Operating Room Integration Market Report Scope & Overview:

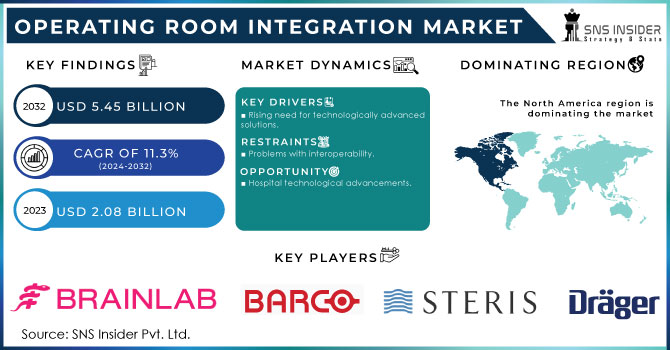

The Operating Room Integration Market Size was valued at USD 2.08 billion in 2023, and is expected to reach USD 5.45 billion by 2032, and grow at a CAGR of 11.3% over the forecast period 2024-2032.

Get More Information on Operating Room Integration Market - Request Sample Report

Increasing demand for technologically sophisticated applications, an increase in the number of surgical operations, congestion in operating rooms (OR), patient safety concerns in OR, and a spike in desire for minimally invasive surgeries (MIS) are important drivers driving market expansion. A fall in the number of surgical operations resulted in a decrease in demand for the technologies and goods necessary for such procedures.

MARKET DYNAMICS

AI advancements can play a critical role in a comprehensive approach to addressing these backlogs, helping hospitals and surgical centres improve efficiency and reduce costs. Furthermore, the introduction of advanced imaging and diagnostic technologies for OR, rising government funding for OR infrastructure or hospital redevelopment projects, an increasing need to reduce healthcare expenditure, and an increase in investments in OR equipment are some of the factors driving market growth.

DRIVERS

-

Rising need for technologically advanced solutions.

The widespread use of modern technology in minimally invasive procedures, such as image guiding methods and endoscopic equipment, makes it a suitable application area for OR integration solutions. OR integration aids in the streamlining of these operations. surgical processes by facilitating smooth connections across diverse systems and ensuring the effective and more accessible operation of these systems, preferably from a single source.

RESTRAIN

-

Problems with interoperability.

OPPORTUNITY

-

Hospital technological advancements.

The increasing complexity of sophisticated procedures has compelled hospitals to invest in technological breakthroughs in the operating room. The use of hybrid operating rooms (ORs) outfitted with a mix of surgical tools and technology, such as integrated digital imaging diagnostics and surgical instruments with robotic 3D imaging, is also increasing. This trend is projected to continue in the next few years, with a rising number of hospitals concentrating on hybrid ORs, which will contribute to market growth.

CHALLENGES

-

There is a scarcity of experienced surgeons in integrated operating rooms.

IMPACT OF RUSSIA-UKRAINE WAR

Regulatory shifts and compliance issues Geopolitical developments might result in regulatory changes and tougher compliance standards. If the conflict alters trade policy, import/export rules, or medical device standards, it may raise the compliance burden for ORI producers and healthcare providers. This might result in product certification and approval delays, impeding market growth. Adoption and investment choices are being postponed. Healthcare institutions, particularly those in conflict-affected areas, may postpone or reevaluate their intentions to invest in ORI systems. In times of economic and political uncertainty, hospitals and healthcare providers may prioritise emergency needs above other vital areas. This might hinder ORI technology adoption and have an impact on market growth in impacted regions.

Migration of talent and knowledge Following the violence, skilled professionals, such as healthcare practitioners and technological specialists, may migrate from conflict-affected areas to more stable places. This talent transfer may result in a skilled labour shortage in the ORI market, hurting the deployment, training, and maintenance of ORI systems in healthcare institutions.

