Olive Oil Market Report Scope & Overview:

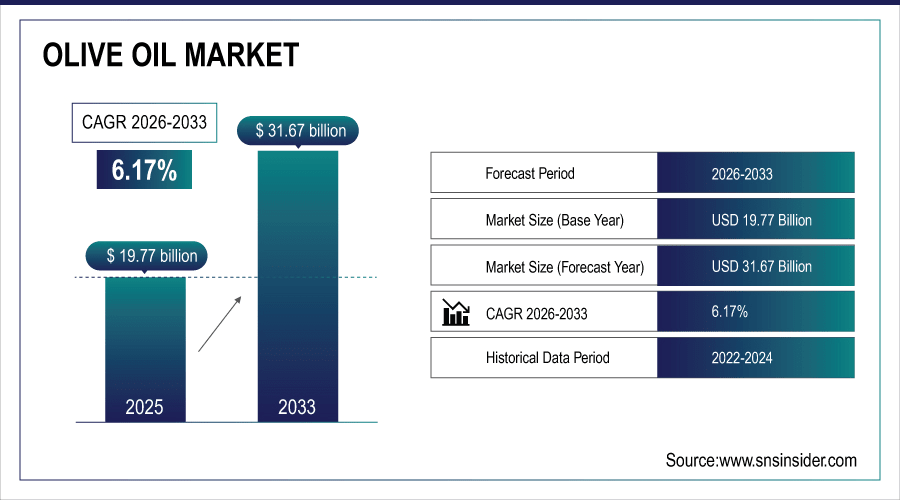

The Olive Oil Market size was valued at USD 19.77 Billion in 2025E and is projected to reach USD 31.67 Billion by 2033, growing at a CAGR of 6.17% during 2026-2033.

The global market, including production, consumption market, supply and demand dynamics, and pricing, quality certification, sustainability and segment performance by distribution channels and regulation by sector and region offers a comprehensive overview to stakeholders. Pricing scenarios, competitive benchmarking, and extraction technology developments are all addressed along with emerging product formats in the forecasts. The olive oil market analysis further identifies investment opportunities, regulatory implications, and changing consumer preferences that are projected to determine long-term growth prospects among key global olive oil markets.

Over 45% of global consumers prefer extra-virgin olive oil for daily cooking and salad dressings.

To Get More Information On Olive Oil Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2024: USD 19.77 Billion

-

Market Size by 2032: USD 31.67 Billion

-

CAGR: 6.17% from 2025 to 2032

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Olive Oil Market Trends:

-

Rising consumer awareness of cardiovascular benefits, antioxidants, and natural ingredients is fueling widespread adoption of olive oil in daily diets.

-

Extra virgin olive oil benefits from its superior quality perception, with premium positioning supported by marketing, nutrition endorsements, and chef advocacy.

-

Companies are increasingly focusing on quality, traceability, and certification to enhance trust, increase market value, and attract specialty and organic buyers.

-

Adoption of drip irrigation, precision agriculture, and pest management improves productivity, reduces environmental impact, and enhances farm-level economics.

-

Innovations in centrifuge and filtration technologies improve extraction efficiency, extend shelf life, and minimize production losses.

-

Sustainability grants, green financing, and cooperative investments in cold storage and processing facilities enable smaller producers to scale and expand exports at reduced unit costs.

U.S. Olive Oil Market Insights

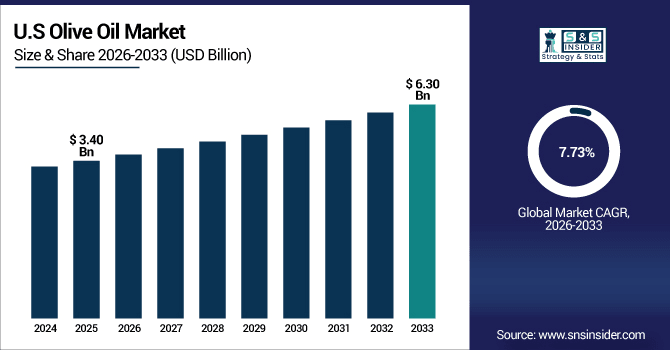

The U.S. Olive Oil Market size was valued at USD 3.40 Billion in 2025E and is projected to reach USD 6.30 Billion by 2033, growing at a CAGR of 7.73% during 2026-2033.

In the U.S. market, the demand for rising health-conscious consumption, increase in adoption of Mediterranean diets, and premiumization toward extra virgin varieties are driving the market growth. The demand is further given an impetus with increasing specialty retail, online channels, and innovation within organic and flavored oils. Quality labeling regulations, higher disposable incomes, and promotional efforts increase consumer trust. Scalability is supported by supply chain resiliency and tactical trade shifts that will enable growing revenue generation and expanding retail assortment across the country through 2033.

