Online Poker Market Report Scope & Overview:

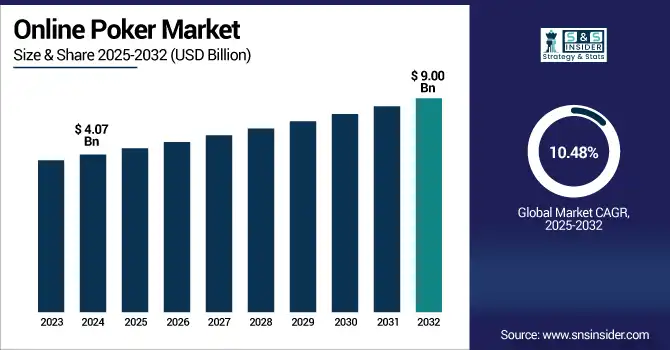

Online Poker Market was valued at USD 4.07 billion in 2024 and is expected to reach USD 9.00 billion by 2032, growing at a CAGR of 10.48% from 2025-2032.

To Get more information on Online Poker Market - Request Free Sample Report

The growth of the online poker market is driven by increasing internet penetration 67.1% globally as of 2024, according to the International Telecommunication Union (ITU) and widespread smartphone usage. The rising popularity of real-money gaming platforms has further accelerated adoption. Technological advancements such as secure payment gateways, AI-based fraud detection, and immersive user interfaces have enhanced player experience and trust. Additionally, the legalization and regulation of online poker in regions such as Michigan, Pennsylvania, and New Jersey, as recognized by the Michigan Gaming Control Board, have expanded the player base significantly. Social gaming trends and the rise of live poker tournaments on digital platforms evident from millions of hours watched on Twitch's Poker streams and collaborations like GGPoker’s partnership with the World Series of Poker (WSOP) have further fueled engagement. Strategic marketing, celebrity endorsements, and integration with streaming platforms continue to boost visibility and user acquisition, contributing to sustained market expansion.

U.S. Online Poker Market was valued at USD 0.85 billion in 2024 and is expected to reach USD 1.85 billion by 2032, growing at a CAGR of 10.25% from 2025-2032.

The U.S. online poker market is growing due to increasing state-level legalization, improved regulatory frameworks, and a surge in digital payment adoption. Rising mobile gaming participation, enhanced cybersecurity, and the popularity of televised and live-streamed tournaments are also attracting a broader audience, driving consistent market expansion across the country.

Market Dynamics

Drivers

-

Increased popularity of skill-based gaming is attracting competitive players and legitimizing poker as a strategic and rewarding activity.

The growing public perception of poker as a game of skill rather than chance is redefining its appeal. Competitive players are increasingly drawn to poker because it rewards strategy, probability analysis, and decision-making under pressure. This perception shift is further supported by online tournaments, leaderboards, and live-streamed gameplay that highlight player expertise. Skill-based engagement also fosters community-building and player retention, as users are motivated to improve performance over time. As consumers seek intellectually stimulating and financially rewarding games, online poker benefits from this transition toward skill-centric gaming behaviors and platforms.

-

In the 2024 WSOP Main Event, held live in Las Vegas, the poker championship attracted a record 10,112 entries, setting a new all-time high for participation.

-

According to SullyGnome’s analytics, poker content on Twitch has amassed over 14.1 million viewing hours this year, with an average of ~2,735 concurrent poker viewers and peak live viewers reaching ~22,043.

Restraints

-

Stringent gambling regulations across jurisdictions create operational barriers and legal uncertainties for online poker platforms.

Inconsistent and evolving gambling laws across countries—and even within states—pose significant limitations for market expansion. Regulatory frameworks often classify poker under general gambling laws, resulting in licensing hurdles, advertising restrictions, and even platform bans. Operators face uncertainty while entering new regions, leading to increased legal compliance costs and cautious market approaches. In some jurisdictions, online poker is still deemed illegal or morally contentious, which affects user trust and market growth. As regulatory clarity lags behind technology, online poker platforms struggle to standardize operations and scale globally without encountering legal obstacles.

Opportunities

-

Expansion into emerging markets with rising digital infrastructure creates strong growth potential for online poker providers.

Countries in Asia, Latin America, and Africa are witnessing rapid digitization, growing middle-class populations, and increasing mobile penetration—making them prime targets for online poker. These regions offer untapped user bases eager for entertainment and digital financial tools. As cultural acceptance of online gaming grows and governments explore regulated markets, poker providers can localize content, integrate regional payment systems, and build strong communities. Language support, local tournaments, and influencer marketing can help gain traction in these new markets, opening significant revenue opportunities for global and regional poker platforms.