IMPACT OF ONGOING RECESSION

Cost-effective decision-making Cost-conscious decision-making becomes increasingly widespread in the healthcare industry during times of economic turmoil. Hospitals and healthcare facilities may prioritise initiatives that provide immediate cost savings or a short-term ROI. This may result in a diminished emphasis on ORI systems, as they are frequently viewed as long-term investments with advantages that are not always immediately apparent. Consolidation and competition Economic downturns can lead to healthcare industry consolidation when smaller hospitals combine with bigger systems or healthcare organisations. This consolidation may result in fewer purchasing organisations with stronger negotiating power, thereby increasing competition and pricing pressures on ORI providers.

KEY MARKET SEGMENTATION

By Device Type

-

Audio Video Management System

-

Display System

-

Documentation Management System

By Application

-

General Surgery

-

Orthopedic Surgery

-

Neurosurgery

-

Others

By Component

-

Software

-

Services

By End-Use

-

Hospitals

-

Ambulatory Surgery Centers

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

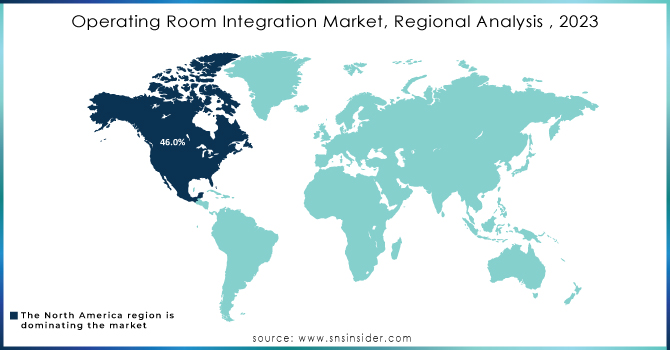

REGIONAL ANALYSES

North America led the market, accounting for more than 46.0% of total revenue in 2023. The growing desire for surgical automation explains the dominance. The rise in demand for efficient healthcare services, an increase in the desire to cut healthcare spending, and successful EHR implementation by healthcare organizations are major reasons ascribed to market growth. Furthermore, the existence of established market competitors, technologically improved HCIT, and funding to upgrade OR infrastructure is driving market expansion.

The market for operating room integration in Asia Pacific is expected to grow at the fastest rate during the projected period. A growing pool of patient populations suffering from chronic illnesses requiring surgical treatments, an increase in demand for advanced medical equipment in hospitals, an increase in the number of MIS operations, and a rapidly expanding healthcare infrastructure are driving the market. The Indian government will launch the National Digital Health Mission, a comprehensive digital health ecosystem, in August 2020. Such measures can help boost overall industry growth.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

The Major players are Braiblab AG, Barco, Dragerwerk AG & Co. KGaA, Steris Plc., KARL STORZ SE & CO. KG, Olympus, Care Syntax, Arthrex, Inc., Stryker Corporation, Getinge AB, ALVO Medical, Skytron, LLC and others.

RECENT DEVELOPMENTS

Karl Storz cooperated: In February 2023, Karl Storz cooperated with Asensu Surgical (US), developing next-generation equipment and aiming to commercialise Asensus' Intelligent Surgical Unit (ISU) as a standalone device.

Stryker: In February 2022, Stryker bought Vocera Communications (US). This purchase provides an innovative portfolio for Stryker's Medical business, bolstering the company's Advanced Digital Healthcare services and advancing Stryker's emphasis on reducing adverse events throughout the continuum of care.

| Report Attributes | Details |

| Market Size in 2023 | US$ 2.08 Bn |

| Market Size by 2032 | US$ 5.45 Bn |

| CAGR | CAGR of 11.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Device Type (Audio Video Management System, Display System, Documentation Management System) • By Application (General Surgery, Orthopedic Surgery, Neurosurgery, Others) • By Component (Software, Services) • By End-Use (Hospitals, Ambulatory Surgery Centers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Braiblab AG, Barco, Dragerwerk AG & Co. KGaA, Steris Plc., KARL STORZ SE & CO. KG, Olympus, Care Syntax, Arthrex, Inc., Stryker Corporation, Olympus Corporation, Getinge AB, ALVO Medical, Skytron .LLC |

| Key Drivers | • Rising need for technologically advanced solutions. |

| Market Opportunities | • Hospital technological advancements. |