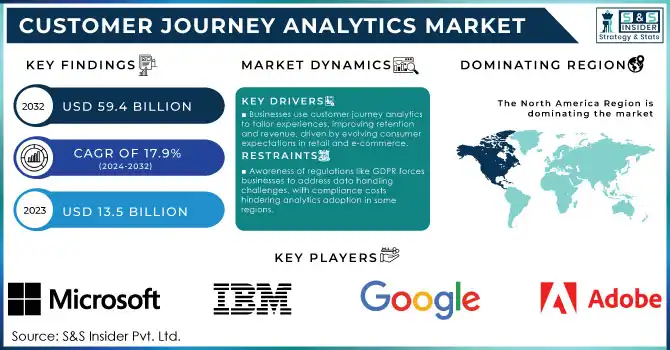

Customer Journey Analytics Market Size & Overview:

To Get More Information on Customer Journey Analytics Market - Request Sample Report

Customer Journey Analytics Market Size was valued at USD 13.5 Billion in 2023 and is expected to reach USD 59.4 Billion by 2032, growing at a CAGR of 17.9% over the forecast period 2024-2032.

The customer journey analytics market is growing due to the increasing emphasis on personalized consumer experiences driven by advancements in analytics technologies and government-backed initiatives. According to the U.S. Census Bureau, e-commerce sales in the United States surpassed $1 trillion in 2023, reflecting a growing reliance on digital platforms. Simultaneously, the European Union allocated €1.2 billion under its Digital Europe Programme in 2023 to bolster AI and analytics capabilities, accelerating data-driven decision-making across sectors. The World Bank reported a 40% rise in mobile internet penetration in developing countries between 2020 and 2023, a factor fostering the adoption of analytics tools that track multi-touchpoint consumer journeys. This momentum is further amplified by regulatory frameworks like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) that encourage businesses to adopt transparent and data-compliant analytics platforms.

Vendors in the customer journey analytics market are enhancing UI/UX, visualizations, and interactive features to improve business outcomes. They are also focusing on developing scalable and advanced platforms. A March 2023 study by CSG Systems International highlights the necessity for businesses to accelerate digital customer experiences by integrating innovative technologies into analytics solutions, enabling real-time insights to drive market growth. Digital transformation and the adoption of new technologies have reshaped business models, with companies increasingly focusing on real-time analysis of customer behaviours, preferences, and purchase decisions. Customers now base their buying choices on the overall shopping experience provided by companies. The use of customer journey analytics solutions allows businesses to map out customer journeys, ensuring they address all touchpoints. Over the past decade, customer experience has become a key driver of business growth across industries.

Customer Journey Analytics Market dynamics

Drivers

-

Businesses increasingly leverage customer journey analytics to create tailored experiences, enhancing customer retention and boosting revenue growth. This trend is driven by evolving consumer preferences, especially in industries like retail and e-commerce, where customer expectations are high.

-

The adoption of AI technologies has streamlined data collection and analysis, enabling more precise customer behaviour predictions. These innovations expand applications across diverse sectors such as BFSI, healthcare, and telecommunications.

Increasing focus on hyper-personalized experience delivery is one of the major factors for the growth of the customer journey analytics market. Modern customers expect that brands not only understand their specific needs but at the same time act accordingly throughout various touch points. To meet this need, businesses are increasingly relying on advanced analytics tools and AI-powered solutions that help them to identify and study customer behavior, focusing on browsing habits, purchase histories, and even real-time interactions. As an example, AI-based recommendation systems present products or services according to individual cravings, leading to a significant growth in commitment. According to brands that incorporate such systems, they see significant improvements in customer loyalty and satisfaction. According to a study, 80 percent of customers are more likely to buy when shown a personalized experience. Also, companies that use these strategies experience an increase in sales of up to 20% when compared to those that depend on generic marketing strategies.

For instance, AI-enabled chatbots use natural language processing to deliver fast personalized replies that can effectively solve customer questions. AI and robotics not only improve the efficiency of service but also lower the cost of operations by automating routine activities. Personalized services provide a strong bond of relationship between businesses and customers adding a competitive edge to the business in today's dynamic market. With the expectation of anticipating needs and delivering relevant interactions as a table stakes for success in customer experience management, analytics tools have proliferated.