Olive Oil Market Growth Drivers:

-

Growing Global Preference for Healthier Fats and Mediterranean Diets Driving Demand for Premium Extra Virgin Olive Oil Products Among Consumers

Consumers are conscious of cardiovascular benefits, antioxidant characteristics, and natural ingredients that have led to the wide adoption of olive oil in the daily diet. To some extent, premiumization benefits extra virgin categories by virtue of higher quality and health perception, while product availability broadens via foodservice and retail channels. Demand continues to be fueled by marketing campaigns, nutrition endorsements, and endorsements from chefs and health professionals. This increased preference also stimulates producers to invest more in quality, traceability, and certification, increasing the market value and incentivizing new entrants intended for specialty and organics. Moreover, this supports broader adoption. Repeat purchases across Sunrise cities, driven by rising disposable incomes and premium snacking trends, reinforce long-term revenue and category loyalty.

Over 55% of consumers are influenced by chef or nutritionist endorsements when purchasing olive oil.

Olive Oil Market Restraints:

-

Challenges in Maintaining Authenticity and Quality Standards Due to Adulteration and Inconsistent Certification Practices Across Certain Supply Chains Undermining Trust

In some markets, incidents of adulteration and mislabeling and unreliable testing standards have dented consumer trust and acted as a barrier against premiumization. As PDO, PGI, and organic claims are enforced differently, local enforcement is realized in separate certification frameworks and as such impedes compliance when traded across borders. Large brands are more likely to shut down isolated incidents that may not affect them, while smaller producers are unable to invest in traceability systems to prevent the same behavior. Such an environment raises compliance costs and requires intensive supply-chain audits, which can push back launches and put a squeeze on margins, especially among exporters accessing stringently regulated markets. While the system built-in consumer education and third-party verification, its implementation costs and time-to-certification slow international market-wide adoption, most notably for small-scale producers.

Olive Oil Market Opportunities:

-

Investment in Sustainable Farming and Advanced Extraction Technologies to Improve Yields, Lower Waste, and Enhance Product Traceability Across Producer Networks

Drip irrigation, precision agriculture, and integrated pest management uptake could help boost productivity and lower environmental externalities, providing more competitive farm-level economics. Advances in centrifuge and filtration technologies improve extraction efficiencies and shelf life, generating value by minimizing losses. Companies that have better track of their products up from the farm to the bottle will leverage this for greater transparency and support for premium certifications that attract buyers with increased health consciousness. Sustainability grants, green finance and public-private partnerships reduce the cost of modernization and allow smaller producers to scale and access higher-value supply chains. As for collective investments, it is also a great opportunity for creation of cooperative processing facilities (includes, but not limited to, cold storage), and market joint handling and increased volumes or cooperatives will have larger capacities for export from one area, reducing unit cost.

Over 40% of olive farms in leading producing countries have adopted drip irrigation or precision agriculture techniques.

Olive Oil Market Segment Analysis:

-

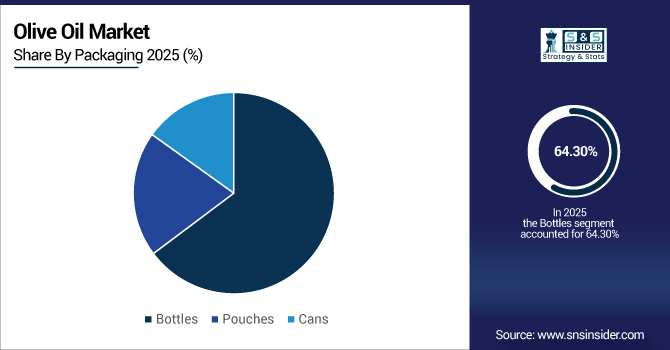

By Packaging, Bottles led the market with 64.30% share in 2025E, while Pouches is registering the fastest growth with a CAGR of 8.20%.

-

By Type, Extra Virgin led the Olive Oil Market with a 46.10% share in 2025E, and is the fastest-growing segment with a CAGR of 7.50%.

-

By Application, the Food & Beverage sector dominated the market with 62.50% share in 2025E, whereas the Personal Care and Cosmetics segment is expected to grow fastest with a CAGR of 7.60%.

-

By Distribution Channel, Supermarkets & Hypermarkets held 54.20% share in 2025E, while Online segment is growing the fastest with a CAGR of 9.10%.

By Packaging, Bottles Lead While Pouches Registers Fastest Growth

In 2025E, bottle segment commanded the largest revenue share of approximately 64.30% owing to the maintenance of quality, helps in premium branding, in addition to meeting the consumer speciation regarding presentation and reuse. Concurrently, pouches will grow at the highest CAGR of 8.20% during 2026-2033 owing to their convenience, lighter weight for shipping, resealability, and sustainability appeal. For instance, Colavita S.p.A. has introducing sustainable pouch solutions designed for e-commerce and cost-sensitive segments of the market.

