Telecom Service Assurance Market Size & Overview:

Get more information on Telecom Service Assurance Market - Request Sample Report

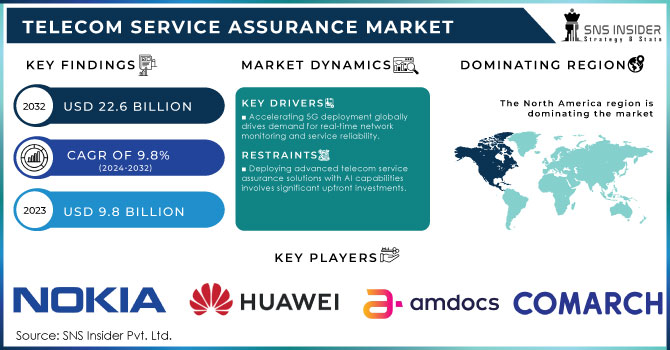

Telecom Service Assurance Market size was valued at USD 9.8 billion in 2023 and is expected to grow to USD 22.6 billion by 2032 and grow at a CAGR of 9.8 % over the forecast period of 2024-2032.

The telecom service assurance market is growing substantially owing to expanding government initiatives to improve telecom infrastructure and access. Recent government statistics show that the global mobile network data traffic increased by 47% in 2023. This increase can be partially attributed to the soaring rate of 5G access and the pervasive growth of the Internet of Things devices. The International Telecommunication Union stated that by the end of 2023, 5.4 billion people were already using the internet, and of this population, 40% relied on mobile networks. In addition, the vast support measures of governments are linked to their ongoing digitalization projects aimed at improving network access in rural and urban areas. The U.S. Government, for example, offered over $65 billion in its broadband Equity, Access, and Deployment program, ensuring small and underserved locations receive high-speed internet by 2030. Another example is the European Union which recently initiated the Digital Decade effort, to make 5G available to 80% of the population by 2025.

The increased network capacity focus of national governments serves the purpose of directly driving the demand for telecom service assurance to enhance and guarantee the quality and reliability of network performance and customer service. At the same time, communication companies face the added pressure of complying with standards and requirements, which also increases investments in assurance. Therefore, telecom assurance providers need to offer solutions that improve service delivery, resilience, and customer satisfaction on top of offering competitive advantages in addressing increasing governmental workloads. Moreover, publicly funded telecom ventures and privately owned communication companies need to upkeep their service delivery pace for the challenges of tomorrow with investment-heavy modern networks and reliance on these ecosystems’ capabilities.

Telecom Service Assurance Market Dynamics

Drivers

-

Accelerating 5G deployment globally drives demand for real-time network monitoring and service reliability.

-

Telecom operators use artificial intelligence and automation to optimize service delivery and manage complex networks, these technologies enhance operational efficiency, boosting the demand for advanced assurance systems.

-

Telecom service assurance helps minimize downtimes and improves service quality, boosting customer retention.

One of the main factors in the growth of the telecom service assurance market is the increased adoption of 5G technology. With the global deployment and expansion of 5G networks, telecom operators have to manage more complex and higher-speed networks. Consequently, to ensure high service quality and the ongoing reliability of their networks, they need advanced service assurance solutions that will assist in preventing and solving various network-related problems.

5G technology offers many benefits, such as ultra-low latency, higher bandwidth, and the ability to connect an enormous number of devices at the same time. However, together with these advantages comes a higher amount of data traffic and the need to monitor the network in real time. For example, the Ericsson Mobility Report states that there were over 1,500 million 5G subscriptions at the end of 2023 and predicts that this number will reach 4,600 million by 2028. Therefore, an increasing number of telecom companies are investing in more advanced service assurance systems that will be able to assist them in handling the increased amount of traffic, reducing network outages and other problems, and better ensuring that the provided services will not be interrupted. For example, Vodafone in Europe uses AI-driven service assurance solutions that continuously monitor its 5G networks and detect faults virtually as they happen, providing a 90% problem resolution rate in real-time at the same time, Verizon has implemented a cloud-native service assurance system in the U.S. that can predict service disruptions before they occur and take them down, thus preventing network outages and assuring good customer experience. Thus, as the adoption of 5G technology is growing, so is the increasing demand to ensure high performance, reliability, and a good user experience with the help of telecom service assurance.