Restraints:

-

Heightened awareness of data protection regulations like GDPR is causing businesses to navigate challenges in handling and analyzing consumer data responsibly. Compliance-related costs and risks can hinder the adoption of analytics solutions in some regions.

-

Many organizations struggle with integrating data from multiple touchpoints such as web, mobile, and in-store interactions, which can delay insights and decision-making. This issue is particularly pronounced in small to medium enterprises (SMEs) with limited technical resources.

The increasing prominence of data privacy regulations, like the General Data Protection Regulation (GDPR) and California Consumer Privacy Act (CCPA), has posed serious challenges for organizations to adopt customer journey analytics. These regulations place a lot of stringent requirements on how consumer data is collected, stored, and processed, creating pain points for implementing analytics. Companies have to acquire consent for any usage of consumer data, and subsequently govern it transparently. The absence of compliance may lead to damage and financial losses, which discourages businesses from implementing Advanced Analytics solutions.

Moreover, customers are increasingly aware of their data rights, which means expecting organizations to process their data makes in an ethical manner. This added scrutiny makes it even more difficult for companies to balance their personalization efforts with their privacy obligations. As a result, complying with these regulatory landscapes frequently necessitates capital and human capital-intensive investment in data governance frameworks and the organizational processes across departments necessary to comply with such regulations.

Customer Journey Analytics Market Segment analysis

By Touchpoint

In 2023, the website segment became the largest touchpoint, with a 26% market share as more and more interactions take place online. According to the U.S. Department of Commerce, websites accounted for 74% of e-commerce traffic in 2023, underscoring their importance in customer acquisition and engagement. Governments globally are also transforming public services, e-governance portals in India saw a 46% increase in visits during Digital India. This culture drives businesses to improve their website analytics, providing information on the activities of visitors and customer experiences.

By Industry

The largest share was held by the Banking, Financial Services, and Insurance (BFSI) sector, occupying 23% of the market in 2023 as sectors devoted to consumer retention processes were at their highest levels. International Monetary Fund (IMF) states that digital banking users throughout the world rose by 33% in 2023, highlighting the significance of analytics in shaping the customer journey. Likelihood of regulatory pressures such as Basel II to lead to the growth of such risk and operational analytics and on top of it the financial firms are adopting evolved analytical solutions to predict the potential needs of the client and improve the service delivery.

By Deployment

In 2023, the cloud-based deployment held a commanding 62% share of the market owing to its scale, cost-effectiveness, and easy accessibility. The U.S. Bureau of Economic Analysis states cloud computing expenditures increased 18% year-over-year during 2023. With its ability to integrate analytics tools across devices in a seamless manner, cloud infrastructure is an essential component of omnichannel customer journey tracking. In addition, cloud adoption programs, such as the G-Cloud Framework of the UK, led by a government have motivated organizations to migrate to the cloud, thus driving the growth of this segment.

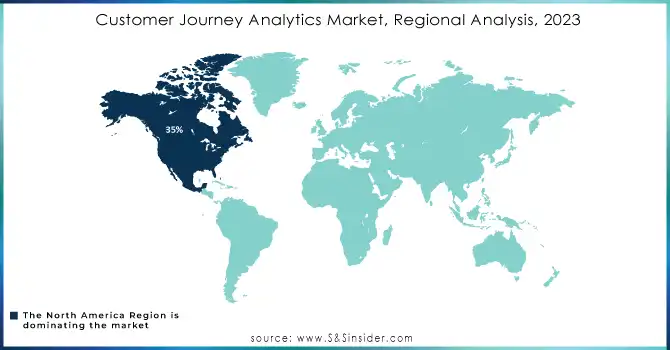

Regional Analysis

The Customer Journey Analytics Market was dominated by North America, which held a 35% market share in 2023. Such dominance can be explained through the highly developed digital infrastructure in the region and the pace at which industries are adopting growing technologies. In North America, 87% of enterprises used customer analytics tools in 2023, as per the findings of the U.S. Census Bureau indicating that the region remains most active in data deployment to improve customer experiences. Corporates across retail, banks, telecom et al are spending heavily on analytics to decipher customer behaviour and decision-making. Moreover, growing initiatives by governments towards data-driven innovation in the region have also positively impacted growth in the adoption of analytics platforms across the region.

