxicity hold back their broad-based clinical usage. Intellectual property (IP) concerns over synthesis technologies and proprietary sequences also hamper market entry for new entrants. The heavy upfront investment needed to establish synthesis facilities acts as a deterrent for small biotech companies to enter the market. In addition, the poor scalability of existing synthesis technologies, especially for large-scale production, limits the capacity of manufacturers to respond efficiently to increasing demand. Also, the absence of standardized synthesis protocols and batch-to-batch variability further inhibit the use of oligonucleotides in high-throughput applications.

Opportunities

-

The expanding applications in gene therapy, molecular diagnostics, and personalized medicine.

The success of COVID-19 vaccines, fueling the growth of mRNA therapeutics, has given way to novel opportunities for developing drugs based on oligonucleotides. Progress in CRISPR-Cas gene editing technology has propelled demand for synthetic guide RNAs further, again propelling the market. The heightened emphasis on rare diseases has created greater interest in oligonucleotide-based orphan drugs, and regulatory benefits are encouraging research here. The advent of affordable and automated oligonucleotide synthesis platforms has opened doors for biotech companies and startups to come into the market with new solutions. In addition, the increasing usage of next-generation sequencing (NGS) and liquid biopsy methods in oncology has supported the demand for oligonucleotides of high quality. The partnerships between academic research centers and pharmaceutical firms are speeding up the transition of oligonucleotide-based treatments from bench to bedside. The growth of contract development and manufacturing organizations (CDMOs) is enabling biotech firms to access cost-effective synthesis solutions, enabling speedy commercialization. The Asia-Pacific region, with emerging markets, presents untapped opportunities as there is growing investment in biotechnology infrastructure and enhanced awareness of genetic-based therapies.

Challenges

-

The oligonucleotide synthesis market faces several challenges, primarily related to scalability, stability, and regulatory compliance.

One of the biggest challenges is the inability to scale up manufacturing with high efficiency due to high purity. Oligonucleotide synthesis on a large scale requires careful reagent handling, optimized purification processes, and rigid quality control protocols, all of which add to the complexity of the operation. The stability of synthetic oligonucleotides is another big challenge since they are very susceptible to nucleases-mediated degradation, rendering transport and storage problematic. Ensuring the long-term stability of oligonucleotide therapeutics is an important issue in drug development. Regulatory issues also introduce challenges, with changing guidelines and safety issues slowing down clinical approvals. The risk of immunogenicity and off-target activities of therapeutic oligonucleotides is a challenge to be met by rigorous preclinical and clinical testing. Competition from other therapeutic strategies, including monoclonal antibodies and small-molecule drugs, is also restricting the use of oligonucleotide-based therapies. Regulatory issues related to gene-editing tools, especially those based on CRISPR technologies, add an extra layer of complexity to pathways. Lastly, the dependence of suppliers on limited players for significant raw materials, including phosphoramidites, leaves the supply chain susceptible to disruption, which impacts production times and costs. All these pose a challenge in addressing through further innovations in synthesis technologies and enhancing regulatory systems.

Oligonucleotide Synthesis Market Segmentation Analysis

By Product & Service

The services segment led the oligonucleotide synthesis market in 2023 with a 37.4% share. This leadership is due to the growing outsourcing of oligonucleotide synthesis by pharmaceutical and biotechnology industries. The requirement for tailored oligonucleotide synthesis, modification, and purification services has risen with growing uses in drug discovery and molecular diagnostics. The difficulty and high cost of in-house synthesis have further driven the dependency on service providers.

The oligonucleotide segment is anticipated to witness the maximum growth in the coming years. The rising demand for therapeutic applications of synthetic oligonucleotides for antisense therapy, siRNA, and gene editing technologies propels this expansion. The augmented pipeline of drug candidates based on oligonucleotides, as well as augmenting research areas in genomics and molecular biology are the central drivers driving rapid growth in this segment.

By Application

The PCR primers segment dominated the largest market share in 2023 due to its extensive application across research, diagnostics, and clinical use. PCR primers are essential for polymerase chain reaction (PCR) assays, which are a standard technique in genetic testing, the detection of infectious diseases, and forensic analysis. Its growing application of PCR-based diagnostics, especially for infectious disease tests and oncology, has entrenched its position as the top-performing segment.

The sequencing segment is anticipated to see the highest growth in the forecast period. The growing need for next-generation sequencing (NGS) technologies, the development of precision medicine, and the decreasing cost of sequencing have greatly fueled this segment. The growing incorporation of sequencing-based methods in clinical diagnostics, oncology, and genetic disease research is fueling its high growth.