Restraints:

-

Deploying advanced telecom service assurance solutions with AI capabilities involves significant upfront investments.

-

Integrating modern telecom service assurance platforms with older legacy infrastructure can be technically challenging.

Telecom operators often have legacy infrastructure that they have built up over years or even decades. These legacy systems are often rigid and based on older technology. They were not designed to be compatible with modern digital solutions. As many advanced telecom service assurance systems use AI, automation, cloud capabilities, etc., integrating them is a significant technical challenge. The new systems must also be able to communicate with the existing tools that operators are using to monitor, analyze, and optimize the performance of their networks. There are often issues with the data flow and a need to integrate the new system into the existing one. The technical complexity of doing so not only slows down the deployment but can increase operational costs as the process requires more time for troubleshooting. Many operators also learn that their legacy systems are not adaptable enough to offer real-time analytics and monitoring, a key capability for maintaining service quality in the fast-paced telecom environment.

Telecom Service Assurance Market Segment analysis

By Component

The solution segment led the telecom service assurance market in 2023 and accounted for 61% of the global revenue. The continually rising complexity of telecom networks and surging demand for real-time monitoring and analytics tools prompt the segment growth. Additionally, governments worldwide are pushing towards higher quality of telecom services. For instance, TRAI has mandated tougher service quality norms in 2023, requiring telecom operators to rectify network outages and congestion within 30 minutes of the issue’s occurrence. The regulations prompt the need for telecom service assurance solutions that are capable of automated fault detection, root cause analysis, and end-to-end network performance tracking.

Moreover, the reliance on cloud-based infrastructure further fuels the demand for solutions of such type as they provide centralized monitoring capabilities across a variety of network environments. With the continually rising shift towards 5G networks and hybrid cloud architecture, the tools able to guarantee network seamless operation and highest-quality customer experience become increasingly sought after.

By Enterprise Size

In 2023, the large enterprises segment dominated the market and accounted for the largest share 72% in the telecom service assurance market. Their dominance is driven by the need to manage extensive, complex, and advanced networks. Telecom service assurance tools are vital to large-scale telecom operators, including AT&T and Vodafone, that operate extensive infrastructures and serve millions of customers. According to the U.S. Federal Communications Commission, large enterprises garnered about 78% of the country’s total revenue from the telecom industry. These organizations realize that managing their network’s performance proactively is essential in keeping their operations running seamlessly. As such, they invest in comprehensive, effective tools as their systems are subjected to various regulatory compliance and customer SLAs. Moreover, several governments across different markets are enacting stricter regulations regarding service quality. Therefore, large enterprises have no other option but to include telecom service assurance solutions in their networks. The organizations have the financial resources required to invest in such flexible, scalable tools, which can manage their current and future demands. Moreover, the tools serve multiple applications and games, ensuring that they can stream content and communicate through different devices securely and successfully. Overall, large enterprises have a strong presence in the telecom service assurance market due to their high investments and intensified regulation uncertainties.

By Operator

The fixed operator segment dominated the telecom service assurance market in 2023, with the largest market share. According to ITU data, fixed broadband subscriptions reached over 1.35 billion in 2023, growing by 6.5% from the previous year. The dominance of the fixed operator segment is attributed to the stability and high speed of internet services provided by fiber optic and other fixed broadband technologies, which are popular in high-density urban areas. Moreover, public investments in the expansion of the fixed broadband network are increasing. For example, China’s Ministry of Industry and Information Technology reported over 20% year-over-year increase in optical fiber network installations in 2023 following a similar increase in 2022. According to the same source, the MiIT aims to achieve a 95% broadband penetration rate by 2025. Therefore, the increasing demand for high-quality fixed service by users and businesses drove the fixed operators to deploy the latest available service assurance tools to gain a competitive advantage. Since fixed broadband is a primary source of internet and home entertainment, such as work browsing and streaming and hosting cloud services, the segment is expected to retain its dominance in the market.