Challenges

-

High player churn and low retention rates reduce lifetime value and profitability for online poker platforms.

Despite large user acquisition numbers, retaining casual and first-time poker players remains a major challenge. Many users quit after initial losses or become inactive due to lack of personalized engagement or motivation. This leads to high marketing spend to reacquire users, impacting ROI. Poor onboarding, generic content, and insufficient reward systems contribute to weak loyalty. Additionally, competition from other online games and entertainment options diverts attention. Platforms must continually innovate user experiences, loyalty programs, and training content to improve retention rates and enhance long-term player lifetime value.

Segment Analysis

By Device

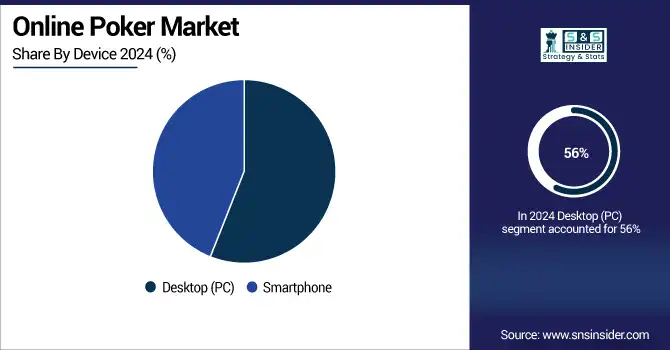

Desktop (PC) usage dominated the online poker market in 2024 with the highest revenue share of 56% due to its superior processing power, larger screens, and stable connectivity. These features offer a more immersive and controlled gaming experience, especially for professional and high-stakes players. Desktops also support multi-table play and advanced tracking software, which are crucial for strategic decisions, contributing to their continued preference among serious online poker users.

Smartphone adoption is projected to grow fastest at a CAGR of 11.51% from 2025–2032 due to increasing mobile internet penetration, affordable smartphones, and user-friendly poker apps. The convenience of playing anytime, anywhere appeals to casual and younger users. Enhanced mobile UI/UX design, real-time updates, and in-app social features further attract a broader audience, positioning smartphones as the most rapidly expanding segment in the online poker ecosystem.

By Payment Mode

Credit/Debit Cards dominated the online poker market in 2024 with the highest revenue share of 36% due to their wide acceptance, user familiarity, and instant processing capabilities. Players prefer card payments because of the trust associated with major banks and card providers. Additionally, minimal setup and seamless integration into platforms help maintain transactional efficiency, especially for users less inclined toward digital wallets or cryptocurrency-based alternatives, securing their dominance in payment preferences.

E-Wallets are expected to grow at the fastest CAGR of 12.11% from 2025–2032 owing to their convenience, speed, and strong appeal among tech-savvy users. These digital payment tools allow instant deposits and withdrawals, often with enhanced security features like encryption and two-factor authentication. The growing popularity of mobile gaming pairs well with mobile-friendly wallet apps, fueling their usage in emerging markets and driving rapid adoption across the online poker ecosystem.

By Game Type

Texas Hold’em led the online poker market in 2024 with a dominant revenue share of 55% due to its global popularity, simple rules, and widespread presence in tournaments and online platforms. Its accessibility attracts beginners, while strategic depth appeals to professionals. Major televised events and influencer-led promotions have further boosted its visibility. The consistent presence of Texas Hold’em in free-play and real-money formats continues to sustain its leadership across player segments.

Omaha is projected to grow at the fastest CAGR of 12.87% from 2025–2032 as more players seek variety and increased complexity in gameplay. Omaha offers higher variance and deeper strategic opportunities, attracting experienced players transitioning from Texas Hold’em. Online platforms are promoting Omaha with dedicated tables, tutorials, and tournaments, enhancing its appeal. The evolving poker community’s appetite for challenging variants is a key driver of Omaha’s accelerated growth trajectory.

By Game Format

Cash Games dominated the online poker market in 2024 with the highest revenue share of 48% as they offer flexibility in entry, no fixed durations, and immediate withdrawal of winnings. Players can join or leave tables at will, making them appealing for both casual users and professionals. These games run 24/7, maintaining high traffic and liquidity. Their steady revenue stream and broad appeal ensure consistent performance over tournament-based alternatives.