Oligonucleotide Synthesis Market Regional Outlook

North America was the leading oligonucleotide synthesis market in 2023, with high investment in genomic research, robust presence of pharmaceutical and biotech firms, and growing utilization of oligonucleotide-based therapeutics. The U.S. is followed by the rest of the region because of sheer funding for gene therapy and precision medicine programs. FDA approval of oligonucleotide-based pharmaceuticals such as Nusinersen and Inclisiran has also increased market growth. Furthermore, growth in next-generation sequencing (NGS) and polymerase chain reaction (PCR) uses in diagnostics has complemented the demand for synthetic oligonucleotides in research and clinical applications.

Asia-Pacific is the fastest-growing market, set to grow at a high rate over the forecast period. Increased growth in the biotechnology industries of China, India, and Japan, increased government expenditure on genomics, and rising investments in personalized medicine are primary drivers. China, for instance, is experiencing an upsurge in oligonucleotide-based drug discovery and sequencing technology, supported by government programs such as the "China Precision Medicine Initiative". The rising incidence of infectious diseases and genetic diseases in Asia-Pacific has further fuelled demand for oligonucleotide synthesis. Furthermore, the availability of low-cost manufacturing centers and growing research partnerships between international pharmaceutical majors and Asian biotech organizations are fuelling regional market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in Oligonucleotide Synthesis Market

-

Thermo Fisher Scientific, Inc. – Custom Oligos, GeneArt Oligonucleotide Services, Invitrogen Oligos

-

Merck KGaA (MilliporeSigma) – Custom DNA & RNA Oligos, OligoPilot, Proligo Oligonucleotides

-

Danaher Corporation (Integrated DNA Technologies - IDT) – gBlocks Gene Fragments, Ultramer DNA & RNA Oligos, PrimeTime qPCR Probes

-

Dharmacon Inc. (Horizon Discovery, a PerkinElmer company) – Custom siRNA, CRISPR Guide RNAs, RNAi Oligos

-

Agilent Technologies – SureSelect Oligonucleotide Probes, Custom DNA/RNA Synthesis

-

Bio-Synthesis, Inc. – Custom Oligonucleotides, Peptide-Oligonucleotide Conjugates, siRNA Synthesis

-

Kaneka Eurogentec S.A. – Custom DNA & RNA Oligonucleotides, GMP-Grade Oligos, qPCR Probes

-

LGC Biosearch Technologies – Black Hole Quencher (BHQ) Probes, Stellaris RNA FISH Probes, Custom Oligonucleotides

-

Biolegio – Custom DNA & RNA Oligos, NGS Adapters, qPCR & FISH Probes

-

Twist Bioscience – Synthetic DNA Oligos, NGS Panels, CRISPR Oligos, Gene Synthesis Services

Recent Developments in Oligonucleotide Synthesis Industry

In December 2024, PeptiSystems raised 45 MSEK in funding, led by Sciety and Sciety Venture Partners, to scale up peptide and oligonucleotide drug manufacturing. The investment will enhance production capacity, sales expansion, and sustainable pharmaceutical manufacturing efforts.

In Nov 2024, Codexis, Inc. announced new data at the TIDES Europe 2024 conference, showcasing advancements in its Enzyme Catalyzed Oligonucleotide (ECO) Synthesis platform. The findings highlight Codexis’s leadership in enzymatic synthesis technology, supporting the scalable manufacturing of RNAi therapeutics.

In July 2024, EnPlusOne Biosciences announced a breakthrough in enzymatic RNA synthesis by successfully synthesizing the antisense strand of Leqvio (inclisiran), a commercially approved siRNA drug for hypercholesteremia. Licensed by Novartis from Alnylam Pharmaceuticals, Leqvio currently serves a multi-million patient population.

| Report Attributes | Details |

| Market Size in 2023 | USD 3.72 billion |

| Market Size by 2032 | USD 11.41 billion |

| CAGR | CAGR of 13.27% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product & Service [Oligonucleotides, Equipment/Synthesizer, Reagents, Services] • By Application [PCR Primers, PCR Assays and Panels, Sequencing, DNA Microarrays, Fluorescence In Situ Hybridization (FISH), Antisense Oligonucleotides, Other Applications] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, Merck KGaA, Danaher Corporation (IDT), Dharmacon Inc., Agilent Technologies, Bio-Synthesis Inc., Kaneka Eurogentec S.A., LGC Biosearch Technologies, Biolegio, and Twist Bioscience. |