Regional Analysis

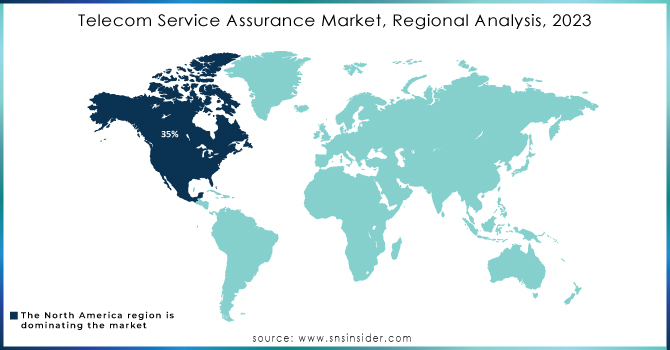

North America was the largest region in the telecom service assurance market in 2023, accounted 35% of the total market share. Early adoption of 5G technology and substantial investments in network infrastructure by the U.S. and Canadian governments have contributed to the region’s market growth. The U.S. Federal Government has focused on modernizing its telecom infrastructure. The government’s investment of over $42 billion in broadband expansion will boost the county’s broadband network as part of the Infrastructure Investment and Jobs Act. Additionally, several prominent telecom service providers have focused on improving their service assurance capabilities as their networks continue to grow more complex. However, the Asia Pacific region is expected to record the fastest CAGR. Investments in 5G networks and the expansion of broadband infrastructure in China, India, and South Korea are the primary drivers of this rapid growth. In 2023, the Chinese Government reported that it had installed 2.1 million 5G base stations to serve more than 75% of the population. The Indian Government’s BharatNet project is also driving market demand. The project’s goal is to connect 250,000 rural villages to high-speed broadband.

Need any customization research on Telecom Service Assurance Market - Enquire Now

Recent Developments

-

In July 2024: Nokia launched an enhanced version of its AVA AI-based telecom service assurance platform with machine learning capabilities, helping automate network operations and improve service quality.

-

In March 2024: ServiceNow and NVIDIA continued their collaboration by launching Now Assist for Telecommunications Service Management on the Now Platform utilizing NVIDIA AI. The solution allows for enhancing AI-driven, automated processes for telco operations, particularly network management and assurance.

-

In March 2024: Huawei launched a new 5G service assurance solution based on a partnership with the China Academy of Information and Communications Technology. The new solution is designed to enhance the end-to-end network performance and visibility for both fixed broadband and mobile networks.

Key Players

Key Service Providers:

-

Nokia (Nokia AVA, Nokia NetGuard)

-

Huawei Technologies Co., Ltd. (Huawei SmartCare, Huawei U2020)

-

Ericsson (Ericsson Expert Analytics, Ericsson Network IQ)

-

NEC Corporation (NetCracker Service Assurance, NEC iPASOLINK)

-

Amdocs (Amdocs SmartOps, Amdocs CES)

-

IBM Corporation (IBM Netcool, IBM SevOne)

-

Comarch S.A. (Comarch Service Assurance, Comarch OSS Suite)

-

Accenture (Accenture Intelligent Operations, Accenture Network Assurance)

-

Tata Consultancy Services (TCS) (TCS Digital Service Assurance, TCS HOBS)

-

EXFO Inc. (EXFO Nova, EXFO Active Testing)

Key Users of Telecom Service Assurance:

-

AT&T Inc.

-

Verizon Communications

-

Vodafone Group

-

China Mobile Ltd.

-

Orange S.A.

-

BT Group

-

Deutsche Telekom

-

Reliance Jio

-

T-Mobile US

| Report Attributes | Details |

| Market Size in 2023 | US$ 9.8 Bn |

| Market Size by 2032 | US$ 22.6 Bn |

| CAGR | CAGR of 9.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Component (Solution, Services)

• By Operator type (Mobile Operator, Fixed Operator) • By Deployment Mode (On-Premises, Cloud) • By Enterprise Size (Small and Medium Enterprises, Large Enterprises) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Nokia, Huawei Technologies Co., Ltd., Ericsson, NEC Corporation, Amdocs, IBM Corporation, Comarch S.A., Accenture, Tata Consultancy Services (TCS), EXFO Inc. |

| Key Drivers | • Accelerating 5G deployment globally drives demand for real-time network monitoring and service reliability. • Telecom operators use AI and automation to optimize service delivery and manage complex networks, these technologies enhance operational efficiency, boosting the demand for advanced assurance systems. • Telecom service assurance helps minimize downtimes and improves service quality, boosting customer retention. |

| Market Restraints | • Deploying advanced telecom service assurance solutions with AI capabilities involves significant upfront investments. • Integrating modern telecom service assurance platforms with older legacy infrastructure can be technically challenging. |