Fast-Fold Poker is anticipated to grow at the fastest CAGR of 12.96% from 2025–2032 as users increasingly demand quicker gameplay and reduced downtime. This format allows players to switch tables instantly after folding, significantly increasing hand volume per session. It appeals to mobile and short-session users seeking speed and action. Platforms are leveraging this trend by integrating fast-fold options prominently, drawing both recreational and volume-focused players to the format.

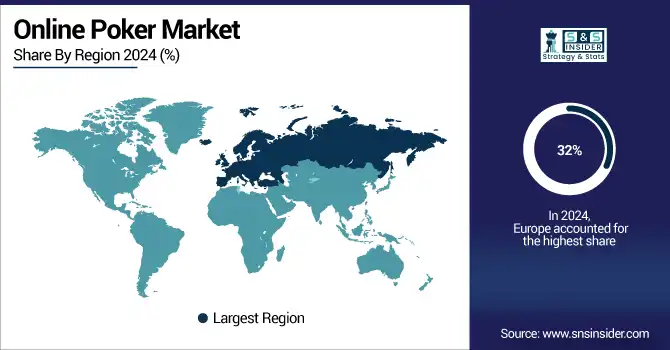

Regional Analysis

Europe dominated the online poker market in 2024 with the highest revenue share of 32% due to a well-established gambling culture, robust regulatory frameworks, and widespread internet access. Countries like the UK, France, and Germany have mature markets with legal clarity and strong user bases. High disposable income, secure payment infrastructure, and longstanding popularity of poker games contribute to Europe’s continued dominance in terms of both player activity and platform revenues.

The United Kingdom is dominating the online poker market in Europe, driven by a regulated environment, high internet penetration, and a strong gaming culture.

Asia Pacific is projected to grow at the fastest CAGR of 12.65% from 2025–2032 due to expanding internet penetration, rising smartphone adoption, and a growing young population interested in skill-based games. Markets like India, China, and Southeast Asia are witnessing increased acceptance of digital gaming. As governments gradually ease regulations and platforms localize offerings, the region offers immense untapped potential, driving rapid growth in the online poker ecosystem.

India is dominating the Asia Pacific online poker market due to rapid smartphone adoption, youthful demographics, and growing interest in real-money skill-based gaming.

North America holds a significant position in the online poker market, driven by the United States’ legalized state markets and Canada’s growing digital gaming adoption. High consumer spending, robust infrastructure, and professional tournaments continue to fuel regional growth and engagement.

The United States is dominating the online poker market due to high player volume, legalized state-level platforms, and strong consumer spending on digital entertainment.

In the online poker market, Latin America and the Middle East & Africa are emerging regions, driven by increasing mobile penetration, youthful populations, and rising interest in online gaming, though limited regulatory frameworks and payment access remain key growth barriers.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Online Poker Market Companies Are Americas Cardroom, Baazi Games, BetOnline, BLITZ POKER, Ignition, MPL, Playtika, Pocket52, PokerStars, Tencent, True Poker, Zynga Inc., 888 Holdings, Entain, Caesars Entertainment, GG Poker, Winning Poker Network, PokerBaazi, Adda52, Kindred Group, Natural8, Bodog Poker.

Recent Developments:

-

2024: ACR Poker announced Tom Dwan (Durrrr) as a new Team Pro in March 2024, marking a high‑profile sponsorship move and enhanced brand visibility via poker legend’s global reputation.

-

2024: PokerStars announced the launch of the PokerStars Open tour set to debut in March 2025, replacing UKIPT, Eureka, Estrellas and FPS tours, featuring USD 1,100 Main Events with USD 1 M guarantees.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 4.07 Billion |

| Market Size by 2032 | USD 9.00 Billion |

| CAGR | CAGR of 10.48% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Game Type (Texas Hold’em, Omaha, 7-Card Stud, Others) • By Device (Desktop (PC), Smartphone) • By Game Format (Cash Games, Tournaments, Fast-Fold Poker) • By Payment Mode (Credit/Debit Cards, E-Wallets, Cryptocurrencies, Bank Transfers) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Americas Cardroom, Baazi Games, BetOnline, BLITZ POKER, Ignition, MPL, Playtika, Pocket52, PokerStars, Tencent, True Poker, Zynga Inc., 888 Holdings, Entain, Caesars Entertainment, GG Poker, Winning Poker Network, PokerBaazi, Adda52, Kindred Group, Natural8, Bodog Poker |