By Type, Extra Virgin Oil Leads Market and Registers Fastest Growth

In 2025E, Extra Virgin olive oil contributed to the major share of revenue at approximately 46.10% owing to its better taste, higher antioxidant concentration, and consumer perception of health benefits. It gets confirmation of its supremacy in the segments with a premiumization, certifications, and an extensive use in gourmet cooking. Similarly, the Extra Virgin segment is estimated to grow at the highest compound annual growth rate (7.50% during 2026-2033), owing to innovations in flavored and single-origin products, greater penetration through e-commerce distribution channels, and the rising consumer trend over the preference of healthier and high-quality oils. This leads to the creation of high-value variants, which companies, such as Deoleo S.A. are investing significant resources in.

By Application, Food & Beverage Dominate While Personal Care and Cosmetics Shows Rapid Growth

Food & Beverage applications captured largest revenue share in 2025E of 62.50%, owing to extensive usage in households, restaurants and food processing along with excellent flavor and health properties. Simultaneously, the Personal Care & Cosmetics segment is likely to exhibit the fastest CAGR of nearly 7.60% during the forecast period of 2026-2033, due to clean-label trends, skin-conditioning advantages, and natural formulations. Pompeian Inc. is one of several companies expanding its range of cosmetic-grade olive oil that can fulfill growing skincare and haircare demand.

By Form, Supermarkets & Hypermarkets Lead While Online Segment Grow Fastest

The market for olive oil was dominated by Supermarkets & Hypermarkets with the highest revenue share of around 54.20% in 2025E, providing wide ranges, large units sale, and good visibility. On the other hand, Online channel is anticipated to become the fastest CAGR of 9.10% throughout 2026-2033 owing to digital marketing, subscription services, and availability of premium and specialty olive oils for people. And online is helping California Olive Ranch and others reach the health- and urban-oriented consumer.

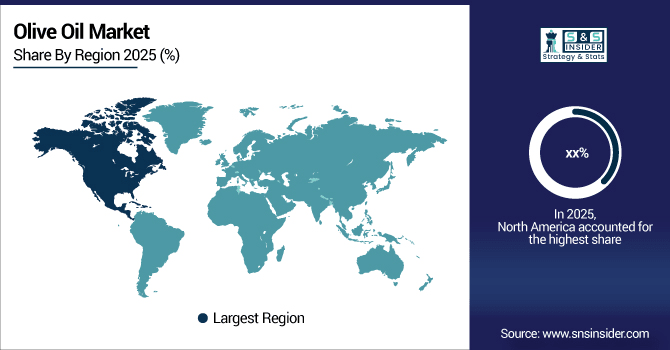

Olive Oil Market Regional Analysis:

North America Olive Oil Market Insights

North America Olive Oil Market is Growing Due to Rising Health Awareness, Increasing Popularity of Mediterranean Diet, along with Demand for Premium & Extra Virgin Olive Oil, Ken Research Some of the factors such as the availability of strong retail and online distribution channels, innovating flavored and organic variants, and regulatory frameworks that boost confidence amongst investors and consumers alike are some of the elements that drive the market. The U.S. continues to dominate, but Canada is showing pockets of growth opportunity.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Olive Oil Market Insights

The U.S. is set to grow at a much faster clip owing to increased consumer knowledge regarding health benefits, extensive penetration of Mediterranean diets, robust retail and online distribution channels, premiumization of extra virgin olive oils, and favorable regulations bolstering product quality and consumer confidence.

Asia Pacific Olive Oil Market Insights

Asia Pacific is expected to witness the fastest growth by 9% in this segment owing to increasing disposable income, expanding middle-class food culture, and higher awareness regarding health. Rising demand for high-end oils due to urbanization and westernized diets, coupled with increasing e-commerce penetration, further enhances accessibility for imported extra virgin goods. Flavored and organic segments are well positioned by local producers and importers, while major markets have seen retailers grow premium assortments.

China Olive Oil Market Insights

China has the largest Asia Pacific olive oil market, driven by increasing disposable incomes, the growing awareness of health and Westernization of dietary trends, rapid urbanization, increasing e-commerce penetration, and the ability of middle-class and affluent Chinese to pay more for imported premium and extra virgin olive oils.

Europe Olive Oil Market Insights

Europe dominates the olive oil market share by 48.20% due to long time cultural preference, primarily established olive farming planted in Mediterranean nations, and value chains well integrated with different levels of the value chain. Nations, such as Spain, Italy and Greece produce large quantities and export branded extra virgin assortments globally, providing an economy of scale for local producers. Their reinforced by strong culinary traditions, quality certifications supported by the government and matured retail infrastructures play a significant role in instilling the consumer confidence which in turn leads to a higher per-capita consumption.