However, the Asia-Pacific region is the fastest-growing market and is expected to have a significant compound annual growth rate (CAGR) during the forecast period. According to the Asian Development Bank, internet penetration across Asia-Pacific reached 63% in 2023, significantly boosting the adoption of digital tools and analytics platforms. With rapid growth in internet access, primarily in developing economies like India and Vietnam, businesses can navigate consumer journeys and analyze customer behaviour more accurately. Regional Governments are also pushing the leadership agenda around digital transformation through policies and initiatives (India’s Digital India program) which in turn, have provided the necessary impetus for enterprises in the region to embrace advanced analytics solutions. These factors put together make the region a high-growth market for customer journey analytics, in the Asia-Pacific.

Recent Developments

-

February 2024: Accenture revealed plans to acquire customer analytics consultancy GemSeek Consulting in Bulgaria, bringing in more than 170 employees.

-

June 2024: Contentsquare announced a new AI-based customer analytics platform with VoC capabilities for issue tracking, feedback validation, and prioritization of improvements

Do You Need any Customization Research on Customer Journey Analytics Market - Enquire Now

Key Players

Service Providers / Manufacturers:

-

Adobe Inc. (Adobe Analytics, Experience Cloud)

-

Google LLC (Google Analytics 360, Firebase Analytics)

-

IBM Corporation (Tealeaf, Customer Insight)

-

Microsoft Corporation (Dynamics 365 Customer Insights, Power BI)

-

SAP SE (SAP Customer Data Cloud, Qualtrics XM)

-

Salesforce.com, Inc. (Salesforce Customer 360, Tableau)

-

Oracle Corporation (Oracle CX Marketing, Oracle Customer Analytics)

-

Accenture (Accenture Analytics, myConcerto)

-

Contentsquare (Contentsquare Analytics, Contentsquare Experience)

-

SAS Institute Inc. (SAS Customer Intelligence 360, SAS Visual Analytics)

-

Teradata Corporation (Vantage CX, Customer Journey Analytics)

Key Users

-

Amazon

-

Walmart

-

Bank of America

-

JP Morgan Chase

-

Target Corporation

-

Procter & Gamble

-

Nike

-

Starbucks Corporation

-

Ford Motor Company

-

Netflix

Recent Developments

-

February 2024: Accenture revealed plans to acquire customer analytics consultancy GemSeek Consulting in Bulgaria, bringing in more than 170 employees.

-

June 2024: Contentsquare announced a new AI-based customer analytics platform with VoC capabilities for issue tracking, feedback validation, and prioritization of improvements.

| Report Attributes | Details |

| Market Size in 2023 | USD 13.5 Billion |

| Market Size by 2032 | USD 59.4 Billion |

| CAGR | CAGR of 17.9% From 2024 to 2032 |

| Base Year | 2022 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Touchpoint (Website, Social Media, Email, Mobile, Others) • By Deployment (Cloud, On-premises) • By application (Customer Segmentation and Targeting, Customer Experience Management, Customer Behavioural Analysis, Customer Churn and Retention Management, Brand Management, Campaign Management, Product Management, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

Adobe Inc., Google LLC, IBM Corporation, Microsoft Corporation, SAP SE, Salesforce.com, Inc., Oracle Corporation, SAS Institute Inc., Teradata Corporation, Accenture, Contentsquare. |

| Key Drivers | •Businesses increasingly leverage customer journey analytics to create tailored experiences, enhancing customer retention and boosting revenue growth. This trend is driven by evolving consumer preferences, especially in industries like retail and e-commerce, where customer expectations are high •The adoption of AI technologies has streamlined data collection and analysis, enabling more precise customer behaviour predictions. These innovations expand applications across diverse sectors such as BFSI, healthcare, and telecommunications |

| Market Restraints | •Heightened awareness of data protection regulations like GDPR is causing businesses to navigate challenges in handling and analyzing consumer data responsibly. Compliance-related costs and risks can hinder the adoption of analytics solutions in some regions •Many organizations struggle with integrating data from multiple touchpoints such as web, mobile, and in-store interactions, which can delay insights and decision-making. This issue is particularly pronounced in small to medium enterprises (SMEs) with limited technical resources |