Spain Olive Oil Market Insights

Spain, with the largest cultivated area of olive trees, high olive production and high olive oil volumes, leading export networks, Mediterranean reasons for high olive oil consumption, and established quality certifications in terms of PDO and PGI standards dominates the olive oil market in Europe. Spain remains ahead of Germany, France, the U.K., and Italy in domestic consumption and has also been leading exports at the level of the globe.

Latin America (LATAM) and Middle East & Africa (MEA) Olive Oil Market Insights

The Middle East & Africa olive oil market is dominated by the UAE due to high-income levels, health-conscious consumption favoring premium imported olive oils, Brazil dominates the Latin American olive oil market due to growing disposable incomes, increasing adoption of Mediterranean diet & lifestyle, flourishing retail & e-commerce channel, and rising demand for imported and high-quality olive oils.

Olive Oil Market Competitive Landscape:

Deoleo S.A. is a Spanish multinational group, and the global leader in bottling olive oil with brands such as Bertolli, Carapelli and Carbonell. The company specializes in premium, high-quality culinary oils for foodservice and retail markets. Notable brands include Bertolli Extra Virgin Olive Oil, known for its rich taste and well-rounded scent perfect for cooking or salad, and Carapelli Organic Olive Oil, which merges certified organic quality with smooth, delicate flavor, suitable for health-oriented consumers in search of natural, sustainable solutions.

-

In September 2025, Bertolli introduced a 100% recycled polyethylene terephthalate (rPET) bottle for its olive oil, marking a significant step in sustainable packaging. This launch aligns with Bertolli's commitment to reducing virgin plastic use and minimizing environmental impact.

Sovena Group, Portugal, an integrated producer and processor of olive oil dedicated to cultivation, extraction, and global distribution. This company focuses on sustainability and high-quality oils for retail and industrial markets. Oliveira da Serra Extra Virgin Olive Oil is a fresh and fruity oil that perfectly fits Mediterranean-style dishes, and Andorinha Pure Olive Oil is a smooth, versatile found at the heart of every kitchen, reflecting Sovena's commitment to quality, traceability, and improved consumer satisfaction.

-

In December 2024, Sovena launched the 1st Harvest Olive Oil, a limited edition capturing the freshness and intensity of the season's first olives, emphasizing biodiversity and sustainable farming practices.

Colavita S.p.A., an Italian olive oil company, is committed to quality extra virgin olive oil and blends steeped in the heritage of Italy. It is the top brand serving Indian and global markets with full quality torching. Providing the robust aroma and true Italian flavor profile for all culinary uses, Colavita Extra Virgin Olive Oil is the go-to brand in the U.S. With Colavita Organic Olive Oil delivering certified organic quality and smooth fruity taste and mouthfeel, pleasing health-conscious consumers and home and gourmet cooks alike.

-

In December 2024, Colavita's Extra Virgin Olive Oil is crafted from 100% olives grown in Italy, Greece, Spain, and Portugal, cold-pressed to retain its rich flavor, and is chosen by top chefs and home cooks alike.

Olive Oil Market Key Players:

Some of the Olive Oil Market Companies are:

-

Deoleo S.A.

-

Sovena Group

-

Borges International Group

-

Colavita S.p.A.

-

Salov Group

-

Pompeian, Inc.

-

Minerva S.A.

-

Gallo Worldwide

-

Cargill, Incorporated

-

Ybarra Alimentación

-

Maeva Group

-

Monini S.p.A.

-

Lucini Italia Company

-

Agro Sevilla Group

-

Olitalia S.r.l.

-

Atlas Olive Oils

-

Grupo Oleoestepa

-

Aceites Toledo S.A.

-

Roland Foods, LLC

-

California Olive Ranch

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 19.77 Billion |

| Market Size by 2033 | USD 31.67 Billion |

| CAGR | CAGR of 6.17% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Refined, Virgin, Extra Virgin and Others) • By Application (Food & Beverage, Personal Care & Cosmetics, Pharmaceuticals and Others) • By Packaging (Bottles, Pouches and Cans) • By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Deoleo S.A., Sovena Group, Borges International Group, Colavita S.p.A., Salov Group, Pompeian, Inc., Minerva S.A., Gallo Worldwide, Cargill, Incorporated, and Ybarra Alimentación. Other significant participants are Maeva Group, Monini S.p.A., Lucini Italia Company, Agro Sevilla Group, Olitalia S.r.l., Atlas Olive Oils, Grupo Oleoestepa, Aceites Toledo S.A., Roland Foods, LLC, and California Olive Ranch. |